dima_zel/iStock via Getty Images

Investment Thesis

NIO Inc (NYSE:NIO) definitely did not pioneer the EV battery swapping concept, however, the company had achieved success with it in the Chinese market, with 7.6M battery swaps as of March 2022. Given CATL’s push for similar services, we may expect a more widespread adoption globally, given that CATL already supplies its batteries to many EV producers such as General Motors, Volkswagen, BMW, and Tesla.

In addition, we may expect to see NIO deliver doubled production capacity moving forward, given that its second manufacturing plant in China is almost ready. As a result, it is possible to see the company achieve a 1M annualized production rate within the next two years, while reporting revenues of $22.52B and net income profitability by FY2024.

NIO Delivered Record Vehicles In FY2021

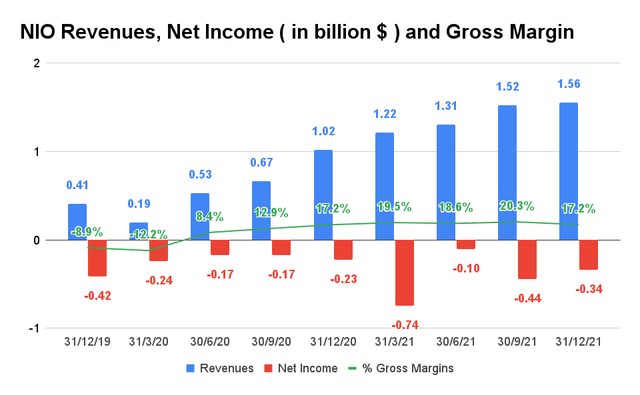

NIO Revenue, Net Income, and Gross Margin

In the past three years, NIO reported tremendous revenue growth at a CAGR of 99.16%. The growth of its sales within China was mainly attributed to the two-year extensions in the government’s subsidies for EV purchases, helping the country achieve an astounding 17% market share for EVs adoption as of January 2022. Comparatively, the EU reached a 19% market share ( including hybrid cars), while the US lagged behind with approximately 4%.

Despite a 20% rollback of government subsidies in FY2021, NIO’s sales more than doubled by 228% to $5.68B for the fiscal year. In addition, the company reported sales of $1.56B in FQ4’21, mainly attributed to the robust demand in China, with approximately 200 EVs sold in Norway in the quarter. The FQ4’21 sales also represented excellent growth of 2.4% QoQ and 52.9% YoY. The improvement in its gross margins is impressive as well, from -8.9% in FQ4’19, to 17.2% in both FQ4’20 and FQ4’21.

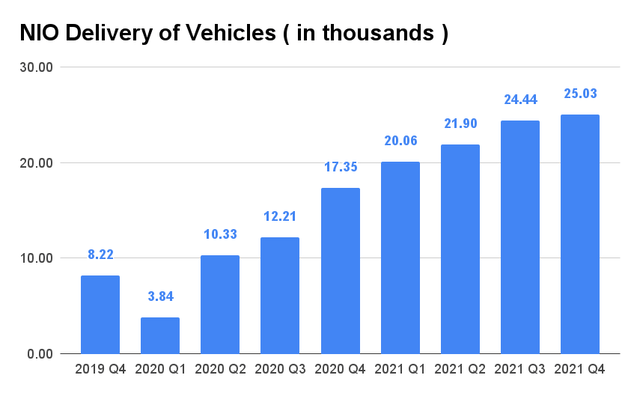

NIO Delivery of Vehicles

For FY2021, NIO reported deliveries of 91K vehicles, representing tremendous growth of 209% YoY and 444% from FY2019. In addition, the company reported deliveries of 25.03K vehicles in FQ4’21, with an impressive increase of 44% YoY and 304% from FQ4’19 levels. NIO also achieved its FQ1’22 deliveries guidance at 25.76K vehicles, representing an increase of 2.9% QoQ and 28.5% YoY.

In its latest earnings call, NIO also reported an annual manufacturing capability of 240K to 300K vehicles for its existing plant. Given that the company has almost completed the construction of its second manufacturing facility in Hefei, China, we may expect to see its manufacturing capabilities doubled moving forward. Assuming a similar growth trajectory, NIO could very well achieve annual deliveries of 1M vehicles in less than two years, given the aggressive YoY growth of its capital expenditure at 65% in FY2021.

