solarseven

From Crushing It to Caution

Despite high inflation. Despite the semiconductor shortage. Despite macroeconomic and geopolitical uncertainty. Stellantis N.V. (NYSE:STLA) has been “crushing it” all year. Here are just a handful of 1H FY ‘22 and Q3 FY ‘22 highlights for readers to digest.

1H FY ‘22 Highlights

-

Net sales just shy of €88B. STLA’s net sales in 1H FY ‘21 were €72.6B.

-

Record 14.1% adjusted operating income (“AOI”) margin, with all 5 geographic operating regions posting double-digit margins. North America and Enlarged Europe, STLA’s two largest markets, achieved AOI margin results of 18.1% and 10.4% respectively in the first-half, as compared to 16.1% and 8.8% in the prior period.

-

50% volume growth in battery electric vehicles (“BEV”) year-over-year (“YoY”). STLA recorded 136,000 BEV unit sales in 1H FY ‘22, with the company earning the #2 spot in Enlarged Europe for BEV and low-emission electric vehicle (“LEV”) sales respectively; along with the #3 spot in the United States for LEV sales.

-

Industrial free cash flow (“FCF”) of €5.3B. First-half FCF includes €3.1B of net cash synergies reinforcing the firm’s Dare Forward 2030 plan goal of €5B in merger synergies by the end of FY ‘24. For additional context, pro-forma industrial FCF for the full-year FY ‘21 was €6.1B.

Q3 FY ‘22 Highlights

-

Q3 FY ‘22 revenues of €42.1B. Q3 FY ‘22 sales reflected a 29% YoY increase versus €32.6B recorded in the prior period.

-

Global BEV and LEV volumes up 41% and 23% respectively YoY. BEV volume in the quarter was ~68,000 units, and LEV volume was ~112,000 units.

-

Strong share positions in the firm’s 3 largest geographic markets. Market share in North America, Enlarged Europe and South American markets stood at 10.8%, 19.2%, and 22.6% respectively during the quarter.

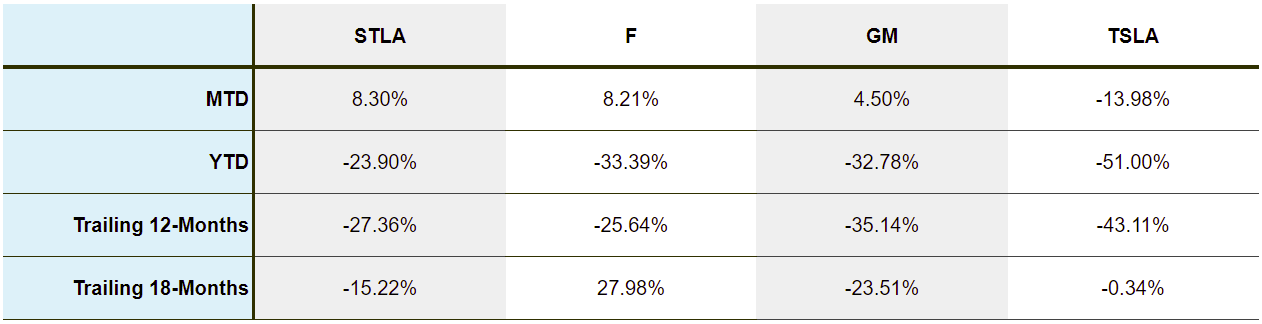

Still, shares – which have rallied this month – are down ~(24%) year-to-date (“YTD”), following the general trend in auto manufacturer stocks.

Figure 1: STLA and Selected Competitor Stock Price Performance (Yves Sukhu)

Notes:

-

Data of market close November 11, 2022.

