Win McNamee

Investors have been expecting big things for electric vehicle maker Tesla (NASDAQ:NASDAQ:TSLA) in the back half of this year. With upgrades to the company’s two main facilities plus two new factories ramping, production and deliveries are set to soar. On Sunday, the company released its Q3 vehicle volumes report, and the results were extremely disappointing.

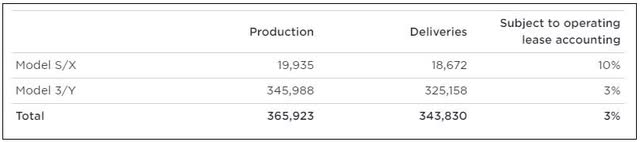

Tesla has been expected to hit new records almost every quarter now as it continues increasing its production capacity over time. A new record was not set in Q2, however, as China’s Covid shutdown meant the Shanghai factory was down for a number of weeks. With that situation now in the rearview mirror, Tesla was all set for new production and delivery records in Q3. The company hit new records, as seen below, but the most important number was certainly not what investors and analysts were looking for.

While the production number was mostly as expected, it is the delivery count that fell almost 20,000 units short of street estimates. Tesla management blamed the large disparity between production and deliveries on its regional batch building of cars, which led to a huge delivery rush at the end of each quarter. With growing volumes, transportation capacity has been harder to secure and is more expensive during these peak times.

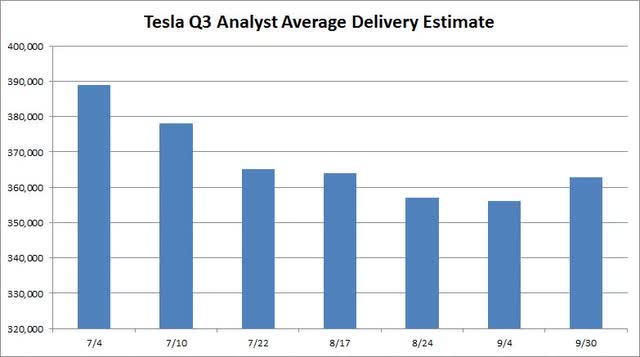

With an even more regional build process in Q3, Tesla ended up with a large amount of in-transit vehicles at quarter’s end. Of course, management has talked about eliminating this delivery surge for more than three years now, so this is a major failure in execution. The company has been using this strategy for quite a while, and this time, it came back to bite them. The delivery number is even worse when you consider that estimates (using Bloomberg) came down overall throughout Q3 as seen below. The 9/30 figure represented below is the company compiled number sent out by Tesla Investor Relations in the final few days of the quarter.

Q3 Street Delivery Estimates (Troy Teslike)

Of course, a large number of in-transit vehicles will have some interesting impacts when we get the Q3 earnings report in a few weeks. This will be a major drag on cash flow for the period as inventory will be elevated a bit. One good thing here for Tesla is that the percentage of leased vehicles declined sequentially from Q2, which means a larger portion of cash sales. That will help average selling prices, along with previous price raises we’ve seen this year. On the flip side, a higher mix of 3/Y vehicles for the company’s total is a headwind to selling prices, as with the much stronger US dollar seen throughout Q3.

I will certainly be watching to see how much analyst revenue estimates change in the coming weeks. Using the Q2 figure for revenue per delivery (including credits and counting leasing the same for units), along with a roughly $400 million increase for Tesla’s other two segments, I come to revenues of about $22.4 billion. As of Sunday, the street was at $22.6 billion, but as I noted above, there are numerous puts and takes to sequential average selling prices changes. As we get closer to earnings, I’ll have my usual preview article with a better projection for Tesla’s results. Remember that at this delivery level, every $1,000 change in average revenues per delivered vehicle equals almost $350 million in total revenue.

As for Tesla shares, they recently hit a bit of a speed bump. This is mostly due to the overall market dropping a bit on fears of the Fed hiking rates further to bring down inflation, which increases the chance of a US recession. As the chart below shows, the 50-day moving average (purple line) was just about to break above the 200-day (orange line). That could still happen, although probably not soon if Tesla drops a bit further on this delivery figure. As a point of reference, the average price target on the street is currently above $308, implying decent upside from here.

Tesla Last 6 Months (Yahoo! Finance)

In the end, Tesla reported a sizable delivery miss for Q3. Despite street estimates coming down by more than 25,000 units during the quarter, Tesla missed the street bar by almost 20,000 vehicles. The company can blame regional builds and its delivery wave all it wants, but it was management who set this process up and has failed to change things over the years. As a result, we are likely to see some pressure on analyst estimates in the coming weeks, and it wouldn’t surprise me to see the stock move lower, especially if overall markets don’t rebound soon.

Be the first to comment