fotocelia/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Not Financial Advice: Don’t Spend Your Last $150 on Stocks

Glad we have that out the way. But in the thought experiment necessary to conduct this comparative analysis, let’s say you are monomaniacal in nature and can’t abide even the complexity of owning two stocks. You want to bet it – sorry, not bet it – invest it wisely – in just one of these two banzai names that lit up the sky in 2020 and 2021, only to make like Icarus in 2022. Which should it be?

Well, in our view, the answer depends on your timeframe. Allow us to explain.

How are Datadog And Cloudflare Different?

Let’s take it back to basics.

Datadog (NASDAQ:DDOG) is a software company that sells monitoring applications to large enterprise customers. Today’s compute stack within the enterprise is a Byzantine mess of applications, containers, databases, microservices, security protocols, failover, backup, remote access, on-premises, in-cloud. It is in short not just spaghetti, but more closely resembles quantum string, to the extent that is even a thing. A more prosaic motif would be a ball of elastic bands that you bundled up neatly ten years ago then tossed in a drawer in the attic and are now trying to understand which band is which. To keep an eye on this stuff you need a monitoring tool and for the most part enterprises use Splunk (SPLK), Dynatrace (DT) or Datadog. There are other niche players – PagerDuty (PD) is a kind of bolt-on that yells FIRE when one of those apps notices that something is on fire – but those three names have much of the market tied up. Datadog is therefore a very niche software business with a tightly-defined end market, few competitors, and a must-have product (as in, you have to buy one of these rigs from someone – and there aren’t so many folks you can buy one from). Being a modern software business, DDOG has few variable costs, almost no capex, and a subscription business model. That it supplies a must-have product in an oligopolistic market means it has a goodly amount of power vs. its customers, and that shows up in the size of its forward order book and, in particular, the big ole chunk of deferred revenue – prepaid contracts yet to be satisfied. The Big Dog grows fast, has fat cashflow margins, a rock-solid balance sheet, and a defensible market position. It’s an easy one to own – save for the crazy revenue multiple and – boo!, hiss! – the ginormous stock-based compensation, value mavens the world over would love this thing.

Cloudflare (NYSE:NET) is a services company that sells network services to enterprise and SMB customers. Those services range from zero-trust security perimeters for federal agencies to server capacity placed nearer to the users of your cat videos than you yourself can reach. No that is not a joke, this is really the range of what the company does. It competes with Akamai and Limelight and Fastly in its low end service, and ZScaler at the high end. What’s notable about NET is mainly the ambition of its management team. CEO Matthew Prince never saw a market he didn’t think he could own, which is how you explain the company crossing a very wide and deep chasm indeed from the cat videos to the FedRAMP. From a business model perspective, NET is a lot less attractive than DDOG. It grows quickly (albeit not as fast as DDOG for now) but it has an insatiable appetite for money. As in, it eats money all day every day, not, it loves to gather money from its customers. It makes a solid enough accounting profit as measured by EBITDA, but then it blows money fast on a stupendously large capex bill and a woefully out-of-control working capital policy. We have told the company this on multiple occasions but as yet, no dice. We note that in the last couple of earnings calls there have been mumblings about starting to charge customers upfront for stuff, so maybe they did read our shouty emails after all.

So before we turn to numbers and charts and all that boring stuff, let’s cut to the chase. We think that in the short and medium term, DDOG is a better risk-adjusted investment, because the growth ought to drive up the stock – the technicals look like the stock wants to run up – and the cashflow and market position ought to protect the downside. But long term, over say 5+ years? We think NET can outperform because at some point DDOG will run out of addressable market and either be acquired by a larger player, or start to die on the vine. That’s just the lot that comes with being a niche enterprise software business. It is rare indeed to see such software companies broaden out into a wider positioning – either by organic development or by acquisition. It’s much more common to see a niche business acquired by a suite player. Whereas we think the NET CEO doesn’t know when he’s beaten and doesn’t know what an unwinnable market looks like. These are superb qualities for someone running a long-range business.

OK, now for numbers.

Datadog and Cloudflare Stock Key Metrics

First up, the DDOG.

