Edwin Tan

For a very long time, infrastructure and other real assets such as natural resources have been favorites of income-focused investors. There are some good reasons for this, including the fact that companies involved in these industries tend to have somewhat low growth rates, which allows them to have higher yields than companies in many other sectors. They have another advantage over many other firms, too, which has begun to show its importance today. This is because real assets tend to act as a store of value and so are capable of holding their value in the face of inflation. As inflation in the United States is currently at a forty-year high, this is something that will likely appeal to most readers today.

The extra income provided by the high yields could also be appreciated because it will help us better afford the rising expenses that we are all facing in our daily lives. Unfortunately, it can be difficult to put together a diversified portfolio of these assets without having access to a considerable amount of capital. One of the best ways around this problem is to invest in a closed-end fund (“CEF”) that specializes in the sector. This is because these funds provide easy access to a diversified portfolio with one easy trade and can in many cases deliver a yield that is higher than most other things in the market.

In this article, we will discuss the Brookfield Real Assets Income Fund (NYSE:RA), which is one CEF that can be used for this purpose. As of the time of writing, this fund boasts a whopping 14.31% distribution yield, and that is easily enough to turn anyone’s head. However, most funds that have a yield over 10% are surrounded by concerns about a potential distribution cut. Thus, let us investigate and see if this fund could be a reasonable addition to a portfolio today.

About The Fund

According to the fund’s webpage, the Brookfield Real Assets Income Fund Inc. has the stated objective of providing investors with a high level of total return. This is not particularly surprising, especially for an equity fund, because equities are by their nature a total return instrument. This makes sense, as investors typically buy common equities both for the dividends that they deliver and for the hope of generating a capital gain. As the name of the fund implies, though, the fund is aiming to primarily deliver its total return in the form of current income, with capital gains only being a secondary concern. This is not necessarily a difficult task for a fund that focuses on investing in real assets such as infrastructure, real estate, and natural resources. This is because the companies in these industries typically pay out generally high dividend yields. After all, these companies tend to have somewhat slow growth rates so it makes little sense for them to retain their cash flows for future reinvestment. These cash flows are therefore paid out to the investors and because of the low growth rate, they do not usually have especially high valuations. As the fund invests in these companies, it will be receiving these high yields and pass them through to its investors.

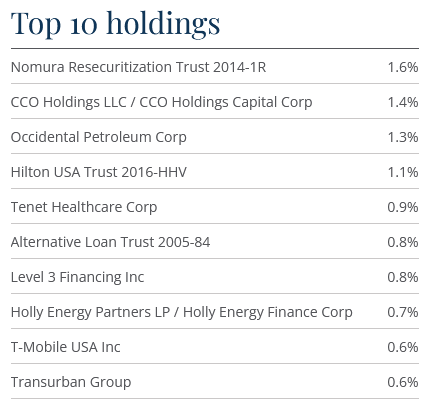

The largest positions in the fund are very different than we see in most closed-end funds. Here they are:

Brookfield Asset Management

Interestingly, we do not see any of the popular stocks for funds such as Exxon Mobil (XOM), Chevron (CVX), or any of the major American technology companies. The exclusion of the technology companies makes sense considering that this is an income-focused real asset fund but as I have pointed out in my articles on Eaton Vance’s various funds, these companies are frequently seen in income funds despite not having much in the way of dividends. It is nice to see some uncommon assets here though as this helps to reduce the concentration risk of an investor’s portfolio. Concentration risk is something that is important because of the tendency of fund managers to “follow the herd.” In short, the investor might be invested in multiple funds and thus think that they have a diversified portfolio. However, this is not the case as all of the funds are invested in the same companies. The fact that this one appears to be very different is something that is very nice to see as adding it to a portfolio will allow us to improve the diversity of our portfolios.

As my long-time readers on the topic of closed-end funds are no doubt well aware, I do not usually like to see any single position in a fund account for more than 5% of a fund’s assets. This is because that is approximately the point at which a given asset begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate through diversification but if the asset accounts for too much of the portfolio, then this risk will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market does not, and if it accounts for too much of the portfolio then it may end up dragging the entire fund down with it. As we can see though, that does not appear to be a concern here as there is no single position that accounts for more than 5% of the portfolio. In fact, this fund does even better than that in terms of diversity as it has no position that even exceeds 2% of the portfolio. Thus, it does not appear that we need to worry about that risk here. This fund appears to be quite well diversified.

