alvarez

ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) is quite possibly a shipping line that a lot of investors may never have heard of yet. But, ZIM Integrated shares have attracted some interest lately chiefly because the shipping company offers investors an eye-popping near-40% dividend yield. ZIM Integrated has benefited from a pandemic-driven surge in shipping volumes and elevated shipping rates and, therefore, is currently highly profitable on an EBITDA and free cash flow (“FCF”) basis. However, I believe the yield is highly unlikely to be sustainable since the shipping industry is cyclical and shipping rates have started to drop off!

ZIM Integrated: Riding a recovery in the cargo industry

The shipping industry has staged a strong recovery during the COVID-19 pandemic, and although problems exist, such as congested ports and prolonged shipping times, the sector has seen strong earnings growth in recent quarters.

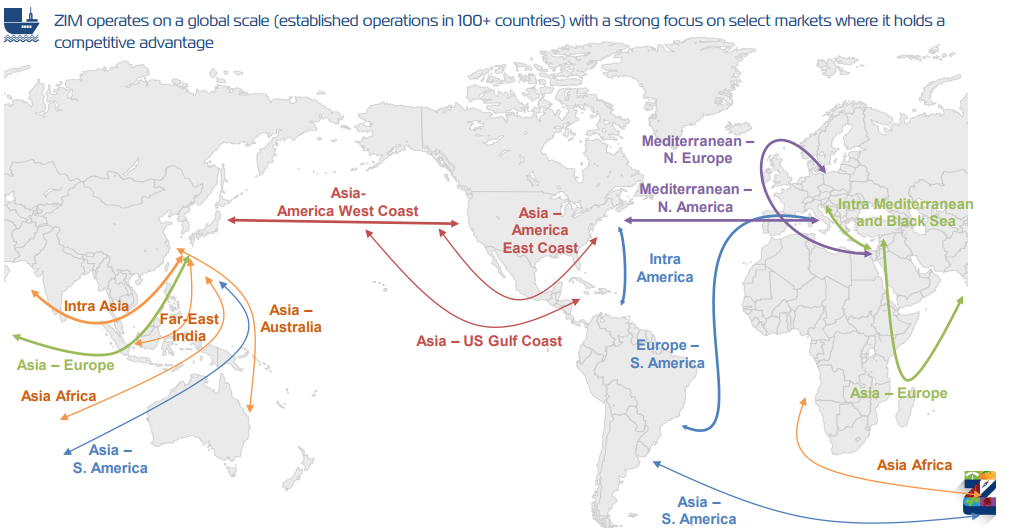

ZIM Integrated is an Israel-based container shipping company that offers its customers seaborne transportation and logistics services around the world. In the second-quarter, the biggest trade volumes for the firm occurred in the Pacific with 291 thousand TEUs — TEU is a measurement unit used in the logistics industry and stands for a 20-foot long container — which calculates to 34% share of the shipping company’s overall trade volume. The second-highest shipment volume occurred in the Intra-Asia trade (32%), followed by Atlantic trade routes (15%), cross-Suez trade (12%), and Latin America (7%).

