Hispanolistic/E+ via Getty Images

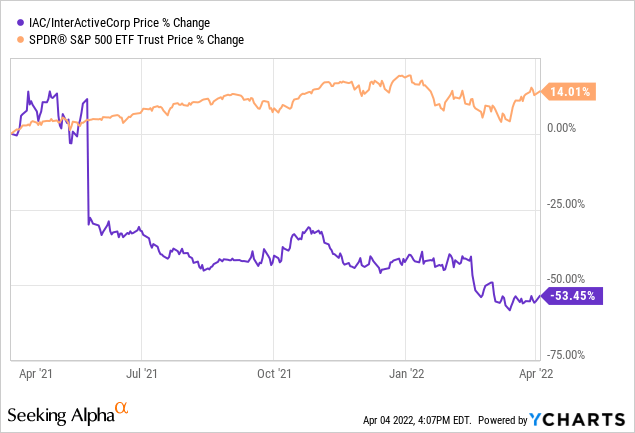

IAC/InterActiveCorp (IAC) is an active investing company working in the intersection of media, the internet, and technology. The stock has significantly lagged the overall market for the last 12 months and lost 60% market cap from its all-time highs. IAC has a successful track record of building companies. Its current holdings on Dotdash Meredith and Angi have already established strong leading positions in the industry and are ready to grow. I think the market didn’t give IAC enough recognition and I will discuss some of my thoughts.

Amazing Historical record for shareholders

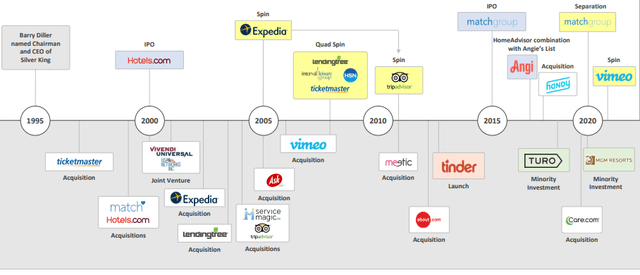

IAC has built companies and invested opportunistically in several businesses over the last two decades, including Hotel Reservations Network (later renamed Hotels.com), Expedia.com (EXPE), Match.com (MTCH), TripAdvisor (TRIP), HomeAdvisor, Vimeo (VMEO), Angi (ANGI), etc. Overall, 100B value was created for IAC shareholders since its inception and 43B value since 2008. IAC has a proven track record of building businesses such as online marketplaces, social networks, and digital services.

IAC historical record of company building (IAC presentation)

During the last two years, IAC acquired Care.com, the leading online marketplace for family caregivers, and acquired 12% of interest in MGM Resorts (MGM) for 1B. It also acquired Meredith holdings, the largest magazine publisher in the US. Meanwhile, IAC has spun off Vimeo and Match Group.

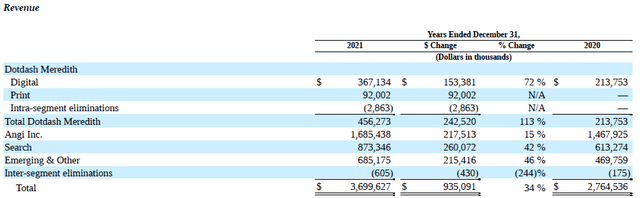

Currently, IAC has four reporting segments, including Dotdash Meredith (online content & media), Angi (HomeServices), Search (Ask.com), and emerging&other (care.com, mosaic, Bluecrew, Vivian, etc.). The FY2021 sales numbers for each segment are shown below.

revenue by segments (10k 2021)

Dotdash Meredith has established brands and scale

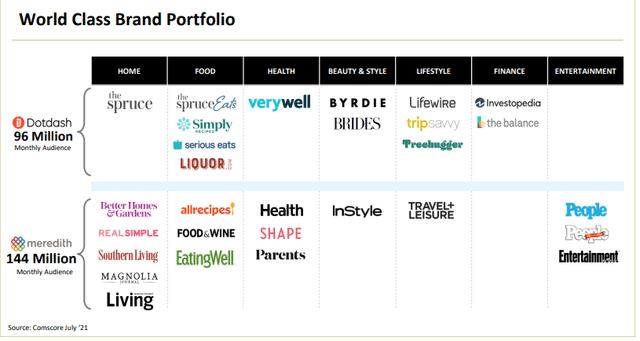

Dotdash Meredith is a leading digital and print publisher in the US with 40 publishing brands engaging 200M consumers each month. Through hundreds of experts, its digital business provides thousands of digital pieces of original content monthly, in entertainment, food, home, beauty, travel, health, family, luxury and fashion. The print business offers 30 magazines and 350 special interest publications with 35M active subscriptions. Most of the revenues were made through web advertising, subscription, print ad, and newsstand, etc.

Dotdash Meredith portfolio (IAC presentation)

Dotdash Meredith owns a portfolio of trusted brands to provide knowledge and help people. Unlike news and entertainment-focused media, its content is intent-driven, safe, and clean, which builds trust and customer loyalty over time. Each brand has editorial independence and targets audiences by their interests. The recent development of 50 testing facilities (100k square feet+) enables independent testing of e-commerce products and services to help consumers make purchases. Dotdash Meredith is the largest entity for intent-based marketing, which could be a real alternative to advertising giants like Facebook (FB) and Google (GOOG).

