miniseries

Booking and Expedia together dominate the OTA market, creating almost a duopoly. In 2021 they totaled revenues of $19.56 billion, while in third and fourth place we have Airbnb and Trip.com, respectively with $5.99 billion and $3.10 billion. Both Booking (NASDAQ:NASDAQ:BKNG) and Expedia (NASDAQ:NASDAQ:EXPE) are highly appreciated by the public for their ability to easily organize and book travel through simple apps; however, I believe there is a clear winner.

Growth achieved and growth expected

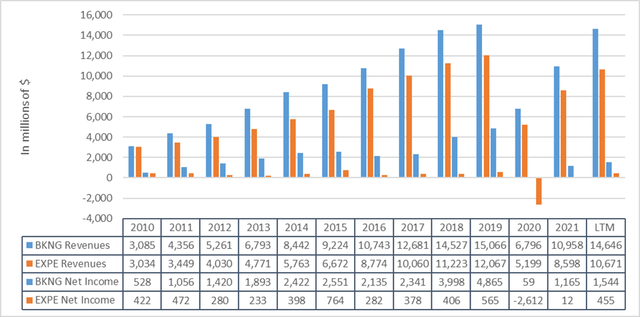

As a first aspect of comparison I am going to analyze the profitability achieved by the two companies since 2010. I would like to point out that the comparison will often be made by considering 2019, since it is the last year available before the entire sector was disrupted by COVID-19. The results obtained in 2020 and 2021 are misleading because they were achieved due to an event of an extraordinary and not an ordinary nature. The last two years will be compared in a subsequent paragraph.

In 2010, the two companies’ revenues were very similar; however, the same cannot be said today. Booking has vastly outperformed Expedia in terms of revenue growth, and the same is true for net income. Moreover, Expedia, except for 2015, only in 2019 managed to achieve a higher net income than in 2011. Based on the past, there is no doubt who was the winner.

- From 2010 to 2019 Booking’s revenue had a CAGR of 19.27%, while Expedia’s revenue 16.58%.

- From 2010 to 2019, Booking’s net income had a CAGR of 27.99%, while Expedia’s had a CAGR of 3.30%. This difference in net income growth was crucial for Booking to improve its OTA market leadership, which is why there will be an in-depth discussion later.

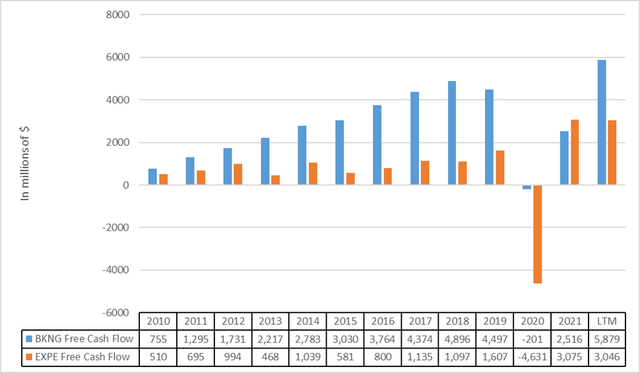

In terms of free cash flow, the result does not change. Booking achieved far better growth than Expedia, experiencing a CAGR (2010-2019) of 21.93% versus 13.60%.

Looking back, there was no match, but what can we expect in the future? In the short term, both companies expressed their confidence about the upcoming Q3, driven by strong travel demand in the summer session. This is very important because typically the summer session represents for both companies the period that generates more revenue than any other quarter. For Q4, both companies have also shown some positivity, but Booking on this provided some additional information: gross bookings for Q4 are currently about 15% higher than the same period in 2019 on a euro basis.

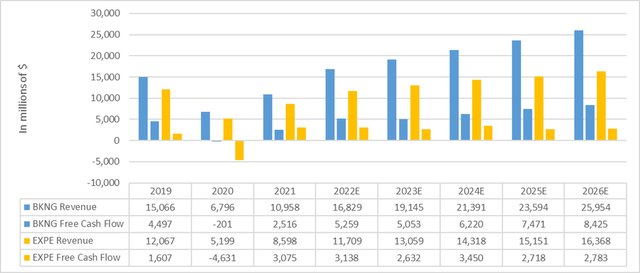

As for the long-term outlook, I will now show the estimates of TIKR Terminal analysts.

- Booking could have a 2022 where both 2019 revenues and free cash flow will be exceeded. The long-term outlook is excellent as revenues (2021-2026) are expected to grow by 18.80% CAGR while free cash flow by 27.30%.

- For Expedia, expected revenues for 2022 are still lower than 2019, but free cash flow is expected to be higher. The long-term outlook is quite disappointing due to stagnant free cash flow.

Moreover, wanting to consider the outlook for the entire global online travel booking services market, grandviewresearch.com analysts expect it to grow at a CAGR of 9% from 2022 to 2030.

Overall, Booking has performed better than Expedia in the past as it has been able to grow much faster, and analysts expect this gap to only widen in the future. Since these are forecasts, we cannot know a priori whether they are correct or not, but what is certain is that currently under a purely income standpoint there is no reason to prefer Expedia to Booking.

