Morsa Images

Agilent Technologies, Inc. (NYSE:A) is a leader in analytical instrumentation and specialized software for life sciences and applied chemical markets. The tools here allow for the analysis of samples at the molecular level with applications in everything from pharmaceuticals, biotech, industrial materials, energy, and food sciences. We last covered the stock about one year ago, highlighting Agilent Tech as a high-quality blue chip checking off all the boxes between solid fundamentals, earnings growth, and significant long-term opportunities.

That being said, shares haven’t been immune to the market volatility, down nearly 20% over the past year. A pullback in expectations amid macro headwinds compared to what was likely peak optimism last year has driven a reset of valuation. We can also point to the company’s exposure to China, adding a layer of uncertainty.

Still, we like the stock ahead of the upcoming quarterly report this month, with the recent selloff setting up a new buying opportunity. We see shares of Agilent as well-positioned to recover into an improving macro environment and outperform the market to the upside. We’ll recap some of the latest developments and share our thought for the year ahead.

Agilent Q3 Earnings Preview

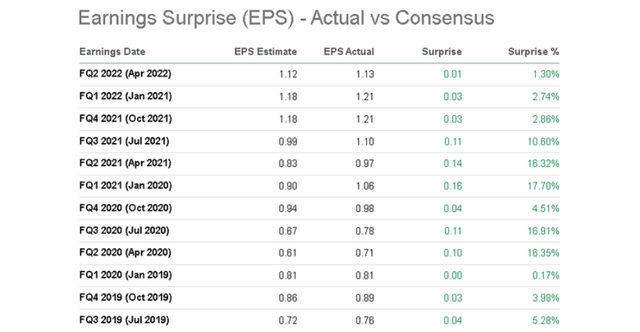

Agilent Technologies is set to report its fiscal Q3 earnings on Tuesday, August 16, after the market close. The current EPS consensus at $1.21, if confirmed, would represent a 9% increase over the period last year. The market is also forecasting revenue at $1.6 billion, a 3% increase over Q3 2021. Notably, both of these figures are in line with management guidance from the last quarterly report.

Seeking Alpha

When looking at these trends, it’s clear that 3% sales growth isn’t much to get excited about and explains some of the weaknesses in the stock over the past year. For context, revenue growth in Q3 2021 was a much stronger 26% which results in a tough comparison period for this report.

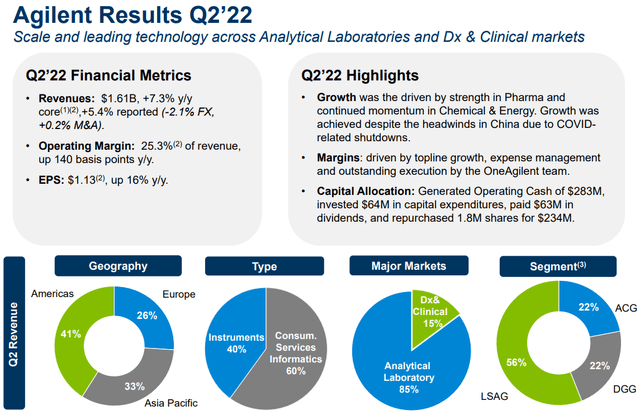

On the other hand, the outlook for earnings to climb ahead of sales implies expanding margins as a point. In Q2, EPS last quarter climbed 16% to $1.13 ahead of a 7% increase in sales, with management citing continued demand strength despite some macro headwinds.

source: company IR

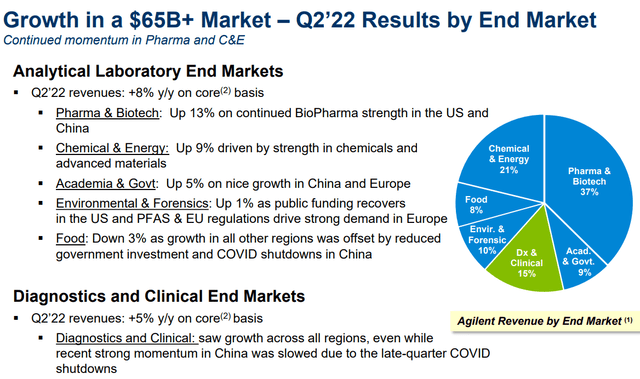

The Q2 operating margin at 25.3%, up 140 basis points y/y has likely been the most positive development for the company in recent quarters. The dynamic reflects strong momentum from its “Diagnostics and Genomics Group”, as the strongest segment of the business, where revenues climbed 14% y/y in Q2. (DGG) benefiting from demand for nucleic acid active pharmaceutical ingredients within the Pharma & Biotech end market, adding to profitability. There is some expectation for this runway to continue.

source: company IR

We mentioned China being a question mark. For Agilent, China currently represents around 20% of its total sales, across all product segments. This follows 2021 growth in the country at 55% y/y highlighting the importance of the region. Agilent has expanded partnerships with local pharma companies to drive diagnostics opportunities while also investing in local manufacturing.

The uncertainty here is that the Chinese economy has been reporting some mixed economic data, below expectations, including disruptions from a wave of Covid lockdowns in the first half of the year. A key theme in this upcoming quarterly earnings report will be how its operations in the Asia-Pacific region are performing amid these headwinds.

We got an update from Agilent in June during a June investor conference event where management highlighted that while the Covid shutdown ended up deferring revenues, some of that business out of China will start to get recognized going forward, apparently into Q3 and Q4. From the event transcript:

Our order book continued to be very strong, double-digit growth for the quarter, outpacing revenue growth. As you know, we’ve had a level of revenue deferral in China because of a shutdown. That’s going to be in the P&L in the coming quarters. End markets are strong, and we feel really good about the health of the business.

