mphillips007

Introduction

I recently wrote an in-depth article on the housing market and home builders in the United States. While we will also discuss the core message in this article, the main takeaway is that major buyers are waiting until unemployment is elevated. At that point, the Fed will have to lower rates, providing a competitive environment for large buyers to outbid the public. I believe this could mark the start of a new massive bull market for home builders and related stocks. In this article, I present one investment idea that should be on everyone’s watchlist. The D.R. Horton (NYSE:DHI) company is a Southern homebuilder with exposure in undersupplied markets. The company is also the largest homebuilder in the United States, focusing on affordable housing – the exact market that needs more supply.

Right now, the company is seeing falling orders, which are being offset by higher selling prices. I believe the pricing tailwind is fading, causing downside risks to rise.

However, instead of shorting the stock, I urge investors to watch this ticker like a hawk in 2023, as we might get attractive buying opportunities.

So, let’s look at the details!

Housing Weakness Is Worsening

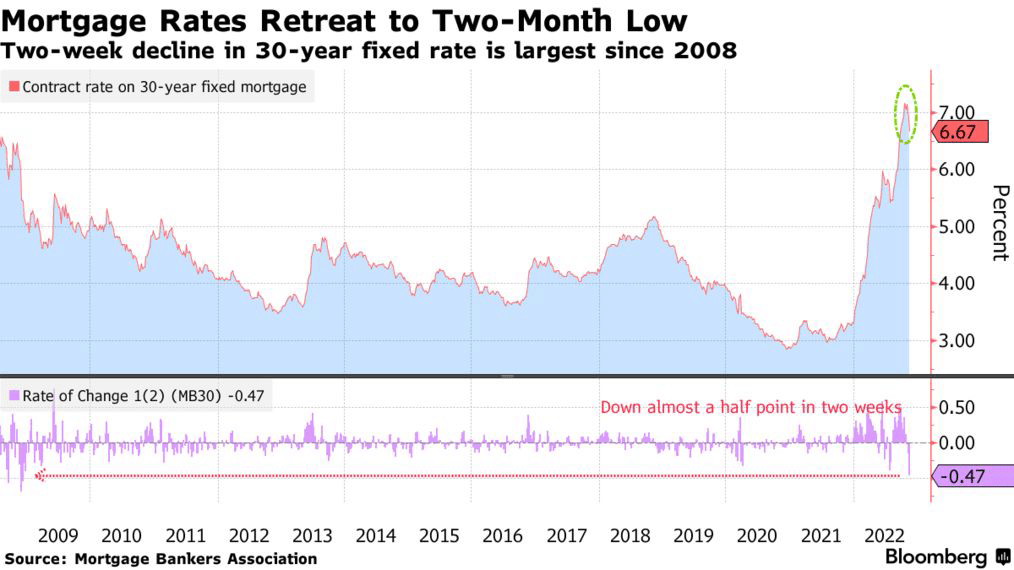

There’s some good news. Over the past two weeks, mortgage rates in the United States have dropped by 47 basis points. That’s the biggest two-week decline since the housing crisis, pushing the average 30-year fixed mortgage rate to 6.67%.

Bloomberg

This allowed mortgage applications to rise, yet demand remains depressed. The index of refinancing activity remains close to a 22-year low.

