G0d4ather/iStock Editorial via Getty Images

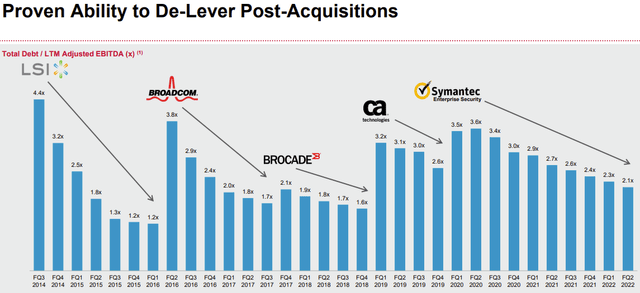

Broadcom (NASDAQ:AVGO) is one of these rare successful serial acquirers. It succeeds over and over by taking over companies with significant amounts of debt. It quickly increases acquisition targets profitability. Then it deleverages again by generating strong free cash flows. It goes through this cycle while also maintaining a high and fast-growing dividend.

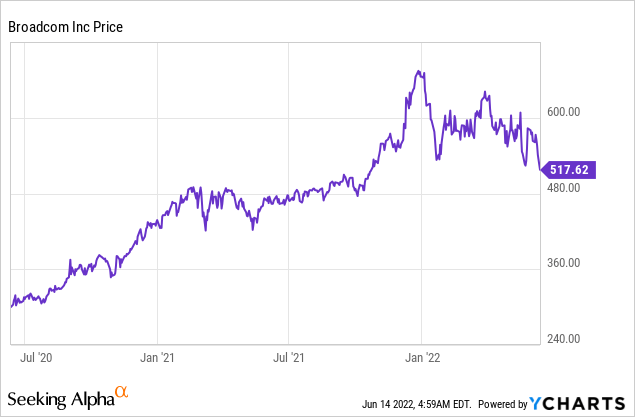

It’s been two years since I published another bullish article on Broadcom. The stock didn’t disappoint with a whopping 70% price increase and 82% total return since.

About Broadcom

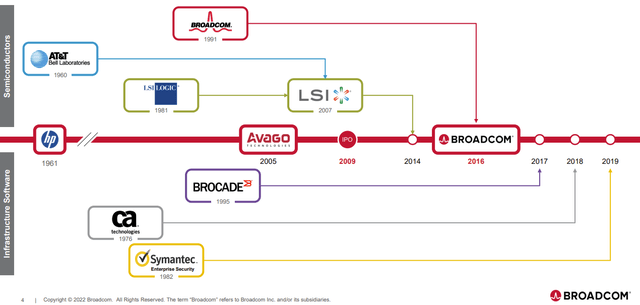

Broadcom offers a wide range of semiconductor and infrastructure software solutions. Its CEO, Hock Tan, has shaped the company since 2006. He makes regular acquisitions and generates synergies like no other.

Broadcom Investor Presentation (Seeking Alpha)

The focus went from semiconductors to infrastructure software. It’s a resilient company with continuously growing revenues and cash flows.

Growth

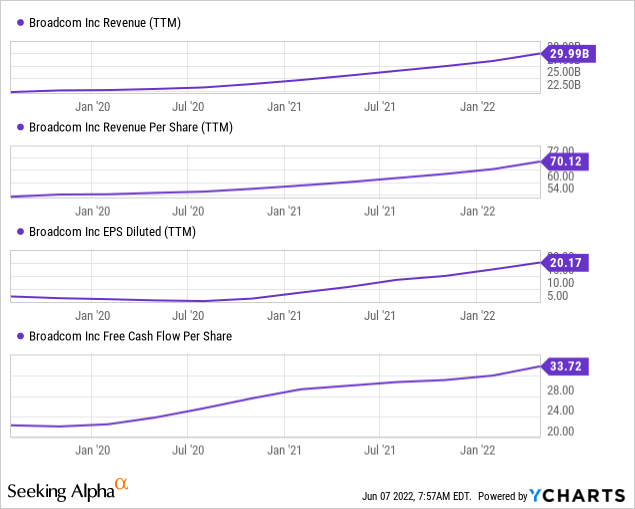

Broadcom’s most recent quarter ending May 1 showed the company’s excellent growth rate. Revenue increased 23% to $8.1B, and non-GAAP EPS followed with a 37% increase to $9.07. Free cash flow grew “only” 20% to $4.2B.

Broadcom’s growth over the past five years is impressive as well. Its revenues grew at a CAGR of 11.7%, and free cash flow increased 24.85% annually.

Its outlook reveals more growth. It expects 24% YoY growth to $8.4B in Q3 revenue. I believe 20% revenue growth for the full fiscal year (ending October 2022) is plausible.

