Thomas Barwick

In recent years, the supply chain has become incredibly important. Strong demand combined with supply constraints has led to a number of problems, the biggest of which is inflation. But not every company has suffered during this timeframe. Some, particularly those that are integrally connected with the supply chain, have benefited. A great example of this can be seen by looking at WESCO International (NYSE:WCC). This enterprise has its hands in a few different areas. For instance, it does provide products and supply chain solutions to other businesses, with examples of products being fasteners, cutting tools, safety products, and more. It’s also involved in network infrastructure, security, and other related activities as well. On the supply side of things, it’s focused on offering inventory management and product packaging for its customers. Truly, the list goes on. Recently, fundamental performance achieved by the company has been rather strong. And when you consider the expectation for the near term, the company looks quite cheap as well. Although the company is not the cheapest player in the space, it does seem to offer some upside potential moving forward. And as such, I’ve decided to increase my rating on the business from a ‘hold’ to a soft ‘buy’.

Understanding recent strength

Back in January of this year, I wrote an article that took something of a neutral stance on WESCO International. I acknowledged at that time that the company had exhibited rapid growth over the past few years, driven in part by acquisition activities that it had engaged in. I also said that the company’s future was looking bright. Having said that, I felt like, at the time, its stock was more or less fairly valued. This led me to rate the company a ‘hold’, reflecting my belief that its shares would experience returns that are more or less similar to what the broader market would. Since then, however, I have proven to be quite wrong. While the S&P 500 has dropped by 6%, shares of WESCO International have generated a return for investors of 11.7%.

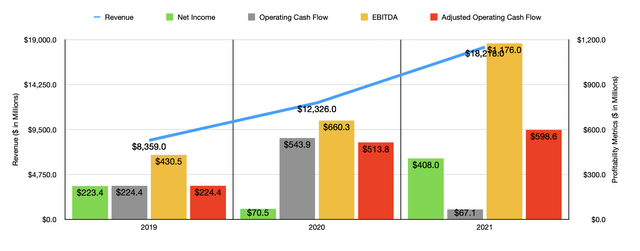

This increase in share price is no coincidence. To understand exactly why it happened, we need only look at recent financial performance. Consider, for starters, how the business finished off its 2021 fiscal year. Sales for the year came in at $18.22 billion. That represents an increase of 47.8% over the $12.33 billion generated just one year earlier. Much of this increase came as a result of the company’s merger with Anixter back in late 2020. However, the company did site double-digit growth across all segments, while price increases helped to the tune of 3%. Unfortunately, management doesn’t give a more specific breakdown of the details. So we can’t know exactly how much of the increase was attributed to other causes like increased volume of goods shipped.

This strength in sales brought with it a rise in profitability. Net income shot up from $70.5 million in 2020 to $408 million last year. Operating cash flow for the business declined from $543.9 million to $67.1 million. But if we adjust for changes in working capital, it would have risen from $513.8 million to $598.6 million. Meanwhile, EBITDA for the company also increased, climbing from $660.3 million to $1.18 billion.

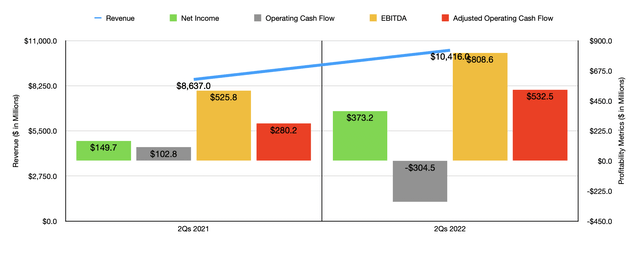

Strength for the company has continued into the 2022 fiscal year. According to management, revenue in the first half of the year came in strong at $10.42 billion. That’s 20.6% higher than the $8.64 billion generated in the first half of 2021. Unlike from 2020 to 2021 when we saw a significant portion of the increase in sales attributed to its aforementioned merger, the increase from 2021 to 2022 was driven by strong organic sales growth of 21%. Growth was strongest under the UBS segment of the company, which focuses on utility and broadband solutions. Year over year, growth here was 29.5%, driven by the passing on of rising costs to customers and as the number of workdays positively impacted the company to the tune of 0.8%.

Naturally, this had a positive impact on profitability as well. Net income rose from $149.7 million in the first half of last year to $373.2 million the same time this year. Operating cash flow went from $102.8 million to negative $304.5 million. But if we adjust for changes in working capital, it actually would have nearly doubled from $280.2 million to $532.5 million. Meanwhile, EBITDA for the company grew nicely, shooting up from $525.8 million to $808.6 million.

For the 2022 fiscal year as a whole, management has some pretty bullish expectations. Revenue, for instance, should grow by between 16% and 18% year over year. At the midpoint, that would translate to sales of $21.32 billion. Earnings per share, meanwhile, should come in at between $15.60 and $16.40. At the midpoint, this will translate to net income of $835.52 million. The company is also forecasting EBITDA of $1.68 billion. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA should, then we should anticipate a reading, net of preferred distributions, of $797.7 million. Normally, preferred distributions are not stripped out from operating cash flow. In fact, they never are. But because I see them as a mandatory cash outflow, I do like to strip them out to see the amount of cash flow going to common shareholders.

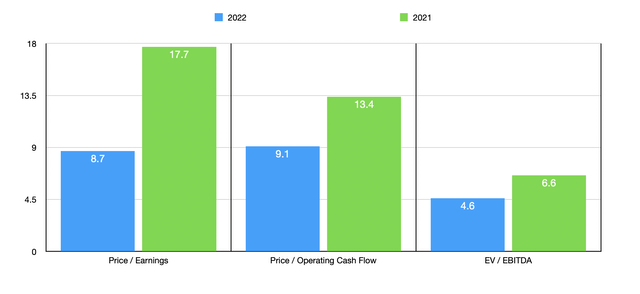

Using these figures, we can see that the company is trading at a forward price-to-earnings multiple of 8.7. This compares to the 17.7 reading we get using 2021 figures. The price to adjusted operating cash flow multiple should be 9.1, down from the 13.4 reading we get using last year’s results. And the EV to EBITDA multiple should decline from 6.6 to 4.6. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, using our forward figures, these companies ranged from a low of 2.6 to a high of 8.5. In this case, WESCO International was the most expensive of the group. Using the price to operating cash flow approach, the range was from 3.2 to 11.3. That’s for the four companies that had positive multiples. In this case, three of those four were cheaper than our prospect. And finally, when it comes to the EV to EBITDA approach, the range is from 2.6 to 10.7. In this scenario, only one company was cheaper than our prospect, while two others were tied with it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| WESCO International | 8.7 | 9.1 | 4.6 |

| BlueLinx Holdings (BXC) | 2.6 | 3.2 | 2.6 |

| Veritiv Corporation (VRTV) | 6.6 | 7.0 | 5.5 |

| Hudson Technologies (HDSN) | 5.9 | 11.3 | 4.6 |

| Marubeni Corporation (OTCPK:MARUY) | 5.6 | 4.4 | 10.7 |

| Barloworld Limited (OTCPK:BRRAY) | 8.5 | N/A | 4.6 |

Takeaway

Based on all the data presented here, it seems clear to me that the rest of this year should be rather bullish for WESCO International. The company is doing incredibly well in the current environment and shares are trading cheaper than when I last wrote about it even though the share prices are higher. It is true that, at least from an earnings perspective, there might be a number of cheaper players out there. But on the whole, the company does look cheap on a forward basis. Because of this, I’ve decided to change my rating on the company from a ‘hold’ to a ‘buy’.

Be the first to comment