porcorex

Nobody said contrarian investing was easy, since we as humans naturally gravitate toward a herd mentality. It’s easy to justify buying a company when everything is looking up, but not so much when things aren’t as rosy. However, buying high-quality companies when things aren’t so rosy is what leads to market-beating returns over the long run, versus the other way around.

This brings me to Stanley Black & Decker (NYSE:SWK), which currently trades at a price point that few could have imagined just a few months ago. In this article, I highlight what makes SWK a great contrarian bet for potentially strong income and long-term returns, so let’s get started.

Why SWK?

Stanley Black & Decker is a diversified industrial company with businesses in tools & storage, commercial electronic security, and engineered fastening. It has been in business for over 170 years and is a well-recognized brand with a loyal following. The company has a diversified product lineup and operates in over 60 countries.

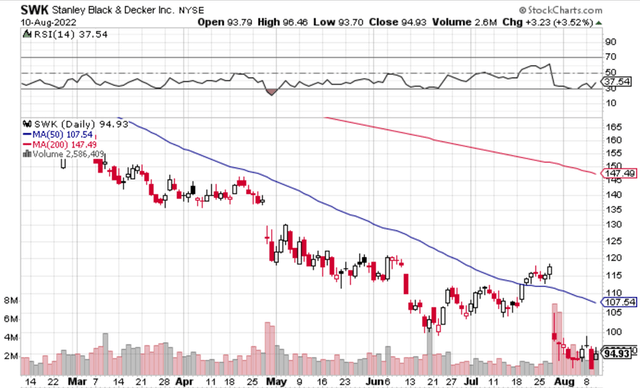

Close followers of SWK stock know that it’s seen its fair share of challenges over the past year, with the share price being decimated by 52% over the year. At the current price of $94.93, SWK is now trading at less than half of its 52-week high of $203. The share price has fallen materially since the Q2 earnings release, and now trades well below its 50- and 200-day moving averages, as shown below.

SWK Stock Technicals (StockCharts)

Of course, the fall in price doesn’t happen for no reason, as cost inflation and higher interest rates have put a damper on the housing market, which drives demand for SWK’s products as well as pressured margins. While revenue was up by 16% YoY to $4.4 billion in the second quarter, this was largely driven by strategic power equipment acquisitions (+24%) and price increases (+7%). At the same time, volume dropped by 13% YoY as customer demand cooled, and commodity inflation drove gross margin down by 800 basis points to 27.5%.

It goes without saying that SWK is seeing its fair share of challenges. However, I don’t see the long-term thesis as being broken, given the strength of its brands, its global diversification, and its competitive advantages. In addition, the company is taking steps to mitigate the challenges it’s currently facing, which gives me confidence that it will be able to weather the storm and come out stronger on the other side.

This is supported by SWK accelerating its global cost reduction program, which anticipates annual savings of $1 billion by the end of next year, growing to approximately $2 billion within the next 3 years. Moreover, SWK is aggressively returning capital to shareholders, with $2.3 billion of share repurchases so far in 2022. Management has put share buybacks on hold for now, considering the challenging environment, but stated that they would look at it again in 2023 or later.

Looking forward, SWK could emerge from the current downturn as a stronger company, as its recent divestitures and acquisitions have made the company more focused on its core business. It’s also reducing complexity in the organization while maintaining investments in R&D, sales, and digital engagement, as noted during the recent conference call:

We are no longer a diversified industrial company. We are primarily a Tools & Outdoor company, with an excellent industrial business alongside of it as well. It makes us a very simpler company than we can be more streamlined, more efficient and effective and then we have a significant indirect spend component, which is not people related.

And then there is the, what I would call, the optimization of spans and layers, which is about $100 million. And that is really looking at that structure of how our businesses are organized and how many layers do we need, what is the span of control and really trying to optimize that.

And that really, for the most part, will avoid the R&D organization, the sales organization, our digital marketing organization and really be more focused on the leadership team and the management of the businesses and also simplifying the processes that they utilize to make decisions throughout the day and the week as they drive the business.

Notably, SWK sports a strong A rated balance sheet and is a Dividend King with over 50 years of consecutive raises. Even with the reduced EPS guidance of $5.50 for the full year, the dividend remains well covered with a 58% payout ratio.

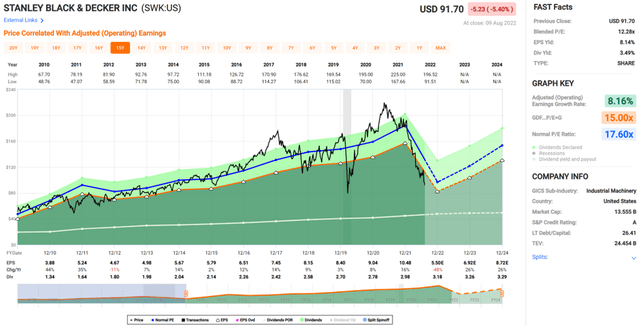

SWK appears to be rather cheap at the current price of $94.93. While the forward PE of 17.3 points to a fair valuation, this takes into consideration the aforementioned reduced EPS guidance. Analysts expect to see a strong rebound over the next two years, bringing the forward PE ratio down to just 9.3x based on 2024 estimates. Sell side analysts have a consensus Buy rating with an average price target of $123.50, implying a potential one-year 33% total return including dividends.

SWK Valuation (FAST Graphs)

Investor Takeaway

While Stanley Black & Decker is facing some challenges in the near term, I believe the company is taking the necessary steps to emerge stronger than before. The long-term thesis remains intact, in my opinion, given the strength of its brands, global diversification, and competitive focus. SWK appears to be rather cheap at the current price, and analysts expect to see a strong rebound over the next two years. For these reasons, I believe SWK is a buy for long-term investors.

Be the first to comment