Torsten Asmus

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on November 11th.

Real Estate Weekly Outlook

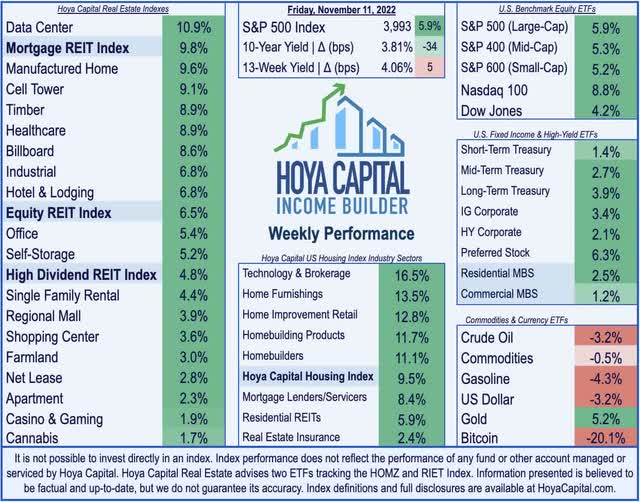

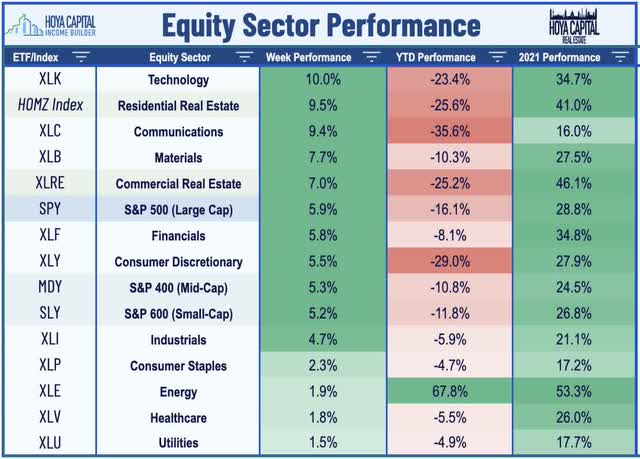

U.S. equity markets posted their best weekly gains since June as cooler-than-expected CPI inflation, election results indicating “fiscal gridlock” in DC, and limited China re-openings raised hopes of peaking inflation and a resulting “Fed pivot” towards a less aggressive monetary tightening course. Perhaps fitting on a week in which hopes of a long-awaited “return to normal” were the prevailing theme, the highly-speculative cryptocurrency market was dealt a potentially fatal blow this week after the collapse of a major exchange.

