Monica Garza Maldonado/iStock Editorial via Getty Images

The news that Vinci S.A. (OTCPK:VCISF, OTCPK:VCISY) will acquire an almost 30% stake in Grupo Aeroportuario del Centro Norte (NASDAQ:OMAB) went largely unnoticed. I would argue that this is, actually, a major development for the Mexican airport operator – and a positive one.

Vinci is not your average infrastructure fund. It’s a conglomerate that, on top of its construction expertise and network of toll roads, has assembled a world-class portfolio of airport concessions. Don’t expect Vinci to be a passive shareholder: it will be actively involved, and I expect Centro Norte to benefit from Vinci’s global network.

Beyond the strategic significance of the acquisition, there are several takeaways for Centro Norte’s retail shareholders. Vinci’s investment of course confirms the attractive nature of the operations, which stand to benefit from the macro trends of a growing Mexican middle class, and the reshoring of manufacturing to North America. The transaction amount, at US$815M for 30%, suggests that the current stock price is on the cheap side. Vinci will also, presumably, support a generous dividend policy. What about a full takeover by Vinci? Unlikely at this stage, in my opinion.

The Transaction

On July 31, Centro Norte announced that its largest shareholder, Fintech Advisory Inc., had informed it of its intention to sell its c. 30% stake in the airport operator:

Such sale will be implemented through the sale to Vinci of 100% of the equity interests in Servicios de Tecnología Aeroportuaria, S.A. de C.V. (“SETA”) and Aerodrome Infrastructure S.á r.l. (“Aerodrome”), which at the time of the sale will own 49,766,000 Series BB shares and 7,516,377 Series B shares of OMA, in the case of SETA, and approximately 58,529,833 Series B shares of OMA in the case of Aerodrome. The purchase price agreed for the sale of SETA is approximately US$578.7 million and the purchase price agreed for the sale of Aerodrome, net of debt, including intercompany debt between Aerodrome and certain affiliates of Fintech, is approximately US$236.7 million.

Source: Centro Norte’s July 31 press release

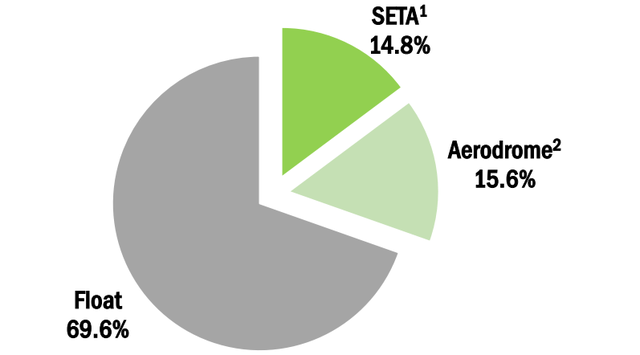

As can be seen in the pie chart below, Vinci is buying two separate legal entities, for a combined amount of US$815M. This will make the French company the leading shareholder of Centro Norte, since no other major owner stands out in the capital structure.

Centro Norte H1 ’22 results presentation

The financial closing of the deal is expected by the end of 2022.

Who Is Vinci?

Despite being one of the world’s largest engineering and construction companies, Vinci may not be familiar to North American readers. The stock, primarily listed in Paris but also available OTC in the U.S., is a solid investment in its own right, and I’ve covered it on various occasions in the past (see HERE).

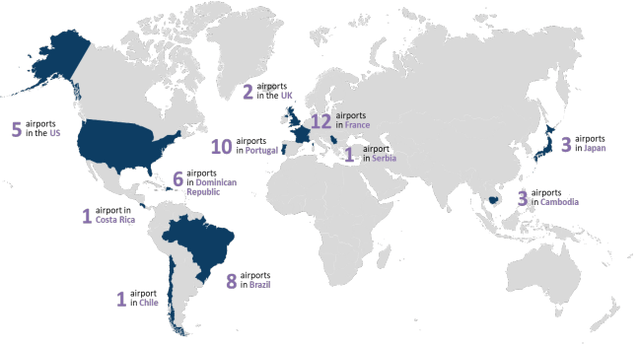

Let’s just mention here that Vinci, whose concessions included mostly toll roads originally (the model usually involved Vinci building and operating highways in Europe), has created an impressive airport division over the past decade. Before the Centro Norte transaction, Vinci operated about 45 airports across 12 countries in Europe, Asia and the Americas.

