Xiaolu Chu

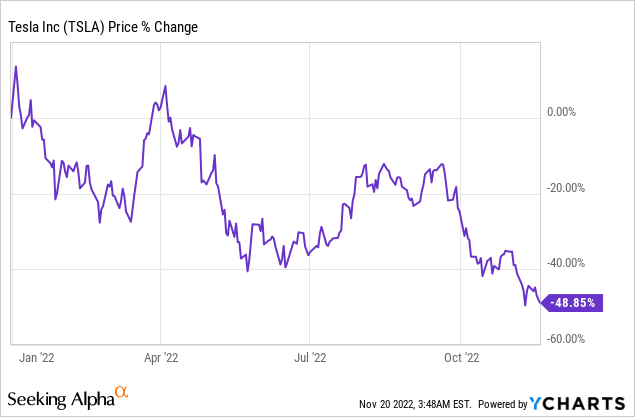

Tesla, Inc. (NASDAQ:TSLA) has seen a strong rebound in production and delivery growth in Q3 2022, which has translated into surging free cash flow (“FCF”) for the electric vehicle (“EV”) company. I believe Tesla’s soaring free cash flow and improving free cash flow conversion could ultimately result in a strong upwards revaluation of the firm’s shares. Year-to-date, Tesla’s shares have lost about half of their value due to many interrelated factors such as factory shutdowns in China, supply chain challenges, as well as inflation which is making raw materials more expensive. Since Tesla experienced a strong production rebound in Q3’22, I believe Tesla’s valuation has become too cheap given its prospects in the electric vehicle industry, and I consider the risk profile heavily skewed to the upside!

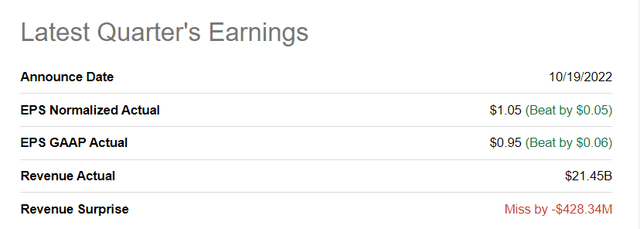

Tesla beat Q3’22 earnings

Tesla reported Q3 2022 results in October which, based off of earnings, were better than expected. Tesla remained solidly profitable in the third quarter and reported EPS of $1.05, which beat the consensus of $1.00 per share. Revenues slightly disappointed, however.

Seeking Alpha: Tesla Q3’22 Results

Massive production rebound in Q3’22

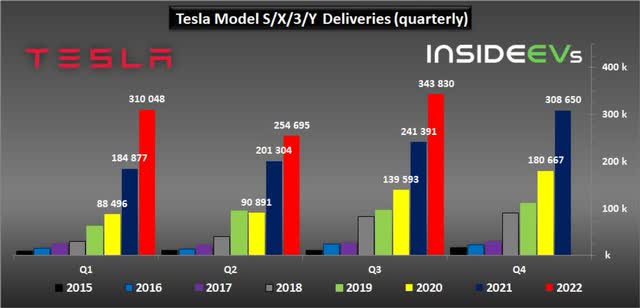

Tesla produced 365,923 electric vehicles in the third quarter, showing an increase of 42% quarter-over-quarter as production came back online after COVID-19 outbreaks forced factory shutdowns in the previous quarter. About 95% of Tesla’s Q3’22 production volume related to the Model 3/Y. Total deliveries in Q3’22 were 343,830, showing 35% quarter-over-quarter growth. Tesla achieved these results due to better factory utilization, as well as strong volume growth driven by robust customer demand for Tesla’s electric vehicle products.

Model 3/Y production ramp resulted in massive free cash flow rebound

The ramp of the Model 3/Y is driving Tesla’s free cash flow growth, and although Tesla experienced a drop-off in revenues and FCF in Q2’22, the third quarter brought a lot of lost production volume back. As a result, Tesla is likely going to see new production and delivery records in Q4’22. I estimate that Tesla could produce between 380-390 thousand electric vehicles just in the fourth quarter and cross the 400 thousand EV production threshold in Q1’23. Tesla also said that it expects about 50% annual growth in production this year.

Tesla achieved $3,297M in free cash flow in Q3’22 on total revenues of $21.5B, which calculates to an FCF margin of 15.4%… which is 4.2 times higher than in Q2’22 when Tesla’s production suffered from COVID-related factory shutdowns. The growth in Tesla’s free cash flow margin is also due chiefly to a resumption of full production. What specifically stood out in Tesla’s Q3’22 earnings report was the improvement in Tesla’s operating-cash-flow-to-free-cash-flow conversion. The FCF conversion ratio — which shows how much money of its operating cash flow gets “converted” into free cash flow – improved from 26.4% in Q2’22 to 64.6% in Q3’22. The improved conversion rate shows that Tesla’s Q3’22 production rebound has fundamentally improved the company’s free cash flow prospects.

Now that Tesla’s production, especially of the Model 3/Y, has resumed, I believe Tesla’s new baseline level of quarterly free cash flow is $2.7B to $3.3B.

|

$ in millions |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

Q3’22 |

Y/Y Growth |

|

Total revenues |

$13,757 |

$17,719 |

$18,756 |

$16,934 |

$21,454 |

55.9% |

|

Net cash from operating activities |

$3,147 |

$4,585 |

$3,995 |

$2,351 |

$5,100 |

62.1% |

|

Capital expenditures |

($1,819) |

($1,810) |

($1,767) |

($1,730) |

($1,803) |

-0.9% |

|

Free cash flow |

$1,328 |

$2,775 |

$2,228 |

$621 |

$3,297 |

148.3% |

|

Free cash flow margin |

9.7% |

15.7% |

11.9% |

3.7% |

15.4% |

59.2% |

|

OCF-FCF conversion |

42.2% |

60.5% |

55.8% |

26.4% |

64.6% |

53.2% |

(Source: Author)

A company’s free cash flow can be used in three ways: (1) repayment of debt, (2) investments in new products and innovation, and (3) for stock buybacks and dividends. For Tesla, I believe points (2) and (3) will be the relevant ones going forward. Tesla is ramping up EV production rapidly, and free cash flow generated from growing deliveries is set to be used for the ramp of the Model 3/Y and the development/market introduction of the Cybertruck, which is expected to become available in mid-2023.

Additionally, Elon Musk has started to play around with the idea of buying back $5-10B worth of Tesla stock which would be the first-ever stock buyback for the electric vehicle company. A stock buyback is usually seen as a sign that management sees its shares as undervalued, and it could push shares of Tesla into a new up-leg. Given that Tesla’s shares have revalued to the downside by nearly 50% this year, I believe the introduction of a share buyback could help ease the negative sentiment overhang that has been created for Tesla’s shares as well.

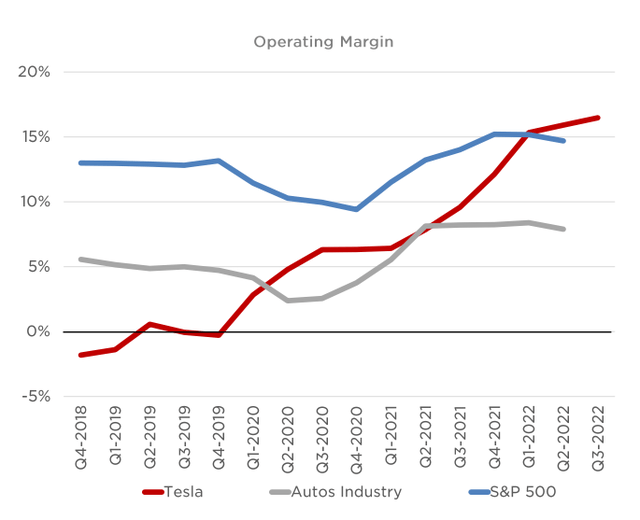

Growth in operating income margin despite industry challenges

Besides improved free cash flow margins, Tesla has seen growth in its operating margins, which has been partly driven by higher volumes and higher average selling prices. Despite lower levels of production due to COVID-19 and massive supply-chain challenges earlier this year, Tesla has successfully navigated these circumstances and managed to grow its operating income margins to 17.2%, showing a 2.6 PP improvement over Q2’22.

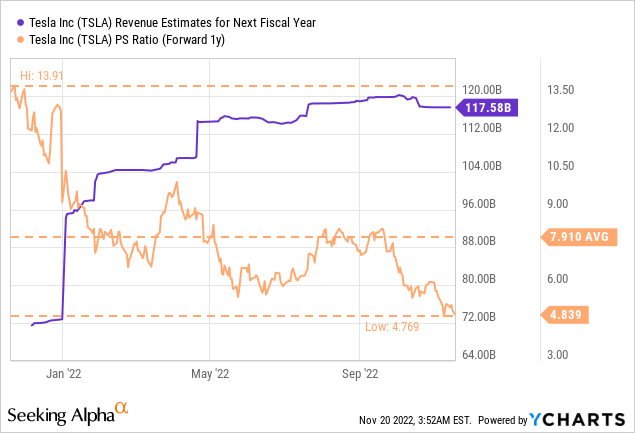

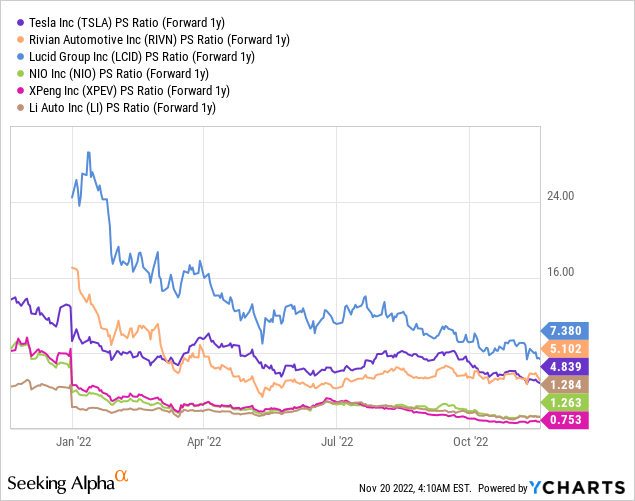

Tesla’s valuation is cheap

Tesla’s valuation is not outrageous considering how quickly the company is ramping up deliveries and revenues. The expectation is for Tesla to sell $117.6B worth of product in FY 2023 which implies an annual revenue growth rate of 41%. Additionally, estimates for Tesla’s forward revenues have increased in FY 2022, showing growing analyst confidence in Tesla’s production ramp, especially regarding the Model 3 and Model Y. Based off of revenues of $117.6B, shares of Tesla trade at a P-S ratio of 4.8 X… which is significantly significantly below the 1-year average of 7.9 X.

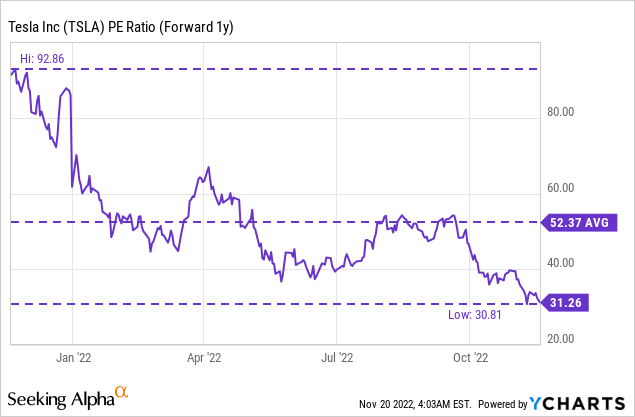

Tesla’s shares are also attractively valued based off of earnings… considering that Tesla is already profitable – it generated $3.3B in Q3’22 profits – and that production is ramping up. Tesla has a P/E ratio of 31.3 X which is not crazy for an EV company that is already generating big profits.

Tesla has also begun hiring new staff in November for the Cybertruck, which is Tesla’s next EV product. Tesla is going to produce the Cybertruck at the Gigafactory in Texas with production expected to commence in FY 2023. The Cybertruck already has way more than 1M in reservations and the introduction of Tesla’s newest model could be an upside catalyst for Tesla’s shares.

Tesla’s valuation compared to other EV companies may be considered high, but the EV company is the uncontested market leader in the electric vehicle industry and has an unrivaled output volume. No other EV company has the scale, capitalization, product lineup, and production footprint of Tesla.

Most of Tesla’s competition consists of smaller start-ups that serve clearly-defined niches, such as pickup trucks, sport utility vehicles, or premium-class sedans. Tesla’s shares, however, due to the near-50% down-side revaluation in 2022, are now even cheaper than shares of Lucid Group (LCID) and Rivian Automotive (RIVN)… and Tesla is profitable.

Risks with Tesla

The biggest commercial risk that I see with Tesla is a slowdown regarding the production ramp of the Model 3 and Model Y or delays with the production of the Cybertruck. High inflation, which makes raw materials more expensive, as well as continual supply chain disruptions are risks for Tesla and the stock as well. I would change my mind about Tesla if the company went through new unforeseen production bottlenecks regarding the Model 3/Y ramp or if the company experienced a steep drop-off in free cash flow.

Limited recession impact, Taiwan risk

I believe a recession would not have a major impact on Tesla’s potential in the EV market because the regulatory environment and customer attitudes have strongly shifted in favor of electric vehicles in recent years, including in China whose government has said it plans to reach net-zero emissions by 2060. However, because Tesla has built a giga-factory in Shanghai to serve Chinese demand for electric vehicles, the EV company is exposed to political risks in the event of a larger China-Taiwan conflict.

Final thoughts

Tesla’s production accomplishments and free cash flow growth in Q3’22 are underrated, especially the improving free cash flow conversion ratio. What makes Tesla attractive as an EV investment is the low valuation based off of earnings, the strong free cash flow rebound and the nearing Cybertruck production start which could revive interest in Tesla. A potential stock buyback of up to $10B could also send shares of Tesla into a new up-leg. Considering that Tesla shares have lost near-50% of their value this year, I believe the risk profile is heavily skewed to the upside!

Be the first to comment