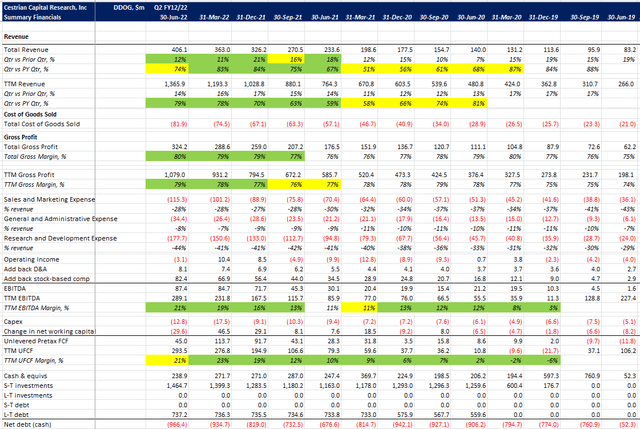

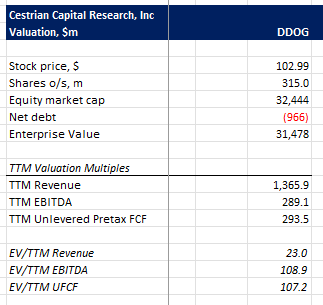

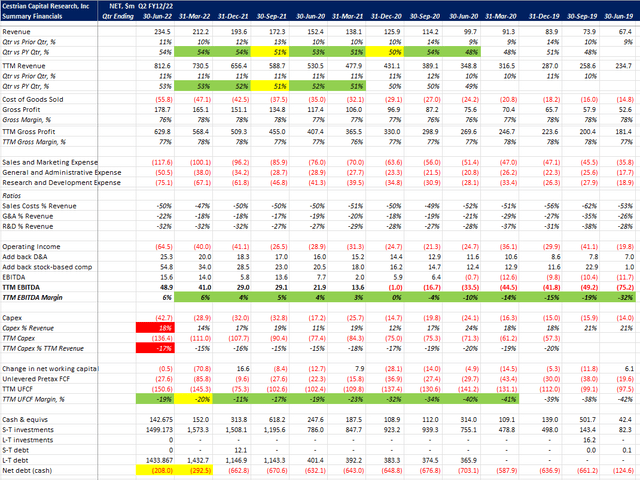

DDOG Financials I (Company SEC filings, YCharts.com, Cestrian Analysis) DDOG Financials II (Company SEC filings, YCharts.com, Cestrian Analysis)

At first blush the story is all good here:

- TTM revenue growth of +79% vs prior year

- TTM gross margin at fully +80%

- TTM EBITDA margins of 21%, and

- TTM unlevered pretax FCF margins of 21% also

The cloud on the horizon, no pun intended, is the slowing growth of the order book (“remaining performance obligation”) and the prepaid part thereof (“deferred revenue”). RPO slowed in Q1 and again – markedly – in Q2. If this continues it will drag down revenue growth, and that will drag down the multiple of sales this thing trades at. Which, as you will know already, is not small.

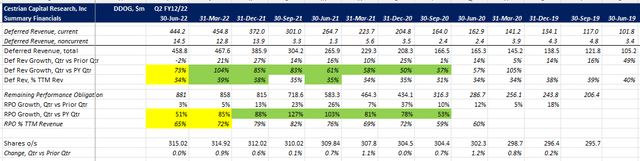

DDOG Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

23x TTM revenue is grin-and-bear-it if growth is on fire, but plain yikes if growth is slowing.

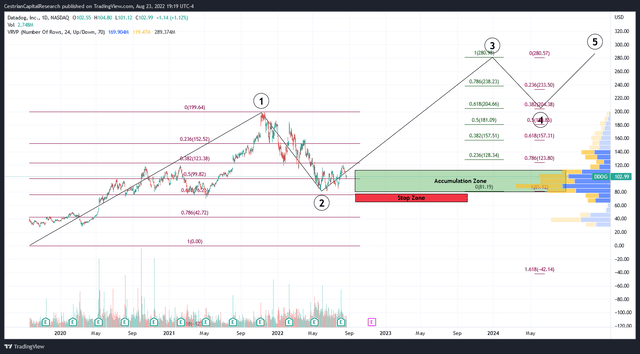

Here’s the DDOG chart. You can open a full page version, here.

