rarrarorro/iStock via Getty Images

Introduction

It may not be today. It may not be tomorrow. But, pretty soon, oil and gas are going to be back in style. People are going to get tired of the rolling blackouts that are being predicted for this summer, and are finally going to start asking woke, climate-alarmist politicians on a local level-“Dude, where’s my power?”

It’s already started to happen, with the president wondering if more refineries might help to bring the price of gas down? Something he says he’s keenly interested in doing, and “working like the devil” to achieve it. Having made this cognitive leap, is it too much then to hope he might next conclude boosting U.S. production might also be a step toward that goal? Houston is a much shorter flight than Riyadh, and I think Rick Muncrief of Devon Energy (DVN) is still waiting for a call. Pick up the phone Mr. President, it’ll be easier now than six months from now, I promise.

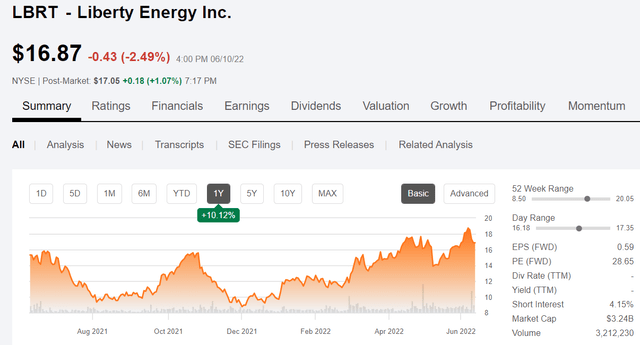

We’re not there yet on a political level, but as I said, the rude awakening from the green dream is happening now, and I think it will continue to gather momentum. You can see it in the stock price of Liberty Energy (NYSE:LBRT) which is coming close to attaining a 4-year high in its stock price. LBRT does one thing primarily – frack oil and gas wells – and business is getting good again.

LBRT price chart (Seeking Alpha)

I last wrote them up at $12ish in February with the admonition that you should add them to your portfolio if you thought oil pricing near $100 was here to stay. That’s been a pretty good call as they’ve risen with the general OFS industry over the past few months.

Now with the sharp focus being paid by nearly everybody on American production, companies like LBRT could be getting ready to see continued gains. Chris Wright, CEO of LBRT, makes some comments along these lines –

To power the global economy and frankly enable the modern world, the frac services market is seeing robust activity improvement and a tightening of the supply demand balance. Leading edge service pricing is recovering to levels that could support fleet reactivations. And we have many long-term partners requesting additional capacity from us. Seven years of underinvestment in oil and gas production capacity was accompanied by an even more dramatic drought in investment in new frac fleet capacity. The emerging cycle is likely to last longer and be characterized by a much slower and more modest rise in active frac fleets.

Regular readers know I think Chris Wright, the CEO of Liberty, is one of the most innovative and prescient leaders in our industry. A couple of months ago, he published an Op-ed in The Denver Gazette about energy realities. I encourage you to give a read if you want to hear the truth about the state of our energy security.

Referring back now to Chris’ quote from the Q-1, 2022 CC, you come away with the essentials truths facing our domestic fracking industry.

- Equipment’s tight and will remain so

- Demand is high and increasing

- Pricing is moving higher

- We are still in early days of this cycle

That sounds like a solid thesis for investment to me. When you add in the fact that the land rig count is approaching 750, and the frac spread count is nearing 300, it’s clear that the worm is turning on domestic energy.

Now I don’t want to get your hopes up that we are about to revisit the era of 2017-19, and frack our way back to 13 mm barrels a day, and $2.00 gas. That time has passed. Capital restraint – still in place in the mindset of operators, supply chain woes, shortage of people, and inflation – what once cost $20 mm is now $60 mm with an 18-month lead time, the quality of the acreage being drilled, will all collude to prevent that from happening.

But, what I am suggesting is that business is going to get dramatically better for service companies like LBRT, and what better way to control inflation than being a part of the story.