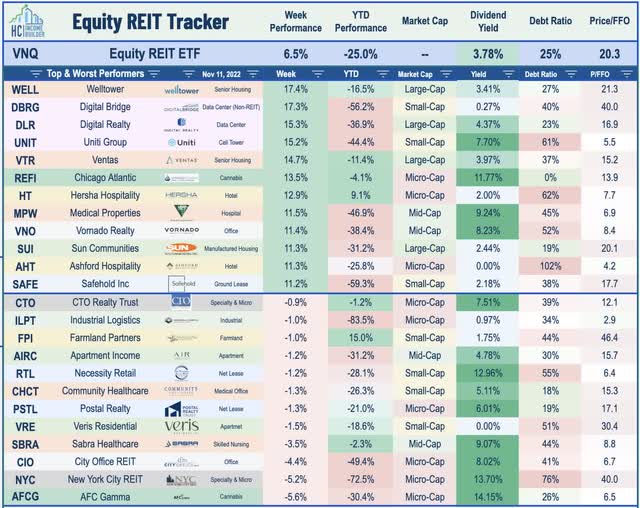

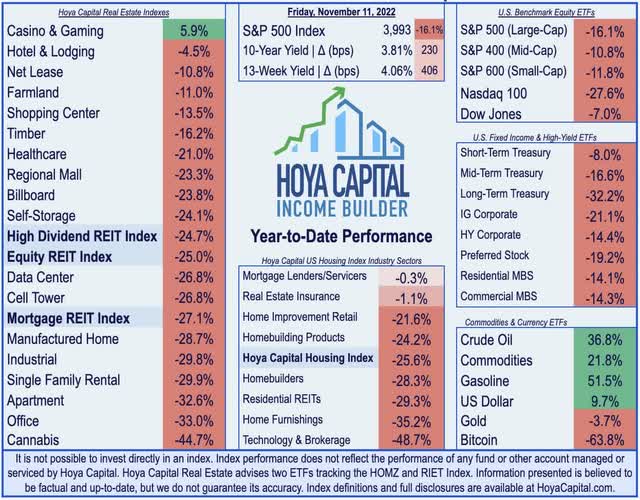

Climbing back out of “bear market” territory, the S&P 500 rallied 5.9% this week – continuing an unusually-choppy pattern with its fourth straight weekly move of at least 3% – while tech-heavy Nasdaq 100 gained nearly 9%. The Mid-Cap 400 and Small-Cap 600 each advanced more than 5% as well. Real estate equities – the sector with perhaps the most to gain for a potential Fed pivot – led the gains on the week as a strong earnings season wrapped up with a handful of guidance raises and dividend hikes. The Equity REIT Index finished higher by 6.5% this week with all 18 property sectors in positive territory while the Mortgage REIT Index rallied 9.8%. Homebuilders, meanwhile, rallied more than 11% as the quoted rate on a 30-Year Fixed Mortgage pulled back by nearly 50 basis points on the week.

Bond markets finally saw some relief in the wake of the cooler-than-expected CPI print amid an otherwise historically brutal year of declines. The 10-Year Treasury Yield plunged 34 basis points on the week to 3.81% – down sharply from the highs late last month of 4.30% – while the U.S. Dollar Index posted one of its worst weeks on record, diving more than 3%. Crude Oil prices, meanwhile, dipped 3% in a choppy week after China announced steps to ease its “dynamic zero COVID” policy which included shorter quarantine time and easing travel restrictions and amid expectations of more-restrained fiscal policy in the U.S. with election results pointing towards Republican control of the House of Representatives – albeit at tighter margins than forecasts suggested heading into the midterms. Bitcoin dipped more than 20% on the week, extending its drawdown to roughly 75% from its highs.