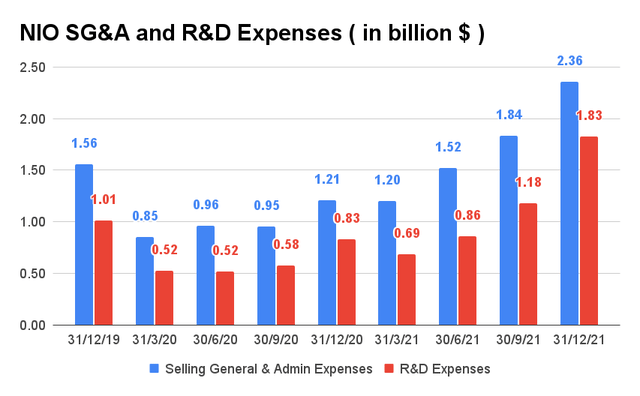

NIO SG&A and R&D Expenses

Due to its rapid expansion and aggressive expenditures, NIO has yet to report profitability. In FY2021 alone, the company spent $1.8B in SG&A and R&D expenses, nearly double its FY2020 expenditure. For FY2022, NIO guided that it will more than double its R&D expenses YoY, with a total headcount of 9K by the fiscal year-end. We agree with the management that these investments are critical to improving its market penetration and “fundamental technologies.”

Given NIO’s ambitions in “full-stack autonomous driving and battery technologies” similar to that of Tesla (TSLA), we expect the company to compete with the former in the higher-end EV market within China. Nonetheless, the combined sales of NIO, Xpeng, and Li Auto, still lag behind TSLA by 13% in FY2021. Due to TSLA’s aggressive gigafactories expansion in Texas, Berlin, and Shanghai, the gap will likely remain for some time, given a speculative output of up to 2.7M vehicles annually.

In the meantime, NIO has shown its global aspirations through the previous entry into the European EV market in Norway in 2021, while doubling the footprint of its US headquarters. In 2022, the company also aimed to enter the EV market in Germany, the Netherlands, Sweden, and Denmark. In addition, during its annual NIO Day event in Suzhou, China, the company revealed its aim to be present in 25 countries and regions by 2025, including in Western Europe and Australia.

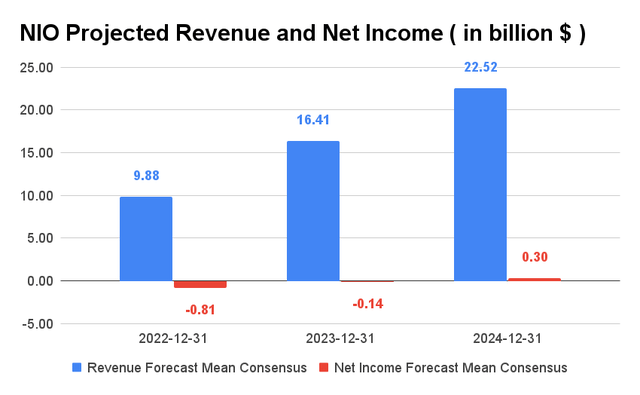

NIO Projected Revenue and Net Income

Assuming similar growth and sales trajectory, we expect NIO to hit and/or easily exceed consensus estimates of $9.88B for its FY2022 revenues, representing a potential increase of 73.9% YoY. For FQ1’22, NIO guided revenues in the range of $1.51B to $1.57B, representing an increase of 25.1% YoY. In the next three years, NIO is also expected to report impressive revenue growth at a CAGR of 58.27%, while achieving net income profitability from FY2024 onwards.

Battery Swap Service Is Likely To Remain In China Only

In FY2021, NIO’s revenue is made up of vehicle sales at $5.2B and other sales at $465.5M, representing impressive YoY growth of 223% and 282%, respectively. It is important to note that its other sales are attributed to services, packages, and accessories, including its Battery as a Service (BaaS) and One-Click-for-Power services for emergency situations on the road, such as dead batteries or flat tires.

NIO embarked on its BaaS service in 2018, when public EV charging facilities were not commonplace in China yet. By the end of 2021, with 7M EVs on the roads in China, charging remains a concern with over 1M points scattered nationwide, with existing NIO fast charging technologies requiring up to 50 mins for a full charge. Despite NIO’s expensive capital investment of $500K per BaaS station in China, it made sense given that most Chinese city dwellers are not able to charge their EVs in their apartment buildings. It is different from TSLA car owners in the US, who are able to charge their EVs in their landed homes with solar panels on their own roof. In addition, NIO’s consumers are able to choose from multiple battery sizes for daily use or long-range driving in just five minutes with this system, given the country’s landmass.

