Spencer Platt/Getty Images News

Thesis

Credit Suisse (NYSE:CS) is losing clients and assets under management at record pace, which is concerning, but not very surprising.

As I have written in a previous coverage article

… banking is all about confidence and trust. And Credit Suisse has lost it.

I predicted (apparently very successfully), that the loss of confidence from clients

will likely scar the bank’s reputation to such a degree that customer assets, employees, and investors will rush to find a different bank. And accordingly, it is in my opinion only a question of time until the bank shrinks itself to match its depressed x0.2 P/B multiple.

Following news surrounding poor risk management, scandals, and speculation on an imminent default, Credit Suisse warned investors that the bank has lost approximately $88.5 billion of client assets since Q3 reporting.

Although it is true that CS is trading very cheap, I reiterate my claim that buying cheap banks is not a successful strategy. I continue to believe that CS is likely to shrink into the x0.22 P/B valuation, thus justifying the low valuation through business contraction.

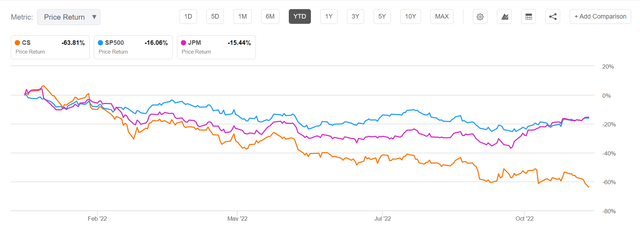

For reference, Credit Suisse has lost approximately 64% YTD, versus a loss of about 16% for the S&P 500 (SPY) and 15% for JPMorgan Chase (JPM).

Seeking Alpha

Credit Suisse Is Losing Client Funds At Record Pace

On November 23, Credit Suisse issued a press release warning investors that Q4 2022 will likely disappoint as compared to expectations and previous guidance.

A key argument why the bank believes that the December quarter will fail to meet expectations is anchored on substantial outflow of client funds – which since Q3 reporting amounted 84 billion CHF (approximately $88.5 billion).

At the Group level, as of November 11, 2022, net asset outflows were approximately 6% of assets under management at the end of the third quarter of 2022.

Outflows were especially aggressive in the bank’s wealth management unit, which has for a long time been a key pillar of Credit Suisse’s profitability.

In Wealth Management, these outflows have reduced substantially from the elevated levels of the first two weeks of October 2022 although have not yet reversed and were approximately 10% of assets under management at the end of the third quarter of 2022. In the Swiss Bank, these client balances have stabilized and were approximately 1% of assets under management at the end of the third quarter of 2022.

Most notably, Credit Suisse loss of client assets hit the bank’s balance sheet with such an impact, that the bank needed to draw on liquidity buffers at the Group level, as CS has intermittently failed to meet ‘certain legal entity-level regulatory requirements’, although management reassured that ‘the core requirements of the liquidity coverage ratio (LCR) and the net stable funding ratio (NSFR) at the Group level have been maintained at all times.’

Macro Considerations Add To Negativity

It is not surprising that the substantial loss of client assets significantly reduces the bank’s net interest income and other income related to recurring commissions and fees.

But investors should consider that the loss of profitability caused by a contraction in wealth management and high net-worth private banking is amplified by a slowing demand environment for investment banking solutions, as the bank communicated:

… the Investment Bank has been impacted by the substantial industry-wide slowdown in capital markets and reduced activity in the Sales & Trading businesses, exacerbating normal seasonal declines, and the Group’s relative underperformance.

According to the previously highlighted press release, Credit Suisse expects that the group is likely to report a pre-tax loss of approximately 1.5 billion CHF ($1.6 billion) in Q4 2022. For reference, CS current market capitalization is less than $10 billion.

Given the challenging macro environment, which I personally do not see as improving anytime soon, investors should consider that the headwinds pressuring CS are likely to persist.

Restructuring Adds Confidence, But Success Is No Guarantee

Credit Suisse’ restructuring ambitions are promising. I have identified three key pillars that should help transform Credit Suisse: sell exposure to high-risk (but very profitable) IB departments (1), reduce costs (2) and raise funds (3).

Credit Suisse Group AG (Credit Suisse) has commenced rapid implementation of actions to create the new Credit Suisse, consistent with the strategic plans detailed on October 27, 2022. These decisive measures are expected to result in a radical restructuring of the Investment Bank, an accelerated cost transformation, and strengthened and reallocated capital, each of which are progressing at pace.

Sell exposure to high-risk IB departments

After the implosion of Archegos Capital caused about $5.5 billion of losses for CS, investors demanded a material reduction of risk taking, which prompted to the bank to divest certain brokerage exposure and IB departments. With the announced sale of a ‘significant’ part of CS’s Securitized Products Group to Apollo Global Management the bank is estimated to reduce risk exposure by about $55 billion, from $75 billion to approximately $20 billion. However, details about the financial transaction, including sale price, has not yet been released.

Reduce Costs

In October, Credit Suisse communicated that the bank expects to achieve cost reductions of approximately 2.5 billion CHF by 2025, and 1.2 billion CHF by end of 2023. Reducing headcount will be a cornerstone to achieve this target, and as of late November, CS has already initiated steps to lay off approximately 5% of the bank’s employees. Personally, I believe it is not unlikely that this number (layoffs) will quadruple by 2025.

Raise Funds

A stronger balance sheet should likely help to restore client confidence in Credit Suisse. Only recently, the bank has communicated the successful sale of approximately $5 billion worth of bonds – highlighting ‘strong investor demand’. On November 25th, the bank has also confirmed ambitions to raise approximately 2.24 billion CHF worth of equity, as CS is aiming to issue 889 million new shares at CHF 2.52 ($2.67) valuation – with the Saudi National Bank likely being a key investor.

Conclusion

Credit Suisse is losing clients and assets under management at record pace, which is concerning, but not very surprising. Moreover, the loss of profitability caused by the contraction in wealth management is amplified by a slowing demand environment for investment banking.

Although the bank is making progress with previously communicated restructuring ambitions, investors should not disregard the fact that restructuring for banks can be very complex, costly and slow (reference: Deutsche Bank (DB) and Citigroup (C)). Moreover, as long as Credit Suisse suffers from a lack of confidence, the bank is unlikely to accumulate significant value.

Concluding, even if there is likely no imminent default for Credit Suisse, I doubt that the bank’s stock will recover anytime soon, if ever.

Reiterate ‘Hold’ rating.

Be the first to comment