halbergman

Solaris Oilfield Infrastructure, Inc. (NYSE:SOI) provides efficiency, effectiveness and safety solutions to a wide range of customers in the controversial fracking industry. One of the main catalysts driving this small-cap stock of $537.924 million is that it has massively broadened its customer scope through the heavy development of an innovative and complementary product line. We can see an increase in deployment and strong EPS results that the company has delivered every quarter of this year. Although revenues decreased by 5% in Q3, SOI showed an EBITDA growth of 14%, an increase in system productivity, no debt, $10 million in cash and is still valued well under the analyst year target of $14.40.

While the stock price has fluctuated, year-to-date, shareholders have been rewarded with upward trending returns of 65.19%, as seen in the graph below.

Stock Price Trend Year to Date (SeekingAlpha.com)

The future of the oil industry is unquestionably under pressure due to its environmental impact, government interventions and unpredictable pricing. However, for a company delivering critical products to streamline processes and minimise damage within the industry, there is still a lot of upside potential. Investors may want to take a bullish stance on this company with growingly impressive fundamentals.

Investing in Technological Advancements

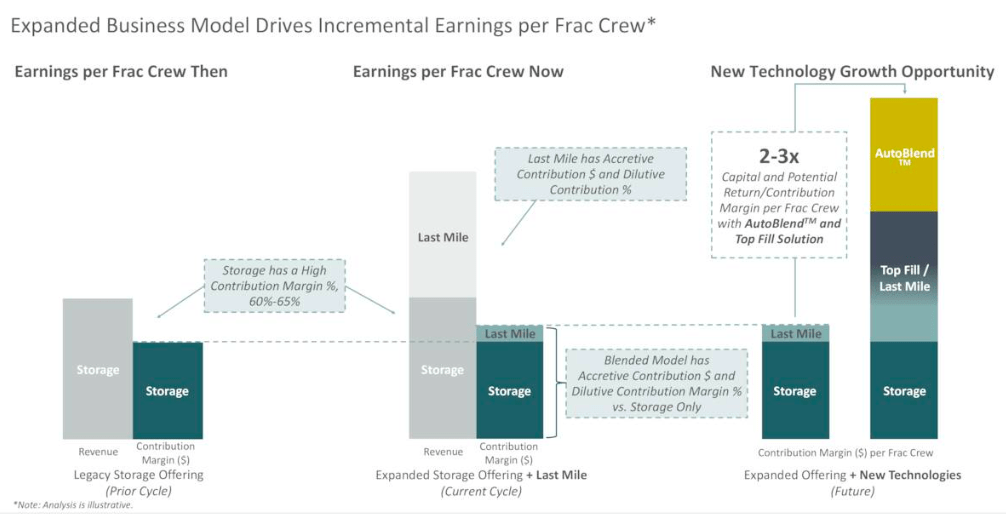

In my previous article, I gave an overview of SOI, its customers and the competitive nature of the fracking industry. SOI’s origin was in sand storage solutions. It has increased its offering to include fracking site top-fill sand loading solutions, AutoBlend blenders, water and chemical management and last-mile service solutions. As seen in the graph below, every additional offering immensely impacts the earnings potential for SOI by broadening its addressable market on the fracking site.

Growth Potential from New Offerings (Investor Presentation 2022)

Customers using the combination of solutions are proving to be sticky and increasing the use of existing offerings due to the technological benefits. They can reduce total truck miles from 20% to 40%, especially in harder-to-reach areas. The combination of solutions increases reliability and flexibility in the basins. The expanding solution deployment of existing customers and the growing number of new customers have created a backlog of demand for SOI.

Although the fourth quarter is seasonally lower performing due to the holiday period, the backlog in demand will offset the typically weaker performance. Furthermore, the company continues to invest in future technology efforts to improve its use of wet sand and aims to have a complete field function offering.

Q3 Financial Results and Valuation

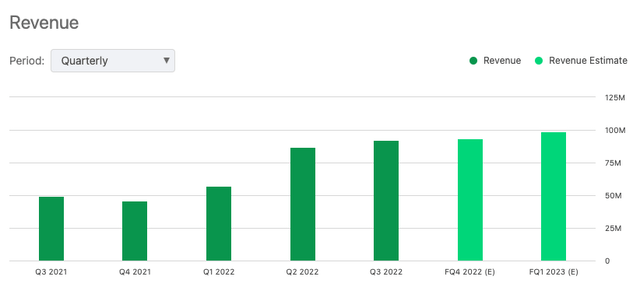

With the stock price dropping 8.49% over the last few days, we can see that the market has not reacted well to the release of SOI’s third-quarter results. However, if we look at the numbers, although revenue was 5% below analyst expectations, there is consecutive top and bottom-line growth in the company’s performance, even amidst the oil industry turmoil. Year-on-year revenues increased by 86.98 % to $92.33 million and 6.474 % from the previous quarter.

