Ca-ssis/iStock via Getty Images

Model N (NYSE:MODN) is something of a contrarian play. When tech stocks were rising in 2020 and 2021, Model N barely moved, which was understandable – in those years, investors were chasing the fastest-growing tech names and IPOs, and Model N, as a rather boring verticalized vendor of revenue management and compliance software, didn’t make that cut.

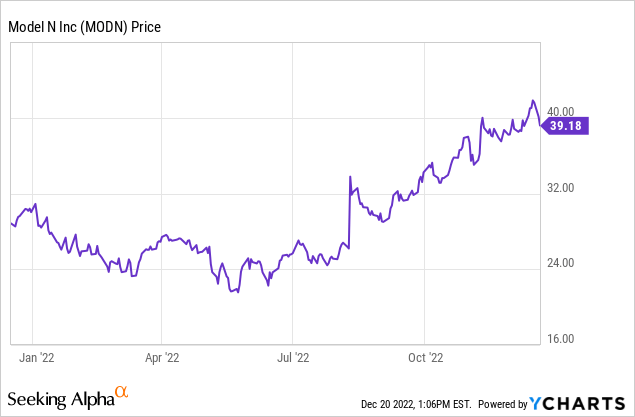

But 2022 was most surprising of all: as other SaaS names declined to the tune of 40% or more as investors retreated from growth stocks, Model N rallied this year. And while it’s true that Model N’s performance this year has slightly improved (with organic growth now stabilizing in the low-teens range) while other companies have cited macro headwinds, the fact that Model N’s stock has risen nearly 30% this year bears close watching:

To level-set here: I was bullish on Model N as recently as this April, as well as throughout most of 2021, when the stock was trading in the mid-$20s to low $30s. Now, with Model N having rallied virtually nonstop since July and approaching $40, I am now bearish on the name.

Here are the key considerations worth mentioning:

- Where does Model N go from here? Model N is a vertical software company that is designed specifically for customers in the life sciences and technology (primarily semiconductor) industries. Within these sectors, the company has already signed some of the biggest names as clients, including Pfizer (PFE), Qualcomm (QCOM), Abbott (ABT), Micron (MU), Johnson & Johnson (JNJ), and several other mega blue-chips. It’s unclear what the company’s strategy is to grow substantially from here, beyond simply defending its current base.

- Gross margin deficit to other SaaS peers- Though Model N saw slight expansion in gross margins in its most recent quarter, its low-60% pro forma gross margins are a full 10-15 points lower than most other SaaS companies, reducing its ability for operating leverage at scale.

- M&A-driven growth- A lot of the company’s >20% y/y revenue growth last year (which has since dwindled) is due to an acquisition of Deloitte Business Services. Going forward, Model N may continue to double down on its inorganic growth playbook, despite the fact that it has quite limited liquidity.

But most starkly of all, we have to consider Model N’s valuation in relation to other tech stocks today. At current share prices near $39, Model N has a market cap of $1.46 billion. After we net off the $193.5 million of cash and $135.4 million of debt on Model N’s most recent balance sheet, the company’s resulting enterprise value is $1.40 billion.

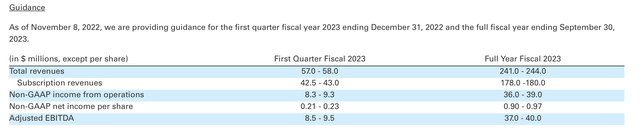

Meanwhile, for FY23 (which for Model N is the year ending in September 2023), Model N has guided to 10% y/y growth to $241-$244 million in revenue:

Model N outlook (Model N Q4 earnings release)

This puts Model N’s revenue valuation at 5.8x EV/FY23 revenue. Note that there are plenty of faster-growing, fallen-angel tech stocks that are trading at far lower valuation multiples. Note Asana (ASAN), for instance, which is one of my top buy ideas at the moment – the stock is trading at <4x forward revenue despite expectations for >20% y/y revenue growth in 2023.

And while Model N does generate a sliver of profitability from an adjusted EBITDA standpoint, it’s still too early to value this company from any earnings standpoint. Based on its $0.90-$0.97 pro forma EPS and $37-$40 million adjusted EBITDA outlook for FY23, Model N’s earnings-based multiples go to:

- ~41x forward P/E

- ~36x EV/FY23 adjusted EBITDA

The bottom line here: Model N looks propped up from a stock valuation perspective, with little fundamental backing. While we applaud the company’s relatively stronger quarterly results against a tougher backdrop for tech companies, it’s difficult to believe in much further upside from current levels. Lock in any gains you have on this stock and re-invest it elsewhere.

