ArtemisDiana

Investment Overview

Roivant Sciences (NASDAQ:ROIV) shares are trading down by -40% across the past 12 months, and down 24% since the company joined the Nasdaq via a merger with the Special Purpose Acquisition Company (“SPAC”) Montes Archimedes Acquisition Corp back May 2021.

That merger netted Roivant ~$411m in funding and with a handful of notable biotech VCs – including SoftBank and Sumitomo Dainippon Pharma – also investing in a private round, Roivant began its publicly traded life with $2.3bn of funds.

Much of the additional funding was created by Roivant’s sale of 5 of its subsidiary companies – Myovant, Urovant, Enzyvant, Altavant and Spirovant – to Sumitomo, the Japanese Pharma, in a $3bn deal plus a 10% equity stake in Roivant, and the opportunity for Sumitomo to purchase 6 more “vants” by the end of 2024.

In its fiscal Q222 10Q submission Roivant describes its business as follows:

building the next-generation “big pharma” company, organized to harness modern technologies and computational tools as well as the entrepreneurial spirit of nimble biotechnology companies at scale.

We are a diverse team of experienced drug developers, scientists, physicians, company builders, data scientists and engineers, biopharma investors, physicists and business development professionals dedicated to improving the lives of patients.

We deploy a hypothesis-driven approach to identify novel or clinically-validated targets and biological pathways in areas of high unmet medical need. We then seek to acquire, in-license or discover promising drug candidates against those targets or pathways.

We develop drugs and drug candidates in subsidiary companies we call “Vants” with a distinct approach to sourcing talent, aligning incentives and deploying technology.

Each of our Vant teams is built with deep relevant expertise to promote successful execution of our development strategy. Our Vants continue to benefit from the support of the Roivant platform and technologies that are built to address inefficiencies in the drug discovery, development and commercialization process.

It’s a bold mission statement but there have been some serious missteps – for example the ill-fated Axovant, which raised ~$315m in a 2015 IPO on the strength of a single Alzheimer’s drug, acquired from GSK for just $5m. The drug failed, and Axovant burned through investor’s cash before changing its name to Sio Gene Therapies (SIOX) and pivoting into rare diseases. Shares today are priced <$0.5.

This misadventure originally made me skeptical of Roivant’s business model, but although its shares are down, it’s possible to make the case that the business has had a strong year, whilst also highlighting multiple catalysts for 2023.

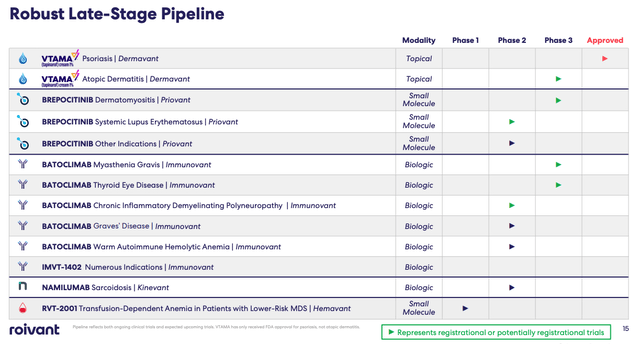

Roivant drug development pipeline (Roivant Q222 earnings presentation)

As we can see above Roivant has four potentially pivotal Phase 3 studies ongoing relating to three different drug candidates, and two potentially pivotal Phase 2 studies ongoing of its small molecule Brepocitinib, and biologic Batoclimab.

The biggest news of 2022 for Roivant however was the FDA’s approval of its tapinarof cream to treat adults with plaque psoriasis. The cream is a formulation of tapinarof – an aryl hydrocarbon receptor agonist – launched with the brand name Vtama, that Roivant believes can compete successfully against existing steroidal based creams in this indication, and become standard of care (“SoC”).

The therapy – developed by the subsidiary company Dermavant – may have earned net product revenues of just $5m in fiscal Q222, but management reported that ~54k prescriptions have been written since launch, by 6.4k different prescribers, and that an agreement was in place for a reimbursement contract with one of the three largest Pharmacy Benefit Managers’ (“PBMs”), that represents around one third of all covered lives.