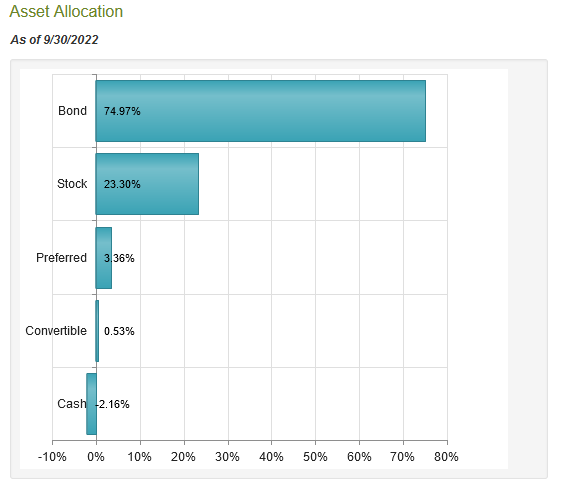

Perhaps interestingly, this fund is mostly invested in fixed-income securities as opposed to common equity. We can see that here:

CEF Connect

This is not completely surprising from an income perspective as fixed-income securities frequently have higher yields than common equities issued by the same companies. That is, admittedly, not always true in the infrastructure space, though. In fact, the common equity of many midstream companies has higher yields than their bonds or even preferred stock. With that said though, bonds may be a better place to be in the near term than common equity. This is mostly because bonds return their full face value at maturity so if the fund is willing to hold the bonds long enough, changes in the price do not really matter. The market is generally expected to be weak over the next year so high-yielding assets are generally the best things to hold. Unfortunately, the fact that the fund is heavily invested in bonds means that it is sacrificing some of its potential for capital gains once the market does eventually turn. After all, bonds only have limited capital gains potential because they are priced based on interest rates and interest rates can only go so low. Presumably, the fund will shift its holdings to favor common stock once the market conditions change to favor equities, but there is no guarantee that the fund’s management will manage to time this transition perfectly.

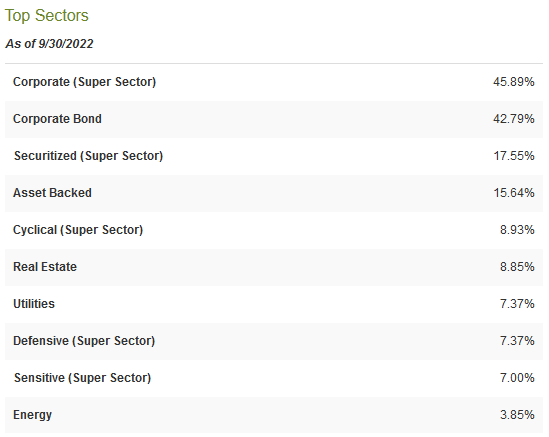

As everyone reading this is certainly well aware, some sectors of the market have handled the events of the past twelve months much better than others. In particular, the Federal Reserve increasing rates has caused real estate stocks to plunge while traditional fossil fuel energy has held up very well. In fact, the energy sector has been by far the best performer in 2022. This is why it is nice to see that the Brookfield Real Assets Income Fund is invested in a variety of different sectors:

CEF Connect

The fact that we see exposure to a variety of different sectors is good from a diversification perspective. After all, the strong performance in one sector can offset weak performance in another sector. I will admit, though, that I would like to see a much larger exposure to traditional energy than what we see here. As 3.85% is nowhere near enough to have any real impact on the portfolio, the presence of these stocks does nothing to offset the weakness in the fixed-income securities or in real estate. This is probably due to Brookfield’s commitment to environmental, social, and governance investing across all of its funds, which has become a somewhat popular concept among fund houses lately but has also proven to be a major drag on performance. We can see that in the fact that the fund’s performance has not been very impressive over any period that we want to use to evaluate it:

Fortunately, the performance of the fund’s share price has little to do with the cash flows of the underlying companies. In fact, the financial performance of both real estate companies and utilities tends to be fairly stable over time. In the case of real estate companies, this is caused by the tenants having long-term leases in most cases (hotels are a notable exception, though). In the case of utilities, it is because the company provides a product that is generally considered to be a necessity, so customers tend to prioritize paying their utility bill. This overall provides a great deal of support for the dividends paid by these firms, which is something that we should always appreciate as income investors. Unfortunately, a company’s share price does not always properly reflect its financial performance, but over extended periods of time, we can expect it to be fairly close.

