Noah Berger

Why is AWS slowing down?

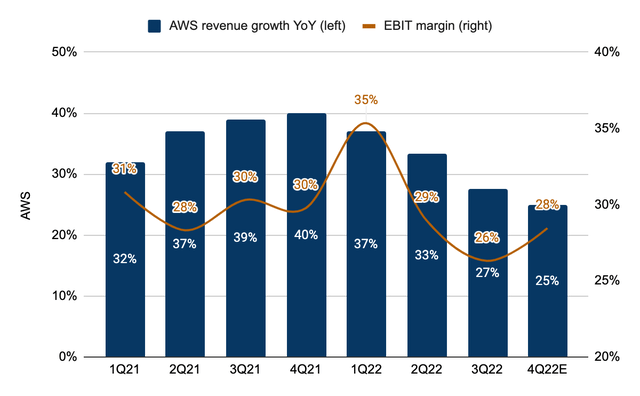

In Q3 2022, Amazon.com, Inc. (NASDAQ:AMZN) reported Amazon Web Services, Inc. (“AWS”) revenue of $20.5 billion (+27% YoY) and a 3-point sequential decline in EBIT margin to 27% during the quarter. The slowdown in Q3 top-line was a 6-point deceleration from 2Q22 vs. a 4-point deceleration from Q1 to Q2. While AWS is a much larger business today and the law of large number has certainly contributed to some of the moderation in revenue growth, there are a number of reasons noted by Amazon management, as well as by peers including Microsoft (MSFT) and Google (GOOGL, GOOG).

Consensus estimates, Albert Lin

The first reason behind the AWS slowdown is higher cost sensitivity amongst customers. The term “cost optimization” was mentioned by both Amazon and Microsoft management several times during their Q3 2022 conference calls. This essentially means finding cheaper ways to run various workloads on the cloud, such as moving to lower-tier storage and compute capabilities and shifting from higher-priced pay-as-you-go to lower-priced Reserved Instances.

By default, AWS bills customers on a consumption basis every month. This on-demand model can become quite expensive when customers are running a lot of workloads and deploying many instances. As a result, an AWS reserved instance allows customers to get discounted billing when they agree to use a specific instance for a period of 1-3 years, which could benefit customers with more steady usage in the form of a lower hourly rate.

Second, cloud migration has become a longer process as customers look to tighten the belt in a downturn. The initial costs associated with migrating legacy on-premise workloads to the cloud are usually high, and CFOs may want to delay such projects until recession risks are gone. This was noted on Google’s Q3 2022 call, where management highlighted longer sales cycles and smaller contracts in GCP. While AWS certainly provides a cost advantage by running workloads using its proprietary Graviton CPUs, the upfront costs (e.g., hiring a 3P consulting firm) to convert corporate operations to AWS could cause many companies to delay the modernization process given usage/consumption is likely to be low in a recessionary environment anyway.

The third factor is lower overall consumption in verticals affected by current macro conditions. Industries such as financials, gaming, digital advertising, and e-commerce are seeing normalizing activities in a post-pandemic environment with rising interest rates. On its Q3 2022 call, Amazon management noted slowing mortgage businesses and a challenging crypto market that partially contributed to the slowdown in AWS revenue growth. The recent FTX scandal suggests confidence in cryptocurrencies is unlikely to return anytime soon. If prominent crypto platforms such as Coinbase (COIN) continue to experience muted trading activities as retail investors lose their life savings on Luna to FTT, that means lower consumption/revenue for major cloud infrastructure providers as well.

Cyclical or secular?

The deceleration in AWS revenue growth (+40% to +25% in 4 quarters) as well as Azure and GCP appears to be more cyclical than secular as demand for digital transformation during the pandemic (work from home, rush to move operations to the cloud, gaming, streaming, crypto, e-commerce, etc.) significantly biased the growth rates to the upside. Given the 3 factors discussed above are largely macro-driven, a 2023 recession remains a wildcard that will likely put further pressure on AWS growth as consumption falls and companies look to cut costs more aggressively.

Since Amazon reported Q3 2022 results, consensus AWS revenue and EBIT margin for 4Q22 have been reduced from $23 billion (+29% YoY) and 31% to $22.2 billion (+25% YoY) and 28% (vs. 30% in 4Q21). The current Q4 top-line estimate is consistent with Amazon’s comments that AWS growth moderated to ~25% exiting Q3. The 2-point deceleration from Q3’s 27% is better than a 5-point deceleration in Azure growth per Microsoft’s Q4 guidance. Therefore, I see downside risk to Street estimates and would conservatively model Q4 AWS revenue of $21.7 billion (+22% YoY vs. +25% consensus). This brings 2022E AWS revenue to slightly over $80 billion, up 29% from 2021.

For 2023, consensus estimates currently call for AWS revenue of just over $100 billion (+25% YoY). While this number may be achievable given continued growth and an AWS backlog of $104 billion (+57% YoY) at Q3, it’s important to recognize that the backlog does not have to translate into revenue right away, since customers may not necessarily hit their contract commitments in a slower environment. If the economy does materially deteriorate in the next few quarters, it’s possible for AWS growth to decelerate into the low 20%s in 1H23 vs. strong 1H22 comps (+37%/+33% in 1Q/2Q22), in my view.

How much is AWS worth?

The question now becomes how much is AWS worth as a mid-20%s grower, as verticals that are severely challenged by macro pressures are unlikely to recover quickly in 2023. I’ve previously valued AWS at 6x 2023 revenue or ~$60 per share, with the target multiple being at the midpoint of Microsoft (8x) and Oracle (ORCL) (4x). This may seem conservative to many, but I believe taking such a defensive view provides some scope for the possibility of markets shifting Amazon’s valuation framework from SOTP to P/E.

For a long time, investors have been used to finding Amazon’s fair price by valuing each of its businesses individually. This does not always have to be the case, considering Amazon is now a much more mature business with low-double-digit revenue growth being the norm vs. 25%+ previously. Given investors are no longer operating in an easy environment with accelerating growth, it’s possible that markets will turn to Amazon’s overall profitability as a key element of the valuation framework. In that scenario, Amazon is trading at a rather demanding multiple of 54x 2023 earnings.

Conclusion

I remain neutral on shares of Amazon given the narrative of “buying AWS and getting everything else for free” may not apply to the current price of $93 if markets are to take a conservative view on the valuation side of the AWS story in a slower-growth environment. That said, it may be difficult to expect shares to reach as low as $60 before pulling the trigger considering Amazon also has a robust, high-margin advertising business that could be worth ~$20 a share by applying a 4.5x P/S multiple (a slight premium to Google’s 4x) to 2023E revenue of $44.5 billion (+18% YoY vs. +21% in 2022E). Putting it all together, I’ll remain on the sidelines for Amazon.com, Inc. for now and revisit the buy case when shares reach $80.

Be the first to comment