Real Estate Economic Data

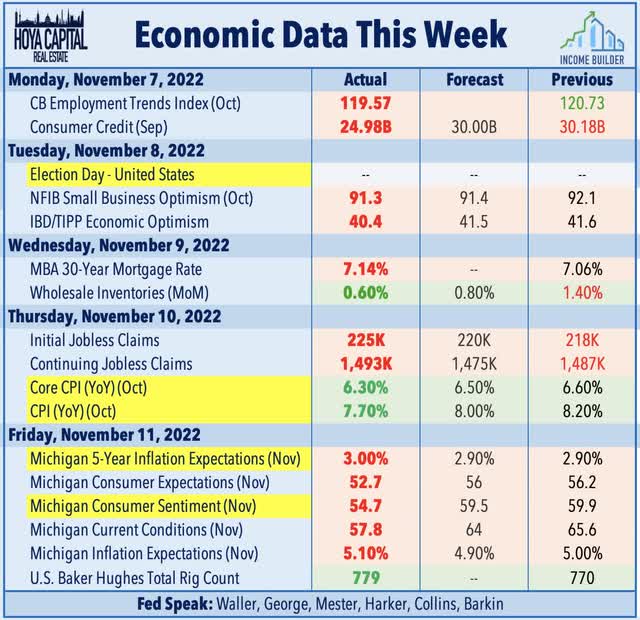

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

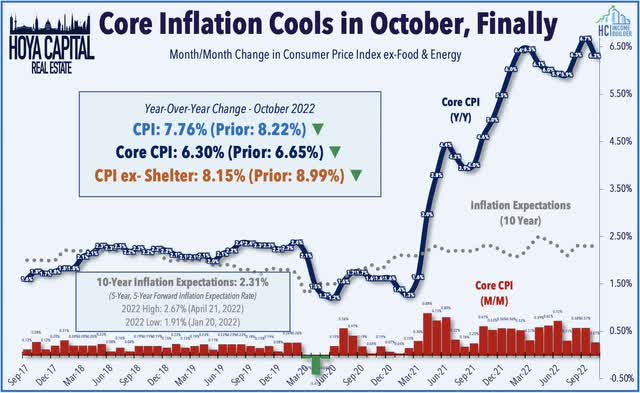

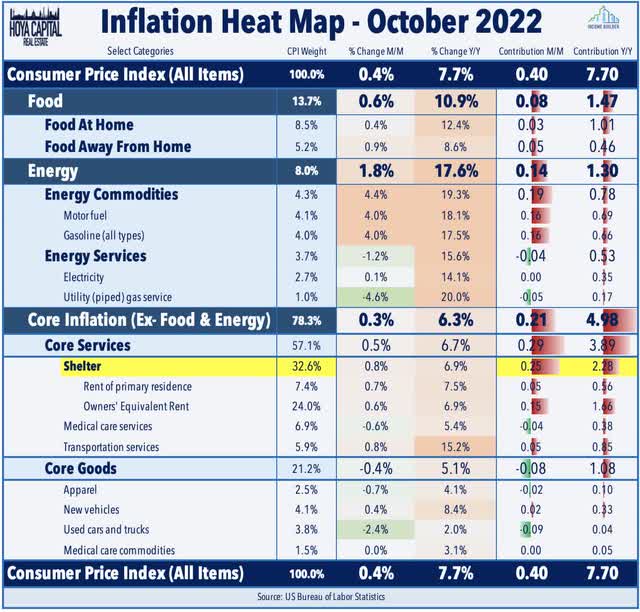

Peak Inflation? Perhaps. Investors finally received some “good news” on the inflation front this week as the Consumer Price Index showed a cooler-than-expected increase in prices in October with the Headline and Core CPI coming in well below expectations, indicating that inflationary pressures may finally be rolling over amid a broader global economic slowdown. The Headline CPI Index slowed to a 7.7% annual rate – the lowest since January – while the Core CPI Index posted its lowest monthly increase in over a year. The cooler-than-expected CPI print sparked a repricing of rate hike expectations with the Federal Reserve now expected to raise rates by 50-basis points at their next meeting to a 4.50% upper-bound following three straight 75 basis point hikes.

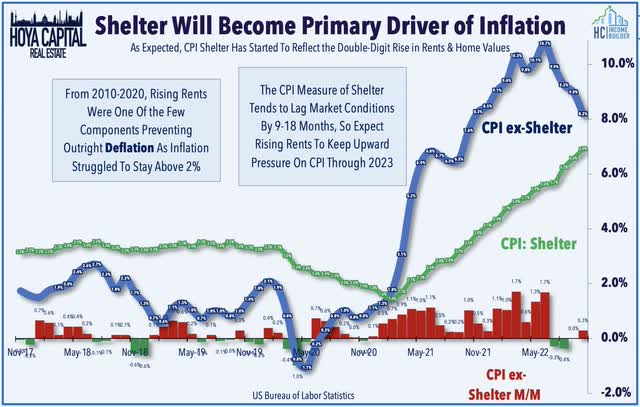

The delayed effects of this Shelter inflation are beginning to show up – and it’s hitting quite hard – and the cooler-than-expected print came despite an acceleration in CPI Shelter to 6.9% – the highest annual increase since 1982 – which accounted for over half of the total increase in the Core CPI Index. As we’ve cautioned for the last year, the CPI Index was substantially understating the real-time increase in the single-largest component of the index – Shelter – since mid-2021 due to the sampling methodology which only collects “same-unit” data twice per year. Offsetting some of that lingering pressure, however, prices for used cars and trucks, medical care, apparel, and airline fares all declined sequentially while energy services prices also declined in October.