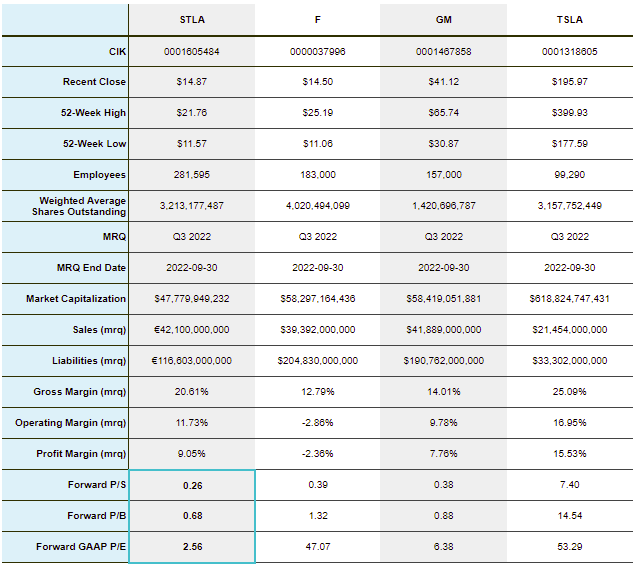

With the stock price depressed, STLA is trading at valuations that appear to be – on the surface – absurdly low by certain measures.

Figure 2: STLA and Selected Competitor Statistics (Yves Sukhu)

Notes:

-

Data as of market close November 11, 2022.

-

STLA gross margin, operating margin, and profit margin data based on 1H FY ’22 results for the period ended June 30, 2022.

-

Forward P/S, P/B, and GAAP P/E data from Seeking Alpha.

Management reaffirmed guidance for the current fiscal year following Q3 FY ‘22 results, including positive FCF and double-digit AOI for the full period. With STLA’s dividend yield exceeding 8% as I write this, one might think investors would be tripping over themselves to get a piece of the company.

But, in spite of the rally in shares this month, this is obviously not the case. When I last wrote about STLA in early June, I proposed the company as a “buy”; but I noted my position was very small and cautioned against jumping on the stock just for the dividend yield, citing concerns about the firm’s 2 largest markets, its ability to grow outside those markets, and the possibility for increased spending as the company transitions to a BEV-led lineup. Perhaps, with the afore-mentioned concerns in mind, investors might consider a few other reasons suggesting caution is in order heading into 2023 irrespective of the firm’s performance so far in 2022.

