urbazon/E+ via Getty Images

Shortly after the pandemic began in April 2020 I wrote an article titled Lyft’s Valuation Won’t Survive Coronavirus.

It wasn’t a particularly bold call. Lyft’s (NASDAQ:LYFT) business was already showing signs of being one dimensional and it was clear the stay-at-home environment was going to put a strain on revenues.

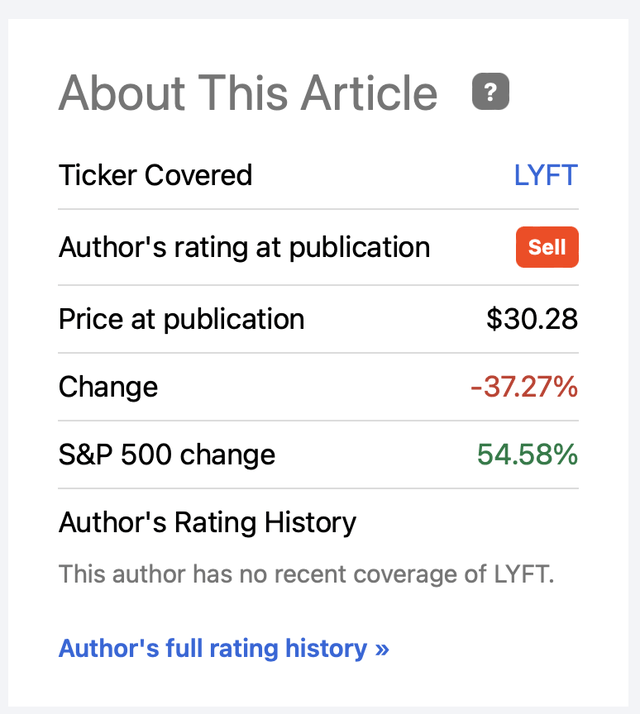

Considering Lyft is down 37% since publication while the S&P 500 is up 54% during the same time frame, I wanted to revisit Lyft to see if it’s ripe to outperform.

Seeking Alpha

There are some things to like.

- 2022 revenue estimate is $4.1B (28.5% growth)

- 2023 revenue estimate is $5.07B (22.9% growth)

Current market cap for Lyft is under $7B meaning the multiple is particularly attractive from a sales perspective.

The challenge is Lyft and its peers used to receive a premium valuation because the idea of self-driving, delivering an array of goods, and massive shifts from owning cars was seen as possible.

Now, essentially Lyft is just a last mile delivery service. The market doesn’t put a premium multiple on last mile trucking companies – Lyft’s not an exception.

That being said, the premium has been drained from Lyft enough that several scenarios could drive the multiple higher. Let’s start with the most obvious one, and that is profits.

Profits

One primary thesis to be long Lyft is rooted in the belief the company can scale its platform large enough that it prints money for shareholders.

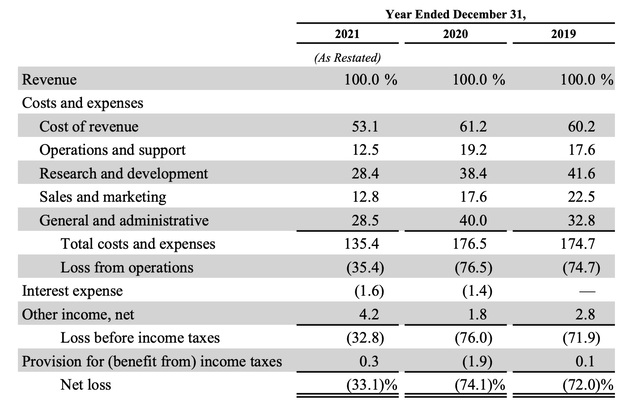

We are seeing some evidence when it relates to costs and expenses.

Lyft 2021 10-K Annual Report

Clearly Lyft’s costs being 135.4% of revenue in 2021 isn’t ideal, but a big improvement over the previous two years when it was closer to 175%.

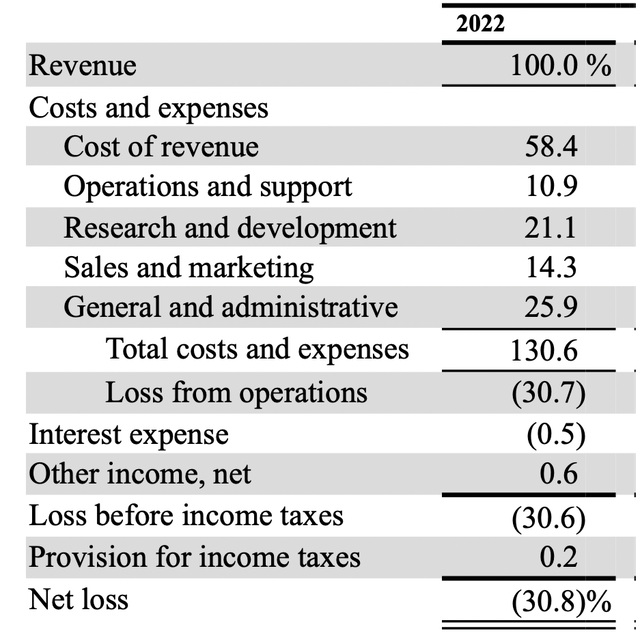

First 6 Months Of 2022 (Lyft Q2/2022 10-Q)

We are seeing follow through by Lyft during the first half of 2022. Total costs and expenses were 130.6% of revenue.

Looking out to the future, Lyft recently provided guidance into 2024:

As we look out to 2024, we are targeting adjusted EBITDA of $1 billion with over $700 million of free cash flow.