While the month-over-month headline CPI increased by 0.4% in September, the CPI-ex-Shelter Index – which we believe should be the metric that officials most closely watch given the Shelter distortion – was barely positive in October following three straight monthly declines – suggesting that “real-time” inflation is indeed decelerating even as headline metrics suggest otherwise. Using this metric, Fed officials would have seen the sharp upward spike in inflationary pressure beginning in early 2021 alongside the dramatic fiscal expansion under the new Administration and Congress with this metric posting double-digit annualized inflation beginning in March 2021 – a full year before we saw these trends show up in the headline CPI metric. Market-based indexes of rents and home values recorded 10-20% year-over-year rental rate increases beginning in June 2021, but these double-digit increases have since moderated to levels that are more in-line with post-GFC averages.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

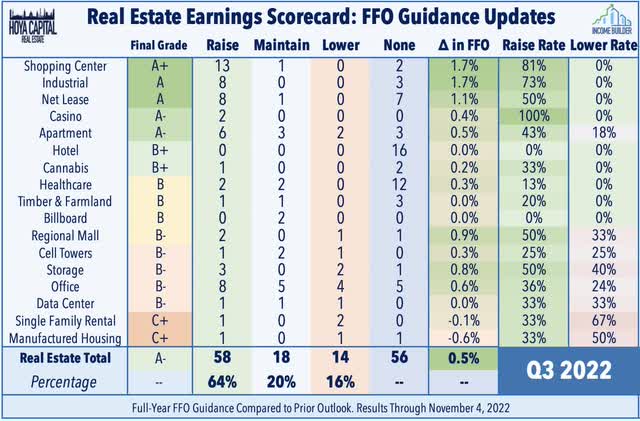

REIT earnings season wrapped-up this week with the final two dozen reports. As discussed in REIT Earnings Recap: Rents Paid, Dividends Raised, REIT earnings season was surprisingly strong across nearly all property sectors. Of the REITs that provide guidance, nearly two-thirds raised their full-year FFO outlook alongside another two dozen dividend hikes. During third-quarter earnings season, the Equity REIT Index outperformed the broader S&P 500 by nearly 10 percentage points while Mortgage REITs outperformed by over 15 percentage points. Earnings results from Shopping Center, Industrial, and Net Lease REITs were most impressive – accounting for exactly half of the 58 guidance hikes. Residential and technology REIT results were more hit-and-miss – accounting for half of the 14 downward guidance revisions.

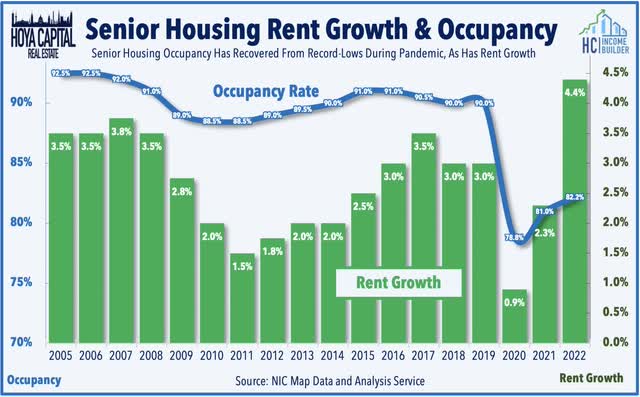

Healthcare: Senior housing REIT Welltower (WELL) surged more than 17% this week after reporting better-than-expected results highlighted by total portfolio same-store NOI growth of 7.2% and provided an upbeat fourth-quarter outlook. Of note, WELL’s Senior Housing (“SHOP”) segment produced NOI growth of 17.6% in the quarter – above estimates – driven by occupancy growth of 390 basis points and REVPOR growth of 5.3%. Welltower also announced that it will move 147 ProMedica Senior Care skilled nursing assets into a joint venture that will be operated by Integra. ProMedica will surrender to Welltower its 15% interest in the skilled nursing portfolio but will keep operations of 58 senior housing communities. Skilled nursing REIT Sabra Health Care (SBRA) was a notable laggard, however, after reporting disappointing results and ongoing operating issues, announcing that it will transition operators in 24 of its properties previously leased to North American Health Care to two of its existing tenants, Ensign and Avamere.

