Jun/iStock via Getty Images

Investment Thesis

It is evident by now that a new critical semiconductor segment is materializing, due to the global electrification push over the next few years and the record high oil/gas prices from the Ukraine war. With more automakers converting their ICE production lines to EVs, there is no surprise that more semi-companies are pushing into new automotive segments with various levels of success. The IoT end market is also a force to be reckoned with, due to the progressive digital transformation post-COVID-19 pandemic.

Qualcomm (NASDAQ:QCOM) is obviously the more successful of the lot, given its massive automotive design win pipeline across connectivity, digital cockpit, and Advanced Driver Assistance System of over $30B by FQ4’22. The number indicates a remarkable growth of 57.89% and $11B QoQ, otherwise by a gargantuan 300% and $20B YoY, despite the peak recessionary fears. This is number is obviously impressive, since competitors such as Nvidia (NVDA) only reported $11B of automotive pipeline wins, with ON Semiconductor (NASDAQ:ON) boasting a total of $14.1B in long-term supply agreements for industrial and automotive applications.

Therefore, QCOM has been sorely misunderstood as a simple “mobile-chip maker,” impacting its stock sentiments against the more popular peers. Furthermore, the stock market has been overly obsessed with data centers and PC/gaming chips thus far, therefore, highlighting Advanced Micro Devices’ (NASDAQ:AMD), NVDA, and Intel’s (INTC) recent fall from grace, after the PC destruction in demand. Meanwhile, ON also remains less covered, despite the tremendous prospects of its Silicon Carbide technology in the EV (notably also used in Tesla (TSLA) under its in-house Chip program), renewable sectors, and IoT through the next decade.

Over the decade, we expect this electrification tsunami to feed the next super-cycle in the semiconductor stock rally. The global EV market will further expand to $1.1T at an accelerated CAGR of 22.5%, against previous projections of 18.2%. IEA also expected the number of EVs on the road to burgeon to 350M by 2030 globally, at an aggressive CAGR of 40.41%. Furthermore, the global IoT market is also expected to expand aggressively from $478.6B in 2022 to $2.46T by 2029 at a CAGR of 26.4%. Thereby, providing QCOM with the much-needed diversification for growth, against the conventional data center and PC/gaming end markets.

QCOM Is Blossoming Brilliantly Above A Simple “Mobile-Chip Maker”

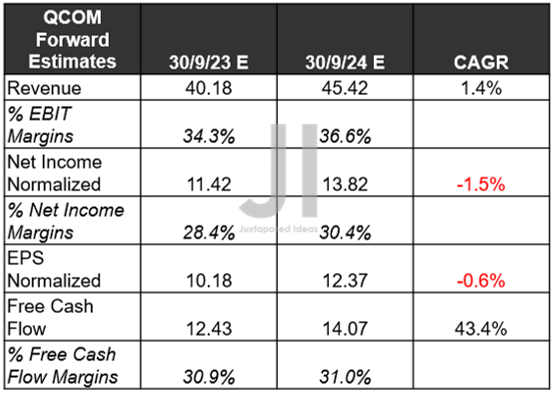

QCOM Projected Revenue, Net Income ( in billion $ ) %, EBIT %, EPS, and FCF %

S&P Capital IQ

QCOM’s fate was unfortunately sealed, when the management reduced their forward guidance drastically for the next quarter’s revenue to between $9.2B and $10B, against the consensus revenue estimate of $12.05B. Thereby, further impacting its EPS negatively to $2.25, against estimates of $3.43. It is no wonder that the stock had plunged by -7.66% post-earnings call, since market analysts have also catastrophically slashed its top and bottom line growths by -13.62% and -21.94% for FY2023, since our previous article in October 2022.

However, we reckon that it is merely a kitchen sink guidance, giving the QCOM management plenty of chances to outperform ahead, due to the robust demand in the automotive sector. The company has smashed estimates for the past seven consecutive quarter, indicating its prudence against NVDA’s overly optimistic guidance for FQ2’23 (thereby, triggering the colossal semi-market depression upon the poorer announcement two months after).

Furthermore, assuming that the rumors of China reopening are true, we may see smartphone sales expand by H1’23 as well, though there are new conflicting reports as well. Things will likely remain uncertain in the short term, unfortunately, since the country is responsible for 63.59% of the company’s FY2022 revenues.