ZIM Integrated: Shipping Routes

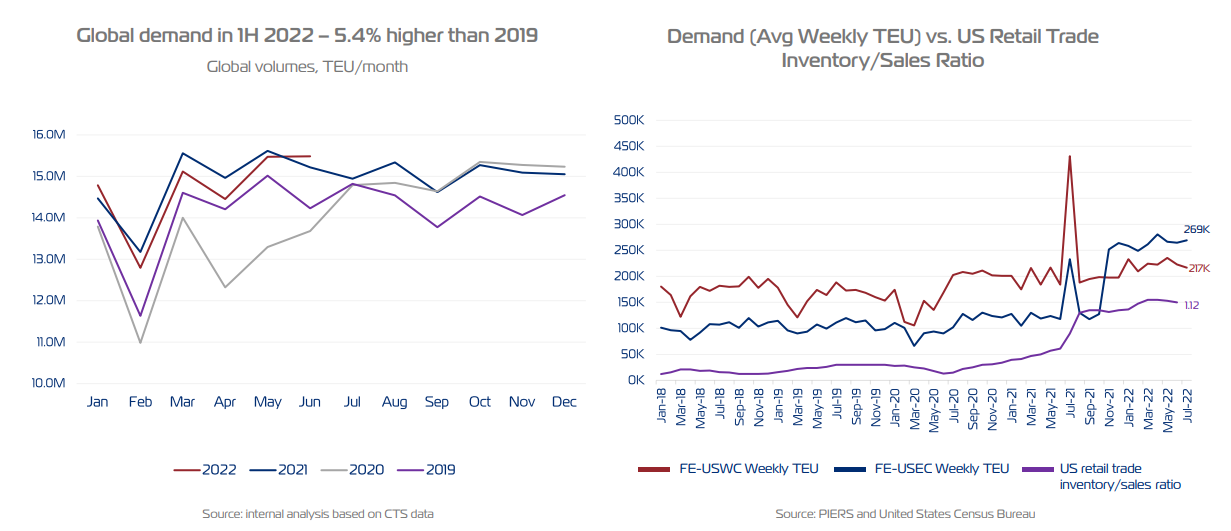

After the pandemic ended, the shipping industry experienced a major boom, in large part because factories which were temporarily locked down during COVID-19 resumed production and scrambled to fill order backlogs, which resulted in significantly higher shipping rates for cargo loads. The demand outlook is still robust for the cargo industry as global shipment volumes in the first half of FY 2022 were about 5% higher than in the same period before the pandemic in 2019.

ZIM Integrated: Global Demand Situation Shipping Industry

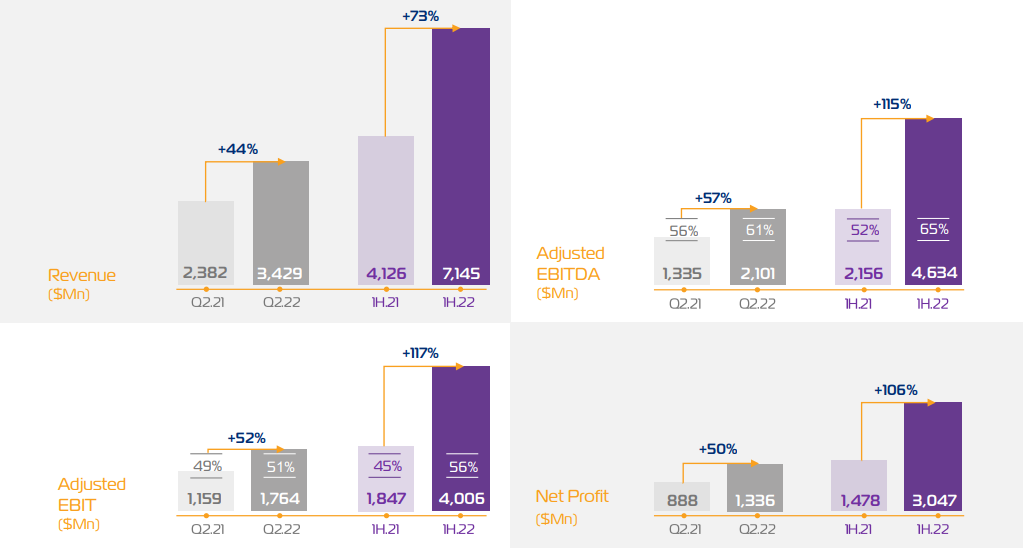

Strong demand for cargo shipping resulted in an explosion of shipping rates which has fueled the profits of container shipping companies such as ZIM Integrated. The shipping company reported record results so far in 2022. The firm’s revenues in the first six months of the year soared 73% to $7.1B while its adjusted EBITDA gained 115% year over year to $4.6B. ZIM Integrated’s adjusted EBITDA margin improved 13 PP year over year to 65% and the company achieved record free cash flow of $3.1B, showing year-over-year growth of $1.6B.

