honglouwawa

By Christopher Gannatti, CFA

In 2020 and 2021, investors put record amounts of investments into thematic funds – another way to describe strategies fairly far out on the growth end of the spectrum. While there is no way in which every thematic fund is the same, two common aspects were noticeable:

- Strategies focused on software were able to showcase very strong revenue growth metrics, often by providing solutions that were more broadly used during the COVID-19 lockdown periods. Investors were attracted to these growth metrics – and in many cases, the assets piled in.

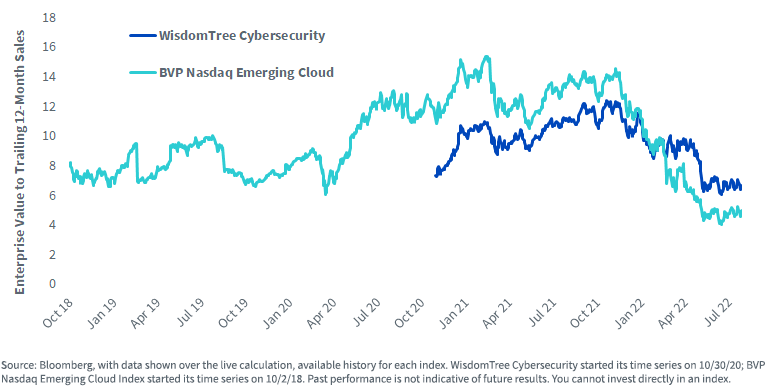

- As performance accelerated, so did valuations, at least as measured by enterprise value to trailing 12-month sales (EV Sales). This tells us that even though sales were growing, investors were pushing up valuations because of their excitement about future potential. Obviously, the environment in 2022 has changed.

The result – well, we see it in figure 1:

- The WisdomTree Team8 Cybersecurity Index (WisdomTree Cybersecurity) and BVP Nasdaq Emerging Cloud Index are distinct indexes aimed at capturing companies in two megatrends, both heavily focused on software.

- Looking at the EV Sales metric, we can see the BVP Nasdaq Emerging Cloud Index has been through three phases. From October 2018 to April 2020, valuation moved around but stayed below 10 times. Then, from April 2020, the valuation ratio expanded toward a level of 12 to 14 times, more or less, until November 2021. Then, the ratio fell off and seems to have stabilized at roughly 4 to 5 times, as of July 2022. It’s clear to see how these dates correspond to different stages of the COVID-19 pandemic and then the announcements of shifts in central bank policies.

- WisdomTree Cybersecurity, during its shorter life history, has behaved with high correlation to the BVP Nasdaq Emerging Cloud Index. It is notable that ‘cloud security’ is an important part of cybersecurity today, and there is overlap between these indexes. Today, one can consider if the fact that cybersecurity is essential to the strategy of any company translates to a higher valuation multiple than what we’d see for the general cloud computing company.

Figure 1: Historical Evolution of the Enterprise Value to Trailing 12-Month Sales Ratio for Specified Indexes

Conclusion – A Signal to Invest?

We wish the matter was as simple as, valuation is down a certain percentage, therefore, it has bottomed and it is a great time to enter. Unfortunately, the indexes shown in figure 1 could drop further from here. We can note the revenue growth of some select cloud computing companies, recognizing that the BVP Nasdaq Emerging Cloud Index saw the larger overall drop in the EV Sales ratio.

- Squarespace (SQSP), Tenable (TENB), ServiceNow (NOW), AppFolio (APPF), 2U (TWOU), Shopify (SHOP), and Zendesk (ZEN) reported quarterly results during the week of July 25, 2022, on the early end of the quarterly earnings reporting cycle.1

- If we think in terms of ranges, Squarespace and 2U saw revenue growth in the 0%-10% range, Shopify was between 10% and 20%, Zendesk, ServiceNow and Tenable were in the 20%-30% range and then AppFolio was the leader at 32% year-over-year revenue growth.2

We are tending to see cloud computing companies guiding in the range of either stable or slightly lower growth for 2022.3 As yet, we have not seen revenue growth ‘disasters,’ but that doesn’t mean it couldn’t happen as companies continue to report.