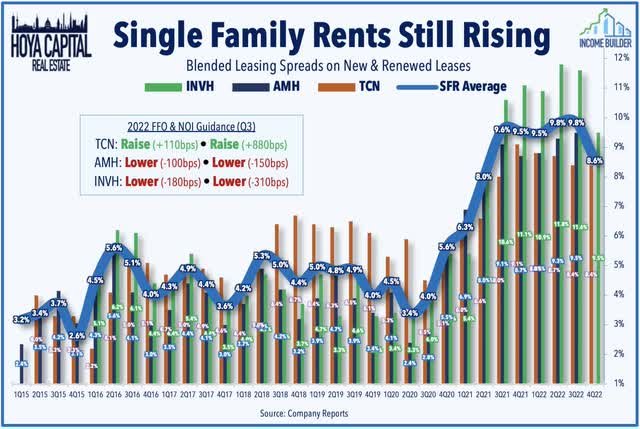

Single-Family Rental: Tricon Residential (TCN) soared more than 10% on the week after reporting strong results and raising its full-year FFO and NOI outlook. Following a pair of fairly downbeat results from its larger single-family rental REIT peers – American Homes (AMH) and Invitation Homes (INVH) – TCN significantly boosted its full-year FFO outlook by 880 basis points to 17.5% driven in part by performance fee earned from the sale of its U.S. multi-family portfolio. Providing further color, TCN commented, “the fundamentals of our SFR business are rock solid.. underscoring the resilience of the single-family rental business in a much higher rate environment where it’s never been more compelling to rent versus own a home.”

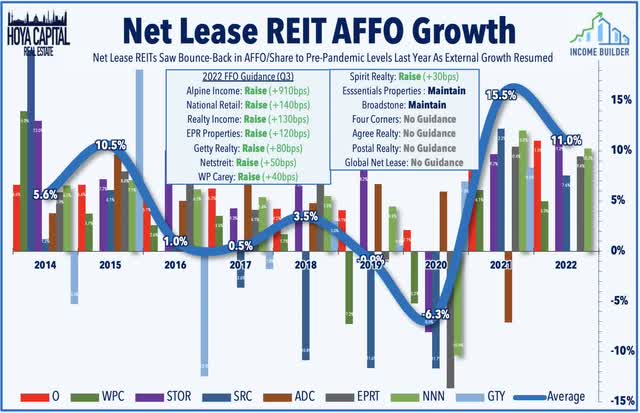

Net Lease: Spirit Realty (SRC) rallied more than 5% on the week after rounding-out net lease REIT earnings season with a strong report and raising its full-year outlook. Spirit raised its full-year FFO growth outlook by 30 basis points to 7.6% – one of eight net lease REITs to raise their full-year outlook this earnings season. Of note, Spirit commented that it’s seeing cap rates that are 150 basis points higher than a year ago – but seeing more “spread widening” among industrial assets than on retail assets. Net lease REITs reported impressive results in the face of interests rate headwinds with 8 of the 10 REITs that provide guidance raising their full-year outlook

Apartments: Sunbelt-focused Independence Realty (IRT) rallied more than 7% on the week after providing a business update in which it reported blended rent growth of 7.7% so far through Q4 and noted that it remains “on track to achieve” its recently-raised full-year FFO guidance. Earlier this week, we published Apartment REITs: Roaring Rents Begin To Ease. Pressured by the broader housing cooldown, Apartment REITs have been among the weaker-performing property sectors over the past quarter despite achieving record-setting rent growth throughout the summer. While the era of 20% rent increases on new leases is over, there remains significant “embedded” rent growth in below-market renewals that should power another year of impressive growth in 2023. The importance of regional selectivity is again becoming a key factor, and we’re seeing a return to the “Sunbelt outperformance” theme with all four Sunbelt-focused REITs raising their outlook this earnings season.