Vinci’s H1 ’22 results presentation

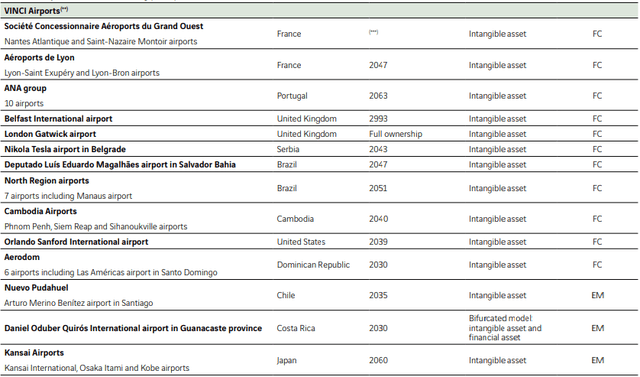

Most of these are operated under a concession model – a notable exception being London Gatwick, which is a freehold.

Vinci’s FY ’21 financial report

After the Centro Norte deal, this number will grow to 70 airports in 13 countries, including recent additions in Brazil and Cabo Verde.

What This Means For Centro Norte

Clearly, having the world’s largest private-sector airport operator as your largest shareholder can only be viewed as a positive. First, Vinci’s investment is an endorsement of the quality of Centro Norte’s assets. Above all, Centro Norte, whose flagship airport is Monterrey, an industrial powerhouse, should benefit greatly from the reshoring of manufacturing to North America, something Vinci must be aware of. This thesis has been well explained by various authors on this website (see HERE).

It goes without saying that Vinci will not be a passive shareholder of Centro Norte, quite the opposite. The European company intends to deploy its long-term partnership model to support the country’s tourism industry and economic growth, according to a statement by Vinci. One can expect Centro Norte and Vinci’s airport division to share best practices and, for instance, leverage their global network when negotiating with suppliers.

A Word On The Implied Valuation

The transaction also gives some indications of Centro Norte’s value. First, Vinci’s press release, which clearly presents the acquisition as a 25-year concession, reminds us that Centro Norte operates its airports under a concession that expires in 2048 – same as its peers Grupo Aeroportuario del Pacifico (PAC) and Grupo Aeroportuario del Sureste (ASR). The concessions may be renewed beyond that, but there is no guarantee. This needs to be factored in when valuing the Mexican operators: it’s safer to consider that the concessions will expire in 25 years.