The Thesis For LBRT

At its core, LBRT is a pressure pumping company. I have written them up a number of times as to why they are my number-1 pick in the independent fracker space. I encourage you to at least give them a skim to get a sense of the company. In recent times at client request and to gain strategic advantage, LBRT has added wire line services and, in particular, sand mines to their portfolio through the OneStim acquisition, and that of PropX in 2021. Chris Wright comments on how they are a differentiator for Liberty-

Liberty customers are seeing differential execution in this challenging environment, in part, due to vertical integration from our OneStim and PropX acquisitions. While many E&Ps directly source sand, we’re seeing a reversal of that trend as no E&P can hope to match the scale and sophistication of Liberty supply chain. Sand supply challenges were exacerbated by truck driver shortages. Liberty logistics, digitization efforts, coupled with a wide network of multiple origins and destinations allowed us to efficiently employ a limited number of truck drivers with dynamic optimization.

Liberty is also a technology company, a fact I’ve stressed in prior articles in some detail. So there’s a reason for you to delve back into those earlier articles on the company.

Of course, the core thesis for Liberty is eloquently stated by Chris in the call, and I won’t try and out do it with my verbiage.

Restrained global investment in oil and gas over the last 7 years leaves the supply short just as worldwide demand for energy is growing and expected to surpass pre-pandemic levels in 2022. Relatively low and declining oil and gas inventories have led to persistent upward pressure on commodity prices even prior to the Russian invasion of Ukraine although Russian export volumes have oil and gas has been only modestly impacted so far. Uncertainty regarding potential future impacts of sanctions and fire aversion to Russian hydrocarbon presents significant risk to future supply and demand balances.

And the modest but low stated plan increases in opec plus supply and the release of global emergency oil reserves, are simply not enough to supplier rebounding world economy. North American oil and gas are critical in the coming years. Tight oil and natural gas markets, coupled with geopolitical tensions in many key oil and gas producing regions, have all eyes on North American supply. The North American economy is proving more resilient to today’s global challenges in significant part, due to a secure local supply of price advantaged natural gas. North America is well positioned to be the largest provider of incremental oil and gas supplies.

I hope you read every word of that. It’s all true.

Liberty Q1 2022 Earnings Results

For the first quarter of 2022, revenue increased 16% to $793 million from $684 million in the fourth quarter of 2021. Adjusted EBITDA increased 345% to $92 million from $21 million in the fourth quarter.

As of March 31, 2022, Liberty had cash on hand of $33 million, and total debt of $212 million including $108 million drawn on the ABL credit facility, net of deferred financing costs and original issue discount. The term loan requires only a 1% annual amortization of principal, paid quarterly. Total liquidity, including availability under the credit facility, was $222 million as of March 31, 2022.

Catalysts For LBRT

I think there are a couple of drivers that will push business and profits for LBRT. The first is the PropX wetsand technology. This saves energy cost in drying sand. This is a huge potential logistics advantage and cost saver. There is also the health aspect of blowing sand and crushed debris. It’s a bad idea to breathe in silica-sand. Doing so can lead to silicosis. Which is not good. If you care about people’s health, not handling dry sand is a step-change improvement that will gain traction rapidly.

The second is Digifrac. LBRT is ahead of the pack – although all fracking companies are pursuing clean power (gas, electric) to shift away from diesel. There are a couple of drivers here. Emissions are being tracked by the operators as a result of government initiatives. Lower emissions are the wave of the future. Cost and efficiency go hand in hand with this technology, as will profit. Having this tech developed to this stage of deployment is a step-change advantage for LBRT.

Risks

Obviously, the growth we are forecasting for LBRT is dependent on the current price regime for oil-over $100 per barrel. As secure as this seems right now, investors should be advised that the energy sector is subject to a lot of volatility. Any adverse moves in the oil price would impact LBRT shares.

Your Takeaway

LBRT is trading for 8X EV/EBITDA. This might seem a little high, and normally it is, but consider the improvement from Q-4, 2021. Using SA’s numbers, the multiple then was ~37.2X. So things are getting better.

One clue as to where the stock might go from here lies in a metric that tabulates EBITDA per fleet. Currently, it’s about $10 mm per year. Guidance is for it to attain $14-18 mm per fleet. That should move EBITDA toward $650-700 mm for 2022. To keep the multiple at 8X, the shares need to re-rate toward $30 per share, a nearly 100% increase from current levels. I will be surprised if it stops there.

I think LBRT is a buy at current prices, and investors looking for growth should consider if their risk profile includes a small company like LBRT.

Be the first to comment