To the Contrary…

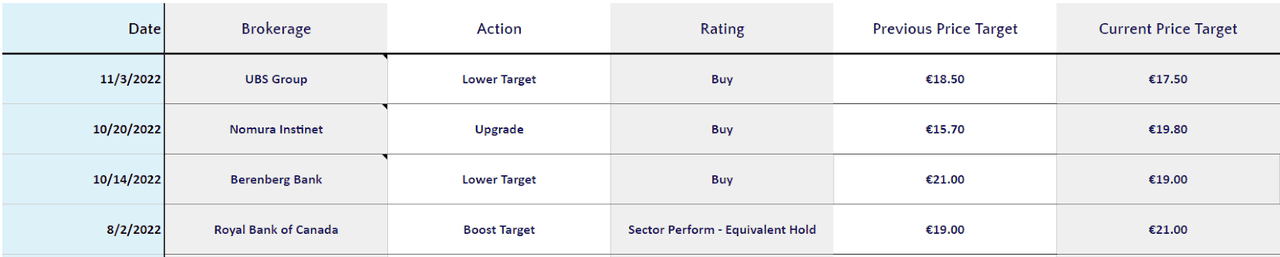

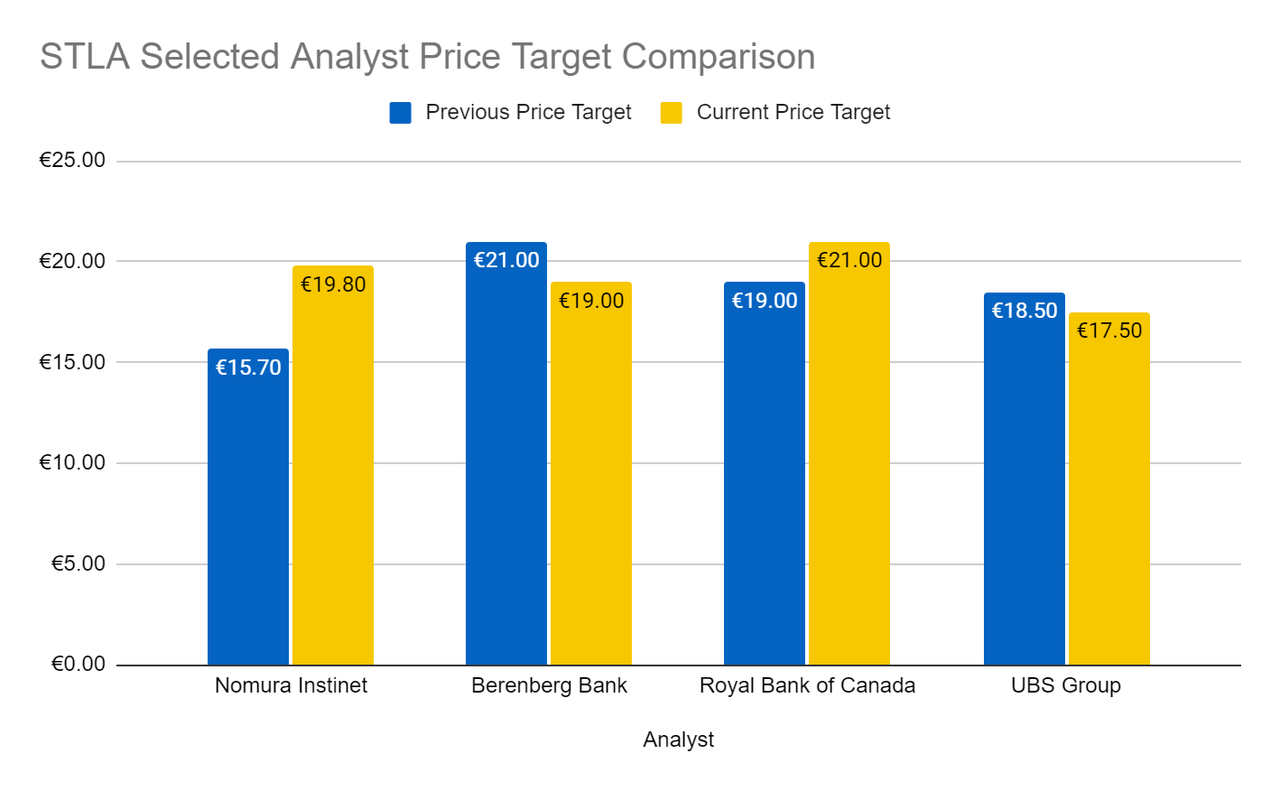

The general analyst position on STLA is bullish; although some have been lowering their price targets for the firm, including UBS who lowered their target from €25.00 to €18.50 on July 8 and then again from €18.50 to €17.50 on November 3.

Figure 3: STLA Selected Analyst Ratings (MarketBeat/Yves Sukhu)

Hence, a cautious view is contrary to the general feeling about the company. Yet, consider:

1. Higher interest rates are likely to dampen auto sales in 2023.

Let’s start with the obvious. Lending rates have generally been going up around the world, including the United States and Europe; and the trend looks set to drag on auto sales in 2023. A recent MarketWatch article quotes Cox Automotive economist Jonathan Snoke who states:

With rates expected to go even higher and stay there for at least the duration of 2023, the auto market will become more dependent on cash-rich, higher-income, and higher credit-tier consumers.

Granted, the article is talking specifically about the auto market in the United States but it is reasonable to extrapolate the general point to STLA’s largest markets, namely North America and Enlarged Europe. While STLA management noted that they enjoyed the highest average transaction price (“ATP”) of $53K/unit versus competitors in the United States in Q3 FY ‘22, that “party” might be over with higher interest rates putting more expensive vehicle purchases out of reach of a large number of buyers. In other words, don’t necessarily expect the same revenue and profit performance as STLA closes out FY ‘22 and heads into FY ‘23 given that the company generates the majority of its revenue (about 50% in Q3 FY ‘22) in the United States.