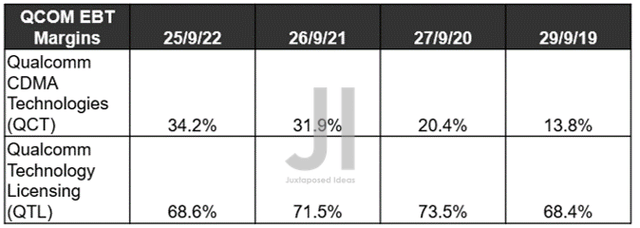

QCOM EBT Margin Expansion

In the meantime, QCOM investors need not fret, since the management continues to expand its EBT margins exemplarily, especially for the QCT segment, which comprises handsets, 5G products, and automotive, and IoT end markets. Despite the management commentary on slowing handset demand and chips glut, we expect these to be temporal, as inventory level naturally right itself as with the cyclical nature of the market. The automotive and IoT end segments will prove to be the company’s backbone through these pessimistic sentiments, proving the bears wrong.

The 5G market alone is already a cherry-topper, due to QCOM’s expanding partnership with Verizon (VZ) on the Qualcomm® 5G Fixed Wireless Access Platform. Though the latter has been losing critical post-paid market share to competitors such as AT&T (T) and T-Mobile (TMUS), the overall market demand for high-speed internet has obviously been accelerating. These three telecom companies reported 1.29M new wireless consumer adds in the latest quarter, despite the rising inflationary pressures. Consumers continue to spend an increased 0.5% sequential sum on broadband solutions, according to the latest October CPI report.

Meanwhile, we encourage you to read our previous article, which would help you better understand QCOM’s position and market opportunities:

- Qualcomm: No Qualms About Adding Here

So, Is QCOM Stock Buy, Sell, Or Hold?

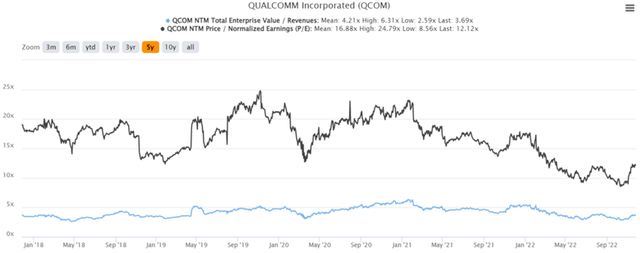

QCOM 5Y EV/Revenue and P/E Valuations

QCOM remains tremendously undervalued, notably trading at a much cheaper NTM P/E valuation of 12.14x and ON at 15.99x, against NVDA’s 41.81x at the same time. These recessionary fears have definitely created a once-in-fifteen-year opportunity for investors with higher risk tolerance and long-term perspective, especially after the tragic corrections thus far. These two companies represent unique and tremendous opportunities for those looking to diversify into automotive/ industrial chip stocks, beyond the usual automotive/EV stocks such as Tesla, General Motors (GM), Ford (F), and NIO (NIO).

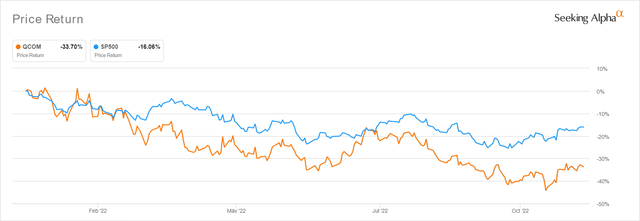

QCOM YTD Stock Price

With QCOM’s stock tragically moderated by -33.70% YTD, we may see more volatility in the short term, depending on the November CPI report. More are expecting a Fed pivot soon, due to the slowing inflation rate from the October CPI report. The S&P 500 Index has already recovered by 10.16% since hitting bottom in late September, with 75.8% of market analysts projecting a 50 basis point hike. Therefore, we surmise that the stock is still attractive at current levels, due to the consensus price targets of $147.44 and a 25.62% upside.

Meanwhile, QCOM has also reported improving supply chain channels due to the ongoing destruction of demand in the lower-margin PC/ gaming and mid-tier smartphone segments. The tragic inventory correction across these industries has also prompted an opportunistic chance for the company to expand its premium processor offerings in the iPhone, Samsung, and Chinese smartphones. Thereby, improving its ASP and bottom-line growth ahead. Not too bad indeed, since there is no destruction of demand in the automotive and industrial markets.

Naturally, investors that choose to add either at current levels must be comfortable with more volatility in the short term, since it is uncertain if the Feds will truly pivot this early. Furthermore, we expect the terminal rates to be further raised beyond 6%, against the previous projection of 4.6%.

Be the first to comment