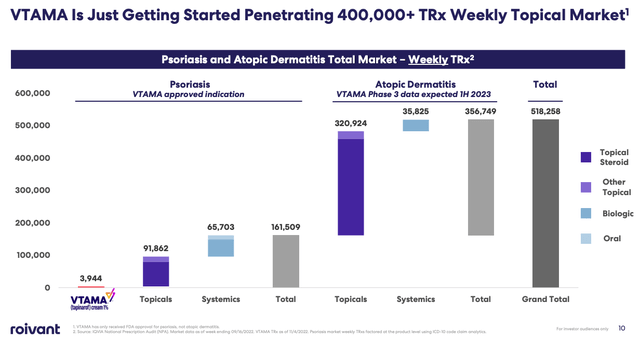

Analysts have forecast sales of ~$50m for Vtama in 2023, but management clearly believes there is a much larger opportunity in this market, with as many as 161k prescriptions written weekly, and >350k written per week in Atopic Dermatitis, according to research shared in a recent investor presentation. Should Vtama be approved in that indication also, management sees a blockbuster (>$1bn per annum) revenue opportunity based on a 5%-10% market share only, as discussed during the Q222 earnings call with analysts.

VTAMA market opportunity (Roivant presentation)

Atopic Dermatitis pivotal data has been promised for 1H23, while in H223, there will be topline data from Brepocitinib in systemic lupus erythematosus (“SLE”), another multi-billion dollar market, Phase 2 data from Batoclimab in Graves’ Disease, and data from candidate RVT-2001 in lower risk myelodysplastic syndrome.

Another earlier stage candidate, IMVT-1402 – a second anti-FcRn antibody to go alongside Batoclimab – reads out initial Phase 1 data in “various indications” in early 2023, while in 2024 Batoclimab could be in line for approvals in myasthenia gravis, thyroid eye disease and chronic inflammatory demyelinating polyneuropathy.

Roivant enjoys a fairly high market cap valuation of ~$4.8bn for a company with one, very recently launched, commercial product, but if we factor in its current cash position of $1.6bn, prospects for Vtama to make $500m – $1bn peak revenues, plus prospects of approvals for both of Brepocitinib and Batoclimab, and perhaps two or three more candidates besides, all targeting indications where several Pharma’s products enjoy blockbuster sales, then does Roivant stock begin to look cheap?

In the remainder of this post I will try to answer this question by looking a little deeper into the various opportunities.

Vtama In Psoriasis and AD

Although the Psoriasis – and wider inflammatory condition / auto-immune disease markets are very lucrative fields to operate in – independent estimates suggest psoriasis is a >$25bn market that could rise in size >$45bn by 2030, and the autoimmune market as a whole is easily worth >$100m – it’s also a highly competitive one.

Just last week I wrote a post for Seeking Alpha all about while new TYK2 inhibitor class drugs being developed by Bristol Myers Squibb (BMY), Takeda (TAK) and Ventyx Biosciences (VTYX) respectively, and all capable of treating Psoriasis.

BMY’s Sotyktu (deucravacatinib) was approved to treat plaque psoriasis in September, based on the compelling results of two separate Phase 3 studies, which saw the drug comfortably outperform Amgen’s standard of care Otezla – an oral therapy. As I wrote in my last note:

The co-primary endpoints were the percentage of patients who achieved Psoriasis Area and Severity Index 75 (“PASI 75”) and the percentage of patients who achieved static Physician’s Global Assessment score (“sPGA”) of 0 or 1 at Week 16 versus placebo.

At week 16, Sotyktu had a 58% pass rate, and Otezla a 25% pass rate for PASI 75, and a 54% pass rate for sPGA versus Otezla’s 32%. At week 24, Sotyktu’s pass rate for PASI 75 increased to 69%, and pass rate for sPGA to 59%, versus Otezla’s respective scores were 38% and 31%.