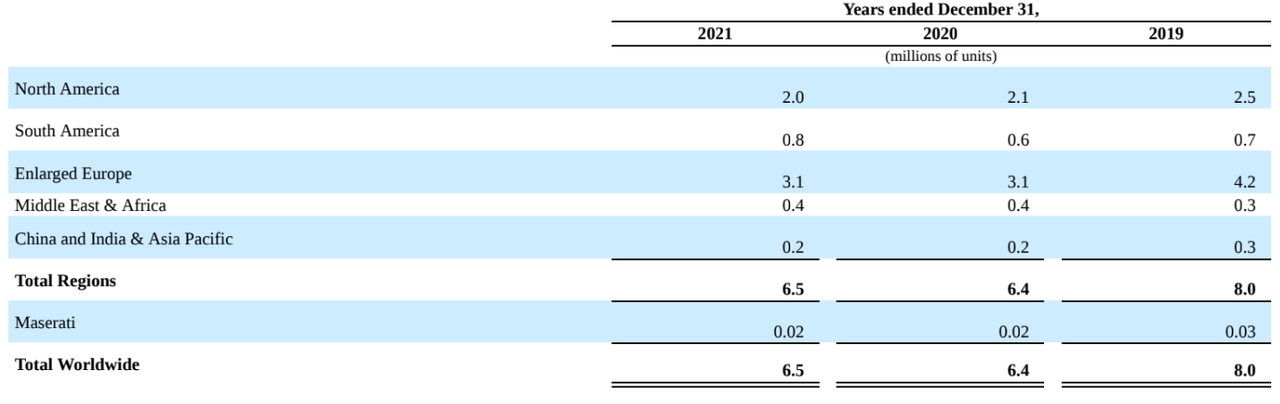

2. STLA’s YTD FY ‘22 performance is gauged against “weak” comps.

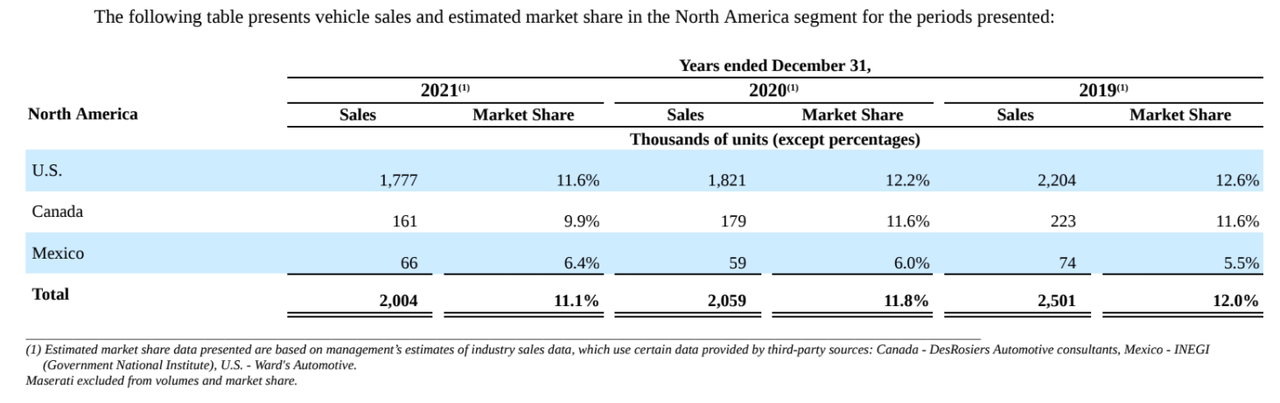

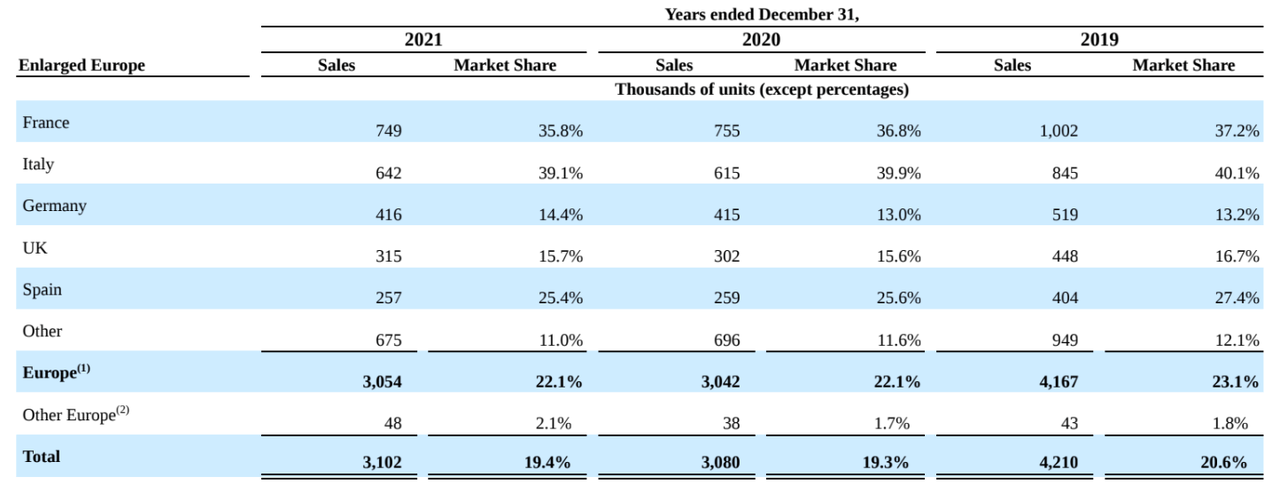

With the pandemic decimating the auto industry in 2020 and 2021, STLA – like other auto manufacturers – saw its volumes drop significantly in its key markets during both periods.

Figure 4: STLA Operating Segment Volumes (STLA Annual Report FY ’21)

Accordingly, 1H FY ‘22 and Q3 FY ‘22 comparisons with their respective prior periods are bolstered by the weaker performance that generally characterized the auto industry in 2021. In making this point, we must keep in