Different profitability

This is probably the most important aspect when comparing these two companies, as the different profitability is what has expanded Booking’s competitive advantage over time. In fact, in the previous paragraph we noted how the biggest difference between the two companies was not the revenue growth rate, but the profit growth rate. Over the past 10 years Booking has consistently had better profit margins than Expedia, which is why in the long run it has proven to be a more trustworthy company. To understand the magnitude of this phenomenon, just think that in 2019 for every $100 of revenue, Booking made $32.3 in profit while Expedia only made $4.70.

At this point the question arises: how can there be such a disparity in profitability between two leading companies in the same industry? The answer lies in where the revenues come from. Expedia operates mainly in the U.S. while Booking is the undisputed leader in Europe with a 70.60% market share. Although both companies make money in the same way, the commissions they earn in percentage terms are different because the hotel market in which they operate is not the same.

- In the U.S., the hotel market is dominated by large hotel chains such as Hilton and Marriott; therefore, they have very strong bargaining power. Since they control thousands and thousands of rooms, they can afford to bargain down the commission they have to pay. In fact, in 2019, Marriot entered into a multi-year agreement with Expedia where it will be paid a 12% commission, far less than the 15-30% that can be charged to independent hotels.

- Europe’s hotel market is very fragmented and is dominated mainly by independent hotels and small hotel groups. Since they have a limited number of rooms their bargaining power is very low, which is why they have to pay a higher commission. This obviously benefits Booking.

In summary, even though Booking and Expedia perform the same service, the underlying market conditions force Expedia to systematically have worse margins than Booking.

Recovery speed

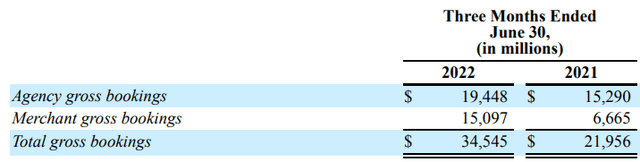

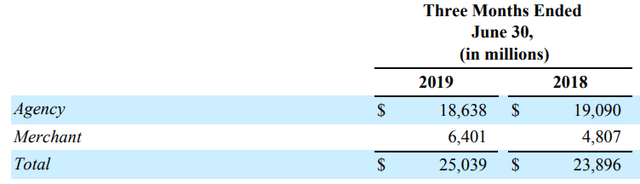

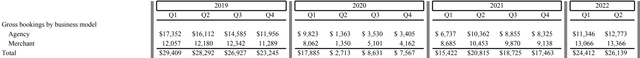

An additional aspect I want to consider is the speed of recovery of the two companies from the difficulties encountered during the pandemic. The year 2021 and especially 2020 were tough years for the entire tourism/travel industry because of the continuous lockdowns. To date, we cannot say that COVID-19 has been finally defeated, but at least compared to 2 years ago we have learned to live with it. From a revenue perspective, however, Booking seems to have already surpassed pre-pandemic levels, while Expedia is still showing some difficulties. Proof of this is the different growth in gross bookings, an operating and statistical metric that captures the total dollar value of all travel services booked.

From what we can observe, compared to Q2 2019 Expedia has a lower gross bookings by $2.15 billion. Certainly, there was growth compared to Q2 2021, but it cannot be considered full recovery.

Booking Q2 2022 Booking Q2 2019

For Booking, the situation is completely different. Q2 2022 broke several records, including the highest gross bookings ever: $9.50 billion more than Q2 2019.

To conclude the topic related to recovery, the same outcome is also obtained when considering room nights.

- Expedia presented in Q2 2019 100.8 million booked room nights, while in the last quarterly only 82.50 million.

- Booking presented in the last quarterly 246 million booked room nights, 16% more than Q2 2019.

Overall, Booking has not only recovered to pre-pandemic levels, but has exceeded them. Expedia, on the other hand, has not yet fully overcome the slowdown resulting from the pandemic.

Final Thoughts

Summarizing what has been analyzed in this article, I consider Booking a better company overall than its competitor Expedia for the following reasons:

- Greater exposure to the hotel market in Europe than in the United States. This factor results in significantly better margins.

- Gross bookings and booked night rooms greater than pre-pandemic levels, unlike Expedia which is still struggling to recover.

- It has been more than 10 years that Expedia continues to lose the clash with Booking. Since 2011, Booking’s growth rate has been significantly higher than Expedia’s. Analysts estimate that this gap may widen in the future, so I don’t see the basis for believing that there can be a turnaround.

Past performance obviously cannot guarantee future performance; anything can happen. However, given the previous considerations, from a long-term perspective I am much more confident in Booking than in Expedia.

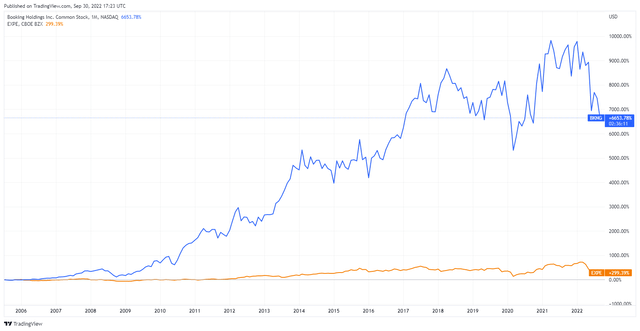

Over the course of these years, the market has already decided who is the OTA market leader: since Expedia’s spin-off, Booking’s performance has been significantly greater.

Be the first to comment