Sjo/iStock Unreleased via Getty Images

Tesla (NASDAQ:TSLA) has had an incredible run over the last several years. With the introduction of Tesla’s mass-market ultra-popular vehicles, the company’s revenues have skyrocketed by approximately 13,000% since 2012. Tesla’s gross profit has surged by roughly 45,000% in this time frame. Tesla’s stock has appreciated by an unprecedented 18,000% over the last decade, making it the best performing stock in the previous 10 years. Tesla is becoming increasingly profitable and should continue to grow earnings and revenues as we advance. The company’s stock had a big surge when Tesla announced its first stock split, and now the company is about to split its stock again. Provided the company’s upcoming stock split, technical setup, explosive sales growth, and earnings potential, Tesla’s stock will likely appreciate considerably in future years.

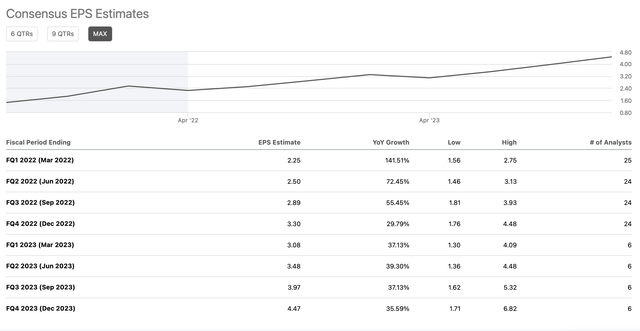

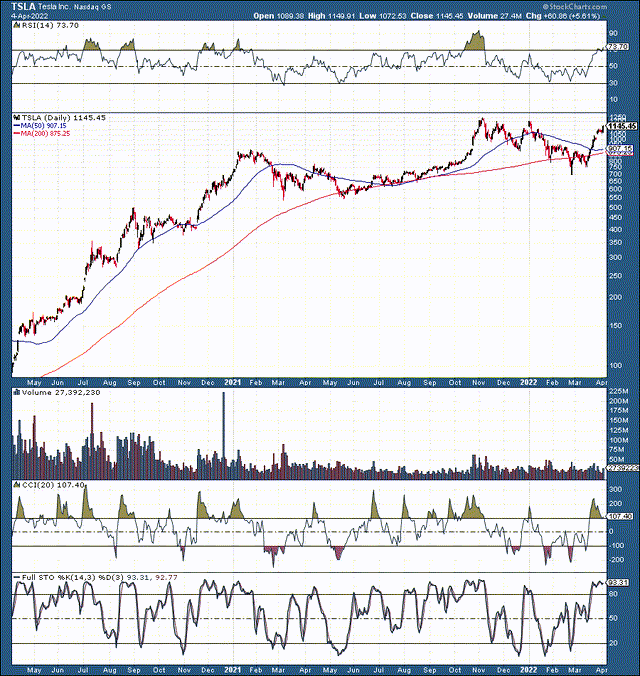

TSLA – Robust Technical Setup

Like most high-profile growth stocks Tesla took a big hit in the recent tech decline. From peak to trough the stock dropped by a whopping 44% from its ATH achieved during the tech blowoff top last November. However, since the bottom, we’ve seen a meteoric rise of about 57% in Tesla’s shares. Now we’re approaching the highs from last year and Tesla should breakout to new highs going into earnings and its stock split event.

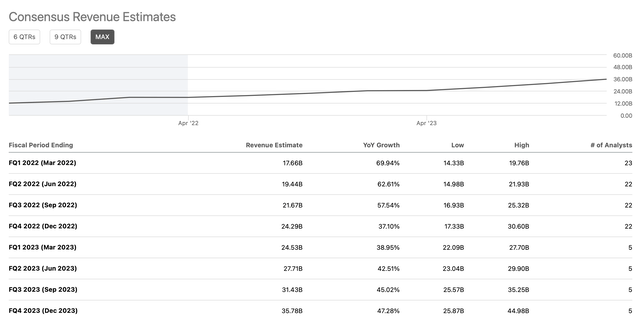

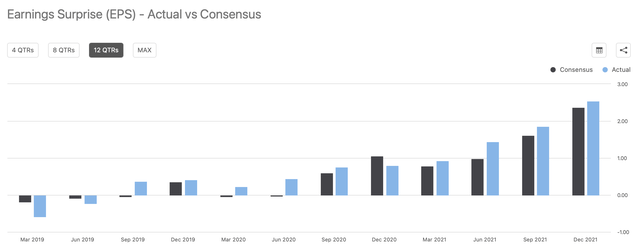

Tesla Revenue and EPS Estimates

I often hear the argument that Tesla is overvalued. If we use traditional valuation metrics like the price to earnings ratio, Tesla’s stock seems rich at around 162 times trailing earnings. Nevertheless, if we look at forward EPS projections, Tesla looks better at 100 times 2022’s EPS estimates. Yet, it’s still relatively expensive. However, where else will you find a large-cap company growing annual revenues at 50%-60% YoY? Moreover, we’re likely to see about a 62% YoY increase in EPS this year. Furthermore, rapid growth should continue, as consensus analysts’ estimates are for about $15 next year.