According to Roivant, in Vtama’s 2 pivotal Phase 3 studies PSOARING1 and PSOARING2:

VTAMA cream demonstrated highly statistically significant improvement in Physician Global Assessment (“PGA”) score of “clear” (PGA=0) or “almost clear” (PGA=1) with a minimum 2-grade improvement compared with vehicle from baseline at week 12. VTAMA cream also demonstrated a highly statistically significant improvement in all secondary endpoints versus vehicle, including ≥75% Improvement in Psoriasis Area and Severity Index (PASI) score (PASI-75) from baseline at week 127.

According to the press release, 92% of patients who completed PSOARING 1 and PSOARING 2 enrolled in the Phase 3 Long-Term Extension, which suggests patients liked the product, and with Vtama apparently comparable in terms of efficacy and safety to Sotyktu, which is expected to become SoC, there seems to a be a good prospect of Vtama achieving blockbuster revenues.

With that said, however, it’s worth noting that Takeda believes its candidate NDI-034858 – acquired as part of a $4bn deal with Nimbus Therapeutics – will soon be able to challenge Sotyktu for market share, with Phase 2 results suggesting it can pass a pivotal Phase 3 study, while Ventyx’ candidate, although still early in a Phase 2 study, may represent a next-generation TYK2 that will be better still.

In its 10Q, Roivant additionally lists the topical PDE4 inhibitor ZORYVE – which is steroid free, like Vtama – marketed and sold by Arcutis Biotherapeutics (ARQT) as a direct competitor, along with OPZELURA (ruxolitinib) in Atopic Dermatitis.

Arcutis’ ZORYVE will be Vtama’s main competitor, with both products launched at a similar time, with similar levels of efficacy and safety. ZORYVE’s pivotal study used a different endpoint – Investigator Global Assessment – IGA – success at Week 8, but in a press release management comments:

ZORYVE also demonstrated statistically significant improvements over vehicle on key secondary endpoints, including Psoriasis Area Severity Index-75 (PASI-75), and patient perceptions of signs and symptoms, such as itching, pain, and scaling, as measured by the Psoriasis Symptoms Diary (PSD).

Given that Arcutis apparently estimates its peak sales opportunity with ZORYVE is $1.8bn – $3.8bn, based on a list price of ~$825 per 60g tube, versus Vtama’s cost of $1,325, or Opzelura’s $1,950, then provided it’s not too badly undercut on price, again, Vtama’s peak sales opportunity would seem to be a blockbuster one.

Non-steroidal topical creams have been released before – Pharma giant Pfizer’s (PFE) Eucrisa was apparently expected to become a $2bn selling asset, but it was ultimately not a success. Nevertheless, Roivant and Arcutis’ drugs appear to be a cut above what has gone before in terms of efficacy and safety.

When we consider that AbbVie’s $20bn selling drug Humira has been a mainstay of the psoriasis market for years, but loses its patent protection next year, the case for patients embracing a more convenient alternative – Humira comes as an injection, as do other psoriasis meds such as AbbVie’s Skyrizi and Johnson & Johnson’s Stelara – appears to be a strong one.

Priovant Therapeutics Set Up To Bring Brepocitinib To Market

With Vtama cream seemingly a good prospect in Psoriasis – and likely Atopic Dermatitis from next year – with bona fide blockbuster potential, we can turn our attention to the company Roivant has set up in collaboration with Pharma giant Pfizer (PFE) – Priovant.

Pfizer took a 25% stake in Priovant which has taken possession of brepocitinib – a TYK2 inhibitor just like BMY’s Sotyktu and Takeda and Ventyx Bio’s candidates. Brepocitinib’s twin studies in SLE and Dermatomyositis (“DM”) ought to be enough to support a marketing application in both indications, Roivant believes, although it seems the Dermatomyositis data will not arrive until 2025.

Analysts don’t seem to expect brepocitinib to be a blockbuster – although Roivant CEO Matt Gline told analysts on the Q222 earnings call that both SLE and DM were:

huge commercial markets where success in either of them on its own would be sort of a comfortable blockbuster product in our view. And obviously across the two of them, just a huge opportunity and there’s obviously room to go beyond those with brepocitinib in other indications as well. So yes, a very large commercial opportunity.

Sales of Lupkynis – a therapy developed by Aurinia Pharmaceuticals (AUPH) to treat SLE – have been forecast by Aurinia management to be just over $100m in 2022, making CEO Gline’s sales forecast for brepoctinib seem too high, but Roivant appears to be all in on the therapy, having terminated multiple other programs as announced in the company’s press release in relation to its Q122 earnings.

Batoclimab, IMVT-1402 and RVT-2001

If the SLE and DM markets may not offer up a blockbuster sales opportunity (my research suggests) then batoclimab’s target market likely does. Horizon Therapeutics (HZNP) – recently acquired by pharma giant Amgen (AMGN) in a $26bn deal – developed the Thyroid Eye Disease therapy Tepezza, which launched in 2021, and earned $491m of revenues in Q322 alone.

Batoclimab also is targeting approvals in myasthenia gravis, a market in which recently approved Vyvgart, developed by Argenx (ARGX) and also a FcRn antibody, has been pegged for ~$2bn peak sales, Warm Autoimmune Hemolytic Anemia , and Chronic Inflammatory Demyelinating Polyneuropathy, with pivotal Phase 2b data due next year.

The main selling points are the success of this drug class, its straightforward subcutaneous dosing, and “potentially best-in-class IgG lowering, whilst the simultaneous development of IMVT-1402 is viewed as an opportunity to build a franchise by management, covering hematology, neurology, rheumatology, dermatology, endocrinology, and renal. Human data from IMVT-1402 is due next year.

A final point of interest for me is RVT-2001 which takes Roivant away from autoimmune and into oncology. This is a drug licensed from Japanese pharma Eisai – a small molecule SF3B1 inhibitor – that Roivant will use to target the market share of BMY’s recently approved blood cancer drug Reblozyl, and its old stager Revlimid. Reblozyl is expected (by Roivant CEO Gline) to make ~$4bn in peak annual sales, whilst Revlimid made >$12bn in sales in 2021, but has recently lost its patent exclusivity.

The initial target is transfusion-dependent anemia in patients with lower-risk MDS – Eisai had tested the drug more in the higher risk setting, while Roivant believes it has proof-of-concept data from a Phase 1/2 study that makes it confident of another approval in lower risk patients in this indication.

Conclusion – 3 Major Opportunities, 1 Already Secured – Achieving Another In 2023 Ought To Reward Investors

The approval of Vtama cream this year has been a positive catalysts that has underpinned a ~150% increase in Roivant’s share price across the past six months or so.

Prior to the approval, Roivant may have best known for the Axovant debacle, but now it has a first commercial product, which has significant peak sales potential, although it is also a new product and by no means a certainty to succeed.

It’s a step in the right direction for Roivant and the company could well follow up with an approval for Vtama in Atopic Dermatitis next year, which gives the product a fighting chance to match Roivant management’s peak sales expectations.

Roivant also could move a step closer to an approval for Brepocitinib in SLE, which would be a triple-digit-million market opportunity, if not a billion-dollar one as management promises, and a step closer to an approval for Batoclimab, and the establishment of a multi-billion dollar franchise, again, if we are being optimistic.

Going into 2023 Roivant feels a different proposition, having generated substantial amounts of clinical data in 2022, and lining up multiple pivotal readouts in 2023, than it has done in previous years.

The company has arguably not achieved much outside of Dermavant and Priovant, but so long as it is having a drug approved or a fresh label indication secured on an annual basis, its target markets are generally large enough to justfiy the company’s ~$5bn market cap.

With no dividend, a high level of uncertainty, and profitability a distant possibility, investing in Roivant is not going to suit all investors, and even experienced biotech investors may balk at the $7 per share price.

Roivant still has a great deal to prove but considering recent M&A activity in the auto-immune drug space – Pfizer’s (PFE) 2021 $7bn buyout of Arena Pharmaceuticals and its Phase 3 stage Etrasimod indicated for several autoimmune conditions, or even Takeda’s $4bn upfront payment for the TYK2 candidate NDI-034858 – Roivant looks to have a reasonably solid and diversified pipeline of opportunities going into what promises to be a pivotal year for the company.

Be the first to comment