Editor’s note: Seeking Alpha is proud to welcome Dominic Rinaldi as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

BING-JHEN HONG/iStock Editorial via Getty Images

Nvidia’s (NASDAQ:NVDA) consistent execution, expanding computing platform ecosystem, and partner landscape is not being fully acknowledged by Wall Street. I believe this company will deliver market beating returns over the next three to five years on average due to its one-of-a-kind accelerated computing platform and ecosystem. This company is mislabeled and misunderstood when investors pigeonhole it as a high-priced semiconductor stock.

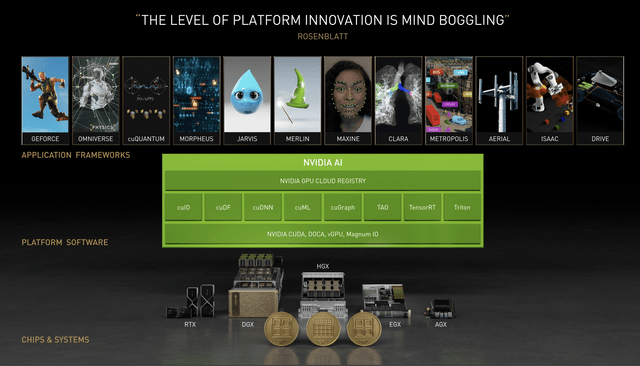

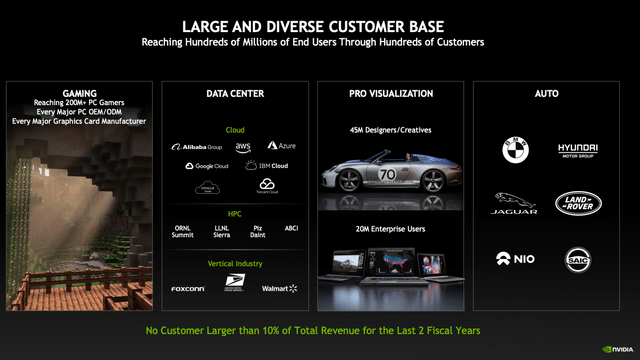

Nvidia is the first-ever full stack accelerated computing platform for customers. It is a company that is a hybrid of hardware, software, and artificial intelligence that spans four core business units: gaming, data center, professional visualization, and automotive. I believe that the media and some investors are not taking into account the full total addressable market that these areas of opportunity will present Nvidia. We will explore how Nvidia’s computing platform creates a flywheel effect for exponential revenue, profit growth, and returns for shareholders. But first, we must acknowledge the gamble, missed execution, and challenges the company had in Q2 of FY23.

The Nvidia Accelerated Compute Platform (Nvidia GTC 2021 Presentation)