It’s worth mentioning that Agilent Technologies has strung together an impressive streak of beating earnings expectations, with a positive surprise on the EPS side every quarter since at least Q3 2019. A scenario where the operating environment in China recovered more quickly than expected is one reason the Q3 report could come in strong through some top-line momentum.

Seeking Alpha

Is Agilent A Good Long-Term Investment?

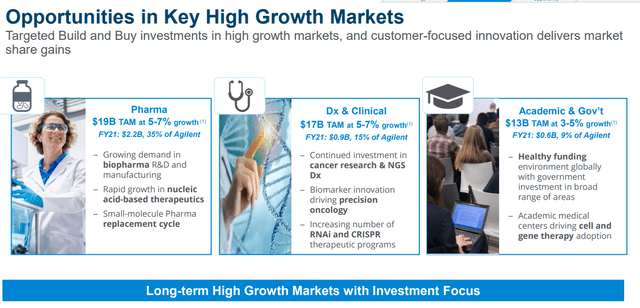

There’s a lot to like about Agilent Technologies, with its core products representing the backbone of innovation in high-growth markets like BioPharma, diagnostics, and even applied materials. Simply put, customers require Agilent equipment and consumables to run laboratory workflow as part of research and development. This includes cancer research and emerging technologies like CRISPR therapeutic programs. Beyond the macro headwinds this year, these are markets where we expect long-term growth to continue.

source: company IR

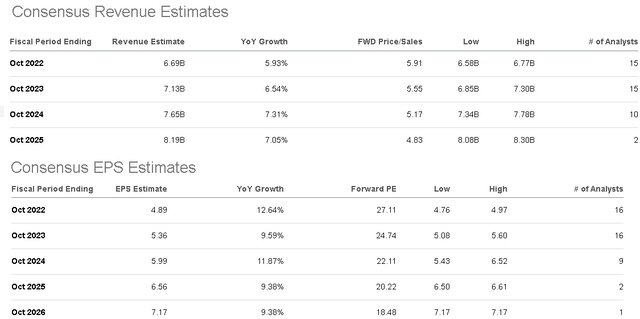

According to consensus estimates, the forecast for full-year revenue is to reach $6.7 billion, up 6% y/y. The EPS estimate at $4.89, up 13% y/y is at the midpoint of management guidance for fiscal 2022. The outlook for top-line growth to average 5% to 7% through 202, follows the expectation that the core addressable markets have a similar long-term trend. What’s more encouraging here is the trend for earnings to climb even higher, averaging around 10% annual growth over the period.

Seeking Alpha

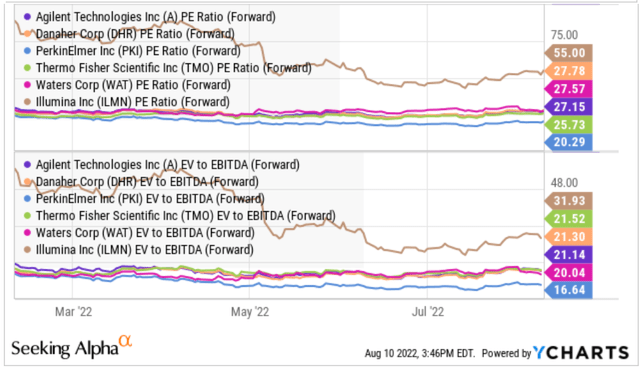

As it relates to valuation, Agilent trades at a forward P/E of 27x which curiously is near the average for a group of competitors between Danaher Corp. (DHR), PerkinElmer, Inc. (PKI), Thermo Fisher Scientific Inc. (TMO), and Waters Corp. (WAT) which offer alternative solutions in life sciences.

What makes Agilent Tech interesting is its exposure to some of the more high-tech segments within BioPharma, compared to some of these players that are more involved in commoditized products. By this measure, the argument we make is that Agilent has room to trade at a larger premium, more akin to Illumina, Inc. (ILMN) which specializes in genomics. The bullish case for Agilent is that it can capture market shares in the high-tech segments, adding to expanding margins.

source: YCharts

Agilent Tech Stock Price Forecast

A bullish call on Agilent to reclaim its all-time will need the macro environment to cooperate, with improving economic conditions globally as a catalyst to drive improving market sentiment. The first step has likely already been accomplished, with shares of A currently trading near a 4-month high and breaking out from a long-running downtrend that started roughly one year ago.

A solid Q3 earnings report next week coupled with positive guidance by management can go a long way to turn the momentum more positive. We can also tie in the more recent economic indicators that have come up better than expected between the July payrolls report and also signs of declining inflation. The setup here is for Agilent to lead its industry peers higher.

Seeking Alpha

Final Thoughts

We rate Agilent as a buy with a price target for the year ahead at $165, representing a 30x multiple on the current 2023 consensus EPS, and around 25% upside from the current level. The key here to recognize is the company’s quality and long-term outlook which can justify a valuation premium and multiples expansion. Longer-term, the ability to re-accelerate growth including through potential strategic acquisitions can support even more upside.

In terms of risks, weaker-than-expected growth trends or deterioration to the macro outlook beyond the current baseline can open the door for another leg lower in the stock. The operating margin and performance from Agilent’s China business will be key monitoring points over the next few quarters.

Be the first to comment