pixdeluxe

Co-produced with “Hidden Opportunities”

Why do we invest our money?

Simply put, we invest to make our money work for us and build wealth over time.

Here’s how I think of my money: soldiers. I send them out to war every day. I want them to take prisoners and come home so there’s more of them. – Kevin O’Leary

In the investment battlefield, several known and unknown enemies exist, such as geopolitical and economic issues. But for a retiree, one of the most critical opponents is inflation. Not saying that inflation doesn’t hurt other classes of investors, but it is particularly hard on retirees. Inflation is in the spotlight now because it is breaking records and soaring to 40-year high levels, and it is rattling the stock market’s cage. But even without these above-average inflation rates, the concept is a daily struggle for most retirees.

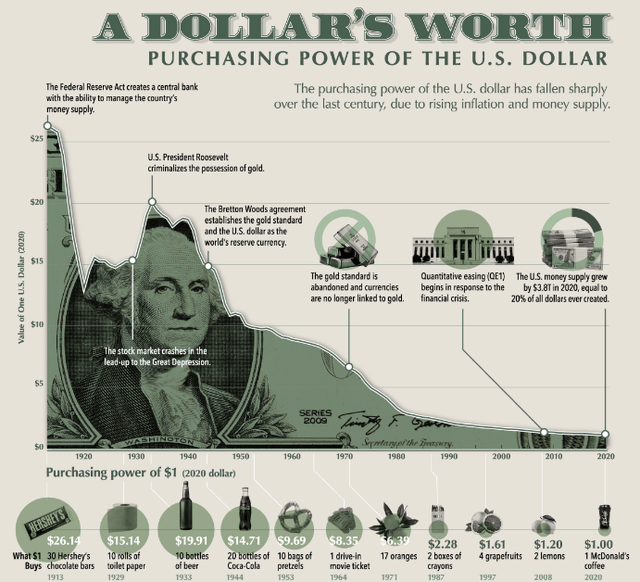

$1 could buy ten bottles of beer in 1933, but its purchasing power has shrunk to a small McDonald’s coffee (before taxes) today. For retirees who must rely on their hard-earned savings, making their money work hard for them is critical.

You see, it may sound tempting to avoid all the fear, uncertainty, and doubt and sit with cash until the situation improves. But cash is the worst asset in almost every sense. The longer you wait, the less you can do with it.

People who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value. – Warren Buffett

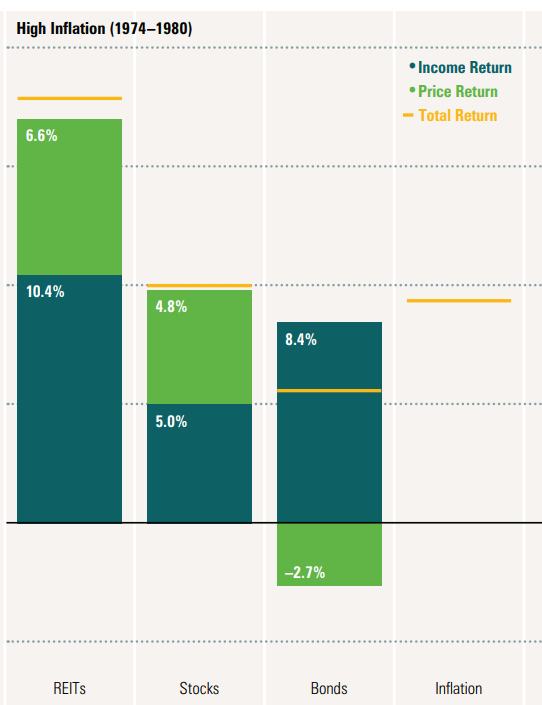

Among equity classes, REITs, in particular, have proven to be better positioned to achieve outperformance than equities and bonds through the longer-term challenges posed to our economy.

REIT.com

This is because they are structurally designed to pay 90% of their profits to shareholders and can perform rent-escalations to combat inflationary cost increases. Today, we discuss two REIT picks with up to 9.2% yields that you can buy, knowing they will protect your retirement from various economic challenges. Without further ado, let us review the picks.

Pick #1 WPC, Yield 4.8%

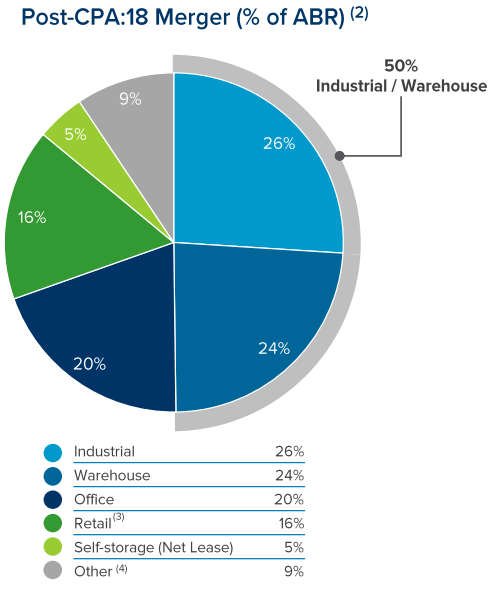

W. P. Carey Inc. (WPC) is a REIT that owns a combination of industrial, logistics, essential retail, office, and self-storage real estate with a healthy mix of assets in the U.S. (64%) and Europe (33%). (Source: July 2022 Investor Presentation)

July 2022 Investor Presentation

WPC is a fundamentally and operationally stronger Triple-Net Lease REIT compared to peers, as evidenced by its consistently high occupancy numbers through the times of highest uncertainties during the pandemic. WPC maintains a portfolio of 1390 properties and 386 tenants, ~31% of which are investment-grade.