Revenue per Quarter (SeekingAlpha.com)

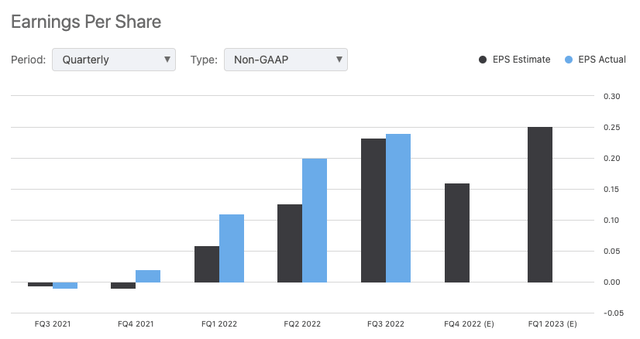

SOI’s net earnings were $11.512 million in this third quarter of 2022, an increase of 703.91% from one year prior. Furthermore, the company has seen better profit margins, with a net margin increase of 12.47% and operating margins of 15.15%.

Earnings Per Share Quarterly Growth (SeekingAlpha.com)

In Q3, SOI had a capital expenditure of $27.2 million. The company will continue to invest between $15 and $20 million in new technology deployments in the last quarter. Furthermore, due to the increased demand, SOI has given capital expenditure estimates of $75 million for 2023.The company has a healthy balance sheet. It has $10.4 million in cash and total liquidity if you include credit facilities of $54.4 million for the third quarter. It had a negative free cash flow and negative working capital of $5.7 and 2.6 million due to the rise in growth.

SOI has had a consistent dividend payment program for sixteen consecutive quarters. In Q3, it paid a dividend distribution of $4.9 million and $107 million in cash to shareholders since 2018.

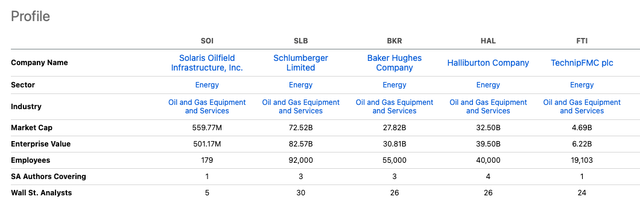

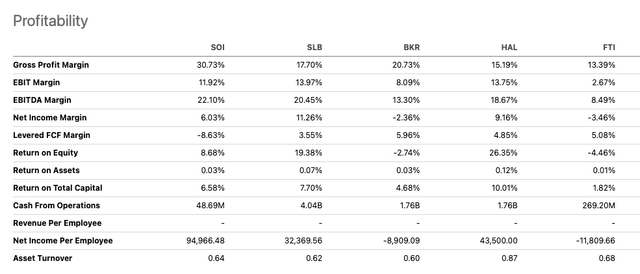

If we compare SOI, a minor player in the highly competitive oil and gas equipment and services industry, to the largest companies in the industry, as seen in the table below, we can see that although much smaller in size, it has delivered strong results through innovative and sought-after technological solutions.

Industry Comparison (SeekingAlpha.com)

The company’s gross profit margin is above the top of the industry at 30.73% and it has an upward and high EBITDA margin of 22.10%

Company profitability comparison (SeekingAlpha.com)

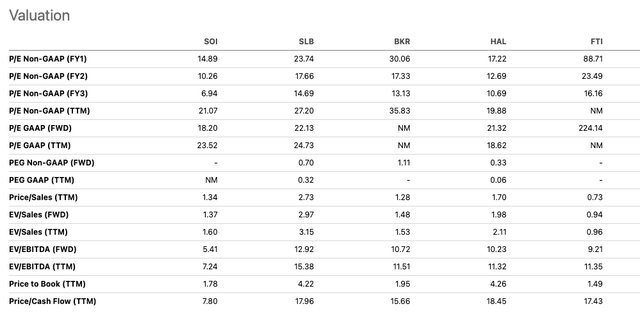

The forward-looking price-to-earnings ratio is also promising, which suggests that the company may be undervalued in the future, although it currently has a high P/E ratio of 23.52.

Company relative valuation (SeekingAlpha.com)

Risks

One of the issues to be cautious of is that most of SOI’s revenue comes from a small number of large customers. The largest customer accounted for more than 20% of the total revenues. However, SOI is increasing a more comprehensive range of its existing customer value and growing its customer base through new offerings.

Furthermore, SOI has increased its offerings over the last year, which means that things have grown and become more complex on the backend of the company. SOI is dealing with more third-party manufacturers, a higher number of units to produce, inventory issues, pricing negotiations and an increased number of unforeseen incidents that can arise with adjusting to the growing business. There is a risk that the company needs to have the internal capacity and processes to handle the growth diligently, and changes in the future might be required to have a better hold on the costs and management of the business.

Final Thoughts

SOI has had an upward-trending top and bottom line performance this year, and it has been increasing its utility on the fracking sites. New and existing customers are benefiting from its unique solutions, and there is a growing demand resulting in a backlog which will help the final quarter. The company is confident in its offerings and estimates further Capex expenditure to meet the ever-increasing demand building well into 2023. The stock price is well under the analyst estimates with more room to grow and looks undervalued if we look at more pricey and bigger competitors in the sector. Investors may want to take a bullish stance on this company.

Be the first to comment