Real Assets As Inflation Hedges

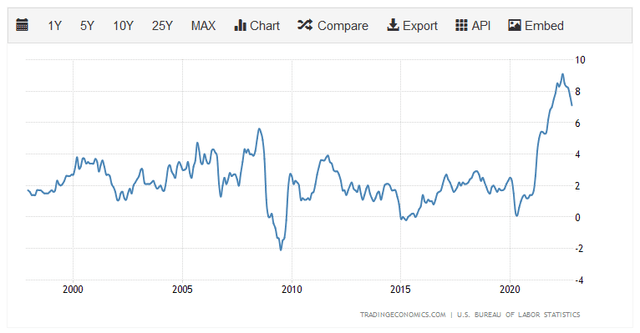

As stated in the introduction, one advantage that real assets such as real estate, natural resources, and infrastructure can offer investors is protection against inflation. This is something that could be important considering that inflation has been running at forty-year-high levels all year:

In order to understand why these assets can protect against inflation though, it is critical to understand the cause of inflation. Economists generally state that inflation is a natural phenomenon but this is not exactly correct. Inflation is actually caused by the money supply growing faster than the production of goods and services in the economy. This is because such a scenario results in more units of currency attempting to purchase each unit of economic output. This has been the case in the United States over the past decade. We can see this by comparing the M3 money supply, which is the most comprehensive measure of the supply of money in an economy, to the national gross domestic product. This chart shows the M3 money supply over the past ten years:

Federal Reserve Bank of St. Louis

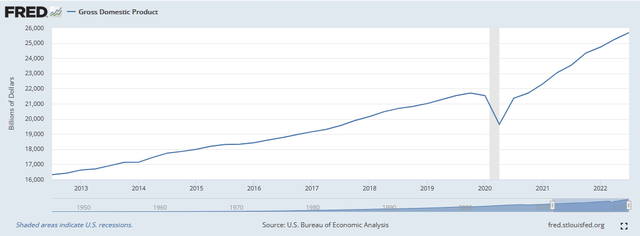

As we can see here, the M3 money supply went from $10.2008 trillion to $21.5034 trillion over the ten-year period. This represents a 110.80% increase over the time period. Let us compare this to the national gross domestic product over the same time period:

Federal Reserve Bank of St. Louis

The gross domestic product went from $16.31954 trillion ten years ago to $25.69896 trillion today. This is only a 57.47% increase over the period. Thus, the money supply increased at roughly twice the rate of the actual production of goods and services in the economy. This is a recipe for the inflation that we are seeing today.

Infrastructure and especially real estate protect against inflation because they have the same qualities as other things that increase in value during such an environment. In particular, there is a limited amount of land on the planet and real estate can only be improved by an actual human or mechanical effort. Likewise, it takes a considerable amount of real work to both construct and maintain infrastructure. Neither thing can simply be created out of thin air as money can. Thus, the value of these assets should increase along with the money supply over long periods of time, although we will still see short-term fluctuations as was illustrated by real estate’s decline this year. The fact that the fund invests in these assets should thus allow it to pass on these characteristics to investors. With that said, though, the fact that the Brookfield Real Assets Income Fund is currently mostly invested in fixed-income securities means that it will not be nearly as good at this task as an all-equity fund would be.

Leverage

One strategy that is frequently used by closed-end funds to boost their yields is the use of leverage. The Brookfield Real Assets Income Fund uses this strategy to great effect as its yield is considerably higher than that of any of the assets in which it is actually invested. In short, the fund is borrowing money and using that borrowed money to purchase income-producing securities. As long as the yield on the purchased securities is higher than the interest rate that the fund pays on the borrowed funds, the strategy works quite well to boost the overall yield. As the fund is able to borrow at institutional rates, which are lower than retail rates, this will usually be the case.

However, the use of leverage is a double-edged sword because debt boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage because that would expose us to too much risk. I do not usually like to see a fund have a leverage of more than a third as a percentage of its assets for this reason. As of the time of writing, the Brookfield Real Assets Income Fund’s levered securities comprise 30.34% of its portfolio, so it appears to be satisfying this requirement. Overall, the fund appears to be striking a reasonable balance between risk and reward.

Distribution Analysis

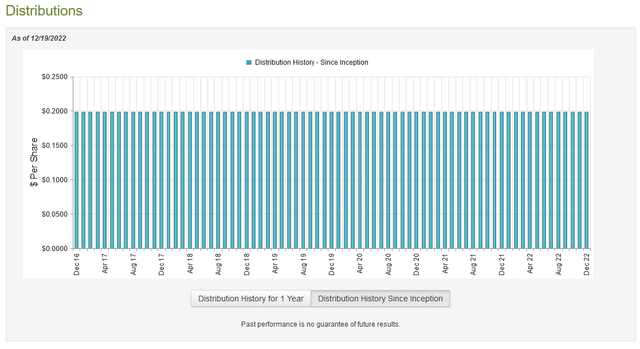

As already stated, the primary objective of the Brookfield Real Assets Income Fund is to provide its investors with a high total return in the form of current income. The fund achieves this objective by investing in fixed-income securities and high-yielding common equity and then leveraging up the portfolio in an attempt to boost the overall yield. As such, we can assume that the fund will boast a reasonably high yield itself. This is certainly the case, as the Brookfield Real Assets Income Fund currently pays a monthly distribution $0.1990 per share ($2.388 per share annually), which gives the fund a 14.31% yield at the current price. The fund has been remarkably consistent about this distribution over the years, maintaining it since the fund’s inception back in 2016:

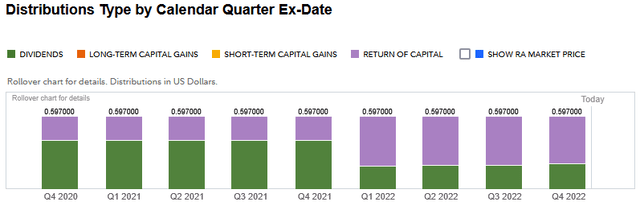

This overall consistency is something that will undoubtedly appeal to those investors that are seeking a stable and secure source of income to pay their bills. The high levels of inflation have made this objective more important than ever as the more money that we have coming in, the easier it is to cope with the rising prices. However, these same investors may be concerned about a large number of return of capital distributions that the fund has been making over the past few quarters:

The reason why this may be concerning is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. There are, however, other things that can cause a distribution to be considered a return of capital, such as the distribution of unrealized capital gains. As such, we want to investigate exactly how the fund is financing these distributions in order to determine how sustainable they are likely to be.

Fortunately, we do have a somewhat recent document to consult for this purpose. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it will not give us much insight into the fund’s performance during the somewhat volatile market that we saw over the past few months. However, the first half of the year was also quite a choppy market environment as that period saw the beginning of the Federal Reserve’s monetary tightening regime and the accompanying market decline.

The report should also provide us with some insight into the cause of the return of capital distributions that we see during the first two quarters of this year. During the six-month period, the Brookfield Real Assets Income Fund received a total of $26,297,074 in interest and another $6,744,712 in dividends and distributions from the assets in its portfolio. As some of these distributions were a return of capital (from master limited partnerships or similar entities), we need to net those out so the fund had $31,540,322 in reportable income during the period. It paid its expenses out of this amount, leaving it with $20,109,822 available for shareholders. This was obviously nowhere close to enough to cover the $62,250,200 that the fund actually paid out during the period. At first glance, this is quite concerning.

The fund does have other methods through which it can obtain the money that it needs to cover its distributions. The most common of these methods is through earning capital gains. As might be expected, though, the fund failed miserably at this during the period. It did report net realized gains of $14,750,873, but these were more than offset by net unrealized losses of $159,272,210 in the reporting period. Overall, the fund’s assets declined by $109,933,338 after accounting for all inflows and outflows, including the sale of new shares. The fund clearly failed to cover its distributions during the first half of the year. Even if we were to add the realized capital gains and the return of capital distributions that the fund received, it still comes up very short. The fund actually paid its distribution by taking in money from new investors and paying that out to the existing investors. This is obviously not particularly sustainable, and it is why the market appears to be expecting a distribution cut. Admittedly, the market may be correct here and anyone buying the fund today should be willing to take on the risk of a distribution cut.

Valuation

It is always critical that we do not overpay for any given asset in our portfolios. This is because overpaying for any asset is a sure-fire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Brookfield Real Assets Income Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current value of all of the fund’s assets minus any outstanding debt. It is, therefore, the amount that the investors would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund’s assets for less than they are actually worth. This is unfortunately not the case with this fund. As of December 19, 2022 (the most recent date for which data is available as of the time of writing), the Brookfield Real Assets Income Fund has a net asset value of $15.66, but the shares actually trade for $16.65. This gives the shares a 6.32% premium to net asset value at the current price. This seems a bit high of a price to pay despite the fact that the shares do currently have a lower premium than the 11.60% one that they have traded at on average over the past month. The price appears especially high when we consider the fact that the fund may have to cut its distribution in the near future. Overall, it might make sense to wait until the shares begin trading for a more reasonable price before buying in.

Conclusion

In conclusion, real assets such as real estate, infrastructure, and natural resources tend to hold their values fairly well in the face of inflation. This is because they tend to exist in limited quantities and cannot just be created out of thin air as fiat currency can. The Brookfield Real Assets Income Fund ostensibly invests in these assets, although it is currently invested in fixed-income securities and not the common equity that we would expect. This reduces the fund’s ability to protect us against inflation. In addition, the appetizing distribution yield may not be sustainable, and when combined with the high valuation, it may not be worth buying the fund today. Should we see a distribution cut or an improvement in the price, though, Brookfield Real Assets Income Fund Inc. may be worth considering.

Be the first to comment