DDOG Chart (TradingView, Cestrian Capital Research, Inc)

We believe DDOG has a bright future in the coming year or two; subject to the company resolving that order book issue we flag above. We believe that building a stake in the company in the ‘accumulation zone’ highlighted above – which corresponds to the high volume nodes on the volume profile which is likely the price zone in which institutions are buying – can reward the patient investor. The Wave 1 up and Wave 2 down we show (note, we start the Wave 1 at a notional pre-IPO zero, a method which is giving us good results with these recent IPO names) means that should a larger-degree wave 3 follow, it can run up, a lot; because the standard Wave 3 target is the 100% extension of Wave 1. Put another way that means the target is the share price move achieved during Wave 1, added to the share price at the bottom of Wave 2. Which is how we get a Wave 3 target of $280 – more than 2.5x money from here. Should the stock move below the recent June lows we believe a stop-loss can keep investors’ capital safe; a plunge below these lows means that something is amiss with the market or with the company itself, either of which are better spent on the sidelines with no position.

And NET?

Numbers:

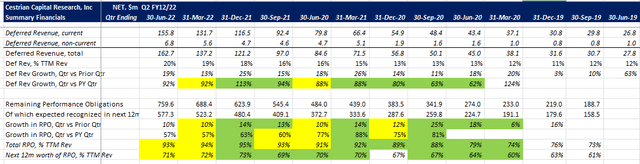

NET Financials I (Company SEC filings, YCharts.com, Cestrian Analysis) NET Financials II (Company SEC filings, YCharts.com, Cestrian Analysis)

Here again, there’s much to like.

- TTM revenue growth of 53%

- RPO growth of 57% – still above the rate of growth in recognized revenue

- Gross margins in the 70% zip code which given the business model is good

BUT accounting (EBITDA) margins are just 6% on a TTM basis, and cashflow margins are woeful – negative 19% TTM unlevered pretax FCF margin in the most recent quarter. This is because of the aforementioned huge capex bill (17% of revenue on a TTM basis!!) and an absence of discipline on the cash management front – in 10 of the 12 quarters shown above, the company leaked cash out of the building because it pays its suppliers a lot faster than it gets paid.

The valuation clearly didn’t get the memo.

NET Valuation (Company SEC filings, YCharts.com, Cestrian Analysis)

26x TTM revenue. Everything better go right at that level.

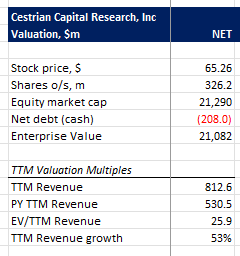

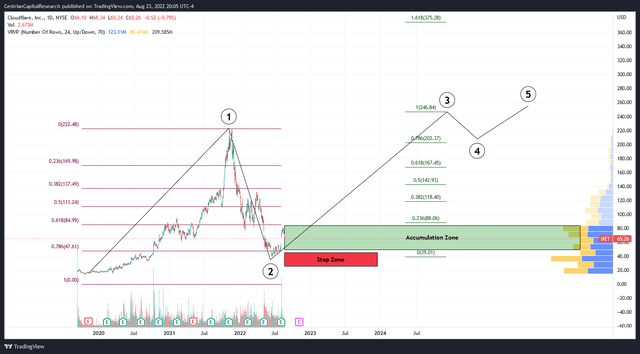

Here’s the NET chart. There’s a full page version, here.

NET Chart (Trading View, Cestrian Analysis)

Using the same start-the-count-at-zero logic as DDOG, which once again we find works rather well for us in these post IPO stocks –

- Wave 1 up from a notional zero to a late 2021 high of $222

- Wave 2 down in a vicious plunge through 2022, bottoming around the June lows

- Initial evidence of a Wave 3 up which, if it continues, can reach the 100% extension of Wave 1; that means a $247 bull case target, a better than 2x money outcome from here.

We believe a stop can be placed below the $45 zone to keep your capital protected.

Are DDOG and NET Stock Overvalued?

The fundamental multiples at which these stocks are valued are elevated vs. normality, but then the best growth stocks always are. We believe the chart logic is a superior method by which to invest in – and protect capital deployed into – these stocks. And we believe both DDOG and NET to be compelling buying opportunities at present. Investors with the discipline to build a position carefully at these depressed levels, then wait for other market participants to bid the stocks up, delivering marked-up unrealized profits, such gains to be taken at the investor’s preferred level – we think investor patience will be rewarded.

Is Datadog or Cloudflare Stock a Better Buy?

If we had to pick one? It would be NET, on the basis that we would put the stock in a very long term account and just wait. But if we had shorter-term liquidity goals, we would likely choose DDOG. As always, it pays to know your timeframe and your risk appetite.

Cestrian Capital Research, Inc – 23 August 2022

Be the first to comment