Vertigo3d

In the business and investment world, high interest rates have dominated the headlines for much of the year, and nobody likes higher rates, except for banks and insurance companies. Higher rates are also seen as being a negative for REITs, who rely on debt and equity markets to fund growth, and whose dividend yields compete with that offered by treasuries and bonds.

This brings me to Prologis (NYSE:PLD), which, as shown below, now trades well below its 52-week high of $174, and whose share price has declined materially by 24% over the past 12 months. In this article, I highlight why market concerns are overblown and why PLD is set to thrive even with the current high interest rate environment, so let’s get started.

Why PLD?

Prologis is a global logistics leader and the largest publicly-traded REIT focused on owning industrial properties in high barriers to entry and high growth markets. At present, PLD’s footprint spans across 1.2 billion square feet of gross leasable space in 19 different countries, serving 6,300 tenants across business to business and retail / online fulfillment needs.

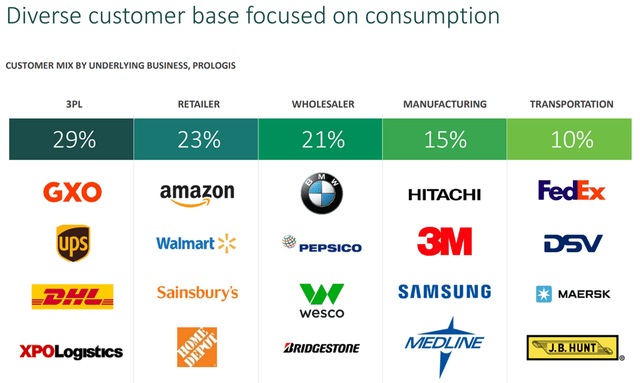

As shown below, PLD serves top names in their respective industries, including logistics leaders DHL, UPS (UPS), and FedEx (FDX), as well as commerce giants Amazon (AMZN), Walmart (WMT), Home Depot (HD), and consumer companies 3M (MMM) and PepsiCo (PEP), to name a few.

PLD Tenants (Investor Presentation)

Meanwhile, PLD is demonstrating record results, FFO per share coming in at $1.73, beating the consensus estimate of $1.66. This was driven by a historically low vacancy rate environment for industrial properties. Portfolio occupancy improved by 110 basis points YoY to 97.7% and same-store cash net operating income grew by an impressive 9.3%.

While high interest rates have posed a headline risk for Prologis and REITs in general, the silver lining for PLD is that this affects all players in the space, and those with the strongest balance sheets are positioned to thrive in any environment. This is backed by PLD’s strong balance sheet, as it is one of just a handful of REITs with an A credit rating from S&P, and it carries a low debt to EBITDA ratio of just 4.3x.

As a sign of bond market appetite for PLD’s debt in a high interest rate environment, it was able to raise $3.1 billion worth of debt during the third quarter at a weighted average interest rate of just 3.6% with a weighted average maturity of 7.5 years. On a YTD basis, PLD and its co-investment ventures raised a staggering $10.8 billion worth of debt at a weighted average interest rate of just 2.6% with an average term of 7 years.

Moreover, higher interest rates mean that weaker competitors, both public and private, are unable to do new construction, thereby further increasing the value of existing real estate in the supply constrained markets in which PLD operates. This is reflected by the high 59.7% re-leasing spreads that PLD saw during Q3. Moreover, the recently acquired Duke Realty properties have significant upside through market to market lease-up potential. The supply constraining dynamic posed by higher rates was noted by management during the recent conference call:

It’s important to acknowledge where supply is being delivered as our submarket location strategies minimize our exposure to new supply. For example, in our coastal U.S. markets where we generate over 50% of our global NOI, vacancies are just 1.7%. Geographically, we have an increased level of focus on Europe given the ongoing war and growing energy crisis.

While we’re reporting record results, including occupancy at 98.6% in a market with 2.4% vacancy, we are closely monitoring conditions. Customers are exercising caution in response to rising energy costs, which may create headwinds to near-term demand. That said, we also believe that new supply will now decline around 15% in 2023, which should support occupancy.

Meanwhile, PLD pays a well-supported 2.8% dividend yield, which comes with a reasonably low 56% payout ratio. While the yield isn’t anything to scream home about, it does come with a high 11.5% 5-year dividend CAGR and 8 years of consecutive growth.

Admittedly, PLD is no longer as cheap as it was when it traded at around $100 during the month of October. However, I continue to see value in the shares at the current price of $114.66 with a forward P/FFO of 22.4. This is considering the estimated 23% FFO/share growth that’s baked into the valuation, 9% FFO per share growth that analysts expect next year, and the overall quality of the enterprise. Analysts have a consensus Buy rating on the stock with an average price target of $135, implying a potential 21% total return including the dividend.

Investor Takeaway

Prologis is a strong, sleep well at night industrial REIT due to its global presence, high quality asset base, and industry-leading balance sheet. This enables it to raise debt at attractive interest rates in the current macro environment. Plus, it stands to benefit from its supply-constrained markets, as new construction costs soar with higher cost of debt. I find PLD to be reasonably priced at present for potentially strong long-term returns.

Be the first to comment