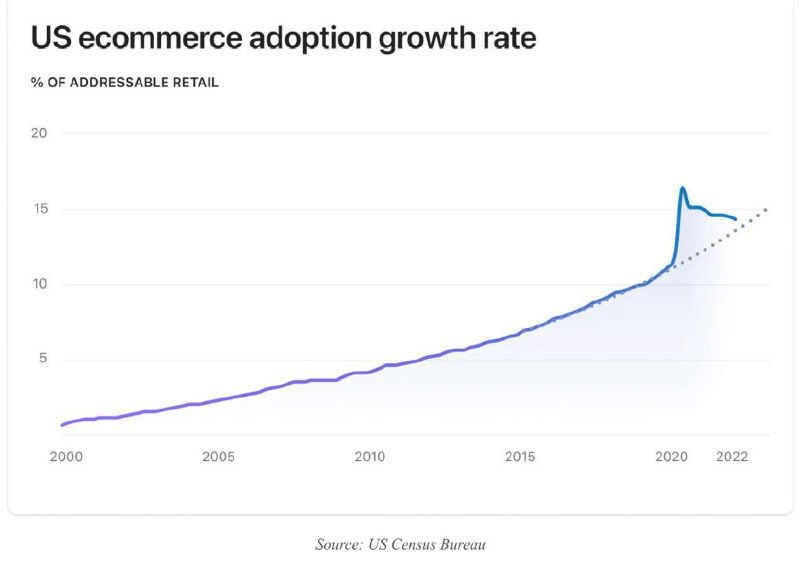

Tobias Lutke, CEO of Shopify, wrote a letter posted to Shopify’s public site concerning their strategic decision to let go about 10% of the company’s workforce. Included was the chart that we show as figure 2, which we think is illustrative of what we are seeing in a lot of the software space.

- Shopify is focused on e-commerce, so the e-commerce adoption rate is critical to their business.

- E-commerce is still on a significant growth trend, but it’s clear the slope is moderating back to the longer-term trend after a very large spike. Many software companies might have been priced as though the ‘COVID spike’ in growth was going to continue, and what we are seeing in 2022 is the need to moderate to a still growing but more sustainable growth figure. In Shopify’s case, the big news in the week of July 25, 2022, was the need to lay off 10% of staff in order to deal with this e-commerce moderation.

Figure 2: U.S. e-commerce adoption growth rate

We think that growth equals opportunity but recognize that it will be critical to see central banks transitioning from aggressive tightening to slowing or pausing their tightening. A massive rally in software company share prices would be difficult to see in the face of continued 75-basis point hikes. One way to manage this risk could be a longer investment horizon, where the risks associated with any singular macroeconomic environment may be lessened.

Those interested in cloud computing or cybersecurity can click to find out more about WisdomTree’s unique options within the thematic equity space.

1 Source: Bloomberg for the aggregation of quarterly earnings reporting dates. 2 Sources: Respective Company investor relations website for each specified company where they post a press release and presentation reporting the most recent results. 3 Sources: Company investor relations websites, recognizing that not all companies provide guidance or provide it based on the same exact metrics or time periods.

Important Risks Related to this Article

Christopher Gannatti is an employee of WisdomTree UK Limited, a European subsidiary of WisdomTree Asset Management Inc.’s parent company, WisdomTree Investments, Inc.

As of August 9, 2022, WCLD held 1.33%, 1.50%, 1.47%, 1.49%, 1.48%, 0.97% and 1.05% of its weight in Squarespace, Tenable, ServiceNow, AppFolio, 2U, Shopify and Zendesk, respectively.

As of August 9, 2022, WCBR held 0%, 3.20%, 0%, 0%, 0%, 0% and 0% of its weight in Squarespace, Tenable, ServiceNow, AppFolio, 2U, Shopify and Zendesk, respectively.

Christopher Gannatti, CFA, Global Head of Research

Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, working directly with Jeremy Schwartz, CFA®, Director of Research. In January of 2014, he was promoted to Associate Director of Research where he was responsible to lead different groups of analysts and strategists within the broader Research team at WisdomTree. In February of 2018, Christopher was promoted to Head of Research, Europe, where he will be based out of WisdomTree’s London office and will be responsible for the full WisdomTree research effort within the European market, as well as supporting the UCITs platform globally. Christopher came to WisdomTree from Lord Abbett, where he worked for four and a half years as a Regional Consultant. He received his MBA in Quantitative Finance, Accounting, and Economics from NYU’s Stern School of Business in 2010, and he received his bachelor’s degree from Colgate University in Economics in 2006. Christopher is a holder of the Chartered Financial Analyst designation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment