arlutz73

Hershey (NYSE:HSY) is benefiting from strong consumer demand for chocolate treats despite inflation, a trend that is likely to continue. Long term strategic efforts to increase share in the domestic chocolate market, increase penetration in better-for-you confectionery, and ramp up its salty snacks brands are promising. However, a relatively poor debt and liquidity position, along with competitive pressures are risks to watch out for.

Robust growth

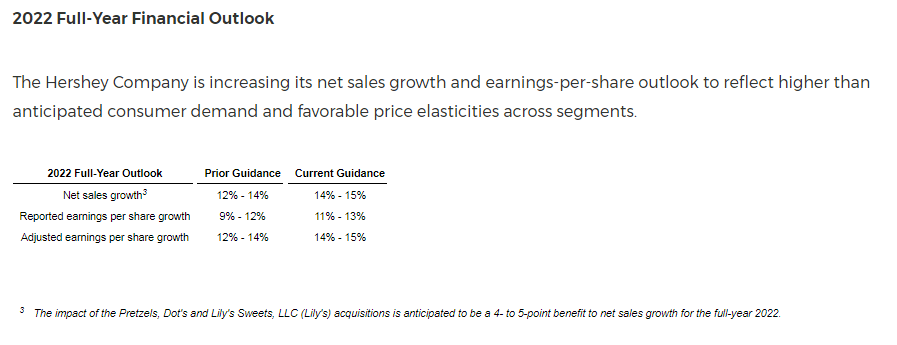

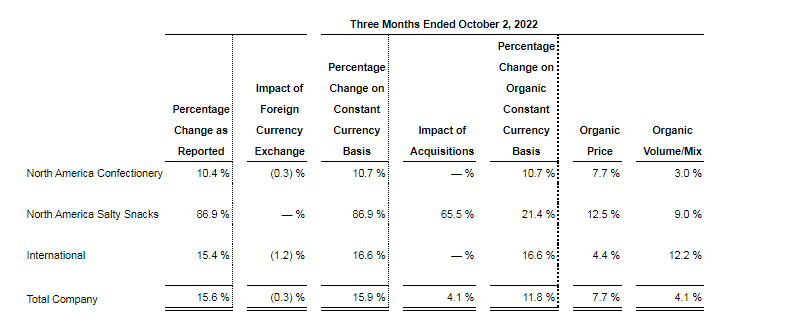

Despite inflationary conditions, consumers are spending on sweets and snacks helping chocolate makers see robust sales growth; Hershey saw revenues up 16% YoY to USD 2.73 billion during the quarter ended October 2022, and the company revised its full year 2022 net sales and earnings per share outlook upwards, a similar performance compared to rivals such as Mondelez (MDLZ) , the maker of Cadbury chocolates, who saw chocolate sales rise 9.3% in the October 2022 quarter, and revised their full year 2022 outlook upwards as well.

PR Newswire

Near term, the momentum could continue. Chocolate is popular among consumers as an “affordable luxury” and stress-reliever, and the category benefits from relatively low private label exposure given chocolate’s relatively high distribution and storage costs, so consumers have few alternatives to national brands. Just 2.7% of the U.S. chocolate retail market is made up of private labels, much lower than other categories such as dairy milk (62%). Even in salty snacks and non-chocolate candy, private label is about 4.8%.

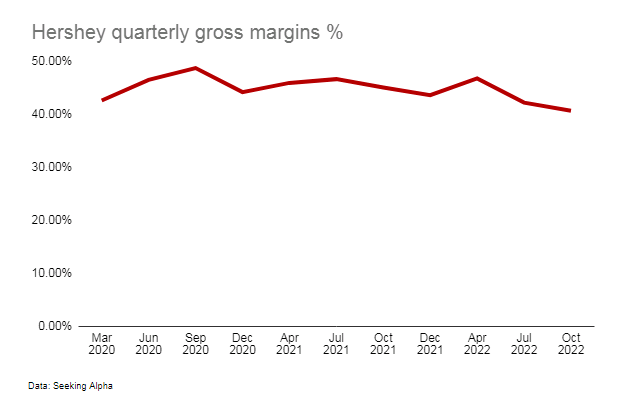

In addition, Hershey’s price hikes planned for 2023 could support top line growth (the chocolate category has so far seen low price elasticity and so price hikes are likely to result in minimum impact to volume), while early signs of moderating price pressures could support margins which have been under pressure over the past few quarters.

Author

Moreover, Hershey’s decision to shift focus away from international markets and into the American market where it has an advantage as the market leader with a 46% market share, could lead to market share gains, further adding to revenue growth.

Capacity expansion to meet demand

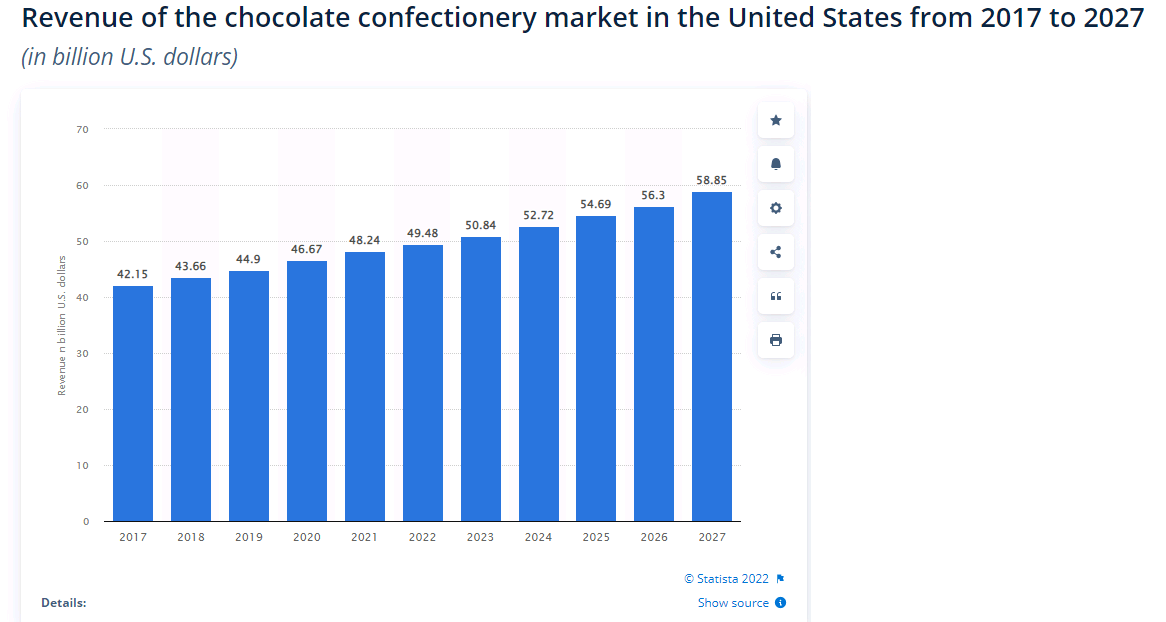

Hershey’s North America Confectionery segment accounts for more than 80% of revenues, and there is room for further expansion. The U.S. chocolate market is expected to continue expanding, albeit at a low single digit rate in the coming years.

Statista

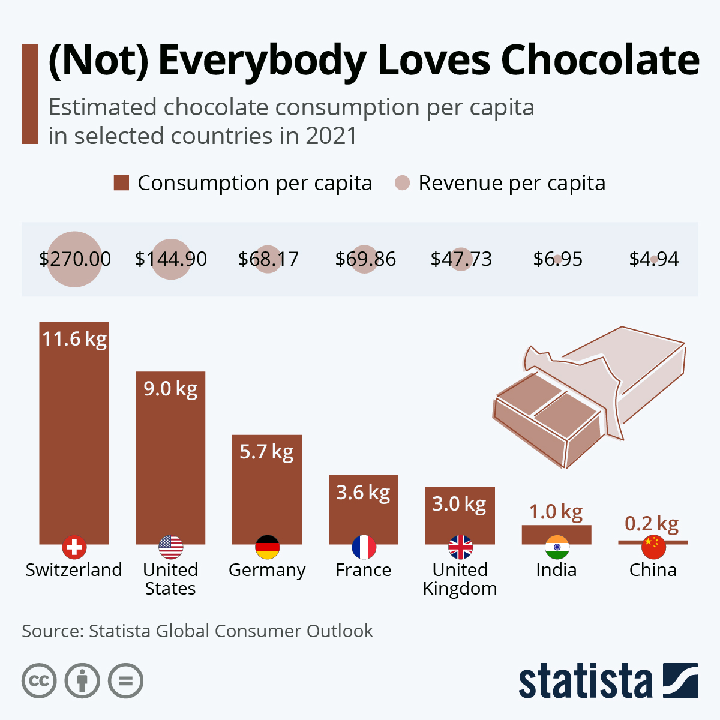

At around 9 kg per capita annually, chocolate consumption in the U.S. is one of the highest in the world. But there is still some room for growth considering Switzerland, the world’s biggest chocolate consuming country, has a per capita chocolate consumption of more than 11 kg per year. Hershey is aiming to capitalize on this demand with capacity expansions planned for 2023 and beyond, including three new Reese’s lines.

Statista

Pushing into high-growth, low-sugar confectionery segment

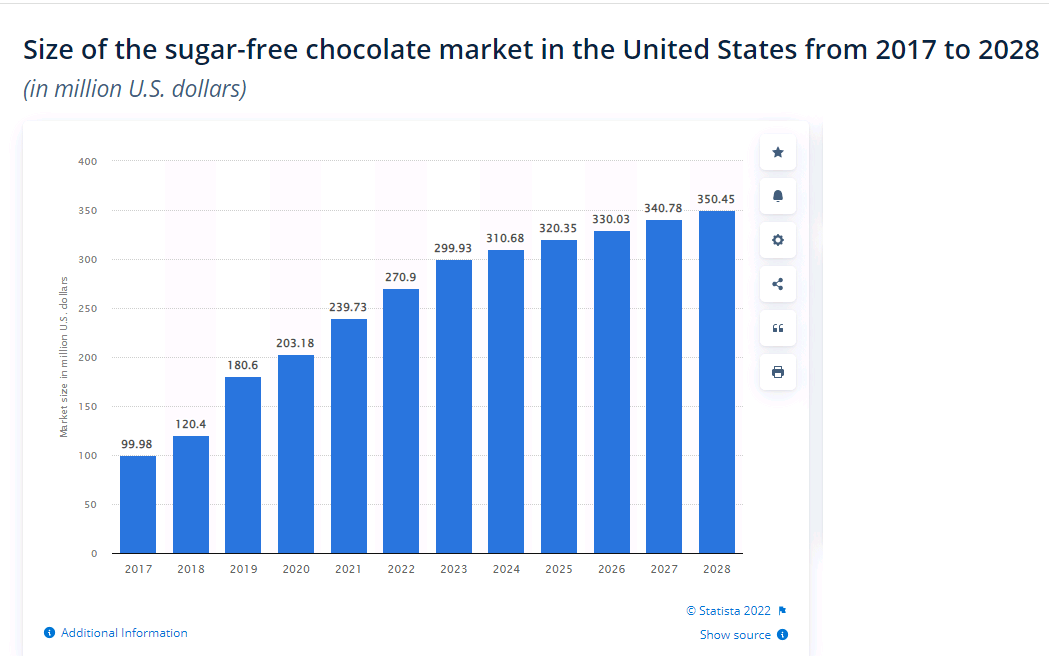

With America’s relatively high diabetes prevalence (10.7% versus about 4.6% for Switzerland) a figure which is expected to increase in the years ahead (diabetes prevalence in the U.S. is expected to increase 54% to more than 54 million Americans between 2015 and 2030), a growing number of consumers (more than 70% according to the company) are looking to reduce their sugar intake. Despite this demand, the market is underdeveloped with more than half of adults looking for better-for-you confectionery options but only 10% of confectionery category sales coming from BFY products. America’s sugar-free chocolate market is forecast to grow at a nearly mid-single digit rate over the coming years.

Statista

Hershey has been making moves to capitalize on this opportunity with a four-pronged strategy focused on brand innovation, partnerships, R&D, and M&A. The company acquired low-sugar confectionery maker Lily’s Sweets in June 2021 (Lily’s Sweets saw strong sales growth of 27% in 2021), has introduced zero-sugar offerings in both Hershey’s and Reese’s products, and together with American Sugar Refining Group (ASR Group) made an investment in Bonumose, a startup focused on plant-based food ingredients including sugar substitutes.

More than a chocolate company, Hershey is now a snack company and salty snacks are driving growth

Growing health awareness and rising diabetes prevalence in the U.S. could present a headwind to chocolate consumption growth, however Hershey’s strategic decision to venture into salty snacks could help offset any impact as snacking habits shift away from sugary snacks and into salty snacks.

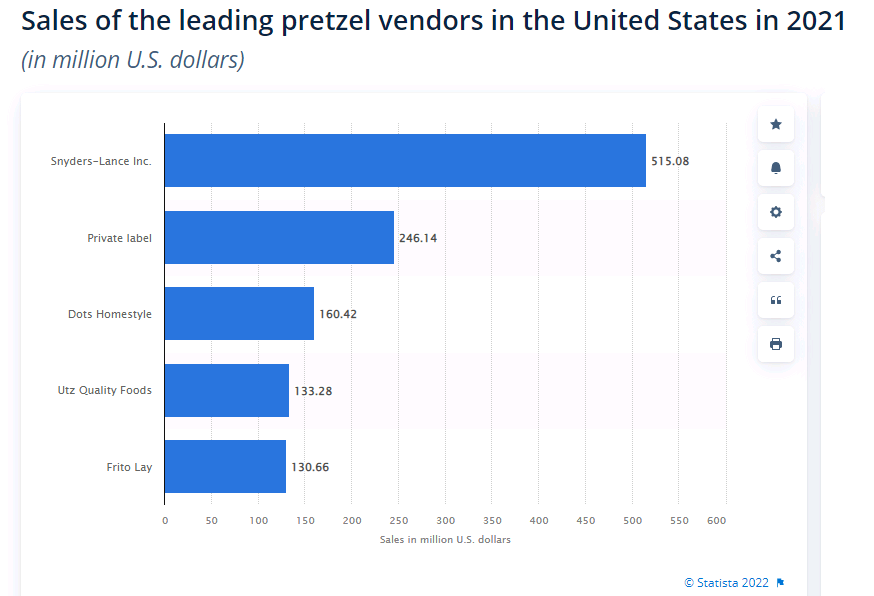

North America Salty Snacks, which covers Hershey’s salty snack portfolio including Dot’s pretzels (one of America’s top pretzel players which Hershey acquired only last year in December 2021), Skinny Pop dairy-free popcorn, and Pirate’s Booty gluten-free puffed rice and corn snacks, was Hershey’s fastest growing segment in Q3 2022 on an organic, constant currency basis with net sales growth of 21.4%, continuing on a strong growth momentum seen this year with more than double digit net sales growth rates in Q2 2022 and Q1 2022.

PR Newswire

Looking ahead, Hershey’s is looking to combine all their salty snacks business including their acquired Dot’s business to scale those brands to leverage synergies and improve margins; salty snacks, has a considerably lower segment margin compared to chocolates at about 15% for salty snacks versus more than 30% for Hershey’s North America Confectionery. However, Hershey has had success improving segment margins considering North America Salty Snacks segment margins were around 12% in 2019.

Risks

Interest rate and liquidity risks

After splashing out billions on salty snack acquisitions, Hershey is loaded with quite a heavy debt burden which may limit their ability to make acquisitions, particularly in a climate of rising interest rates. In addition, their current ratio of 0.79 and quick ratio of 0.37 is concerning.

|

Debt to equity |

Current ratio |

Quick ratio |

|

|

Hershey |

169% |

0.79 |

0.37 |

|

PepsiCo (PEP) |

205% |

0.92 |

0.68 |

|

Mondelez |

83% |

0.69 |

0.40 |

|

Lindt |

33% |

1.87 |

1.07 |

Competitive risks

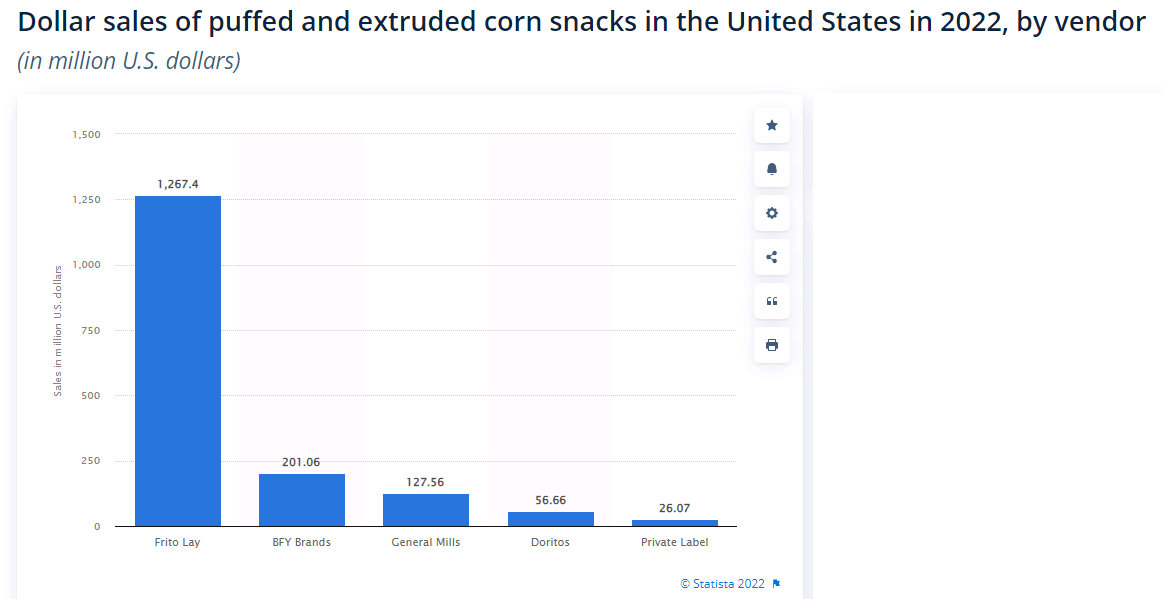

Salty snacks is an extremely competitive market with national brands such as snack giant Pepsi’s Frito Lay (which is the leading player in America’s puffed and extruded corn snacks market) and Snyder-Lance (the leading pretzel player in the U.S.) along with private label brands competing for market share. Stiff competition may make Hershey’s efforts to expand margins an uphill climb.

Statista

Statista

Summary

Hershey is benefiting from solid consumer demand for chocolate despite inflationary conditions and the momentum could continue near term with the category having limited private label exposure, and price hikes along with moderating inflation could support performance. Longer term the company’s strategic efforts in its core chocolate business in its home market North America, better-for-you chocolate, and salty snacks are promising. The company does have quite a high debt burden, and their liquidity position is concerning.

With a P/E of 28.3 (versus 27 for PepsiCo, and 22 for Mondelez, only premium chocolate titan Lindt is more expensive at 42), Hershey is trading at a slight premium and some may prefer to wait for a better entry point (although some may argue it is fair for a market leader).

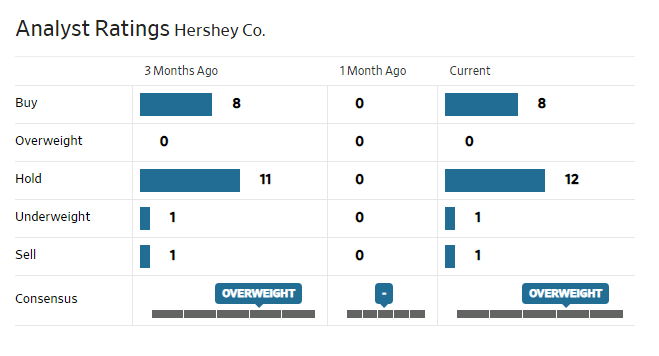

Analysts are mostly neutral on the stock.

WSJ

Be the first to comment