Beyond 2022, VMware Could Add Growth

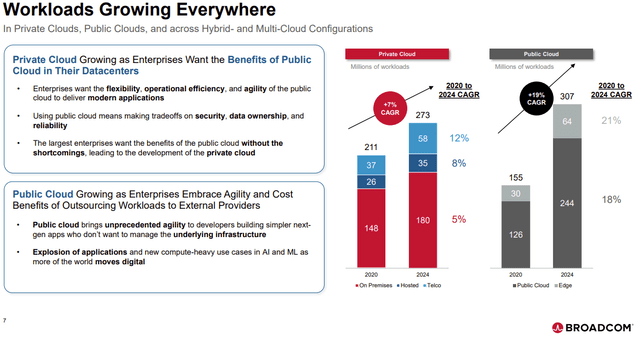

Broadcom VMware Presentation (Broadcom)

Broadcom would rebrand its software division to VMware. The offering of both focuses on the fast growth in cloud applications. Broadcom wants to increase recurring revenues with a clear outlook on future recurring revenues.

Free Cash Flow Generation

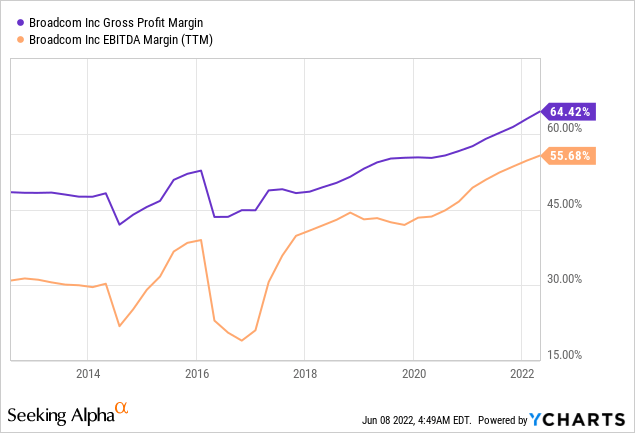

Broadcom produces robust free cash flows. It consistently improved its margins by maximizing the synergies from acquisitions.

Broadcom’s gross profit margin is at an all-time high of 64%. Over the past decade, you can clearly see the acquisitions and the fast recovery of Broadcom’s high margins.

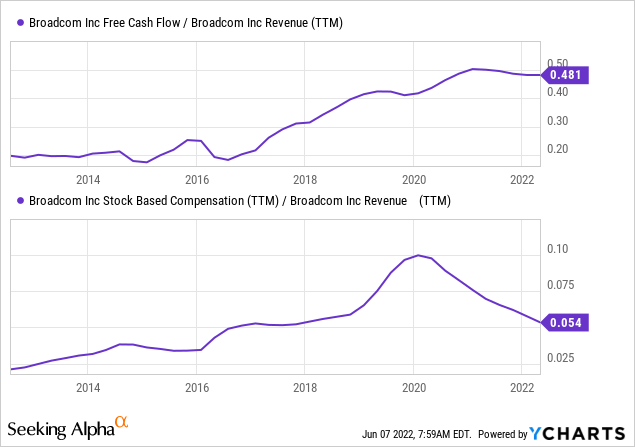

AVGO manages to translate this into a robust free cash flow generation.

48% of revenue is converted to free cash flow. An awe-inspiring feat and one of the most attractive feats of Broadcom. I’ve also included SBC as it isn’t considered a cash cost but has a material effect on shareholders. After SBC, Broadcom still produces a healthy adjusted free cash flow margin of 42.7%, or $11,617M.

Shareholder Returns

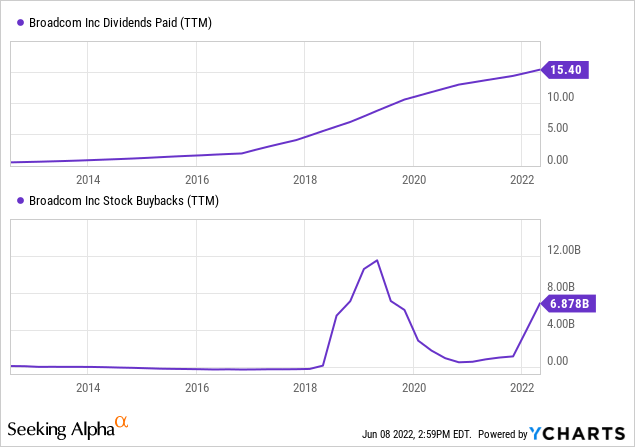

Broadcom uses the free cash flow for paying back some debt and shareholder returns. It pays out 50% of last year’s free cash flow as dividends. It recently also revealed two $10B buyback programs, one in December and one in May.

Broadcom uses available cash for its shareholders whenever possible. It confirmed the share repurchase program simultaneously VMware acquisition announcement. I expect Broadcom to use the ~$13B left under the programs.

Broadcom’s return to shareholders in fiscal 2022 adds up to $20B cash through buybacks and ~$6.7B through dividends. The buybacks won’t continue at this rate, but it still makes for an impressive 3.1% dividend yield and 9% buyback yield in 2022.

