matimix/iStock via Getty Images

On paper, last month’s headlines don’t sound like a recipe for a stock market rally. Russia pushed deeper into Ukraine, energy prices soared, and the Federal Reserve hiked interest rates for the first time since 2018. But that didn’t stop the US market from snapping a two-month losing streak in March, even if it didn’t escape its first quarterly loss since 2020.

What may have surprised many investors was the fact that the market rebounded right around the time the Fed raised its benchmark interest rate by 0.25%, signaled increases would continue into 2023, and indicated its willingness to use larger hikes, if necessary, to tame inflation.

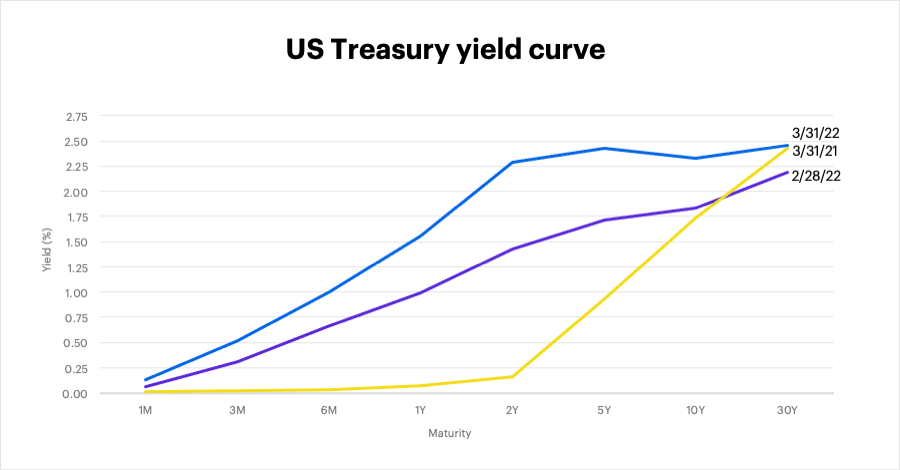

Although the Fed’s move had been expected, last month made things official: We’ve entered a new era of tighter monetary policy-and nowhere was this change more apparent than in the fixed-income market. Treasury yields soared, and portions of the yield curve inverted (longer-term rates fell below shorter-term rates), a development that has traditionally stoked concerns of recession.

US equities

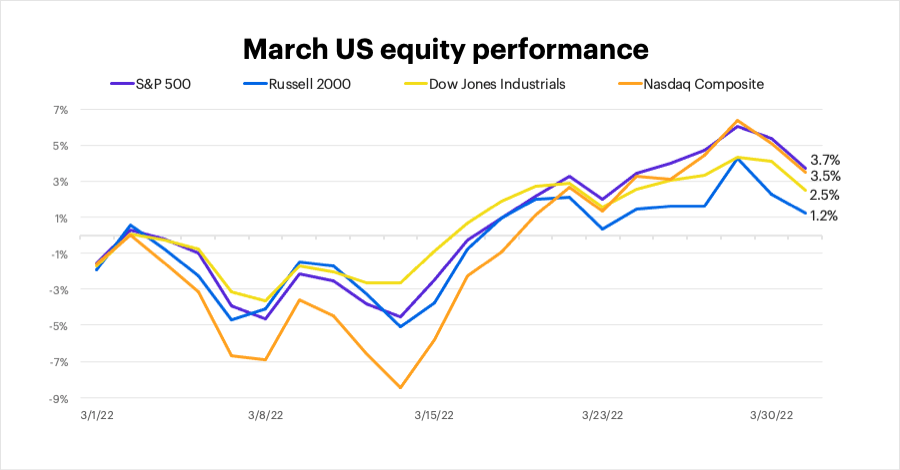

March was a tale of two halves. The US market rebounded from a sizable mid-month deficit to post its third-biggest monthly gain since last April. The S&P 500 led the way with a 3.7% rally, followed closely by the tech-heavy Nasdaq Composite with a 3.5% gain:

FactSet Research Systems

Sectors

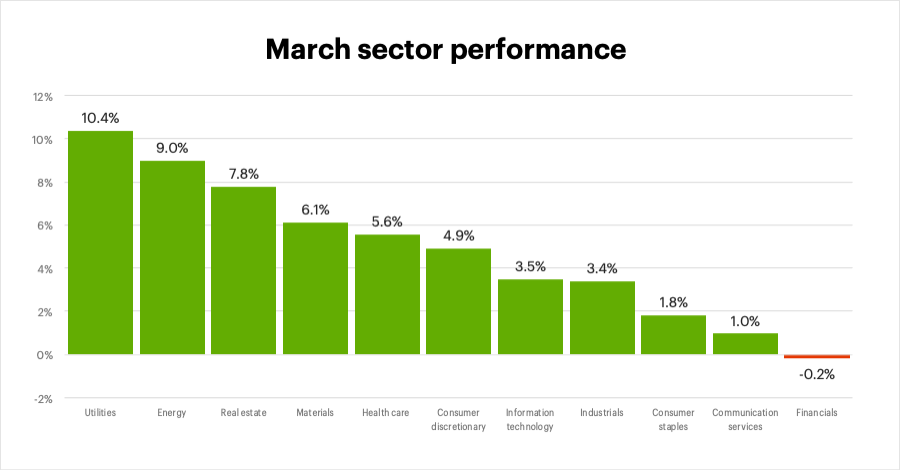

All S&P sectors but one gained ground in March, with traditionally defensive utilities edging out the top-seeded energy sector, which had another strong month as crude oil prices hit their highest levels since 2008 before retreating toward the end of the month. Real estate-an underperformer in January and February-also made a strong showing, while financials were the only sector in the red for the month:

FactSet Research Systems

International equities

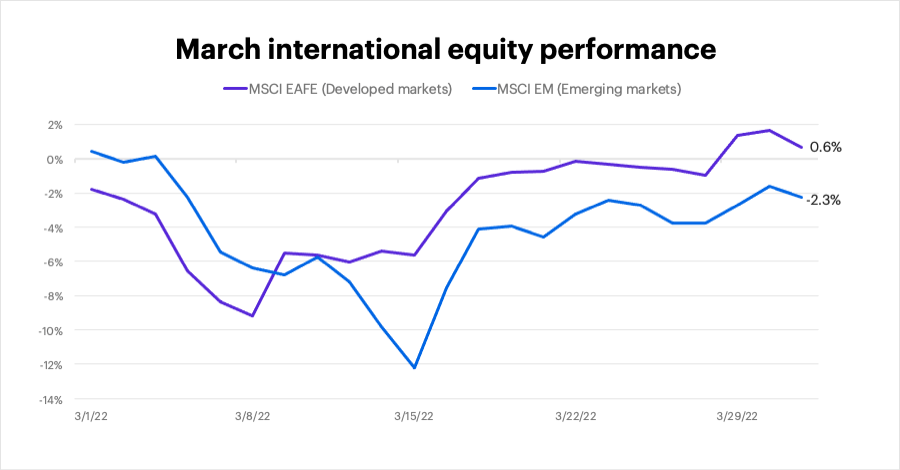

International stocks mostly underperformed the US, with developed markets faring better than emerging markets. But there were big differences in performance from region to region: The MSCI EM Europe & Middle East Index fell 11.3%, reflecting more of the impact of the Russian invasion of Ukraine while the MSCI EM Latin America Index gained 13.1%. The MSCI EAFE Index of developed markets gained 0.6% in March while the MSCI Emerging Markets Index fell 2.3%:

FactSet Research Systems

Fixed income

In one sense, March extended the trend of falling bond prices as yields, which move inversely to prices, pushed higher. But that doesn’t do justice to the magnitude of the moves. The 10-year T-note yield hit a nearly two-year high of 2.5% and climbed more than it has in any month since November 2016. But because shorter-term rates jumped even more, the yield curve flattened and different portions of it inverted, at least briefly-a possible sign of flagging optimism about longer-term economic growth. The 10-year yield ended the month below the 5-year yield:

FactSet Research Systems

Looking ahead

The dramatic shifts in the interest rate landscape may have prompted some investors to rethink their portfolios, especially their bond holdings. But these are the moments when investors are wise to maintain a big-picture perspective.

For example, Morgan Stanley Wealth Management analysts have noted the challenge the Fed faces in attempting to engineer a “soft landing”-taming inflation without tipping the economy into recession.1 But their research also shows that recessions don’t always follow yield curve inversions, and when they do, they don’t necessarily occur immediately.2 With that in mind:

- Stay the course with fixed income. While the jump in yields has been significant-and painful for bond holders-fixed income can still provide “ballast” in a diversified portfolio, balancing the swings in stock prices. Also, higher yields improve expectations for future fixed-income returns.

- Stock market resilience. Although the market is likely to experience more short-term volatility, equities have displayed a great deal of fortitude in the face of war, elevated energy and commodity prices, and a shift to hawkish monetary policy. Investors should consider concentrating on fundamentals and focusing on stocks that can weather a challenging environment.

Although we may be in a “new era” of rising interest rates, investors should remember that portfolios based on time-tested principles-diversification and a long-term time horizon-have shown a remarkable ability to ride out the markets’ many storms.

Be the first to comment