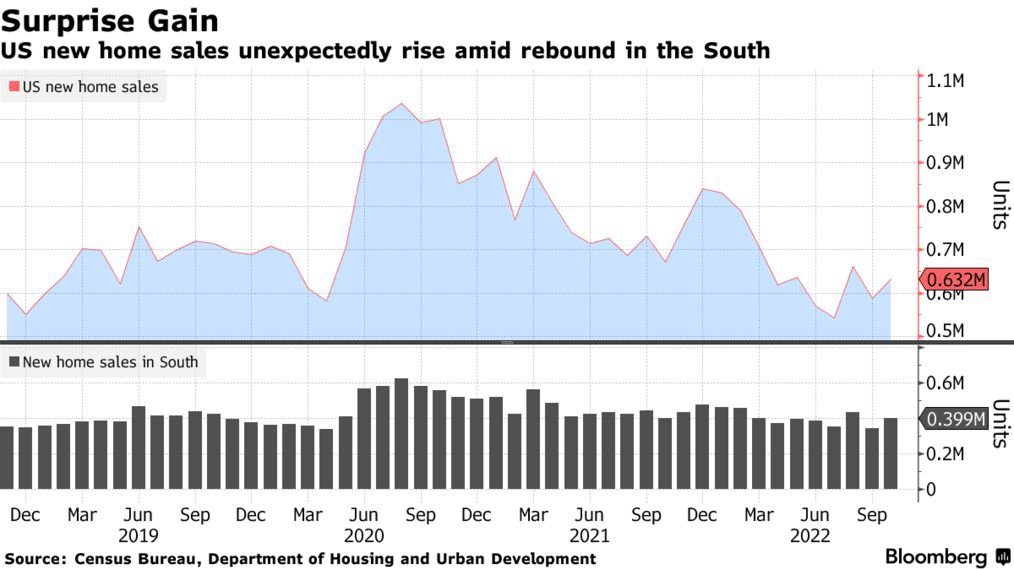

Moreover, the number of new single-family homes sold in the United States rose by 7.5% in October (versus September). The number came in at 632 thousand, which is above the median estimate of 570 thousand.

Bloomberg

Unfortunately, the rise wasn’t *that* good news. The upswing was mainly caused by higher demand in the South, as Florida, parts of Georgia, and South Carolina rebounded after several hurricanes.

As reported by Bloomberg:

Even with the surprising pickup in sales, buyer demand has rapidly evaporated this year amid the Federal Reserve’s aggressive interest rate hikes to tame inflation. Mortgage rates, which topped 7% by the end of October, have more than doubled this year. That’s put a brake on sales and construction while also helping to push down home prices.

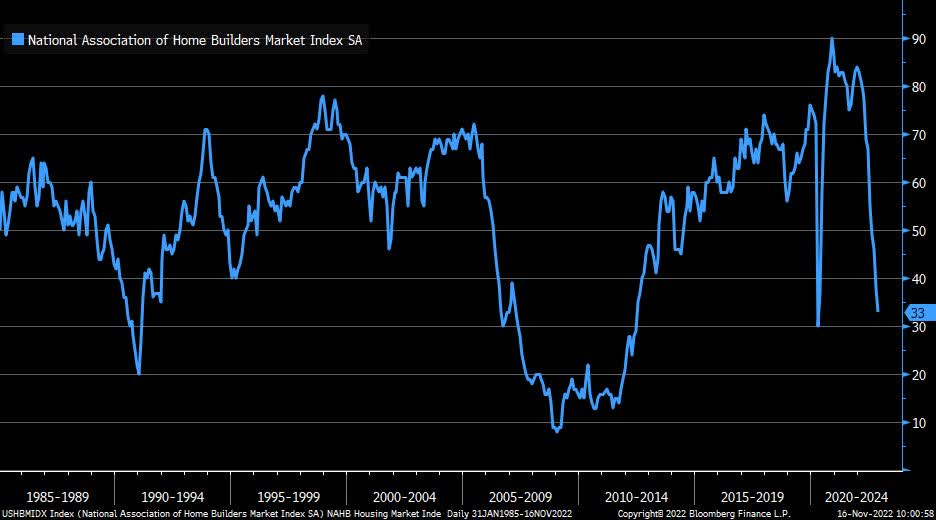

As I wrote in my most recent article (mentioned in the introduction), things aren’t looking good. Homebuilder sentiment is now at 33 after 11 consecutive monthly declines. We’re now back to 2012 levels. Back then, it marked the start of the housing recovery.

Bloomberg

This is the comment the NAHB (National Association of Home Builders) gave when it published these numbers:

“Higher interest rates have significantly weakened demand for new homes as buyer traffic is becoming increasingly scarce,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga.

[…] “To ease the worsening housing affordability crisis, policymakers must seek solutions that create more affordable and attainable housing. With inflation showing signs of moderating, this includes a reduction in the pace of the Federal Reserve’s rate hikes and reducing regulatory costs associated with land development and home construction.”

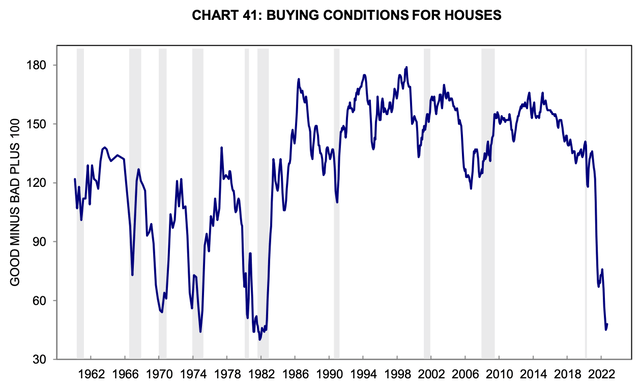

That’s no surprise, as people aren’t buying homes anymore. High inflation, falling economic growth, a hawkish Fed, and other reasons have pushed home-buying sentiment to levels not seen since the 1980s. Back then, the Fed was also hiking into a supply-driven inflation uptrend and economic weakness.

