Theo Wargo

This article first appeared on Trend Investing on October 5, 2022; however has been updated for this article.

Tesla Inc. (NASDAQ:TSLA) – Price = US$215.31

Tesla and Elon Musk have an extremely successful history of disruption. To name a few, they have disrupted the auto industry (EVs), the energy industry (solar with energy storage), the space industry (SpaceX), and potentially many others via Hyperloop (indirectly), The Boring Company, Neuralink and OpenAI. Musk also disrupted online banking and payments when he developed X.com which later merged with Confinity to form PayPal. (Source: Wikipedia)

The bottom line is “don’t bet against Elon”. He has a long history of success and is the world’s richest person with US$195b (as of Nov. 4, 2022).

Tesla now has its sights set on disrupting the biggest industry of all, human labor, using robots. Tesla is working to develop the humanoid robot (“Optimus”) and hopes one day to build millions of robots, initially deploying them to work in Tesla factories.

For a background on Tesla’s humanoid robot (named Optimus), we suggest reviewing some of the following AI Day 2022 videos:

- Tesla AI Day 2022 (full video 3 hrs 23mins) (The main show starts at the 14 min mark beginning with the Tesla bot demo)

- Optimus to Autopilot: The Biggest Reveals from Tesla AI Day 2022 (14 min, great summary video)

- Tesla AI Day Highlights | Lex Fridman (good video commentary about AI Day)

Tesla humanoid robot (Optimus) is in the development stage. Elon Musk hopes to have it ready in 3-5 years from now (2026-28)

Summary of the Tesla humanoid robot to date and AI Day 2022 (robot focus)

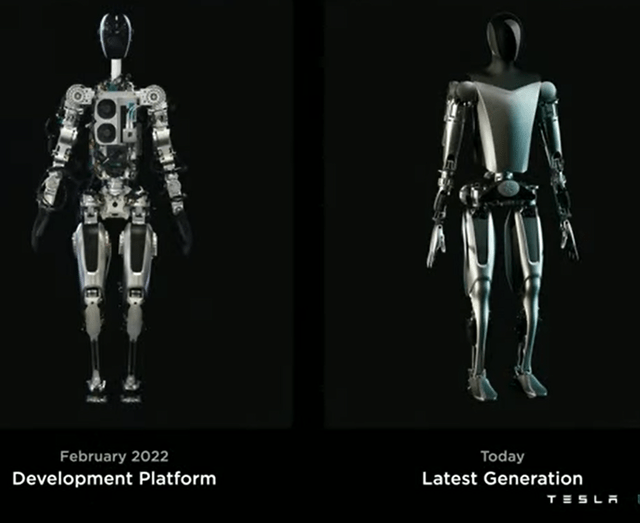

Tesla’s robot was first announced at AI Day 2021 when it was just a concept.

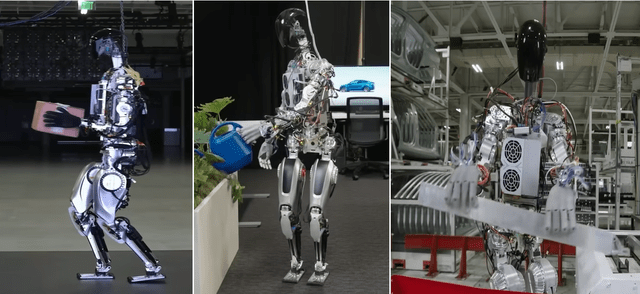

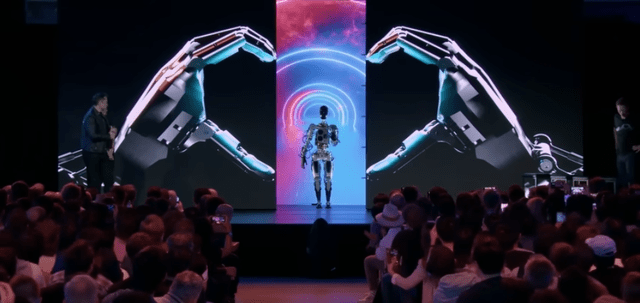

By AI Day 2022 on September 30, 2022, Tesla revealed two versions of its robots. The first was an off-the-shelf components robot which is already able to do simple work tasks such as watering plants and moving parts in a factory.

Tesla’s humanoid robot shown at AI day 2022 walking and doing tasks at a home, office, or factory

Tesla AI Day 2022 official video

The second robot is Tesla’s latest version that leverages of all Tesla’s learning with vehicle design including full self driving (“FSD”) and manufacturing processes. It runs for roughly a full work day on a 2.3kWh battery pack.

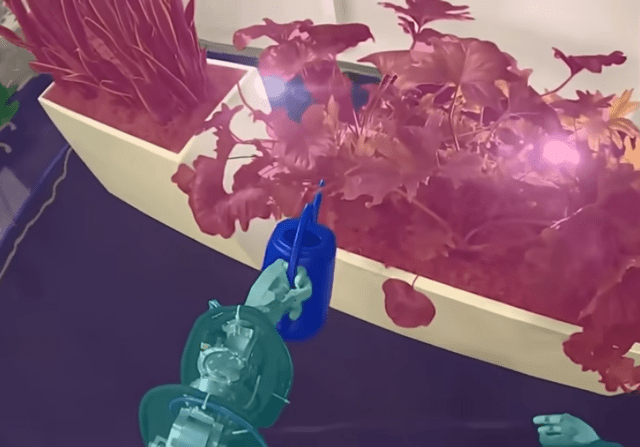

Both versions show incredible progress for <1 year of development. A key point to understand is that the robots work using AI (machine learning) much the same way as Tesla’s EVs are learning to drive using the full self driving software. This means they operate using computer vision in a similar way to how human’s operate.

The rendered view below shows what the robot is seeing (Source: Tesla AI Day 2022)

Some key Elon Musk quotes from AI Day 2022

- “The robot can do a lot more than we showed you.”

- “Our goal is to make a useful humanoid robot as quickly as possible”

- “We have also designed it using the same discipline that we used in designing the car, which is to say to design it for manufacturing such that it is possible to make the robot at high volume, at low cost, with high reliability.”

- “It is expected to cost much less than a car, so I would say probably less than 20,000 dollars, would be my guess.”

- “The potential for Optimus is, I think, appreciated by very few people…..”

- “I think we want to have really fun versions for Optimus and so that Optimus can both be utilitarian and do tasks but can also be kind of like a friend and a buddy.”

- “I think Optimus is going to be incredible in 5 years, in 10 years mind blowing.”

- “When can people receive one…I would say probably within 3 years and not more than 5 years.”

Source: Tesla AI Day 2022

What is the global labor market size?

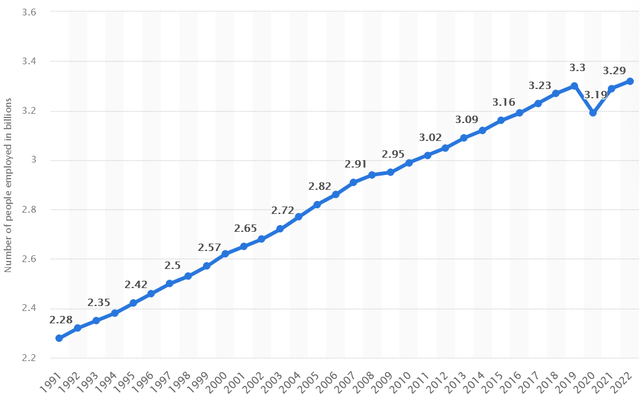

In May 2022 Statista reported: “In 2022 there were estimated to be approximately 3.32 billion people employed worldwide.”

Number of employees worldwide from 1991 to 2022 (currently 3.32B)

The potential implications IF Tesla disrupts the global labor market (hypothetical scenario)

If Tesla succeeds in bringing a mass produced humanoid robot to market by 2030, the potential implications are enormous. Below are some scenarios to consider (based on only today’s global workforce number of 3.32b).

If we took the case where 30% of the global workforce was disrupted then that would require 996 million robots. If Tesla was able to achieve 50% market share then that equates to needing 498 million Tesla humanoid robots.

Note: This only accounts for the workforce and not other areas such as home use etc.