Revenues (SeekingAlpha.com) EPS (SeekingAlpha.com)

This projection implies that EPS should rise by about 40% YoY in 2023, but the company could beat consensus figures, and we may see EPS closer to $20 next year. In addition, next year’s revenues should come in at about $120 billion, roughly 50% above this year’s projected results. Tesla’s growth remains remarkable, with the force and scale I’ve never seen. Furthermore, the growth runway remains extended as Tesla plans to introduce new factories, vehicles, and revenue streams as we advance. Therefore, Tesla’s stock may not be overvalued relative to the company’s extensive growth prospects and earnings potential.

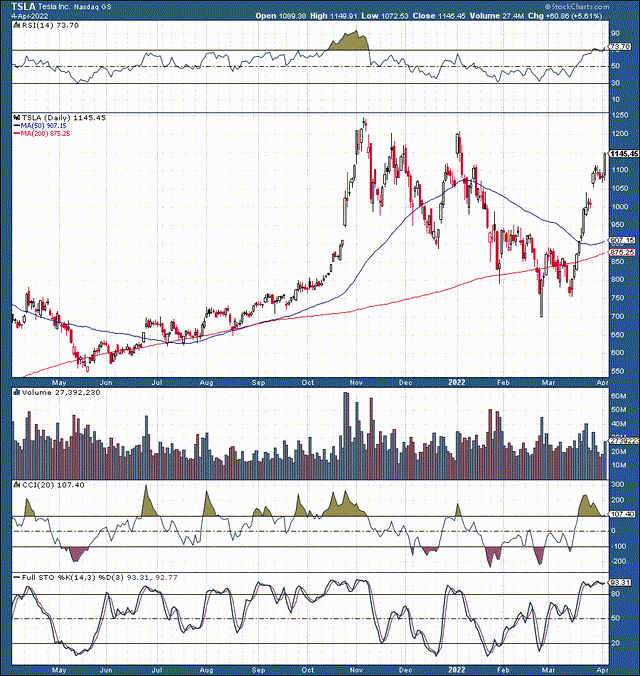

Tesla’s Earnings Surprises

Tesla’s earnings have surged in recent years. In early 2019 the company was still recording significant losses, but earnings took off in the second half of the year. Tesla’s become increasingly profitable recently, with earnings spiking in past quarters. Moreover, we see that Tesla has beat nine of its last ten earnings estimates, and this trend of surpassing analysts’ estimates should persist as the company advances in future years.

In its last four quarters, Tesla has beat EPS estimates by 22%, and we may see a similar outperformance dynamic as we advance. However, even if we apply a 15% average beat ratio, we arrive with an EPS of around $12.60 this year. If we add the consensus projected 40% EPS growth rate, we come at about $17.64 in EPS next year. Additionally, once we apply our anticipated 15% EPS beat rate, we may see EPS of around $20.29 next year. This dynamic implies that Tesla may be trading at only approximately 52 times forward earnings. Provided the company’s phenomenal growth rate and remarkable earnings potential, 52 times forward P/E ratio is relatively inexpensive for Tesla right now.

The Stock Split Phenomenon

We’ve seen many stocks split lately, and the effects have been highly positive. In recent years, one of the highest-profile splits was Apple’s four-to-one split in August 2020. First, the stock doubled from its coronavirus-induced low going into the split. Then, the stock skyrocketed by about 40% in the months following the split. Apple’s stock has essentially doubled since its split in 2020. Incidentally, in August 2020, Tesla had its first stock split. The company issued a five-for-one split, and its share price exploded higher. The stock nearly doubled in the months surrounding the split announcement and has appreciated by around sixfold since July 2020.

Tesla 2-year Chart

We can see the scale of Tesla’s stock price appreciation around the time of its split announcement. Now, I’m not saying we will see another six-fold return over the next several years, but we will probably see another leg higher when Tesla splits its shares again. We will likely see about a 5-10 per one stock split, which would bring Tesla’s stock price down to around $100-300. This dynamic would make the company’s stock much more attractive for many retail investors who are not interested in paying more than $1,000 per share for a stock. Additionally, we could see more demand for covered call strategy holders as a block of shares would only require an investment of $10-30K rather than more than $1,000. Finally, we could see more short covering as a split typically implies that the share price will rise. Regardless of the company’s stock split, Tesla remains a company with excellent growth prospects and earnings potential.

Here’s what Tesla’s financials could look like moving forward:

| Year | 2022 | 2023 | 2024 | 2025 |

| Revenue | $85B | $120B | $162B | $210B |

| Revenue growth | 41% | 35% | 30% | 25% |

| EPS | $12.60 | $20 | $30 | $40 |

| Forward P/E | 75 | 60 | 50 | 45 |

| Stock price | $1,500 | $1,800 | $2,000 | $2,500 |

Source: The Author

Risks to Tesla

Risks exist for Tesla, and there are quite a few. While I estimate that the company can earn close to $40 per share in 2025, the company is very far from such figures right now. Therefore, there’s the risk that Tesla will not illustrate the kind of earnings growth I envision. A slowdown in demand, increased competition, supply issues, decreased growth, and other variables are all risks we should consider before betting on Tesla to grow EPS severalfold through 2025. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider the risks carefully before committing any capital to a Tesla investment.

Be the first to comment