Without VMware, I expect Broadcom could reach ~$15.9B in FCF in 2022. It would translate to a yearly dividend of $19 per share next year or a 15% increase.

FCF After Acquiring VMware

VMware has a much lower FCF conversion rate than Broadcom. It turns 30.9% of revenue in FCF, and only ~22.5% accounting for SBC. So this could temporarily reduce Broadcom’s free cash flow conversion again.

Broadcom already revealed it wants almost to double VMware’s EBITDA, and I expect a similar effect on FCF. Broadcom intends to acquire VMW for an enterprise value of $69B and would initially get $3,971M in free cash flow (unadjusted for SBC). FCF could increase 80% based on the EBITDA target to $7,147M or ~$6,000M after SBC.

Balance Sheet

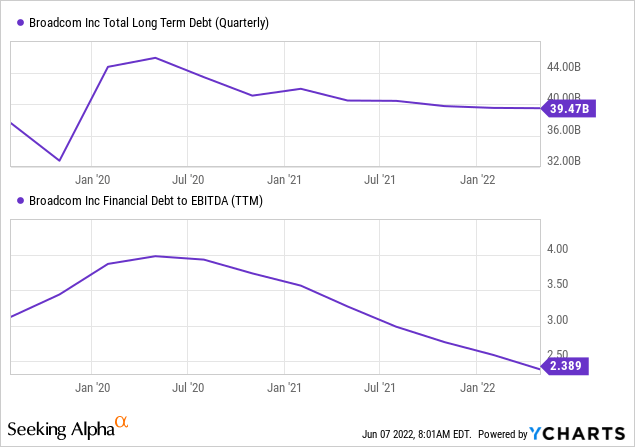

The downside of continuously acquiring companies is the leverage that Broadcom needs. It uses large amounts of debt to finance its acquisitions.

It deleverages by increasing its EBITDA. It doesn’t pay back its debt quickly as it’s financed with long-term loans. The high debt is probably the biggest risk for Broadcom. It has managed this debt very well so far and should continue so.

The recently announced acquisition of VMware (VMW) would add $32B in debt. Its leverage would increase as well to ~3.4 debt/EBITDA. The already announced expected increase of VMware’s EBITDA will be essential to deleverage swiftly after the acquisition.

Valuation

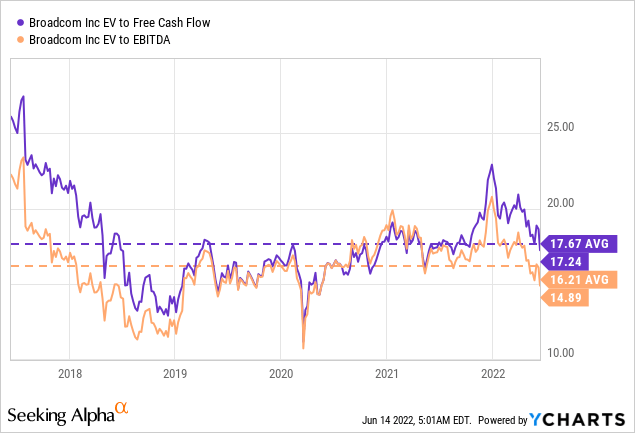

Broadcom is reasonably valued to its recent historical valuation. The EV to FCF is slightly above its 5-year average, and the EV to EBITDA is slightly below its 5-year average. I prefer these metrics over PE because they consider debt and Broadcom’s free cash flow, often higher than its earnings.

An important note to the 5-year average, it also includes periods where Broadcom was integrating an acquisition, like the end of 2017 and early 2018.

So I wouldn’t call Broadcom cheap, but the track record and possible accretive acquisition of VMware make the valuation acceptable. Broadcom doesn’t need to get cheap if it keeps growing like it did in the past.

Risks

There are risks to acquisitions. Every integration has its challenges. Broadcom could miss the expected synergies or cost cuts. It also works with high leverage, which could become more expensive. Rising interest rates will increase Broadcom’s funding costs.

There is also some key person risk to Broadcom. Tan Hock is the architect of the current Broadcom, and investors trust him a lot. He is 70 years old but doesn’t seem to be thinking about retirement yet.

Broadcom benefited from some pandemic tailwinds as well. These tailwinds are fading, although it’s active in many sectors with a secular growth outlook.

Conclusion

Broadcom is a stock that appeals on many levels. It pays a hefty dividend and promises to continue so at 50% of last year’s cash flow. It grows fast organically and regularly makes accretive acquisitions. The perfect execution and integration of each acquisition are some of the fundamental strengths of Broadcom.

I believe Broadcom will do well with or without VMware. I see it as reasonably valued today. The recent dip could be a buying opportunity for such a fantastic company. It isn’t cheap yet, but the current price leaves plenty of upside potential as the company grows further. VMware could be a catalyst for the share price when the deal closes. The closure is expected in Broadcom’s fiscal year 2023, which starts in November 2022.

Be the first to comment