The Impact of Missing Your Forecast

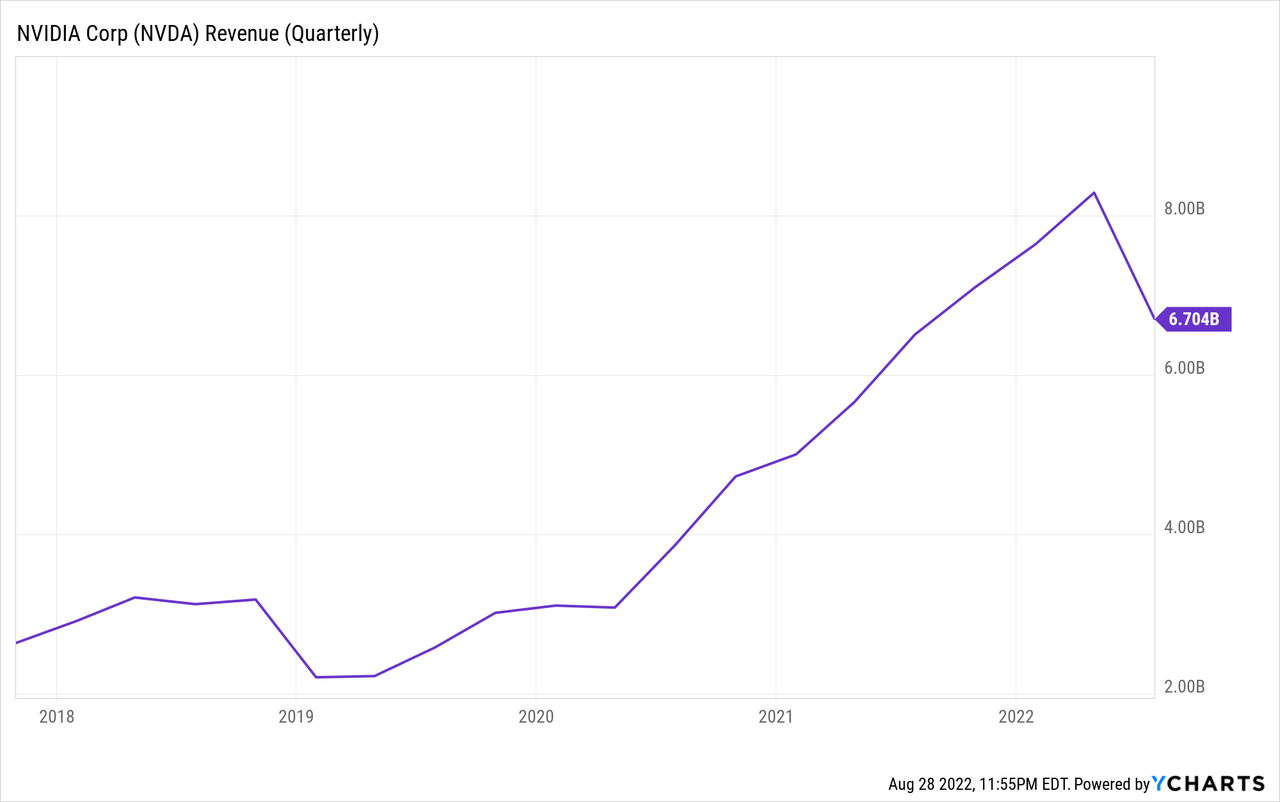

Nvidia delivered total revenue of $6.7 billion, which was down 19% sequentially and only up 3% year on year. This was significantly below the $8.1 billion outlook they provided on their previous earnings call in Q1 FY23. This downfall in performance and miss on expectations was driven mainly by the large miss in gaming revenue of $2.04 billion, which was down 44% sequentially. The lack of performance overall in Q2 can be partially attributed to the softness in revenue in Europe, related to the war in Ukraine as well as the COVID-19 lockdowns in China.

For example, the hyperscale customers in North America nearly doubled year on year in revenue, but this was not the case in other regions internationally. The data center business did grow 61% year on year with a record $3.81B. But this too was lower than Nvidia’s own expectations, and was due to supply chain disruptions.

Another factor impacting the miss in Q2 was the combination of underestimating the macroeconomic headwinds for consumers in gaming, and over ordering on gaming chips to overcompensate for previous supply chain concerns. This led Nvidia to having to take a $1.34 billion charge down on inventory, which consequently brought gross margins down to 45% in Q2.

During the earnings call CFO Colette Kress said:

The decline in gaming GPU revenue was sharper than anticipated, driven by both lower units and lower ASPs. Macroeconomic headwinds across the world drove a sudden slowdown in consumer demand. We implemented programs with our gaming channel partners to adjust pricing in the channel and to price position current high-end desktop GPUs as we prepare for a new architecture launch.

Kress later said the following on the same earnings call:

We expect gaming and ProViz revenue to decline sequentially as OEMs and channel partners reduce inventory levels to align with current levels of demand and prepare for our new product generation. We expect that decline to be partially offset by sequential growth in data center and automotive. Revenue is expected to be $5.9 billion plus or minus 2%. GAAP and non-GAAP gross margins are expected to be 62.4% and 65%, respectively, plus or minus 50 basis points.

Risks to Nvidia and the Semiconductor Industry

The semiconductor industry overall can be cyclical at times and earnings can be lumpy at times, especially when forecasts are miscalculated. The other risk potential with Nvidia is around tensions between China and Taiwan escalating to the point that it impacts Taiwan Semiconductor Company (TSM). TSM produces a large amount of chips for Nvidia, and because of this the company is starting to explore expanding production with additional foundries.

Exponential Performance Delivered by One Architecture on One Platform

Nvidia’s short-term downfall in performance due to the macroeconomic environment provides long-term investors a chance to dollar-cost average into their position with a company that is innovating and impacting markets in healthcare, automotive, gaming, finance, entertainment, education, telecommunications, and more. Everything we do can generate some form of data, and to make that data actionable, solve problems, and deliver results a computing platform is required. Nvidia has everything you could need and want for the datacenter from a hardware, AI, and software perspective. In fact, they even sell a supercomputer that is a datacenter in a box that’s small enough to fit under your desk.