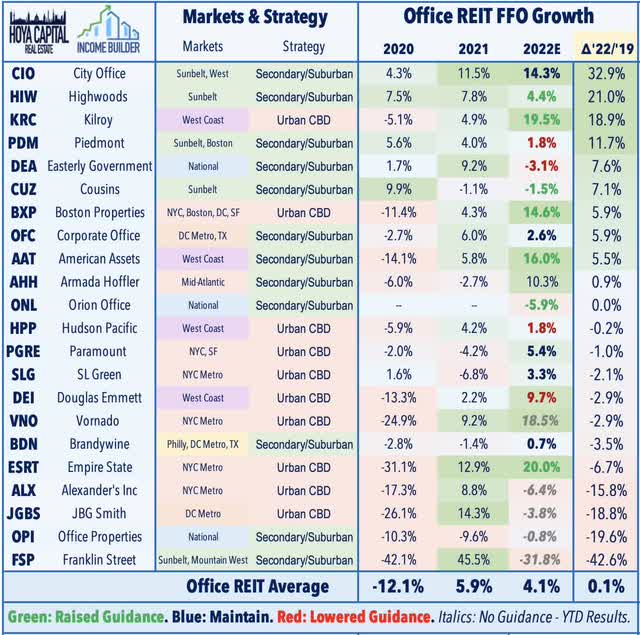

Office: Small-cap City Office REIT (CIO) was among the weaker performers this week, dipping about 4% after reporting mixed results – reiterating its full-year FFO outlook calling for impressive FFO growth of 14.3%, but providing a cautious outlook for 2023, noting “general pressure on leasing metrics across the industry” and “elevated levels of subleasing and downsizing” that has put downward pressure on effective rents. Last week we published Office REITs: Work from Home Reckoning? Pressured by the painfully slow “return to the office” with daily utilization rates still 50% below pre-pandemic norms, Office REITs are the among worst-performing property sectors this year even as leasing activity and REIT earnings results have been surprisingly resilient. With labor markets still historically tight, employees are still dictating the terms of the “Work from Home” dynamic, especially in coastal markets with long commutes where WFH benefits outweigh costs.

Mortgage REIT Week In Review

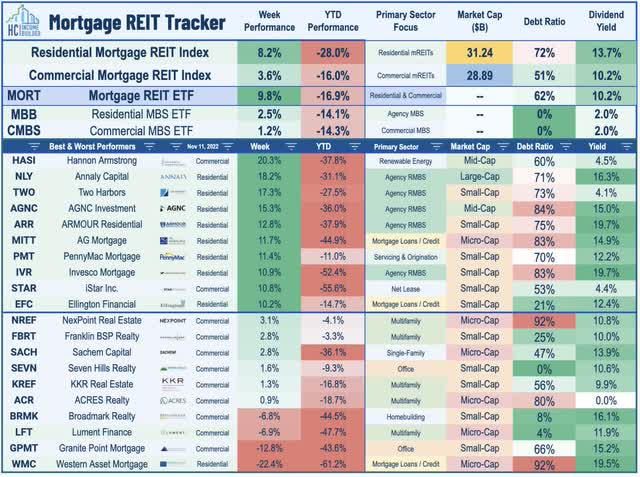

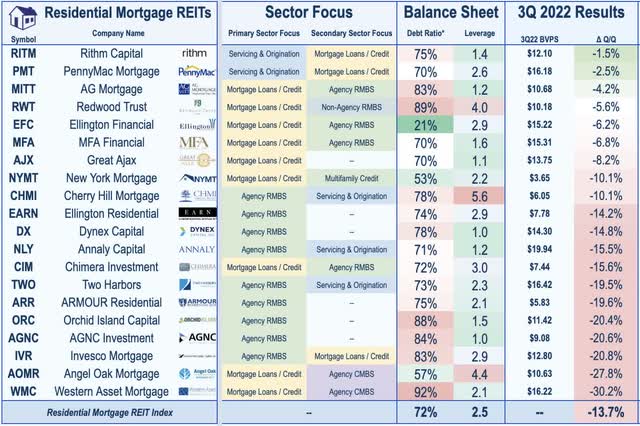

Mortgage REITs continued their strong rebound this week as earnings season wrapped up – a rally that has lifted the iShares Mortgage Real Estate Capped ETF (REM) to gains of nearly 30% from its lows on October 10th. On the residential side this week, the beaten-down Agency-focused mREITs led the gains with 15%+ gains from Annaly Capital (NLY), AGNC Investment (AGNC), and ARMOUR Residential (ARR) – each of which reported third-quarter results in the prior week. Commercial mREIT Hannon Armstrong (HASI) – one of the most heavily-shorted REITs – rallied more than 20% on the week. There were a handful of notable laggards on the week, however, including small-cap Western Asset (WMC) which dipped over 20% after reporting the steepest third-quarter Book Value decline among the 40 REITs in the sector.