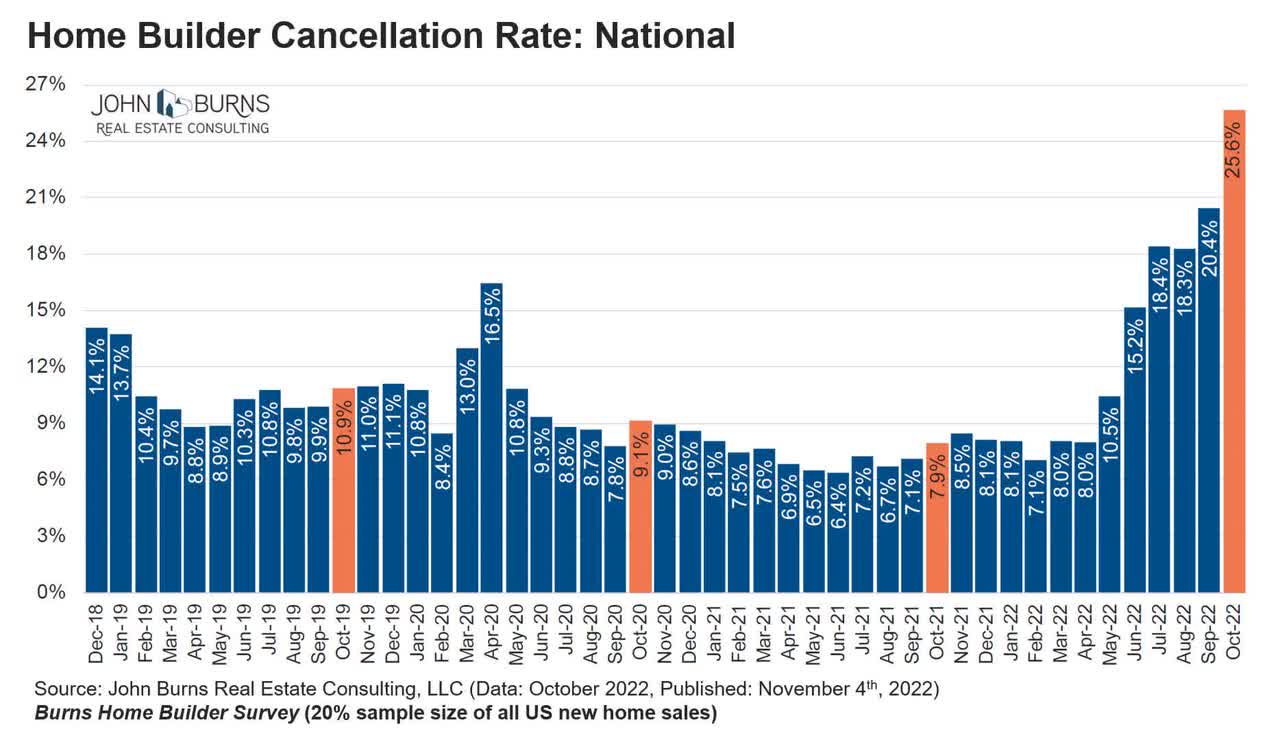

As a result, home builders are receiving a lot of cancellations. The most recent numbers show a surge to 25.6% in October. That’s almost 10 points above the COVID peak when nobody knew what the future would look like.