Q4 download

Let’s now go through Model N’s latest quarterly results in greater detail. Again, the key message here is: while it’s true that Model N’s performance has held up better than expectations, it’s hardly sufficient to justify what I now consider to be a premium valuation for the stock.

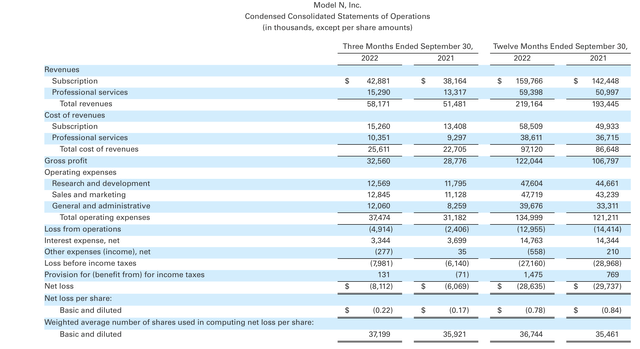

The Q4 earnings summary is shown below:

Model N Q4 results (Model N Q4 earnings release)

Model N’s revenue grew 13% y/y to $58.2 million in the quarter, beating Wall Street’s expectations of $56.4 million (+10% y/y) by a three-point margin. We do note as well that Model N’s revenue growth rate also accelerated three points relative to 10% y/y growth in fiscal Q3. We won’t downplay this: this is an impressive feat in an earnings cycle where many tech companies have cited steep macro headwinds as the reason for sharp deceleration. At the same time, we’ll repeat: is 13% y/y growth really exciting enough to justify a ~6x revenue multiple?

Model N has focused of late on moving customers to the cloud and onto its subscription SaaS products. The company has seen success in retaining and upselling customers in the cloud. Per CEO Jason Blessing’s prepared remarks on the Q4 earnings call:

Our SaaS subscription growth retention rates are best-in-class and have been trending at or above 90%. And during the 12 months ended September 30th, 2022, our SaaS net dollar retention rate was 129%, a new high watermark for us […]

This past year, we made significant progress on transitions. As of the end of fiscal 2022, we have transitioned approximately 70% of our on-premise Life Sciences customers to the cloud. We expect to have substantially all of our customers transitioned over the next 12 to 18 months, and we remain ahead of our internal plan for SaaS transitions, which is one of the reasons we saw upside this year.

In addition to successful SaaS transitions, overall sales momentum continued to be strong during 2022, due in part to the changes we’ve made over the last three years to our go-to-market teams, most notably building out dedicated customer base and new logo sales teams. This go-to-market alignment has allowed us to capitalize on SaaS transitions, but what’s even more important is the focus drove a shift in our bookings composition this year”

Blessing went on to note that the majority of the company’s new cloud bookings in 2022 came not from existing customer transitions, but from sales executives working in “whitespace” and “expansion” territories.

From a margin standpoint, pro forma gross margins ticked up 70bps y/y to 62.3%, largely driven by a three-point increase in professional services gross margins to 41%. As a reminder, Model N’s margin profile is still quite below most SaaS companies in the 70-80% range (which again calls into question the company’s premium revenue valuation multiple), driven by a relatively heavy 26% revenue mix on lower-margin services.

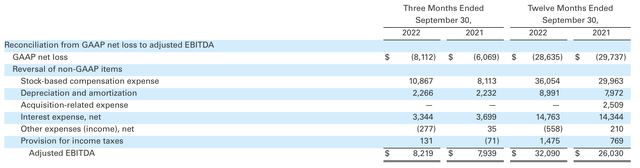

Adjusted EBITDA in Q4 grew slightly at a 4% y/y pace to $8.2 million, while full-year adjusted EBITDA clocked in at a 14.6% margin – up 110bps from 13.5% in FY21.

Model N Q4 adjusted EBITDA (Model N Q4 earnings release)

Model N’s guidance for FY23 implies adjusted EBITDA growing roughly 28-37% y/y to $41-$44 million, with margins rising to 15-16%: again, however, this isn’t sufficient to justify the company’s $1.4 billion enterprise value.

Key takeaways

In a nutshell, my view on Model N can be summed in a simple statement: too expensive for few merits. Investors have treated Model N as a “port in the storm” during a tumultuous 2022 for tech stocks, but I’m more keen on buying beaten-down rebound plays rather than hope that Model N’s rally has further steam. Sell here and invest elsewhere.

Be the first to comment