As discussed in our REIT Earnings Recap, results from the final dozen mREITs to report results this week showed that the damage to mREIT balance sheets was not nearly as catastrophic as many feared in Q3 during a historically brutal quarter for fixed-income securities. Two Harbors (TWO) rallied more than 17% this week after reporting that its Book Value Per Share (“BVPS”) declined by roughly 19% in Q3 to $16.42 – consistent with preliminary results provided in early October. Ellington Residential (EARN) advanced about 5% after reporting that its BVPS dipped 14% – roughly at the midpoint of the average for residential mREITs this earnings season.

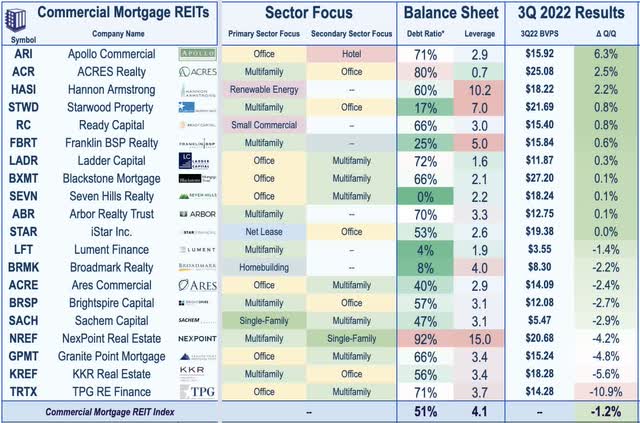

On the commercial mREIT side, Starwood Property (STWD) rallied nearly 6% after reporting that its BVPS increased about 1% during the quarter to $21.69. Ready Capital (RC) rallied 10% after reporting that its BVPS increased 1% in Q3 to $15.40 – one of seven mREITs to report BVPS growth during the quarter. Laggards this week included Granite Point (GPMT), which dipped more than 12% after reporting an uptick in credit losses and noting that its BVPS declined 5% to $15.24 – among the steeper declines among commercial mREITs this quarter. Broadmark Realty (BRMK) also dipped more than 6% after reporting an increase in loans under default to 41 loans totaling $287M, up from 37 loans totaling $248M in commitments in the prior quarter.