John Burns Real Estate Consulting

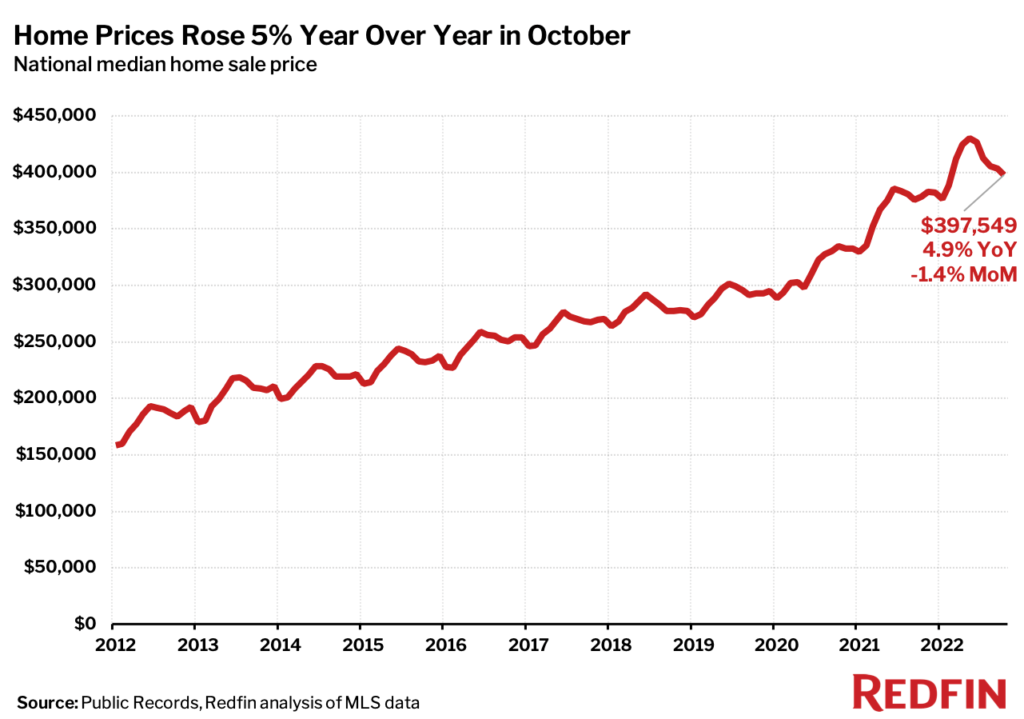

The worst thing is that prices are still high. That’s bad because this is hurting affordability even more. Homes are still expensive, yet now mortgage rates are higher.

Redfin

Hence, large buyers are now waiting for the perfect moment as the only thing that is now able to crash prices is higher unemployment. As I wrote in my most housing article:

The big operators in the industry know this. And they are taking advantage of the situation. In the third quarter, 17.5% of all homes sold were sold to investors. That number is set to rise again as homebuilders are looking to sell unsold inventory in bulk to rental landlords.

JPMorgan (JPM), for example, put together a $1 billion fund to buy up homes with rental landlord Haven Realty Capital. There are many more examples of this.

I do not like this new situation, yet I cannot change it. I believe that large buyers will wait for unemployment to come up. Once that happens, they will use lower rates (I expect rate cuts by then) to outbid weakened private buyers.

That’s why I want to buy homebuilders with the right product in the right location at the right time.

Also, note that DHI sells rental properties in bulk to investors.

That’s Where D.R. Horton Comes In

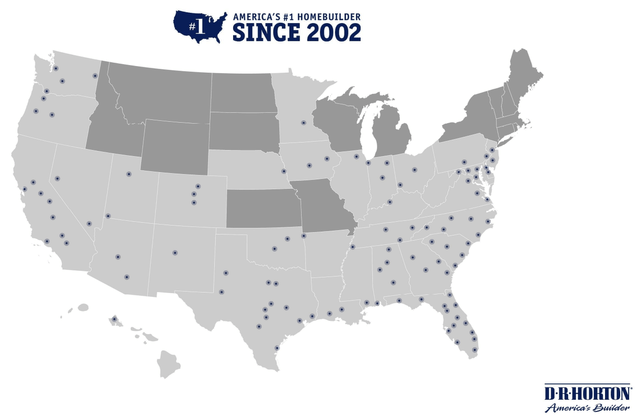

D.R. Horton is America’s largest homebuilder, with a market cap of $28.9 billion. Headquartered in Arlington, Texas, the homebuilder is now servicing most major economic hotspots in the United States.

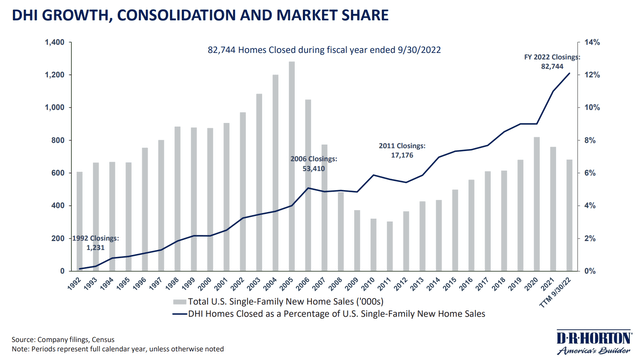

The company has a market share of roughly 12%, which has consistently grown throughout multiple cycles. Before the Great Financial Crisis, the company had a 4% market share. After the crisis, that number was 6%.