Number of Tesla humanoid robots needed to displace 30% of the global workforce would be 498m (~500m) based on a 3.32b global workforce

|

% of global workers displaced by a humanoid robot |

Number of humanoid robots needed |

Tesla grabs 50% market share |

| 10% | 332 million | |

| 20% | 664 million | |

| 30% | 996 million | 498 million |

| 40% | 1.328 billion | |

| 50% | 1.66 billion |

Now looking at the table below, Tesla would have the potential (if successful) to make additional revenue of US$1T pa (~50m x US$20,000) and additional earnings of US$300b pa (assumes 30% net profit margin), based on these assumptions.

Tesla sells its humanoid robot – Potential revenue and profit [USD] pa if selling ~50 million robots pa starting in 2030

|

No of Tesla robots sold per year in 2030 (estimate) |

Revenue pa (selling at US$20K each) |

Net Profit (assumes a 30% net margin) |

| 50 million | 1 trillion | 300 billion |

An additional US$300b pa of net profit for Tesla would potentially add US$6-12T (using a PE range of 20) of market cap to Tesla’s current market cap of US$719B. That equates to a 8.3-fold increase in Tesla’s valuation, not adjusting for time value to 2030 or any stock dilution.

Of course, these numbers are all hypothetical, purely designed to get you thinking of the enormous possibilities ahead should Tesla succeed with its humanoid robot plans. Also note we have assumed Tesla can raise the CapEx to build 50m robots pa.

What if Tesla decided to ‘lease’ their robots rather than sell them

A final thought is perhaps Tesla would not sell its humanoid robots, but rather lease them at close to the average global labor rates. This could potentially mean recurring income each year in the order of US$20,000 per robot. Now multiply that by 500 million robots and the numbers are staggering, especially when considering the number would potentially steadily grow each year in line with population growth.

Note: The $20,000pa lease fee per robot would be reasonable when you consider a robot has no sick days, no holidays, can work long hours, and requires minimal maintenance. The purchase cost maybe higher in higher labor cost countries and lower in lower labor cost countries.

Based on 500m robots leased at US$20,000pa, Tesla’s revenue ‘only from leasing robots’ by 2040 could potentially have grown to US$10T pa and net profit of US$8T pa (Tesla’s net profit margins on leasing would be extremely high, assume 80%). These numbers are mind blowing, but certainly not yet to be relied upon.

Note: Elon Musk has so far only mentioned selling robots not leasing robots. In the scenario above, leasing revenue could begin as early as perhaps 2030.

Tesla leases its humanoid robots

|

No of Tesla robots leased by 2040 (estimate) |

Recurring revenues from robot leasing (average US$20,000pa per robot) |

| 500 million | 10 trillion |

A more conservative scenario

The above scenarios are the ultra bull case and would see plenty of potential opposition by society and governments, due to the potential to cause large unemployment. Below is a more conservative scenario where a humanoid robot displaced 10% of the global workforce and Tesla again took 50% market share.

As shown in the table below, if Tesla chose to sell their humanoid robots, based on the assumptions below, they could achieve additional revenue by 2030 of US$332b pa. If they chose to only lease their robots by 2040, they would have grown to a fleet of 166m leased robots at US$20K each, resulting in revenue of US$3.32T pa.

|

10% of global workers displaced (No of robots) |

No of Tesla humanoid robots sold pa (50% share) (over 10 years) |

Tesla revenue pa (selling at US$20K each) by 2030 |

Leasing revenue (at US$20K pa each) by 2040 |

| 332 million | (332m*50%)/10 = 16.6m | 332 billion | 3.32 trillion |

Risks

- The above scenarios are purely hypothetical numbers with numerous assumptions, the biggest being that Tesla succeeds at producing and selling/leasing a humanoid robot.

- Governments may oppose displacing human jobs by robots.

- Humans may reject the idea of humanoid robots replacing human jobs. Note, however, that robots already displace millions of human jobs globally in factories today.

- Competition from existing or new robot companies.

- Tesla may not be able to achieve these targets, costs, or time frames.