Given that NIO completed over 7.6M battery swaps as of March 2022 with 866 BaaS stations, it is evident that the system is popular with its Chinese consumers. It is also interesting to note that over 90% of its customers in Norway opted for the BaaS system, instead of the conventional EV purchase. In addition, NIO unveiled its 2025 goals of installing 3K BaaS stations in China and 1K overseas including Europe, as a testament to its confidence in the strategy.

However, given the massive capital expenditure of $500K per BaaS station compared to a charger unit at $100K, it would make sense that NIO complements the battery swap strategy with charging technology. In its latest earnings call, the company had aimed to achieve 1.3K BaaS stations and 6K public charging facilities in China by the end of FY2022. Nonetheless, NIO still has some ground to catch up for its existing fast charging technology, which fully charges an EV in 50 mins. Currently, ABB and TSLA hold the global lead with their Terra 360 and Superchargers V3 hardware, capable of a full charge in less than 15 mins, respectively, depending on battery capacity.

On the other hand, with its partnership with Shell Group, we expect accelerated growth for its combined battery swapping and fast charging hubs at Shell Stations in China moving ahead. Nonetheless, though the Shell partnership includes a network development of co-branded battery swap stations in Europe, we doubt the pilot program will take off, given the lack of government support previously offered by the municipal government of Hefei in China. In addition, NIO only projected 1K BaaS stations overseas by 2025, with a portion allocated in the EU. Though speculative, we think that NIO may potentially concentrate on the fast charging technology in the EU to reduce its CAPEX, given that the company expects to be profitable by FY2024 in its latest earnings call.

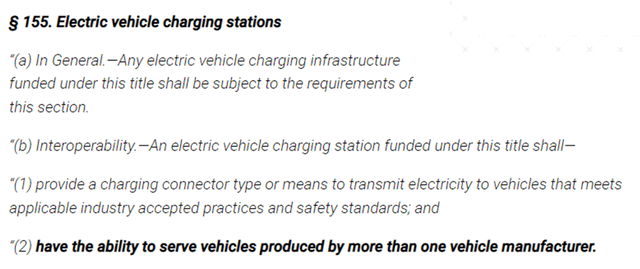

Interoperability For Obtaining US Government’s Financial Support

NIO’s BaaS strategy will probably not take off in the US as well, due to the overwhelming focus on charging by most providers and the government. TSLA themselves had abandoned the battery swapping idea back in 2013. NIO’s BaaS system also only works for its own vehicles and batteries, thus disqualifying the company from US government funding. On the other hand, TSLA plans to triple the number of its EV charging network over the next two years, from its existing 30K Superchargers globally as of the end of 2021. By allowing other EV brands to utilize its Supercharger networks, TSLA would also be able to access some of the US government’s $7.5B funding for EV charging infrastructure from its $1.2T Infrastructure Bill. However, given that the US only has 113K public charging stations, including 1.2K TSLA Supercharger stations as of January 2022, the charging capabilities remain below those in China.

Nonetheless, given that CATL, the world’s largest battery supplier ( and also NIO’s supplier), is also pushing for a battery swap system for EVs, NIO’s BaaS concept may work in the long term, assuming one caveat. That is if the stars are aligned and most EVs are standardized to the extent that a BaaS station can serve multiple EV brands moving forward. Given how all conventional fuel-powered cars already feature the same fueling method, CATL and NIO could partner up to provide the battery swap service just like how Shell Group dispenses fuel at gas stations. Given how CATL is already supplying its batteries to multiple leading automotive makers, such as General Motors, Volkswagen, BMW, and Tesla, only time will tell if the world adopts the BaaS method, though we think both methods do complement each other while serving different needs and purposes.

So, Is NIO Stock A Buy, Sell, Or Hold?

NIO is currently trading at an EV/NTM Revenue of 3.51x, lower than its 3Y mean of 7.7x. Given the previously bearish sentiment on Chinese stocks, the stock is also trading at $23.85 as of 4 April 2022, down 55% from its 52 weeks high of $55.13. Nonetheless, given its projected growth and the recent turnabout stance from the Chinese government on US listing, NIO stock is definitely a strong buy now at its current undervaluation.

However, interested investors must still be aware that NIO, just like all other automotive makers, is facing hikes in raw material costs and shortages in semiconductor chips. Given that chip shortages are only expected to be alleviated in 2023, the company may continue to see increased pricing and margin pressures in the near term.

Therefore, we rate NIO stock as a Buy only for speculative investors.

Be the first to comment