Nvidia’s Mass Market Scale With No Customer Concentration (Nvidia Q1 FY23′ Earnings Presentation)

Nvidia has provided amazing results historically for shareholders, such as 300%+ returns for those who held the stock these last three years. One of the key things to remember is that these results were primarily built on their technology of graphics cards and GPUs, and that’s it. Nvidia is launching new software and hardware revenue streams in 2022. Nvidia is about to launch their first data center CPU (central processing unit) called the “Grace CPU Super Chip,” and it will provide exponential speeds and cost reduction in energy per watt against any of the leading CPUs in today’s market. This super chip also runs on the entire Nvidia software stacks and platforms, including Nvidia RTX, HPC, Nvidia AI, and Nvidia Omniverse.

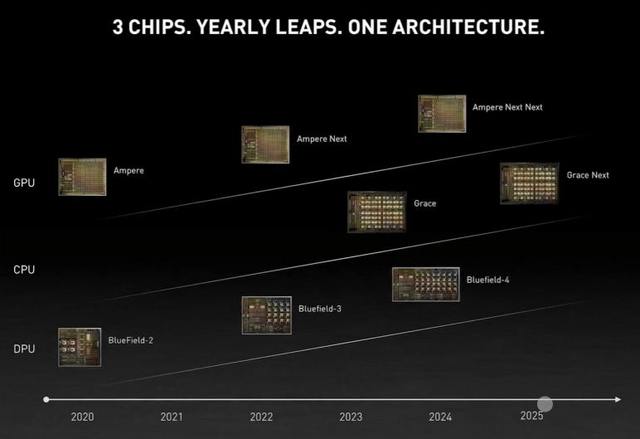

Nvidia recently launched their new DPU (data-processing unit) chip “Bluefield-3” and plan on releasing a new CPU, GPU, or DPU chip every 18 months. The key to this is that these chips are so much faster with each release that it drives enterprise customers to refresh their hardware much sooner than before. Now Nvidia is tying all the software offerings they have to their different chipsets, and it has provided an ecosystem for their customers to adopt.

This flywheel revenue effect that the software, hardware, and AI that Nvidia creates is similar to how you would view a SaaS-based company and their net revenue expansion. Consequently, except for the recent Q2 FY23 performance, Nvidia has had gross margins consistently above 62%-65%, which is what they are estimating for Q3 FY23. These high gross margins are heavily impacting the net income and free cash flows Nvidia continues to bring in.

Nvidia Chip Architecture Release Schedule (Nvidia GTC 2021 Presentation)

What Catalysts Should I Pay Attention to for Nvidia’s Future?

I recommend paying attention to Nvidia’s automotive business, as it generated $220 million in Q2 with 59% sequential growth. Nvidia believes this will be their next business segment to achieve an annual run rate of $1 billion a year. The CFO said it best on the future of their automotive business:

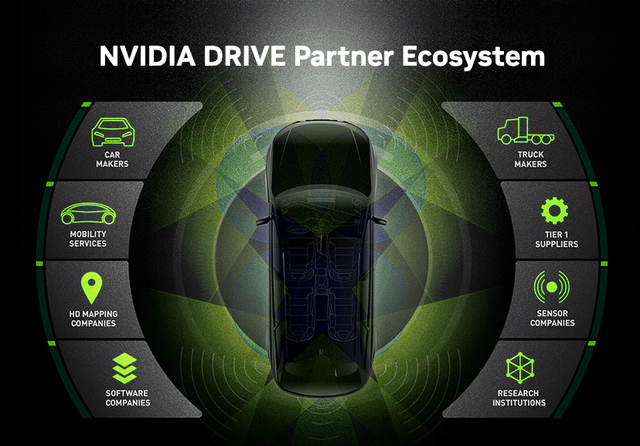

We believe Q2 was an inflection point for our automotive revenue as NVIDIA Orin has great momentum. During the quarter, we announced rollout plans of new vehicles from OEM partners, NIO, Li Auto, JIDU and Human Horizons as well as Pony.ai’s line of self-driving trucks and robotaxis, all built on NVIDIA DRIVE. Looking forward, we expect our $11 billion automotive design win pipeline to translate to continued growth.

So there is much more to come from this business segment, both in the near and long term.

Nvidia DRIVE Partner Ecosystem (Blogs.Nvidia.Com)

Is Nvidia Stock a Buy, Sell, or Hold?

If your time horizon is longer than three years and you can invest with discipline by dollar-cost averaging into the position, I believe Nvidia is a “must buy” to beat the market average. It is my second-largest stock holding and I still to this day continue to add to my position. In the short term we could see some positive movement in the stock due to the VMware Explore 2022 Conference, where Nvidia will be making some announcements, and the Nvidia GTC AI Conference 2022. Make sure to check out their website, previous GTC AI conferences, and financial earnings reports to draw your own conclusion on the stock.

Be the first to comment