Nattakorn Maneerat

QQQ down by over 33% YTD

The tech-heavy NASDAQ 100 (the tech sector is nearly 48% of the Index), as proxied by the Invesco QQQ ETF (NASDAQ:NASDAQ:QQQ), is down by over 33% during the first 9 months of 2022. This would qualify as a tech crash, even though it doesn’t feel like it sometimes. Here is the QQQ screenshot from Seeking Alpha:

I mainly covered the S&P500 (SPY) this year, but I did issue a sell recommendation on QQQ on September 6th. Even since then, QQQ is down by 9% – September was a difficult month, as I expected.

My sell recommendation on Sep 9th was based on the observation that tech stocks were still overvalued. Given the Fed’s objective of a “growth recession,” it was very likely that we would get earnings downgrades and further valuation multiple contractions. I even recommended a sell on Apple (AAPL), the most heavily weighted stock in QQQ (almost 14% of the index), which decreased by over 12% since.

So, what’s next for QQQ?

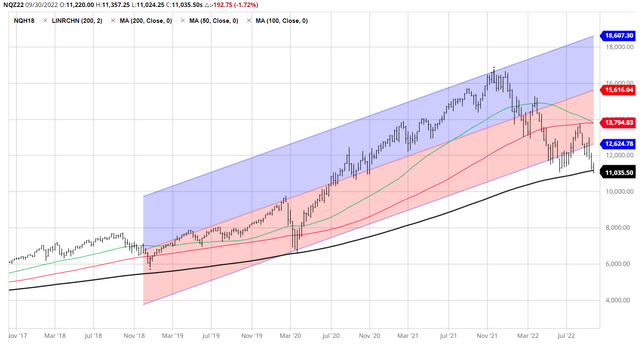

Surprisingly, even after the 33% crash, the longer-term bull market in Nasdaq 100 is technically still in place, based on the long-term trend. However, we are at the key support, the 200-week moving average, which held even during the March 2020 crash, (the black line in the graph below). In fact, we closed on Friday just below it.

Thus, NASDAQ 100 is currently at the crucial level. So, what happens next for QQQ?

There are 3 possible scenarios as I see it:

- The tech crash continues with the 200wma breakdown, towards the 2008-like or the 2000-like 50%-75% crash.

- The QQQ find the short-term support and rallies towards the 100wma (red line) in a bear market rally.

- We are currently at a longer-term bottom for QQQ, and the new bull market is about to commence. Note, allow for additional drawdown up to 5% in this scenario as the bottom is processed.

Let’s evaluate the probability of scenario 1 or the crash continuation to over 50% total drawdown. Obviously, by ruling out the scenario 1, the implication would be that QQQ would rally from here, at least for a short period.

How likely is a 2000-like tech crash?

First, let look at the 2000-crash similarities. The 2000-crash was the dot-com bubble crash, where investors irrationally priced the dot-coms and related companies, many of which had no earnings. As a result, the forward P/E ratio for NASDAQ 100 was over 100 in 1999.

Today, the forward P/E ratio for NASDAQ is only 20. Also, last year the P/E ratio was “just 34,” which was expensive, but not at the point where we can say an irrational bubble. Furthermore, NASDAQ 100 is currently fairly priced. Thus, it is unlikely that we have the valuation based 2000-like bubble burst on our hands. Thus, I rule out the 2000-like continuation of the tech crash.

How likely is a 2008-like tech crash?

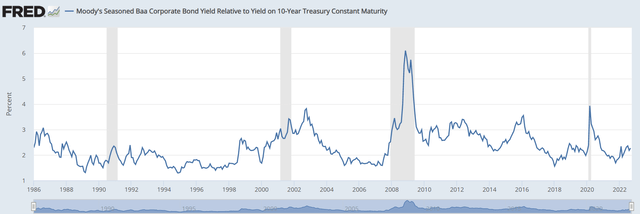

Second, let’s evaluate to 2008-like similarities. The 2008 crash was essentially the credit crunch, primarily caused by the Lehman Brothers bankruptcy. In 2008, the housing bubble was at the heart of the problem, and financial institutions held the “toxic waste” assets on and off their balance sheets, and nobody could tell which financial institution would go bankrupt next.

The credit risk spreads today are low/moderate, which indicates little fear of the credit crunch. Here is the spread between the BBB rated corporate bonds yield and the 10Y Treasury Bond yield. The current value is 2.27%, which is only moderate based on the historical values, and it would have to spike to above 3% to become worrisome.

Yes, the housing market is currently correcting, but we don’t have the similar problem with the ARM mortgages and the subprime mortgages like in 2008. Thus, I don’t anticipate the credit crunch like in 2008, and thus rule out the 2008-like tech crash continuation.

What else can cause a NASDAQ crash continuation?

Every crisis is different. Yet, all stock market selloffs always happen due to: 1) a liquidity shock, 2) a deep recession, or 3) a credit crunch. In addition to these variables, there is always the risk of an extraordinary geopolitical event, or other internationally related crisis.

The QQQ selloff YTD was due to the Fed-induced liquidity shock, as I warned during the first half of the year. Specifically, I warned that “the Fed will talk the talk and walk the walk,” and that the stock market was 40-50% overvalued. Those were the reasons to sell stocks earlier this year, but most of them are priced in now.

As previously stated, we are likely at the peak Fed hawkishness. Additionally, the mild-to-modest upcoming recession, with the unemployment rate climbing to up to 4.4% is likely priced in, given the forward P/E ratio of 20. Yes, there could be some additional selling, but nothing like in 2000 or 2008.

In addition, as previously mentioned, it is unlikely that the Fed would allow additional domestic Lehman Brothers bankruptcy, and the current macro environment is nothing like in 2008.

Yet, the geopolitical situation is currently very tense with the war between Ukraine and Russia, and the probability of a nuclear war is definitely above 0%. Furthermore, the relentless rise of the U.S. dollar is increasing the probability of the 1997-like crisis “somewhere.”

However, any severe geopolitical escalation or a serious international financial crisis is likely to cause the Fed’s dovish pivot, which could, in fact, cause a rally in stocks.

So, where is the bottom?

Thus, based on the current situation, it seems appropriate to shift from a bearish view on QQQ to neutral. Recommending to sell QQQ at this point after the 33% correction requires a high probability of an additional adverse event. At this point, there are no indications of: 1) a severe deep recession, 2) the 2008-like credit crunch, or 3) the 2000-like bubble burst.

The long-term technical support for QQQ seems to be at the current level (200wma), but I would stop short from calling it a definitive bottom. The technical breakdown below the support could cause further short selling by the trend-followers and stop-loss selling by the bottom pickers, which could push the QQQ price even lower over the short term.

Plus, while we anticipate the peak in Fed hawkishness, but we still do not have any indications of the Fed pivot from the Fed itself, neither the verified peak in the CPI inflation.

For these reasons, I would still not recommend buying QQQ. However, I do see the higher probability of next 15%+ move to the upside than to the downside (scenario 2). Thus, if the 200wma support decisively holds, I would be inclined to initiate a speculative QQQ long and reevaluate whether the definite bottom has been reached afterwards.

In fact, the bear market bottoms become obvious only sometime after they have been reached.

Be the first to comment