ZIM Integrated: YTD Financial Results FY 2022

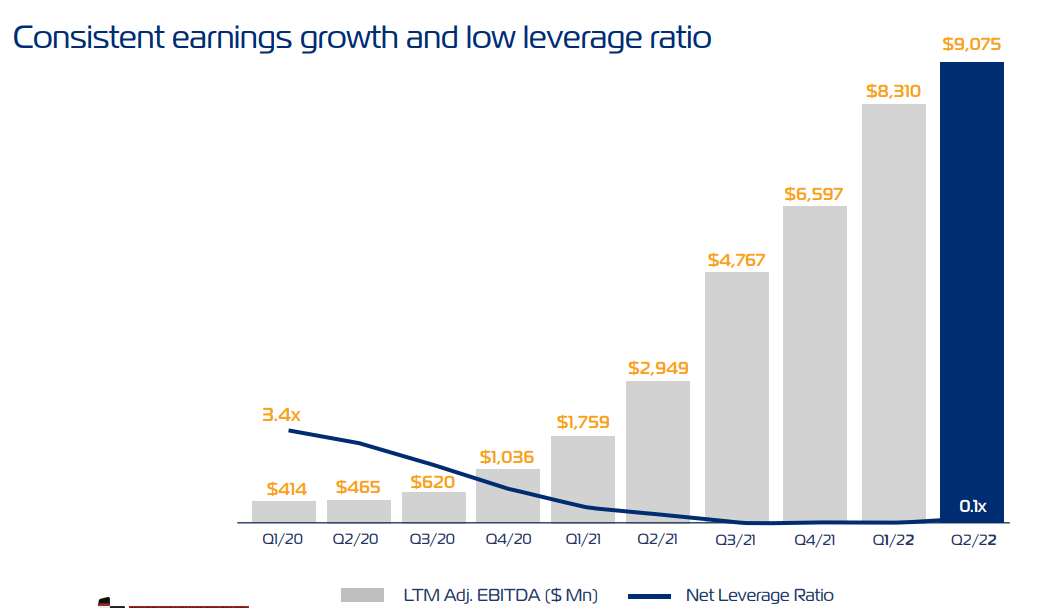

Healthy balance sheet

ZIM Integrated Shipping had $946.8 million in cash at the end of the second-quarter and almost no debt, which gives the company a high amount of leverage to build out its fleet. ZIM Integrated’s low leverage ratio is one of the most attractive features about the shipping container company.

ZIM Integrated: Earnings Growth, Low Net Debt

Guidance for FY 2022

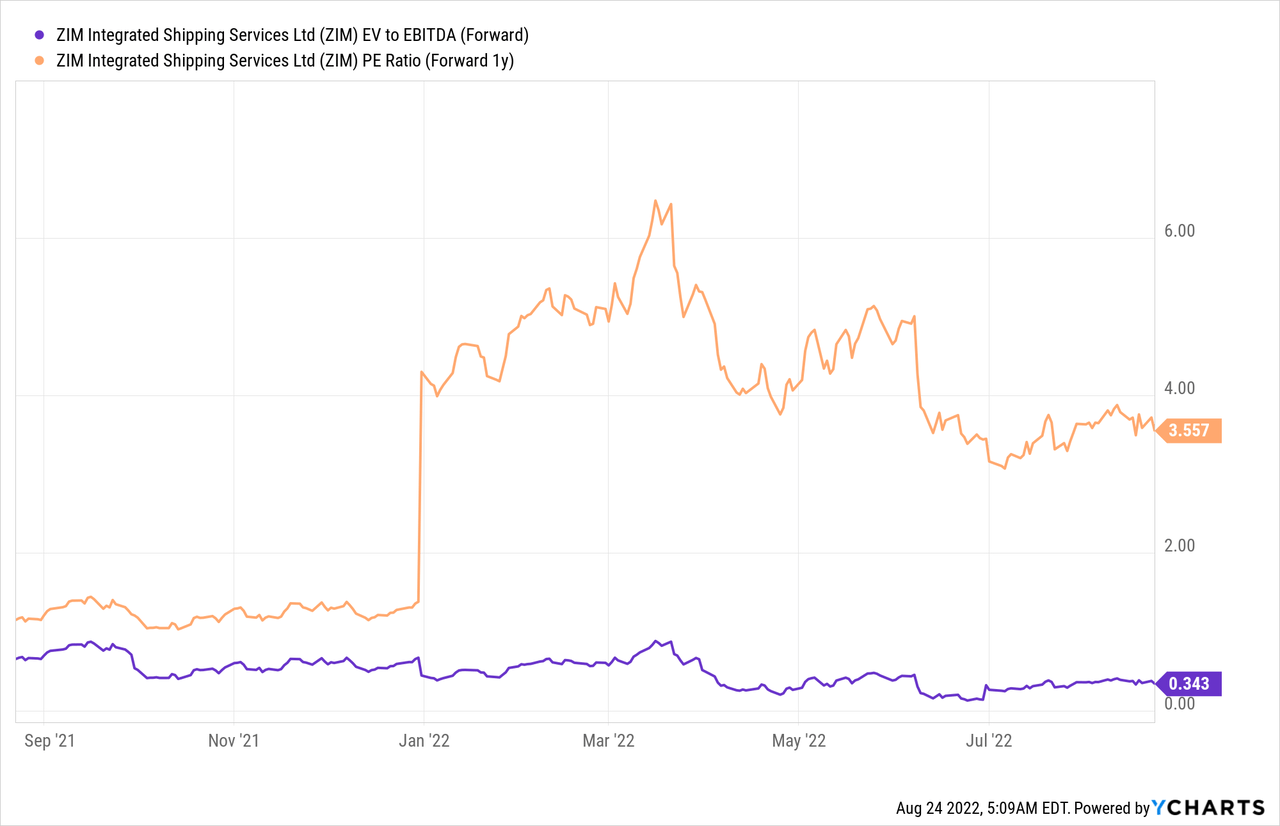

Due to favorable operating conditions in the industry, the company has issued a very strong EBITDA forecast for FY 2022: the container shipping firm expects to generate adjusted EBITDA of between $7.8B and $8.2B this year. The shipping company raised its guidance from $7.1-$7.5B which was submitted back in March. Based off of EBITDA and earnings, ZIM Integrated has a very low valuation. However, should profit expectations deteriorate, perhaps due to a down-turn in the shipping industry, ZIM Integrated’s valuation factors could rapidly increase.