Historically, Dotdash is a fast-growing business with a revenue CAGR of 32%. Meredith’s printing business is declining quickly, while the digital business has a 15% CAGR. After the acquisition, the combined Dotdash Meredith will become the largest segment for IAC in terms of revenue (2.3B+). CEO Neil Vogel targets 450M EBITA in 2023 and 15-20% revenue growth. The company will move Meredith titles to the Dotdash platform, reinvest content, rebuild distribution, close underperforming brands, and improve user experience. All these measures should be completed by 2023.

Angi has a leadership position in a super large home-service market

Angi is a rebranding of former Angie’s list, HomeAdvisor, Handy Technologies, and Angi Roofing. This new brand consists of three segments: Angi Ads, Angi leads, and Angi services. Angi Ads creates a national directory of local service professionals. Angi leads provide tools and resources to help consumers pre-screen and match professionals. Consumers could communicate and pay for services directly through Angi leads. Angi service (27% of the Angi business and growing fast) is a pre-priced booking platform provided to consumers free of charge. Consumers can directly order services from Angi instead of requesting quotes from professionals.

Through these functions, Angi collectively connects service professionals across 500 categories from repairing to cleaning in the US. It is currently the largest digital marketplace for home services and is #1 in revenue, service pro network, service requests, and pre-priced services. During the year 2021, 240k service pros have connected with consumers through Angi, and it has helped approximately 33M projects. 18M unique homeowners completed a request for a home service job through Angi.

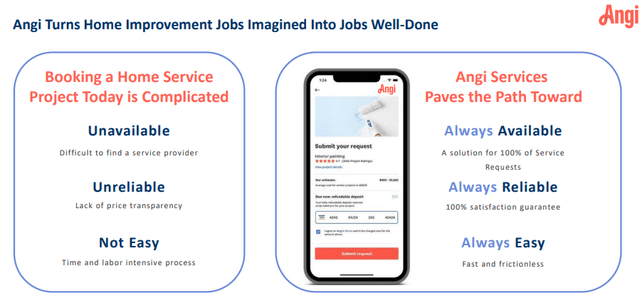

Consumers lack price transparency and enough info to find providers. Booking a home service is often time-consuming, while Angi does make this whole process easier with its large professional network, geographical coverage, transactional data, and AI technology. The home services industry is huge (600B TAM) and fragmented with low digital penetration. The current Angi platform is just the beginning, with a long runway ahead.

Angi service (IAC presentation)

Angi currently has 1.5B revenue and has grown its service requests by 19X since 2005. The pros want to grow their business, and customers want to get the job done. If Angi can deliver satisfying services consistently, Angi should gain more market trust over time. The management also projects a long-term 15% to 20% growth rate.

Recent Omicron surge led to significant project call-offs (8x increase than normal). The new Angi brand integration has also adversely affected the Google search engine optimization result since Angi doesn’t have the domain history of Angie’s List, HomeAdvisor, and others. These headwinds slowed down Angi’s growth in early 2022, but future growth rates should return.

Care.com, Vivian & Bluecrew are emerging

Besides Dotdash Meredith and Angi, IAC has other emerging businesses that are serving large TAMs. All of them have the potential to become billion-dollar companies in the next ten years.

Care.com is a leading online platform to connect caregivers. According to the management, as the core product, the childcare business is growing rapidly in terms of revenue, conversion, and subscribers. Newly launched daycare and pet care products have shown positive signs in the early stage.

Vivian is a platform for health professionals, such as nurses or travel nurses. In the past, the company’s focus was on building nurse profiles with certifications and geographies to have a solid base of people who could work. It seems that Vivian has progressed on that and is starting to work on building up employers on the other side.

Bluecrew is a business that connects people with flexible w-2 work. It has many employers on the platform and is bringing workers onto the platform and driving fill rates.

Evaluation is attractive

IAC has 612M EBITA for Dotdash Meredith (450M) and Angi (162M). Using a 15% growth rate for the first five years, a 10% growth rate for the second five years, and a 7% discount rate, IAC should collect a discounted EBITA of 9.26B in ten years. The Ask business has an EBITA of 108M. Assuming no growth in this business, IAC can collect 0.75B discounted EBITA for the next ten years. Therefore, about 10B discounted EBITA could be collected. Assuming 60% of these EBITAs could be converted to earnings as IAC’s businesses mature, we have 6B discounted future earnings power. Moreover, investment in MGM and Turo also offers a cushion to IAC’s valuation. 14.4% stake in MGM is worth at least 2.5B market value. The value of the 35% stake (initial investment is 0.25B) in Turo is not clear since Turo just filed for IPO early this year. Considering the 9B market cap and 2B+ cash holdings, the current valuation is attractive to me. I have not considered the upside of the emerging & others segment yet; any success in those new startup companies will greatly impact evaluation.

Conclusion

IAC has long-term expertise in investing in internet and media companies. The current holdings in Angi, Dotdash Meredith, and Care should work well in the future under the eyes of CEO Joey and founder Diller whose family has approximately 41% of the voting power in the company. Homeservices, digital publishing, and care are essential parts of our lives, and they haven’t been disrupted by the internet yet. At a 9B market cap, the downside risk is very low, while the potential for future growth is huge.

Be the first to comment