Note: WPC has completed its $2.7 billion merger with CPA 18. The above portfolio figures are those reported by WPC before closing the transaction.

99% of WPC’s annualized base rent is protected with contractual rate increases, with 57% linked with the Consumer Price Index (‘CPI’). This means WPC is well-positioned to earn more as prices go up and pay growing dividends.

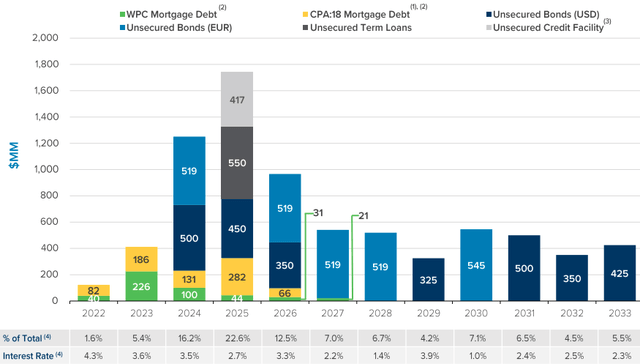

Property level expenses are inflation sensitive and a legitimate cost for REITs. But WPC side-steps this by pursuing Triple-Net Leases, where the tenant bears responsibility for most of the property level expenses. Debt is another significant expense for REITs, and WPC is again at a comfortable spot with fixed-rate debt and no significant maturities until 2024-2025.

July 2022 Investor Presentation

WPC has maintained quarterly dividend increases for 20 years. Its current $1.06/share dividend calculates to a 4.8% annualized yield. The merger with CPA 18 to expand its asset base strongly indicates growing income and more dividend raises to come. With a Weighted-Average Lease Completion term of 10.8 years, a cash interest coverage ratio of 6.6x, and a solid 99.1% occupancy, WPC presents a fundamentally strong investment to help your portfolio weather the long-term effects of inflation.

Pick #2: NYMTM, Yield 9.2%

Generally, above-average yields are a powerful hedge against inflation. But as the Fed continues to raise interest rates to combat this inflation, it would be beneficial to have exposure to fixed-to-floating preferred stocks. We want high yields now and even higher yields in the future. We will discuss this today with the deeply discounted New York Mortgage Trust – 7.875% Series E Fixed-to-Float Cumulative Redeemable Preferred Stock (NYMTM).

NYMT is a mortgage REIT that primarily deals with mortgages for single and multi-family residential assets. NYMTM is one of the four currently trading preferred securities issued by NYMT and only one of two that have a fixed-to-floating rate coupon structure.

NYMTM is trading at a significant discount to its par value, with ~16% upside for investors from current prices. It is worth noting that this security traded above par value on numerous occasions, including pre-pandemic days and in 2021, before the markets began their bearish streak. Today’s price provides a healthy 9.2% yield. This preferred is callable on 1/15/2025, at which point, if uncalled, it switches to a floating rate at par which will be the 3-month LIBOR rate plus 6.429%.

Calculations based on this week’s 2.92% LIBOR rate, the floating rate would be 8.72% compared to the current 7.875% fixed rate. It is worth noting that NYMTM has a much higher floating rate floor than other mREIT peers (including the sister preferred NYMTN), making it a fantastic hedge against higher interest rates.

At the end of Q2, NYMT had $407 million in cash and cash equivalents, which adequately covers NYMT’s preferred dividends 9.7 times. Additionally, NYMTM is a cumulative preferred, meaning missed dividends must be paid in full before the security can be redeemed. These make NYMTM a safe income investment with an attractive upside and a solid hedge against inflation and higher rates.

Istock

Conclusion

More cash-producing assets and less cash is the formula for long-term success vs. inflation. Remember that the dollar has lost over 96% of its value in the past 90 years. Whether inflation rates are at historic high levels or stay within acceptable average ranges, it is an unavoidable tax on your retirement financials. As years go by, you will be paying more for the same lifestyle you enjoy today. For your retirement to be sustainable, your portfolio must be put to work instead of you.

Many readers disagree with our stance that “Cash is Trash” by mentioning that Warren Buffett has massive cash assets in Berkshire Hathaway (BRK.A) (BRK.B) balance sheet. However, it is essential to note that Buffett’s asset size is enormous to take meaningful positions in several attractive opportunities. Contrary to his methods in the 60s and 70s, today’s Buffett must move very slowly and cautiously.

If I was running $1 million today, or $10 million for that matter, I’d be fully invested. It’s a huge structural advantage not to have a lot of money – Warren Buffett

With inflation-beating properties through their structural design and proven market outperformance over the long-term, we like REITs and think they should be part of a well-diversified income portfolio. The opportunity is great now that the market is still worried about inflation, the Fed, and recessions. Two REIT picks with yields of up to 9.2% to build your income and improve the sustainability of your retirement.

Be the first to comment