CEO Logan Green Q2 2022 Conference Call

Clearly these targets aren’t resonating with investors when Lyft is down over 55% year to date. Additionally, it seems ambitious of Lyft based on current results and revenue estimates for 2024.

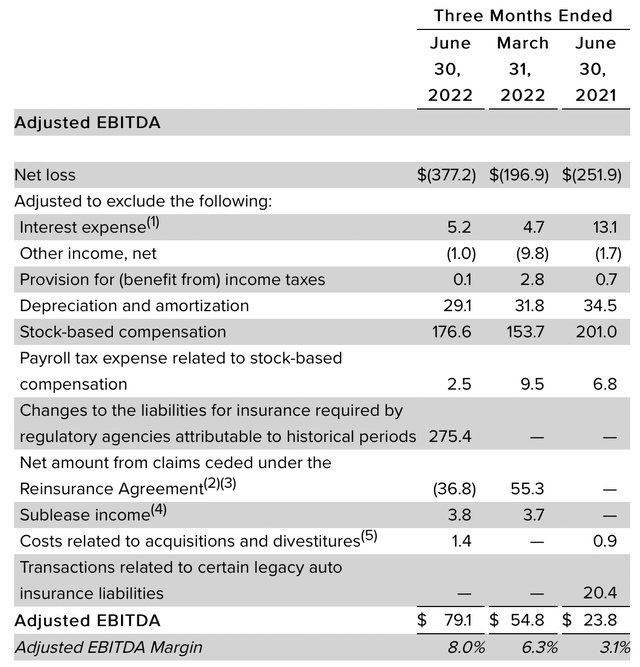

Lyft Q2 Earnings Press Release

Wall Street estimates are for around $6B in revenue for 2024, roughly $2B, or 50% higher than this years projected revenue total of $4B.

Lyft achieved record Adjusted EBITDA in Q2 of $79.1M. In order for this to be on a $1B run rate, this total would need to be over 3x higher in 18 months.

Certainly doable, as the company essentially did this Y/Y on revenue growth around 30%.

Lyft gave some ideas on the Q2 earnings call on how Lyft is going to triple adjusted EBITDA in 18 months.

On the $1 billion target for 2024, there’s four key levers to get there. The first is overall rideshare market growth. Second is pricing. And along with that, changes in ride mix and modes and the sort of revenue management behind that. Third is the impact on our work to drive efficiency in the marketplace. And finally is overall operating leverage.

CEO Logan Green Q2 2022 Conference Call

Let’s unpack the CEO’s response. On the demand side, Lyft is applying a straight line demand increase and assumes Lyft will capture an equal share. Probably a fair assumption, given Lyft’s market penetration. However, it ignores the fact GDP growth has turned negative in the United States and the tailwind of travel and “back to work” trends could lag over the next few years.

His second point is pricing. Can Lyft raise pricing in a cooling economy stretched by inflation? Isn’t Lyft handcuffed to what Uber (UBER) does on pricing, let alone the other alternative transportation methods?

The third point of “ride mix and modes” is a choice the consumer makes based on factors Lyft can’t control other than pricing.

Finally, efficiency and operating levers are largely controlled by Lyft – but based on the track record of the company, is anyone confident it will be executed flawlessly?

Sure, if the macro environment is good, ride-sharing usage keeps climbing and Lyft can raise prices there’s no reason why the company couldn’t adjust its way into a $1B EBITDA number.

Additionally the stock’s multiple from a forward 2024 sale perspective would be around 1x – so understand $1B in EBITDA, even adjusted, isn’t paying a huge price.

However, the key point is this would be adjusted EBITDA five years after the stock went public. Is that really going to be enough to drive Lyft’s stock higher?

Expansion

What would really drive Lyft’s multiple is expansion into something other than last mile delivery. It truly doesn’t matter if Lyft is delivering food, packages or people – the market just isn’t going to pay a huge multiple. UPS (UPS), FedEx (FDX), XPO (XPO) all trade at price-to-sales ratios under 2.0 and these are profitable companies, some of which pay dividends and have large buybacks.

This idea that Lyft can just deliver people or groceries and expand its multiple is asking a lot.

We’ve seen some movement by Lyft recently to try and expand into new opportunities. Recently the company announced Lyft Media; an array of ad formats from basic billboard type display on the cars to in-app add-ons.

Lyft Media Site

This certainly comes at difficult time in the ad space with Meta (META) growth turning negative and Google (GOOG, GOOGL) tamping down expectations. Let alone Snapchat’s (SNAP) dramatic 80% fall.

Advertisers are pulling back on ad spend from tried and true methods, it seems unlikely Lyft generates significant traction from advertising revenue in this environment.

The elephant in the room with Lyft, or any delivery service for that matter, is autonomous delivery. For the most part Lyft is relying on an array of partners to develop self-driving; which certainly has helped Lyft from a cash burn perspective.

The challenge is if/when autonomous is ready to become a significant method of delivery, would Lyft be in a position to dominate?

When it comes to transporting people, Amazon (AMZN) owned Zoox’s is already seeking approval in California. Tesla (TSLA), via The Boring Company, is already transporting people in Las Vegas. These are just the recent headlines and the projects the public is aware of.

The main point is, once autonomous crosses into the mainstream, Lyft’s competitive advantage is likely to shrink. Given that Lyft has little proprietary technology that’s superior to a mega cap company – we have to assume a possible outcome of autonomy is Lyft gets passed by.

The Bottom Line

Investors have to ignore the fact Lyft doesn’t generate GAAP profits and won’t into 2024. In that sense Lyft stock isn’t wildly overvalued. However without profits or a proprietary advantage, investors aren’t going to pay a premium multiple on sales. Some investors think autonomous delivery will save Lyft – but it will only usher in competition from companies with more resources. I would avoid Lyft.

Be the first to comment