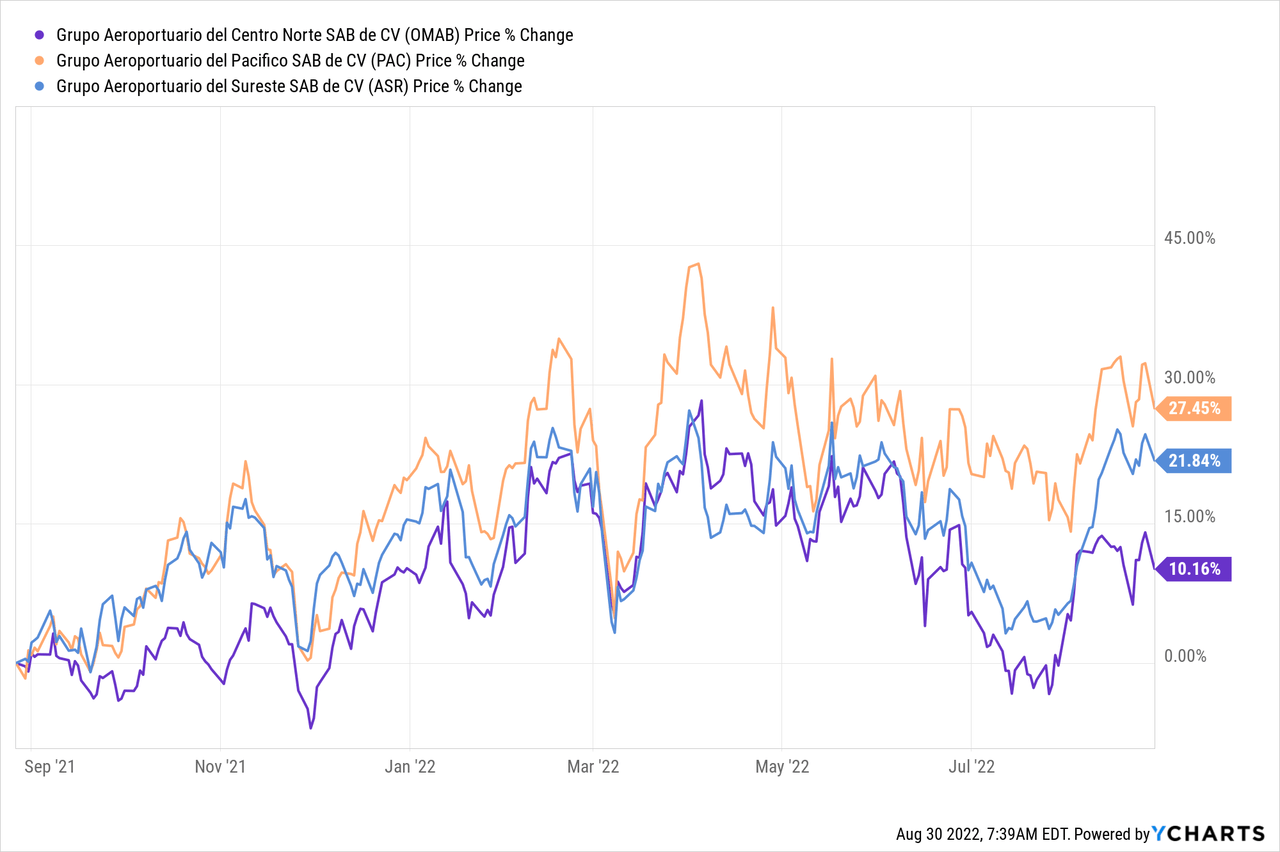

That being said, what does the Vinci transaction price tell us? At US$815M for a 30% stake, it values the equity at approx. $US2.72B, compared to a market capitalization of $US2.59B at the current share price of $53.66 for the NYSE-listed shares. This implies that Vinci paid approx. $56.3 per share for its stake. Given that large stakes like this usually command a discount, this should give minority shareholders confidence that Centro Norte is worth more than the current share price. In fact, price action in Centro Norte has lagged Pacifico and Sureste, whose passenger traffic numbers rebounded faster, helped by a dynamic tourism segment:

Based on the Vinci transaction, Centro Norte should be worth at least 10% more and should close the gap relative to its Mexican peers.

Vinci’s Involvement Should Support The Dividend

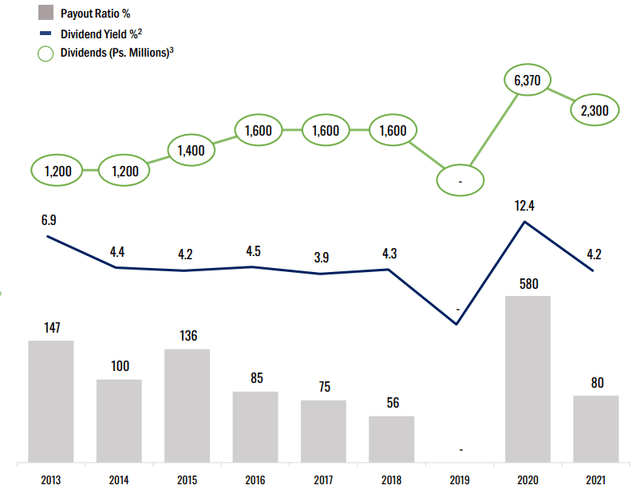

An aspect that will be of importance to income-oriented investors is the distribution policy. Centro Norte has been a rather generous dividend payer, with a typical yield of 4%, nothing to sneer at for a growing company.

Centro Norte’s H1 ’22 results presentation

I expect Vinci to also favor substantial dividends. Centro Norte might bid for new concessions, possibly in the Caribbean where Vinci already has some presence, but given Centro Norte’s strong balance sheet, this should not threaten the distributions. And from Vinci’s perspective as a group, it makes no sense to leave cash idle in a subsidiary, when it can put this capital to work elsewhere across its global activities. This should support generous distributions going forward.

Takeaways

Vinci’s investment in Centro Norte, and its likely involvement in the strategic decisions of the Mexican operator, is good news for minority investors, in my opinion. Not only does it confirm the potential of Centro Norte’s portfolio of airports, it also enables it to leverage Vinci’s global expertise and network.

I expect Vinci’s interests to be well-aligned with those of retail shareholders, notably in terms of distributions. Finally, the million-dollar question: is a full takeover by Vinci in the cards? Even if Vinci can certainly afford it, I would be surprised if anything happened in the medium term. Vinci first needs to get familiar enough with the Mexican market, and I think a 30% stake will suit them well at this point.

Be the first to comment