Why you shouldn’t get excited about ZIM Integrated’s 40% dividend yield

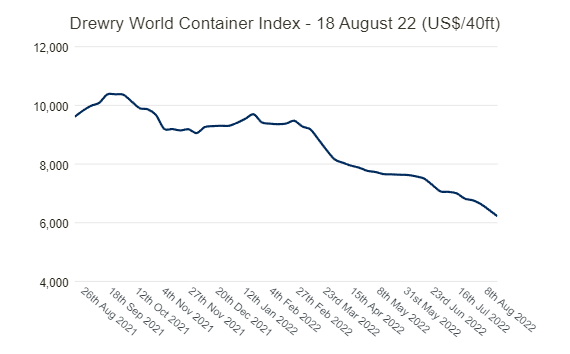

Shipping rates have begun to drop and prospects for consistently strong earnings growth for ZIM Integrated are dimming. According to the Drewry World Container Index, which measures shipping rates for 40-foot long containers, prices for shipping such containers decreased by 3% to $6,223.82 last week. Freight rates were well above $10,000/40ft container in the year-earlier period and they are set for a continual normalization as the global economy deals with the prospects of a recession.

Drewry World Container Index

ZIM Integrated has a policy of distributing 30-50% of annual net income to shareholders which means that at times of elevated profitability — due to favorable market conditions — investors are getting a larger dividend check. However, shipping companies tend to have highly volatile earnings profiles which correlate to shipping rates. Global container shipping rates before the pandemic, per Statista, were below $2,000 per container so a normalization in freight rates would seriously pressure ZIM Integrated’s profits.

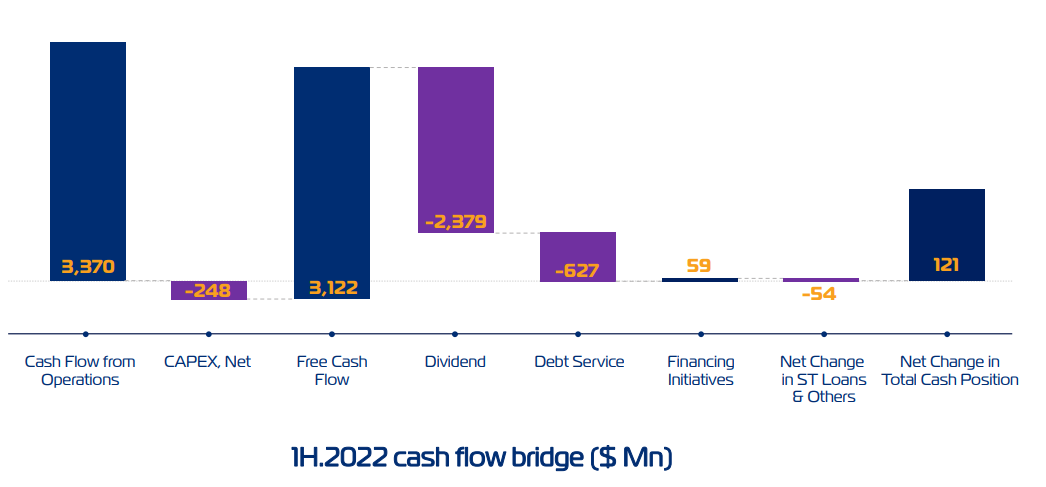

As shipping rates contract, a variable payout policy strongly implies that ZIM Integrated’s shareholders may see much lower dividend payments in the future. ZIM Integrated did cover its $2.4B dividend payout in the first six months of FY 2022 with $3.1B in free cash flow, but weaker shipping rates going forward strongly indicate a drop-off in FCF… and with that could come a major contraction in variable dividend payments.

ZIM Integrated: Free Cash Flow FY 2022 Covers Variable Dividend

Risks with ZIM Integrated

The biggest risk that I see for the container shipping company is a continual contraction of shipping rates which have already dropped from more than $10,000 in 2021 to close to $6,000 today. A contraction in shipping rates, declining free cash flow and the generally cyclical nature of the cargo industry are risks that indicate that ZIM Integrated’s dividend yield may not be sustainable.

Final thoughts

Although ZIM Integrated’s near-40% dividend yield is tempting, it is likely a value trap. I don’t expect the cargo company to maintain its current dividend payout going forward, especially if cargo freight rates continue to decline.

ZIM Integrated is paying a variable dividend that is dependent on overall company profitability which may fluctuate greatly going forward, especially if a global recession were to depress shipping volumes and freight rates were to drop closer to the pre-pandemic average of $2,000/container. As operating conditions in the container shipping industry normalize, so should ZIM Integrated’s dividend yield!

Be the first to comment