JohnFScott

Starbucks Corporation (NASDAQ:SBUX), together with its subsidiaries, operates as a roaster, marketer, and retailer of specialty coffee worldwide. Its stores offer coffee and tea beverages, roasted whole beans and ground coffees, single serve products, and ready-to-drink beverages; and various food products, such as pastries, breakfast sandwiches, and lunch items. Starbucks is one of the most well-known coffee shop chains around the globe.

Starbuck’s stock has not performed particularly well year-to-date, losing about 27% of its market value, while the broader market has declined by about 21%. In this article, we will elaborate on three reasons, why we believe that despite the recent underperformance the stock could be an attractive long-term investment.

High demand for Starbucks’ products, despite the low consumer confidence

Many firms that are selling products and services in the consumer discretionary segment, including restaurants, have been hurt in 2022 because of the particularly difficult macroeconomic environment. Headwinds included elevated raw material costs, a tight labour market, supply chain disruptions, high freight costs, COVID-19 related restrictions in China and low consumer confidence.

Numerous companies have seen the demand for the goods that they produce and market substantially decline. As the consumers became more concerned about their financial outlook, they started to save more, for example, by spending less on discretionary products and by switching to lower cost alternatives.

Starbucks is one of the exceptions from this trend.

Recent reports have shown that the demand for Starbucks’ beverages remains strong. One of the primary drivers of the recent spike in demand was the change in the menu.

Visits to Starbucks were up 25.7% this year during the seven days after the chain launched its fall menu, compared to the average weekly visit numbers for the previous five weeks, […] During that same stretch, visits were up 7.5% compared to 2019’s numbers, too.

This is however not the only sign of strong demand. During the latest investor day, the tone of the management was quite promising.

First, both sales and earnings forecasts have been revised upwards. This is quite a promising sign in the current macroeconomic environment.

Annual growth in adjusted EPS of 15-20% for fiscal 2023-fiscal 2025 is expected, while the expectations for annual global comparable sales growth is 7-9% over the same period, feeding global revenue growth of 10-12%. Despite the challenges in China, the firm expects comp sales to grow 4-6% annually over the same time span, with net stores growing 13%.

Furthermore, the firm remains committed to return value to its investors in the form of both quarterly dividend payments and share repurchases. Accounting for both dividends and buybacks, the firm foresees to return about $20B in capital to shareholders over the next three years.

This takes us to our next two points: dividends and share buybacks.

Dividend

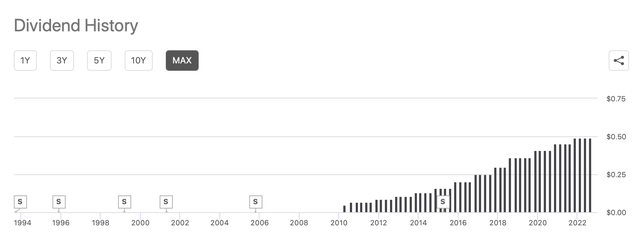

While Starbucks does not have the longest history of paying dividends, the firm has been consistently paying and raising its payout throughout the last 11 years.

Dividend history (Seekingalpha.com)

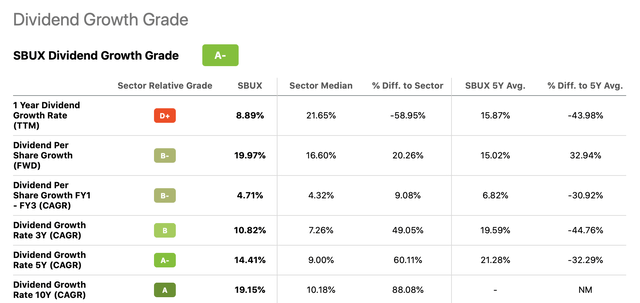

Even during the pandemic, in 2020, the company kept rewarding its shareholders, while a lot of its peers and competitors have stopped paying dividends. The growth of the dividend compared to the consumer discretionary sector median appears to be attractive.

Dividend growth (Seekingalpha.com)

The current quarterly dividend is $0.49 per share, which translates to an annual yield of about 2.2%. Management has mentioned during their investor day that they are aiming to keep the dividend around 2% in the next years.

When talking about the dividend, it is important to understand whether the current payment is safe and sustainable or not. While SBUX has a payout ratio of more than 60%, which is substantially higher than the sector median, we believe that the firm will be able to return value to its shareholders as both revenue and EPS are projected to increase substantially.

All in all, we believe that Starbucks could be an attractive addition to a dividend and dividend growth portfolio.

Share buyback programs

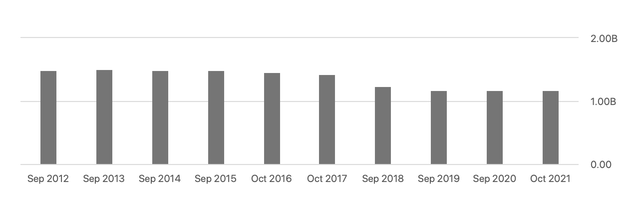

While dividends represent direct cash payments to the shareholders, a share buyback is when a company buys its own outstanding shares to reduce the number of shares available on the open market and thereby increase the value of the remaining shares. Recently the firm has announced that they are resuming their share repurchase program, which has been halted in April 2022. In our opinion, this step is signalling management’s confidence in the business going forward.

Moreover, the firm has a strong track record of gradually buying back their shares. In the last decade, the number of outstanding shares have been reduced by more than 20%.

Number of shares outstanding (Seekingalpha.com)

In our opinion, investors and potential investors with a long-term investment horizon may benefit from this continuing trend.

Key takeaways

Many argue that Starbucks is trading at a significant premium compared to the consumer discretionary sector median and that the risks related to the Chinese operations are too high, due to the government’s zero COVID policy.

While the valuation indeed appears high, we believe that Starbucks’ revenue and EPS growth, brand recognition, customer loyalty and commitment to return value to its shareholders justify the current figures.

We believe that the superb revenue and EPS growth, combined with the relatively high margins that are expected to further expand in the coming years, makes the firm’s stock attractive.

All in all, we rate Starbucks’ stock as “buy”.

Be the first to comment