mind that 2022 itself has been a lousy year for the auto industry and STLA has performed admirably. But, investors would be remiss to conclude that the strong results seen so far in 2022 are irrefutable evidence that management is on the right track with its strategy,

3. The depressed outlook for North America and Enlarged Europe in 2022 may continue in 2023 as STLA is simultaneously losing share.

2022 has not turned out the way some industry analysts thought that it would, with declines in both North America and Enlarged Europe.

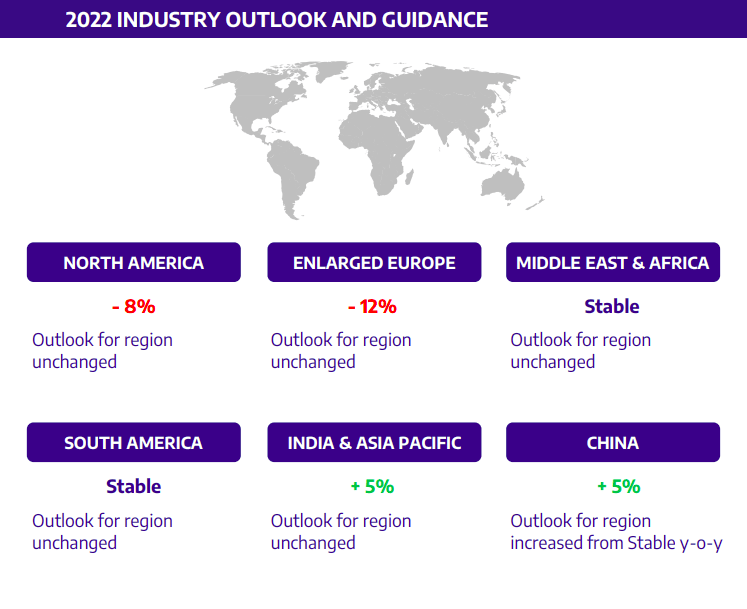

Figure 5: 2022 Industry Outlook and Guidance (STLA Q3 FY ’22 Earnings Presentation)

