RomoloTavani

From the tones held in Q3, management seemed quite satisfied with the results achieved; however, as far as I am concerned there are still too many concerns related mainly to debt. The summer session is the most profitable period for cruise companies and I would have expected better results.

Continuous losses and unsustainable interests

The goal of this paragraph is to understand whether from a profitability perspective Carnival (NYSE:NYSE:CCL) is returning to pre-pandemic levels, which is why I will compare this Q3 2022 with Q3 2019. Comparing this quarter with 2020 and 2021 I think is only misleading since the company was severely limited in its operations due to the pandemic-related restrictions. The results in 2020 and 2021 were awful and would overestimate Q3 2022 growth. Also, making a comparison with Q1 2022 and Q2 2022 would be unreasonable since Q3 has always been the best quarter of the year for cruises since it is the summer session quarter.

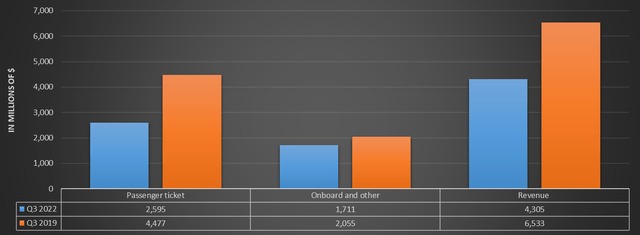

As we can see from this chart, $2.22 billion is still missing to achieve pre-pandemic results. In particular:

- Onboard and other revenues are lower than Q3 2019 by $344 million, not by that much after all.

- Passenger ticket revenues are still a long way from Q3 2019 results, missing another $1.88 billion.

The reason why ticket revenues are struggling the most to increase is due to the significant discounts that cruise companies have allowed passengers in this 2022 to fill vacant seats. More precisely, we are talking about a 17% drop in average fares from June 1 to July 13 compared to the same period in 2019. Once on board, however, passengers did not limit their spending, which is why onboard and other revenues are not that different from 2019.

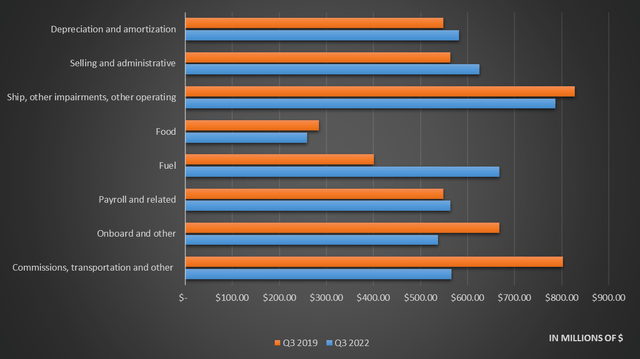

As for total operating costs, in Q3 2022 they were $4.58 billion while in Q3 2019 $4.64 billion. Overall, this is not such a noticeable difference even though $2.22 billion less was generated, which is why I am disappointed with this quarterly. Fuel costs increased by 66.58%, and the weight of inflation exacerbated the overall cost increase. With less revenue and similar operating costs, it is inevitable that this quarter is far from the results achieved 3 years ago. Q3 2022 operating income was -$279 million, compared to $1.89 billion in Q3 2019.

Having negative operating income is serious because it means that the company cannot generate a surplus through its core business: this situation is not sustainable over the long term. Moreover, even assuming that operating income in the coming quarters is positive, the problem of the cost of debt would remain. Operating income, in fact, does not consider the burden of interest expenses. But how much does this interest amount to?