DHI is the largest operator in the following metropolitan markets: Dallas-Fort Worth, Houston, Atlanta, Phoenix, and Austin.

The pandemic has boosted the company’s market share by another 300 basis points as D.R. Horton is perfectly positioned to benefit from the surge in demand.

First of all, it is a major builder in areas that benefited from a population migration from blue to red states (to put it bluntly).

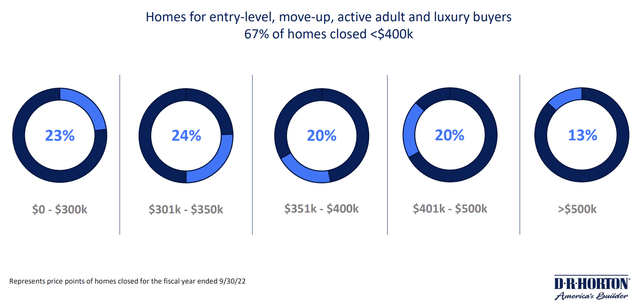

Reason number two is affordability. 67% of DHI homes closed at a price below $400 thousand. Almost a quarter of homes sold below $300 thousand. Just 13% sold at a price of more than $500 thousand.

So, how bad is affordability?

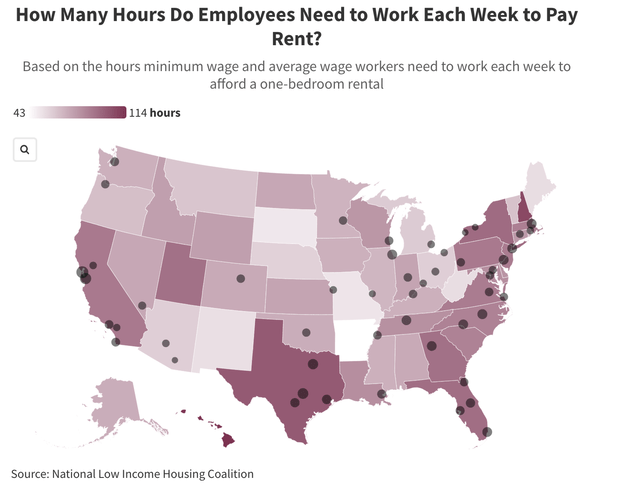

To quote the United Way of the National Capital Area, it’s bad. And extremely bad for minimum wage earners.

What’s more, in certain metro areas, minimum-wage workers must work 80 or more hours per week, and average-wage workers must work 50 or more hours per week to afford a humble, one-bedroom rental at fair market rent.

Some of the most unaffordable markets in need of new supply are located in D.R. Horton’s biggest markets. The map below shows these markets. Comparing it to the DHI map that I used in this article clearly shows the similarities.

National Low-Income Housing Coalition

Bear in mind that this gives DHI a competitive advantage, but it does not take away the ongoing risks facing the housing market. After all, affordability is only getting worse.

But First, Some Pain

Earlier this month, D.R. Horton reported poor quarterly results. The company’s earnings per share in the September quarter came in at $4.67. That’s well below the $5.13 consensus estimate and unchanged from the fiscal third quarter. It’s up from $3.70 in 4Q21, the prior-year quarter.

In its fourth quarter, the company ended a record-breaking year, closing 83,518 home deals. However, since June, the company has been experiencing weakness. According to the company:

[…] we began to see a moderation in housing demand that has continued and accelerated through today. The rapid rise in mortgage rates, coupled with high inflation and general economic uncertainty, have made many buyers pause in their home-buying decision or choose to not move forward with their home purchase. However, the supply of both new and resell homes at affordable price points remains limited and the demographics supporting housing demand remained favorable.

In its September quarter, DHI generated a 23% revenue growth rate, pushing revenue to $9.4 billion. This is based on 23,212 closed home deals. The average closing price was up 17% year-on-year and up 3% sequentially.

Unfortunately, these numbers are worse than expected due to a slower sales price, increased cancellations, and ongoing construction delays as supply issues are lasting.

Moreover, some closings were delayed due to hurricanes in Southern states.

Unfortunately, it gets a bit worse. Cancellations were 32% in the fourth quarter. That’s up from 19% in the prior-year quarter and 8 points above the third-quarter cancellation rate.

What supported the company was pricing. Average selling prices were up 6% year-on-year. Unfortunately, sales prices were down 4% consecutively as cracks are appearing.