To remind readers, these two markets accounted for more than 80% of STLA’s total sales in FY ‘21. As these markets decline, STLA’s share has also been slipping.

Figure 6: STLA North America Market Share (STLA Annual Report FY ’21) Figure 7: STLA Enlarged Europe Market Share (STLA Annual Report FY ’21)

Note further that STLA’s market share dipped (20 bps) and (90 bps) to 10.8% and 19.2% in North America and Enlarged Europe respectively in Q3 FY ‘22 versus the prior period. Obviously, the combination of declines in STLA’s two biggest markets while they are losing share is not exactly ideal and does not paint the most encouraging picture for 2023 and beyond. While the firm has managed to demonstrate strength in North America and Europe in 2022 through strong pricing and increased volumes, the effects of higher interest rates and worsening economic conditions may result in far more challenging market conditions moving forward.

Daring to Sell

Clearly, quite a bit of what I said in the previous section would apply to any auto manufacturer, not just STLA, and helps explain the generally low valuations across the industry, which are also necessarily impacted by the ongoing uncertainty with respect to commodity and energy prices as well.

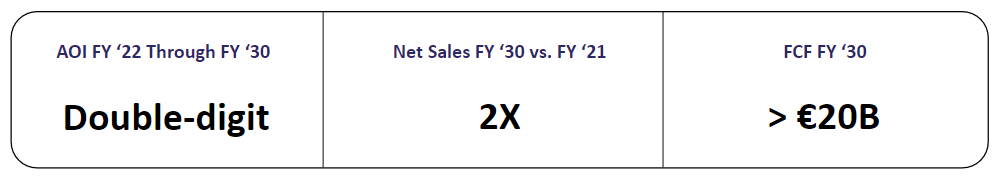

Current macroeconomic headwinds, which have evolved significantly since the early summer, should lead STLA investors to question management’s ability to continue tracking to its Dare Forward 2030 strategic plan (mentioned earlier) and its associated growth algorithm.

Figure 8: STLA Growth Algorithm (Yves Sukhu)

I would remind readers that doubling FY ‘21 net sales by FY ‘30 implies STLA intends to generate ~€300B on the top-line by the end of the decade. STLA aims to achieve this financial feat through the “…[transformation of] itself to a global mobility tech company – emphasizing the electrification and software of its vehicles.” While this sounds good on paper:

-

STLA will have to grow outside of its North America and Enlarged Europe segments but maintains very small market share in China and India which are obvious markets for expansion. For example, GM (GM) sold 630,000 vehicles in China in Q3, 13x the 48,000 vehicles that STLA sold via their entire China, India, and Asia Pacific operating segment during the firm’s analogous quarterly period. Moreover, particularly with respect to China – the world’s largest car market, management has indicated they intend to pursue an “asset-light” approach suggesting a certain “caginess” investing in the country. Questions abound if STLA can hit its top-line target without significant growth in other large auto markets outside of North American and Europe.

-

Management’s goal of generating €20B in software-related revenue by 2030, including features-on-demand and self-driving, mimics similar strategies by STLA’s peers. It does seem, on the surface, that next-generation vehicles represent a remarkable opportunity for auto manufacturers to treat each as a platform that can be monetized in a variety of ways, not the least of which is over-the-air (“OTA”) software-based feature updates. However, this too is not a “sure thing”. Bloomberg published a fantastic article last month titled “Even After $100 Billion, Self-Driving Cars Are Going Nowhere”. The article’s general thrust is that self-driving technology is nowhere-near ready for “prime-time” and is not likely to be for several years (as in far beyond 2030). New Jersey recently introduced a bill to make it illegal for auto manufacturers to charge subscription fees for certain features. It would not be surprising if other states/countries were to follow suit. STLA might very well have to walk-back some of its software-based ambitions as regulations evolve and if certain technologies, such as Waymo, are revealed to be woefully immature.

-

Many analysts have lamented that STLA’s sprawling portfolio of brands reflects a lack of focus. Arguably, the company is attempting to be “all things to all people” and that might ultimately prove increasingly difficult as management struggles to spread its investments out effectively. This challenge, of course, is compounded as STLA transitions to a majority BEV and LEV lineup, with the goal of 5,000,000 BEV vehicle sales in 2030; and as management attempts to generate ~25% of revenues from peripheral business including Free2move mobility services, parts recycling/refurbishing/reuse services, and commercial vehicles. Management may very well hit every target it has set, but there is a lot that can go wrong with the business spreading itself out in so many different directions.

Readers presumably expect, after everything I’ve said in this report, that my recommendation will be to “sell”. And, as I must concede, I ultimately decided to exit my small STLA position as macroeconomic conditions took a turn for the worst after writing my original article on the company. But, the analysts outlined in Figure 3 obviously still see upside in STLA shares, even if some have tempered their expectations.

Figure 9: Selected STLA Analyst Price Target Comparison (MarketBeat/Yves Sukhu)

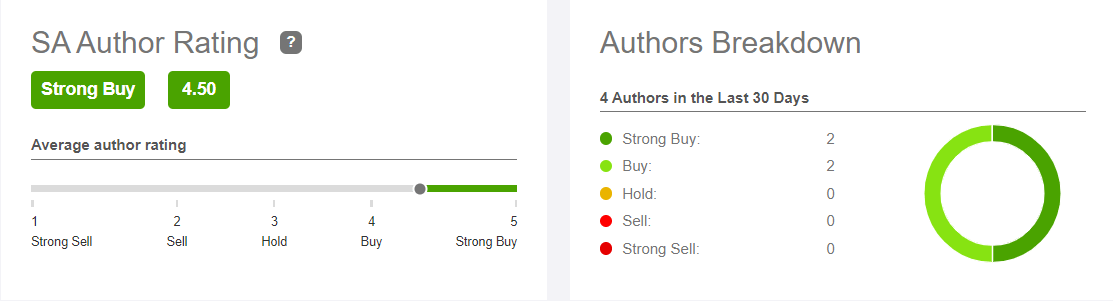

The average target using the data from the 4 analysts above is €19.33, or roughly $20.10 using a conversion ratio of €1/$1.04. That figure represents a 35% premium over the close price of $14.87 on Friday, November 11. I would also add that the average rating among Seeking Alpha authors for STLA is “strong buy”.

Figure 10: STLA Seeking Alpha Author Rating (Seeking Alpha)

Nonetheless, I indeed offer a “sell” rating on the stock as I tend to think 2023 may turn out to be a difficult year for the auto industry in general and I remain somewhat skeptical of the forecasts for the BEV market. While the analysts in Figure 9 have an opposite perspective that should not be ignored and STLA’s brand, platform, and geographic diversity could still lead to a lot of things going right in the coming fiscal period, I suggest that current macroeconomic uncertainty leads to unacceptable risk with respect to a long position. The dividend yield is very attractive, as are the dividend yields of several other auto manufacturers right now including BMW (BMW.DE) at ~6.9%, Mercedes-Benz (MBG.DE) at ~7.7%, and Volkswagen (VOW.DE) at ~4%. However, as I suggested in my prior article, investors should be cautious jumping on STLA (or any stock for that matter) merely for the income, particularly given the concerns outlined herein.

Be the first to comment