Tesla AI Day Sept. 30, 2022 when Tesla first showed their 2 humanoid robot prototypes and discussed their plans to potentially produce robots on a large scale

Further reading

Conclusion

Elon Musk and Tesla have a stellar record of success when it comes to disruption. Investors who have gone along with Elon have done very well and those that bet against Elon very poorly. History, therefore, suggests Elon and Tesla will one day succeed at producing a workable and saleable humanoid robot. Will it be by 2025, 2030, 2035, or 2040, that is a harder question to answer. Our thoughts are that 2030 maybe realistic for a good Tesla humanoid robot usable in the workforce, and by 2040, Tesla could potentially be leasing up to 500m Tesla robots pa at US$20,000pa (assumes 10 years of producing 50m robots pa starting 2030), if they decide to go the leasing route. Elon says he thinks Optimus would be ready for purchase in 3-5 years from now, or around 2025-28.

The implications of success would be enormous. Mundane human work could be replaced by robots. Of course, there could be significant opposition to this.

Risks of Tesla achieving these outcomes are high. The numbers in this article are highly speculative and based on a hypothetical scenario that should not yet be relied upon. Please read the risks section.

This article demonstrates IF Tesla succeeds at disrupting the labor market with robots, the upside for Tesla revenue could be enormous, perhaps even as much as US$1Tpa if selling from 2030 or growing to a staggering US$10Tpa by 2040 if leasing. The latter could potentially have ~80% profit margins. Of course, significant CapEx would be required to achieve this.

A more conservative scenario where humanoid robots achieved 10% market share of the global workforce and Tesla achieved 50% share would result in US$332b pa of additional revenue from 2030 if Tesla chose to sell their robots, or by 2040 (based on a fleet of 166m leased robots at US$20K each) additional revenue of US$3.32T pa if Tesla chose to lease their robots.

Given none of this is currently priced into Tesla’s stock price, it may just be another reason to consider adding Tesla to your long-term portfolio.

As usual, all comments are welcome.

Authors’ note

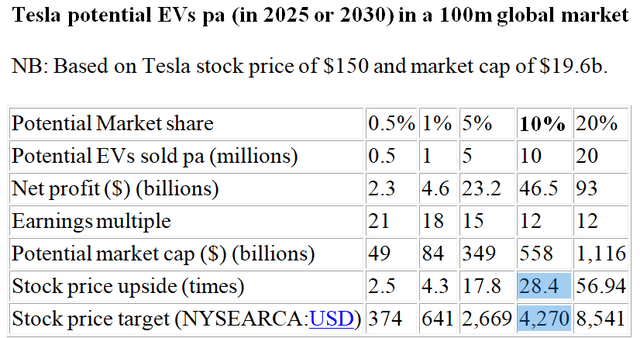

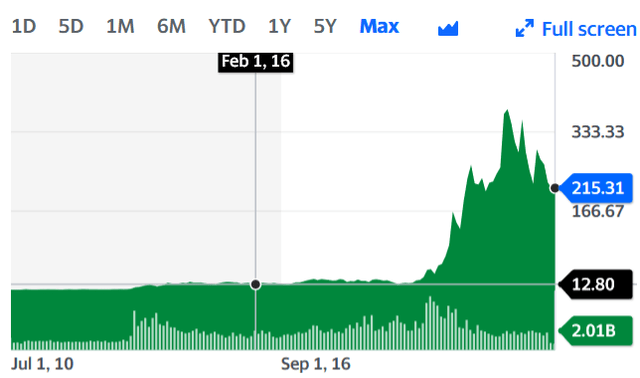

We wrote a similar article to this back in Feb. 2016 about Tesla and the implications if it disrupted the auto industry with electric vehicles.

Our 2016 article was titled “Don’t Buy A Tesla Car, Buy Their Stock Instead”. Seeking Alpha (“SA”) editors chose to reject the article (and several others on Tesla in this time period) as the article forecast a Tesla PT of US$4,270 in 2025, for 28.4x upside. We assume they thought this was crazy. Splits (5 for 1, 3 for 1) adjusted the PT equated today to US$285. Interestingly today Tesla trades at US$215.

Had SA had the foresight to publish the article (Tesla was at US$150 or US$10 per share split adjusted) investors would have achieved a nice ~21.5x return, quite close to our target of 28.4x return.

A screenshot from the Feb. 2016 Tesla unpublished article (Source: Saved word doc of Trend Investing from 2016)

Saved word doc of Trend Investing from 2016

Tesla price chart (Source: Yahoo Finance)

Be the first to comment