REIT Capital Raising & REIT Preferreds

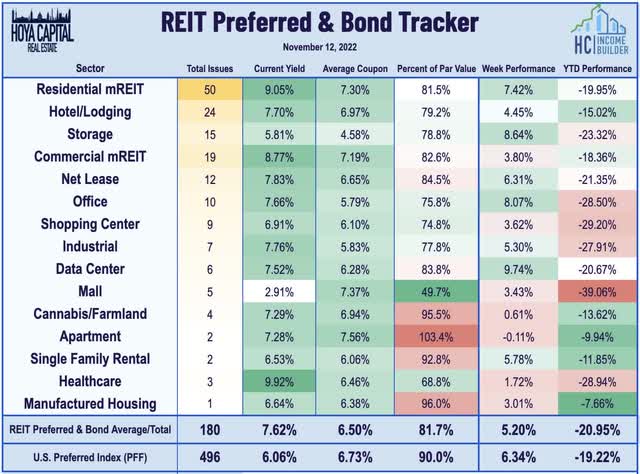

The REIT Preferred Index (PFFR) surged 5.0% this week – one of the best weeks of performance for REIT preferred on record – but slightly lagged the broader iShares Preferred and Income Securities ETF (PFF) which ended the week higher by 6.3%. Notable movers this week included the preferred suite of office REITs Vornado (VNO), Hudson Pacific (HPP), and SL Green (SLG) which rallied by 10% or more while the large preferred suite of Public Storage (PSA) rallied by over 8%, on average. Other double-digit gainers included the preferreds of Global Net Lease (GNL), and Gladstone Commercial (GOOD) along with a handful of mortgage REIT preferreds from Cherry Hill Mortgage (CHMI), New York Mortgage (NYMT), and Two Harbors (TWO). Laggards included preferreds from more pro-cyclical sectors – notably mall and hotel REITs. We’ll also see a new preferred issue in the near future as Gladstone Land (LAND) filed for a public offering of 8M shares of its newly-designated 5.00% Series E Cumulative Redeemable Preferred Stock at an offering price of $25.00.

2022 Performance Check-Up

With ten months and a week of 2022 now in the books, Equity REITs are now lower by 25.0% on a price return basis for the year – still their second-worst YTD performance for the REIT Index on record through this date behind 2008 – while Mortgage REITs are lower by 27.1%. This compares with the 16.1% decline on the S&P 500 and the 10.8% decline on the S&P Mid-Cap 400. Within the real estate sector, just one property sector is in positive territory on the year – Casino REITs – but just two property sectors are lower by more than 30% – down from nine in the prior week. At 3.81%, the 10-Year Treasury Yield has surged 230 basis points since the start of the year, but is well below its 2022 highs of 4.30%. Despite the rebound this past week, the US bond market is still on pace for its worst year in history with a loss of 14.1% on the Bloomberg US Aggregate Bond Index, which is 4x larger than the previous worst year back in 1994 (-2.9%).

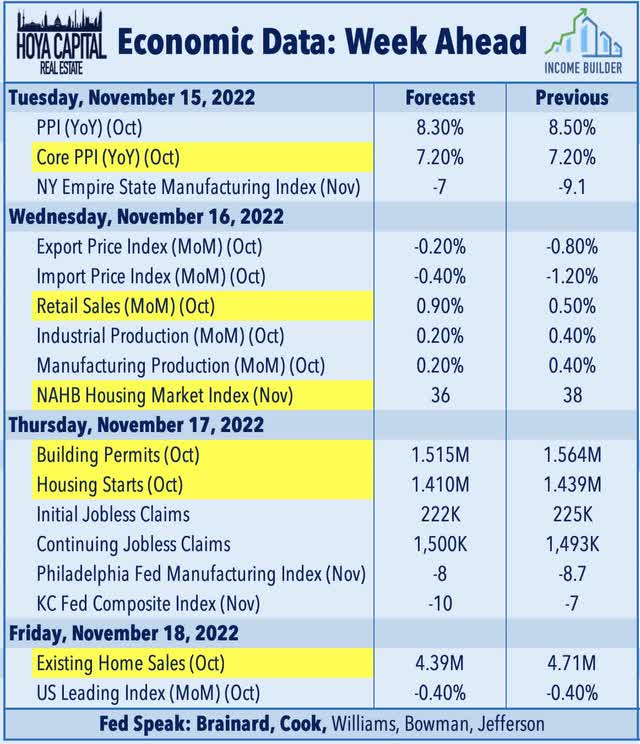

Economic Calendar In The Week Ahead

As corporate earnings season and election season winds down, we’ll see another busy slate of economic data in the week ahead with the U.S. housing market in focus – the industry that is bearing the brunt of the aggressive tightening path through the historic surge in mortgage rates – and perhaps also the sector with the most to gain from a “Fed pivot.” On Wednesday, we’ll see NAHB Homebuilder Sentiment data for September which is expected to decline to the lowest level since 2014 – excluding the brief pandemic dip in April and May 2020. On Thursday, we’ll see Housing Starts and Building Permits data which is expected to show a further pull-back in home construction activity to levels below that of late 2019 before the pandemic boom. On Friday, Existing Home Sales data is also expected to dip to the lowest levels since 2014 excluding the pandemic shutdown months. We’ll also be watching Producer Price Index data on Tuesday and Retail Sales data on Wednesday along with Jobless Claims data on Thursday.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment