Michael M. Santiago

2022 has been a challenging year for financial markets, with the sharp rise in interest rates causing a general slowdown in financial activity. Bonds have declined at a near-record pace, while specific equity sectors, such as technology, have faced the most significant losses in years. Looking into 2023, mounting evidence suggests the US and global economy is likely headed into a recession. Despite the shift, some sectors, such as financials, have fared well in 2022, with the Financial Sector ETF (XLF) losing only 5.5% of its value year-to-date (compared to technology and consumer discretionary at -22% and –28% respectively).

Since November, most financial stocks stopped outperforming the market, with XLF falling about twice as quickly over the past month. While technology layoffs have risen dramatically, most investment banks have avoided significant cuts. However, it was recently reported that Goldman Sachs (NYSE:GS) planned to lay off as many as 4,000 employees, suggesting strain is spreading into the banking sector.

Certain investment banks, such as Credit Suisse (CS) and Deutsche Bank (DB), have suffered immense drawdowns as their sales & trading and investment banking activity has collapsed. Goldman Sachs is at the other end of the spectrum, faring far better than its European peers. Still, Goldman Sachs trades at a higher valuation and is not far below its all-time-high price despite growing headwinds. The bank has faced significant declines in its investment banking and asset management business and may not continue to offset those losses with its other segments. Goldman has also increased its employee overhead costs dramatically in recent years, so if it is slow to pursue layoffs, its profits may decline dramatically, given the ongoing slowdown in financial services activities.

Goldman Faces Mounting Headwinds in 2023

In many respects, the investment banking industry requires relatively high economic growth to earn steady profits. That is particularly true for IPOs and equity sales segments. This year, global IPO activity has declined by around 45%, with Asian markets making up for immense losses in the US and Europe. In Q3, US IPO activity was down about 83% YoY and was the lowest in many years. Problematically, IPO activity was extremely high in 2021, so many investment banks dramatically increased headcounts, creating excess losses now that the market is slowing.

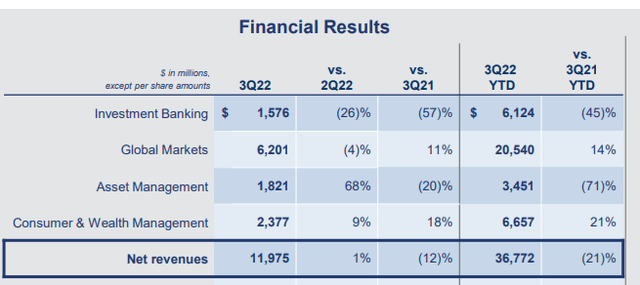

Goldman Sachs is a top-tier investment bank, so its business activity has not fallen as quickly as many of its peers. The company’s investment banking net sales were down around 57% year-over-year last quarter. However, its global markets segment, its largest division, is up materially. See below:

Goldman Sachs Segment Net Revenue Q3 2022 (Goldman Sachs Investor Presentation Q3)

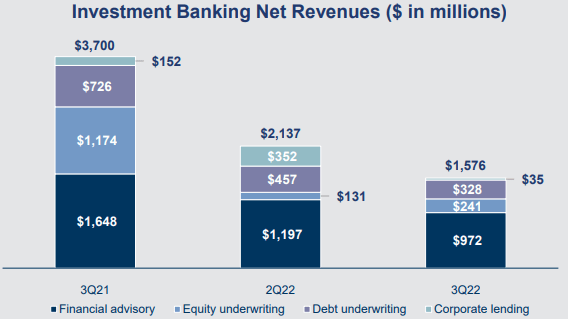

The company’s investment banking revenue decline is significant, with large losses in almost all subsegments. The most extreme have been corporate lending -77% and equity underwriting -79%, which are more cyclical. See below:

Goldman Sachs IB Segment Net Revenues (Goldman Sachs Q3 Investor Presentation)

The staggering decline in Goldman’s investment banking business seems likely to persist going into 2023. There are generally few firms within the pipeline, and with valuations lower and interest rates higher, IPOs and many M&A deals are not as feasible. Asian markets have offset massive declines in the US, but that is unlikely to persist if the global economy slows at a faster pace, implying most investment banking activity could shutter more.

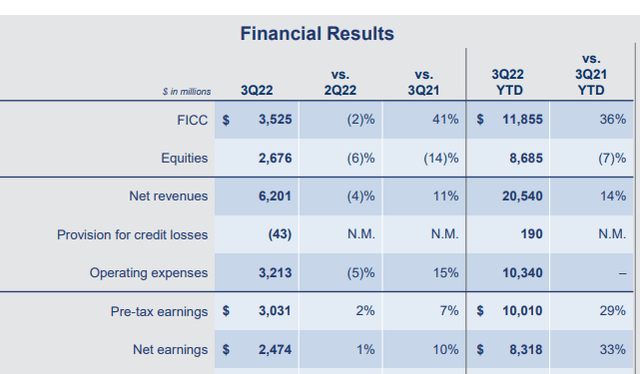

Losses in Goldman’s investment banking segment have been offset by slight growth in its larger market division. The segment saw a significant increase from 2019 to 2021 as equity volatility and booming stock prices led to immense trading activity. This year, equity trading net revenues have declined moderately but were offset by tremendous growth in “FICC” (fixed-income, currency, and commodity) trading sales. See below:

Goldman Sachs Global Markets Performance Q3 2022 (Goldman Sachs Investor Presentation Q3 2022)

Goldman’s market segment requires significant volatility to see strong net revenues. 2022 saw extreme volatility in the “FICC” business, with many sovereign bonds experiencing record declines. Currency and commodity market volatility were also immense, with oil rising dramatically during the beginning of the year and the US dollar rising to an all-time high.

Looking toward 2023, I believe this segment will likely see significant net revenue declines. Extreme “FICC” market volatility appears unlikely to remain as high after the record year. If “FICC” volatility normalizes while equity trading activity continues to slide, the market segment may face moderate declines in 2023.

Goldman’s asset and wealth management segments appear more stable in the short term than its other two since they generate more consistent net sales. Of course, as discussed regarding Credit Suisse, this segment faces growing competition as banks look to grow asset management businesses to improve stability. While it may take time, I believe this segment may struggle under growing competition as investors look toward lower fees. As pensions and large investors (or funds) face significant portfolio losses, fee discrimination may increase, and incentive fees will shrink.

More broadly, as “artificial intelligence” technologies expand, I believe virtually all financial services activities. This change may reduce costs in the short run, but I think it will eventually create immense competitive pressure, lowering profits as the technology matures. The shorter-term economic outlook is undoubtedly bearish for Goldman Sachs, but recessions also tend to accelerate long-term trends, such as technological improvements, as efficiency becomes more critical. Thus, I believe Goldman Sachs has a somewhat precarious long-term outlook and a generally negative short-term one.

The Bottom Line

Goldman Sachs faced moderate declines in 2022 as higher interest rates and slowing economic growth resulted in much lower demand for most financial services. The bank has seen in TTM EPS level fall from around $60 at its peak in 2021 to $37, while its net revenues fell about 12% over the past year. In my view, the company’s 2023 net revenue decline is likely to be much more prominent as the segments which offset losses, such as “FICC” trading and non-US IB, slow similarly. The company has begun to pursue layoffs and shuttered struggling businesses, such as its retail “neobank,” but has not done as much as needed to offset sales decline – and (seemingly) likely 2023 declines. As such, the company may find its 2023 profits well below 2018-2019 levels if its sales decline while its operating costs remain abnormally high.

GS is still valued as if its stellar 2021 performance is likely to persist. In my view, 2021 was a very rare “goldilocks” environment for the sector due to the combination of ultra-low interest rates, high “reopening” economic growth, and immense fiscal and monetary stimulus – in the US and abroad. I do not believe the financial services sector will see such an environment again within the foreseeable future and is more likely to decline below pre-COVID levels as the global economy falls into a recession – a “hangover” from the 2020-2021 binge.

In the long term, I expect Goldman’s EPS to remain around the $10-$20 range it was over the decade before 2020. While inflation should hypothetically result in a slightly higher EPS level, technological innovation and automation of some of Goldman’s business segments may increase fee competition. Assuming Goldman’s long-term EPS is around $20 and its “fairly valued” at a “P/E” of 12X (slightly low due to its inherent cyclical risks), then the stock may be worth around $240 per share or about 30% lower. While I believe GS could fall below that level in a recession, I would not be so bearish if it were below $240.

Overall, I am very bearish on GS and believe it will decline in value in 2023. GS is up by around 22% from its 52-week low and suffered significant declines over the past two weeks. In my view, its earnings outlook has likely deteriorated faster as the market begins to brace for a more extensive economic recession. Despite this, very few are short-selling GS with a short interest of 1.8% and well-below-average option implied volatility, making the stock a potentially strong contrarian short opportunity. The chief risk of betting against the stock is likely a significant increase in financial market volatility that improves its global markets segment revenues or an economic boost that increases investment banking demand. In my view, both of those potentials are unlikely, even if the Federal Reserve makes a dovish pivot. Still, speculators who seek to minimize exposure could use a call (with a short) or a long put option to limit risk – and they may be attractive given GS’s low implied volatility level today.

Be the first to comment