The Tesla Final Crash Sean Gallup/Getty Images News

This is a sequel to my previous article on Tesla (NASDAQ:TSLA), Rising Interest Rates And Market Valuation Impact – Sell which focused on the penal impact of a rising discount rate on a growth stock, where a large part of the valuation rested in its terminal value. The recommendation (1st March 2022) argued Tesla’s market value would fall from the prevailing $886bn to $435bn as higher interest rates dented the present value of future profits. Much of that has come to pass.

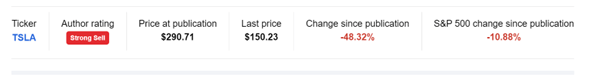

Perf stats (seeking alpha)

This article conveys the rationale for further downside towards my updated target of $84/share. It follows the following narrative:

- a summary of the methodology. (It was fully articulated in my previous article, so the reader is advised to go there for a full explanation.)

- an update on the operating free cashflow (FCFF) forecasts for Tesla, using current earnings growth consensus for 2023 to 2027 as the predicate for cashflow growth. (Free Cash Flow to the Firm (FCFF) is defined as the operating cash flow less capital expenditure.)

- a revision of Tesla’s terminal growth rate (from 2027 to perpetuity), implicit in Tesla’s current market valuation.

- rationale for a revising the discount rate appropriate for Tesla today. The increase stems from two factors: a small rise in the risk-free discount rate (due to a more restrictive Federal Reserve), and a sharp jump in the equity risk premium.

- Why the higher equity risk premium? First, due to the chasm between Tesla’s representation of Full Service Driving (FSD) and reality. An elaboration on why a resolution, both with regulators and the public is imminent.

- Second is a hypothesis: Musk’s obsession with Twitter which when analysed, predicts a probable negative outcome for Tesla coming soon.

- Use of the higher discount rate to compute Present Values of Tesla’s 5-year cashflows and a new Terminal Value. These summate to produce a new valuation estimate of Tesla of $291bn, or $84 per share.

Summary of Methodology

The article quantifies the impact of a rising discount rate on Tesla’s market value. It uses the two-stage valuation model (specific growth rates for the first 5-years followed by a terminal growth rate to perpetuity).

NB. The methodology was fully explained in my previous article, including academic support in an attached appendix, so the reader is advised to go there for the detailed thought process.

Using the current market valuation and consensus growth rates for the next 5 years of cashflows as inputs to compute Present Values (PV), the model derives the Terminal Value (TV) investors currently accord to the present value of Tesla’s free cashflows from 2027 to perpetuity.

From this, the value of Tesla’s stable growth rate to perpetuity ‘g’, implicit in the current market valuation, can be deduced.

Then, a revised discount rate is applied. That new discount rate, caused by a sharp jump in Tesla’s equity risk premium is used to work back to a revised market valuation, via revised Present Values of the 5-yr cashflows and the Terminal Value.

Free Cashflow for 2022

The actuals for first three quarters for 2022 are derived from Tesla’s 8K’s and Q4 is estimated from consensus earnings.

| Cashflow from SEC 8K | q1 22 | q2 22 | q3 22 | q4(E) 22 | 2022 |

| Net Cash provided by operating activities | 3 995 | 2 351 | 5 100 | 5 250 | 16 696 |

| Capital expenditures | 1 767 | 1 730 | 1 803 | 1 810 | 7 110 |

| Free Cashflow post capex | 2 228 | 621 | 3 297 | 3 440 | 9 586 |

Source: SEC 8K

Free cash flow growth next five years

The FCFF growth rate for the next 5 years is estimated using the street consensus of earnings-per-share growth – this is the best predicate for FCFF growth for the next 5 years.

The cashflows are discounted to Present Value (PV) using r as 6.5%, which represents the current 10-yr Treasury yield as the discount rate rf , (30-day average 3.49%, rounded to 3.5%), plus an equity risk premium of 3%.

| Year | EPS Estimate | YoY Growth | FCFF Estimates | Present Value of FCFF using r |

| Dec-22 | 4.13 | (Actual) | 9 586 | 9 586 |

| Dec-23 | 5.66 | 37.1% | 13 138 | 12 336 |

| Dec-24 | 7.06 | 24.7% | 16 385 | 14 446 |

| Dec-25 | 8.64 | 22.4% | 20 057 | 16 604 |

| Dec-26 | 7.2 | -16.7% | 16 712 | 12 990 |

| Dec-27 | 8.45 | 17.3% | 19 608 | 14 311 |

| Total | 95 485 | 80 274 |

Calculate Tesla’s current Terminal growth rate ‘g’

First the Terminal Value accorded to Tesla today needs to be deduced.

| Market Cap Current | PV of cashflows from 2022 to 2027 | Terminal Value accorded today |

| $ mn | $ mn | $ mn |

| 520 998 | 80 274 | 440 724 |

Derivation of Terminal Value when ‘r’ = 6.5%

| Market Cap Current | PV of cashflows from 2022 to 2027 | Terminal Value accorded today |

| $ mn | $ mn | $ mn |

| 520 998 | 80 274 | 440 724 |

| TV in 2027 compounded at r = 6.5% | 603 830 | |

From above, the table below shows the calculation of Tesla’s Terminal Growth rate ‘g’.

| Year | Cashflow for 2027 at growth rate ‘g’ | Discount rate ‘r’ | Value of variable ‘r-g’ | Terminal Value |

| $ mn | $ mn | |||

| “$19607 * (1+g) | r-g= | |||

| In 2028 | 20 392 | 6.5% | 0.0335 | 608 355 |

| PV Now | 444 027 | |||

| Terminal growth rate ‘g’ | ‘g’ = | 3.148% | ||

As shown above, ‘g’ is computed as 3.15%, the terminal growth rate implicit in Tesla’s valuation today. In other words, ‘g’ is derived from the present value of Tesla’s future free cashflow growth ($19.6bn in 2027) growing at 3.15% per annum to perpetuity that is implicit in Tesla’s market valuation today, after accounting for consensus estimates of free cashflow for the first five years (2023-2027).

A new discount rate is necessary due to a higher equity risk premium

There is wide debate regarding an appropriate discount rate, ‘r’, for a company’s equity. Some investors have leaned towards WACC proffered by the Capital Asset Pricing Model (CAPM), while others believe it’s best to add a supplement to the 10-yr Treasury Yield, labeled an equity risk premium. The value reflects the variability or uncertainty associated with future cashflows and can be interpreted as the intrinsic riskiness of the company’s prospects.

discount rate r = rf + Equity Risk Premium

Tesla’s intrinsic risk has risen materially due to two key factors: a reckoning on Full Service Driving; Twitter in China and Musk’s dual roles. Each is elaborated below.

Tesla’s Full Service Driving (FSD)

Nowhere is the gap between Musk’s claims and reality more evident than with Tesla’s FSD, where EV owners are currently driving the latest beta version of the software, having paid as much as $15,000 for the benefit.

The press is littered with examples where Tesla’s FSD has proved erroneous, if not fatal, so these will not be repeated. However, it’s worthwhile stating some recent and salient events:

- In June this year, the National Highway Traffic Safety Administration (NHTSA) upgraded its preliminary investigation on Tesla’s autopilot to an “engineering analysis”, which is taken before the agency determines a recall. The outcome is still pending and involves all vehicles with the feature sold in the US.

- In October Reuters reported that Tesla’s FSD is under criminal investigation in the United States over claims that the company’s electric vehicles can drive themselves. Although the fine print does specify the drivers must have their hands on the wheel, in October on Tesla’s 3q ’22 earnings call, Musk publicly said FSD’s latest version will allow customers to travel “to your work, your friend’s house, to the grocery store without you touching the wheel”.

- Musk has often claimed Tesla will crack machine vision with cameras and a neural network, without the use of lidar or radar sensors that have been dropped in the freshest models. (Note since 2017 Musk has claimed FSD will be solved ‘later this year’.) However earlier this month, news emerged that Tesla was adding radar sensors to its cars in 2023 amid FSD concerns. This should be especially concerning as Musk has repeatedly claimed Tesla’s cars had all the needed hardware to become self-driving with future software updates.

The author is not alone in imputing a significant portion of Tesla’s current value to the advent of FSD and robotaxis. In fact, Musk recently said

The overwhelming focus is on solving full self-driving. That’s essential. It’s really the difference between Tesla being worth a lot of money or worth basically zero.

This too, should be cause of great concern to the Tesla shareholder. If Musk has decided only now that radar is essential for full autonomy and Tesla’s approach has omitted radar sensors, it would seem obvious that revenue from robotaxis is far from reach. Hence a higher equity risk premium for Tesla’s discount rate.

Twitter in China and Musk’s Dual Roles

Much has been written about the Musk’s obsession with Twitter and the cost to Tesla shareholders (recent article on Seeking Alpha here), and as relevant as this is, the focus here will be on China’s autocratic regime, Twitter and Musk’s dual roles as CEO of Tesla and owner of Twitter.

Permit this train of thought that ends in conjecture, if you will.

Musk’s close relationship with the Chinese government has long sparked concerns on Capitol Hill, with some lawmakers questioning whether the billionaire’s dealing are a potential security risk.

When President Xi was handed an unprecedented third term as the CCP’s party Chief, he made a public commitment to maintaining the stringent strategy, saying Zero-Covid was a “people’s war to stop the spread of the virus”.

It’s no secret that the harsh zero-COVID lockdown conditions imposed by China’s government recently were met with strident protests, especially when they were deemed to be responsible for fatalities in preventing people from escaping a burning building.

Discussion about the protests, a rare act of defiance swept across major Chinese cities and universities, but they were closely monitored by censors and were largely silenced on local social media.

As a result, Chinese citizens were pouring onto foreign alternatives especially Twitter to disseminate information. Twitter saw a surge in downloads in China as protests against the country’s stringent COVID restrictions erupted nationwide over November.

The authoritarian government was so sensitive about the negative press on Twitter that

China is reportedly spamming Twitter with posts about porn and escorts in an apparent attempt to block news about the widespread protests across the country against COVID lockdowns. Users searching for major Chinese cities that have seen mass demonstrations like Beijing and Shanghai will mostly see ads for escorts/porn/gambling, drowning out legitimate search results.

After the tumult in November, China has reduced the lockdown measures and there’s currently less a sense of impending crisis. Now the government is in a position to take a cold sober look at the major source of foreign negative press: it was without doubt via Twitter.

It does not need a genius to see that silencing protestors at Twitter will be a government priority; this is where the government is likely to focus, in order to suppress any negative press that may leak out of the autocratic country and spread first abroad and then back into China, as evidenced in November.

President Xi and his party know exactly how to get Twitter to comply. For there’s a man called Elon Musk who owns Twitter, and whose company Tesla has received numerous special favours and privileges from the Chinese Communist Party. These could easily be withdrawn as Musk insists on being a bothersome ‘global guardian of free speech’. To wit, Musk will find it virtually impossible to comply to China’s authoritarian demands due to resistance from Capitol Hill in preserving Twitter as a platform for free speech. Recent criticism from Europe on Musk’s decision to suspend journalists on Twitter shows just how delicate a balancing act Musk has sunk himself in! This presents a significant intrinsic risk to Tesla.

Revised Valuation of Tesla using a higher discount rate

Calculate the new Terminal Value using r = 10%

| Year | Cashflow for 2027 at growth rate ‘g’ | Discount rate ‘r’ | Value of variable ‘r-g’ | Terminal Value |

| $ mn | $ mn | |||

| “$19607 * (1+g) | r-g= | |||

| In 2028 | 20 392 | 10.0% | 0.0685 | 297 607 |

| PV Now | 217 218 | |||

| ‘g’ = | 3.148% |

The revised Present Values of FCFF

| Year | EPS Estimate | YoY Growth | FCFF Estimates | Present Value of FCFF using r= 10% |

| Dec-22 | 4.13 | (Actual) | 9 586 | 9 586 |

| Dec-23 | 5.66 | 37.1% | 13 138 | 11 943 |

| Dec-24 | 7.06 | 24.7% | 16 385 | 13 542 |

| Dec-25 | 8.64 | 22.4% | 20 057 | 15 069 |

| Dec-26 | 7.2 | -16.7% | 16 712 | 11 414 |

| Dec-27 | 8.45 | 17.3% | 19 608 | 12 175 |

| Total | 95 485 | 73 729 | ||

| Discount rate ‘r’ = | 10.0% |

The above are added to compute the revised market valuation; using the fully diluted share count (3,468m) from the latest quarterly 10Q a target of $84/share is the result.

| Market Cap Revised | PV of cashflows from 2022 to 2027 | Terminal Value to PV now |

| $ mn | $ mn | $ mn |

| 290 947 | 73 729 | 217 218 |

| Target per Tesla Share | $ 83.9 |

Conclusion

It’s worth noting that there’s no empirical way of quantifying how the above risk factors should influence the discount rate – this is a subjective opinion. Admittedly, a discount rate of 10% (from previous 6.5%) is a significant increase but warranted in light of the materiality of risks above. Sell Tesla before these risks become actualities.

Be the first to comment