Hence, in the first quarter (the current quarter), net sales orders are expected to be down 25% to 35%, which shows that weakness is accelerating and that the expectations range is wide. Nobody knows how bad things could get.

To adjust to these conditions, the company is renegotiating lower construction costs and working on existing inventory. In its September quarter, the company started 13,100 homes. Home inventory ended at 46,300 homes, down 3% year-on-year and 18% lower since the third quarter.

Valuation & Balance Sheet

It helps that DHI has a solid financial position. The company has more than $4 billion worth of homebuilding liquidity, consisting of $2 billion of unrestricted cash and $2 billion worth of available capacity under its revolving credit facility.

Total homebuilding leverage was 13.2%, offering significant flexibility to withstand market challenges.

Moreover, the company repaid $350 million worth of senior natures at maturity with another $700 million maturing in fiscal 2023.

According to the company:

On September 30, our stockholders’ equity was $19.4 billion, and book value per share was $56.39 and up 35% from a year ago. For the year, our return on equity was 34.5%, an improvement of 290 basis points from 31.6% a year ago.

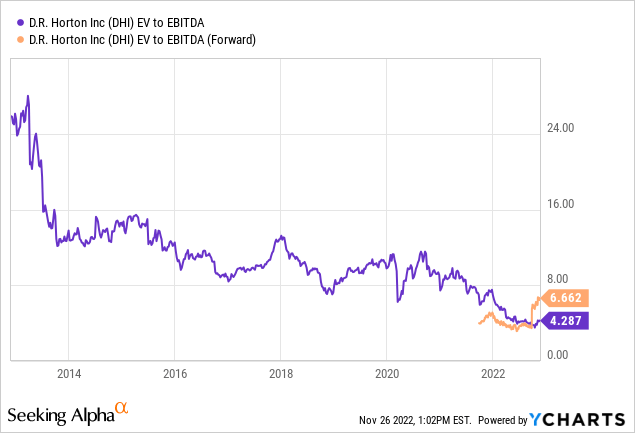

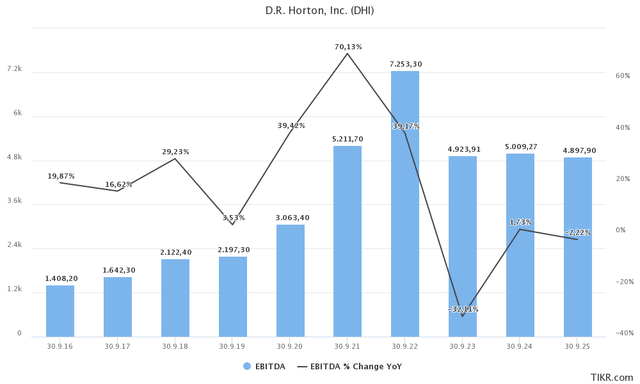

Concerning the valuation, it’s tough to make the case that the stock is cheap, despite trading at just 6.7x forward EBITDA. Note that this already incorporates lower EBITDA.

After all, 2022 was an outlier year due to strong demand and high pricing.

Analysts are now expecting an EBITDA moderation, but nothing wild in terms of weakness.

At this point, it’s important to mention that analysts (almost always) do not incorporate specific macroeconomic developments in their forecasts. Most analysts are slow to adjust to improving housing markets and equally slow to adjust to deteriorating conditions. Let alone predicting that things could get very bad.

So, here’s how I would deal with DHI.

Takeaway

The housing market is rolling over. What used to be a market benefiting from both higher demand and higher prices is now a market with very low demand and slowing prices. Unless a miracle happens, we’ll soon see lower demand and significantly falling prices.

This comes at a time of weakening economic growth and a hawkish Fed, looking to get inflation back to acceptable levels.

All of this creates a situation that could push up unemployment. Large investors are looking for this situation to unfold, as it will allow them to outbid private homebuyers.

I believe homebuilders will become highly attractive buys the moment unemployment has come up. I expect that the industry will be trading lower at that point, offering us an attractive risk/reward.

My go-to pick in the industry is D.R. Horton. It’s not just America’s largest homebuilder, but a homebuilder with a focus on faster-growing regions seeing significant affordability issues. Moreover, DHI addresses these needs by being able to produce rental properties in bulk and focusing on homes with a below-average ticket prices.

So, long story short, keep an eye on DHI, it might come in handy in 2023.

(Dis)agree? Let me know in the comments!

Be the first to comment