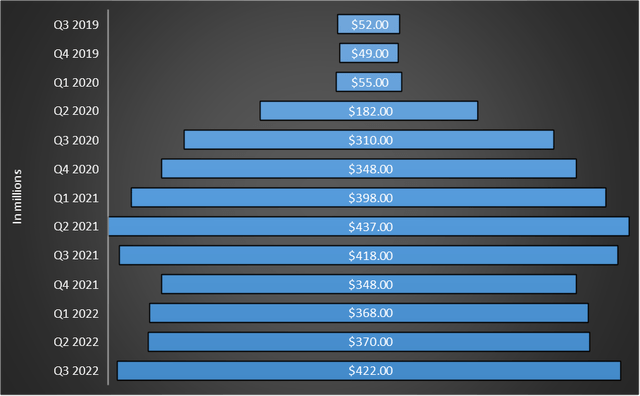

Last quarter $422 million was paid in interest expenses, $390 million more than Q3 2019. Covid-19 has forced this company to significantly increase its debt to stay afloat, but my hunch is that it has only postponed the sinking. The interest paid is about 10% of the revenue generated and the remaining debt to be paid is huge.

Carnival Q3 2022

How can a company with interest expense equal to 10% of revenues and negative operating income (in its most favorable quarter) manage to pay $12.50 billion by 2026? The effects of Covid-19 have been devastating for cruise companies, and in my opinion, I believe it will take decades for the entire industry to recover.

A downward spiral

Honestly, I would like to find a silver lining in all this but I find it difficult, partly because so far I have not even considered the macroeconomic aspect. We are in the midst of a recession where central banks are raising interest rates sharply to deal with inflation at 40-year highs. Risk-free interest rates are skyrocketing and getting into debt will become more and more expensive. Carnival already pays 10% of revenues in interest not even having a positive operating income, how would it react if it had to pay even higher interest? Who would lend money to Carnival if not at a sky-high interest rate? This company is unfortunately amid a vicious cycle that seems to be plunging it deeper and deeper into the abyss. Since the pandemic broke out there has not been a single quarter where there has been positive free cash flow, a sign that millions and millions of dollars are being burned every quarter. The industry in which it operates does not help either, as it requires huge maintenance costs. It also doesn’t help the stringent covenants, which if not met could make the situation even worse. One of the most worrisome is not to bring net worth below $5 billion. In Q3 2021 total shareholders’ equity was $14.86 billion while it is currently $8.37 billion; how long will Carnival be able to keep it above $5 billion considering that it incurs losses every quarter?

Final thoughts

This Q3 2022 achieved strong income growth over the previous year but is very far from achieving the results of Q3 2019. The reasons for this divergence are mainly 3:

- Declining revenues due to ticket price reduction to increase demand.

- Increasing operating costs in relation to revenues earned due to high inflation encountered especially in fuel prices.

- Operating income still negative despite Q3 generally being the most profitable of the year.

- Interest expenses payable quarterly that are far higher than those paid years ago. The current tight monetary policy could only make the situation worse.

On the other hand, from a purely financial point of view, the situation is dire. Since the company does not currently generate positive free cash flow the only way to deal with debt is to either issue new shares or take on additional debt to pay down short-term debt. In the former case, shareholders would suffer severe dilution; in the latter, the financial structure would worsen even more. For these reasons, it is good for the company to start generating positive free cash flow, but it will be more difficult than in the past because you have to pay disproportionate interest and face a recession derived from double-digit inflation.

Now we come to the last consideration: is it worth investing in Carnival now since it has lost 90% from its all-time high? I personally think not, but I would like to underline one point. My view is influenced by my personal degree of risk tolerance, which may be different from yours. When I analyze Carnival I see a company that is in very deep trouble, and that represents too much risk beyond the possible return it can provide me in the future. Someone else with a higher risk tolerance, on the other hand, may see in this company a unique opportunity to make a 10x if it were to return to all-time highs. The fact that the company is in trouble is an objective matter, but that I do not want to invest in it because it is too risky is purely personal. My opinion is that during a bear market derived from tight monetary policy the best option is to invest over the long term in solid companies with strong free cash flow, as it is rare for them to be at a discount as they are now. Investing in companies that are heavily indebted and burning cash every quarter is the last thing I would do at present. I have already expressed my concerns about an investment in Carnival in a previous article, and I continue to be wary even after this quarterly report.

Be the first to comment