spooh/E+ via Getty Images

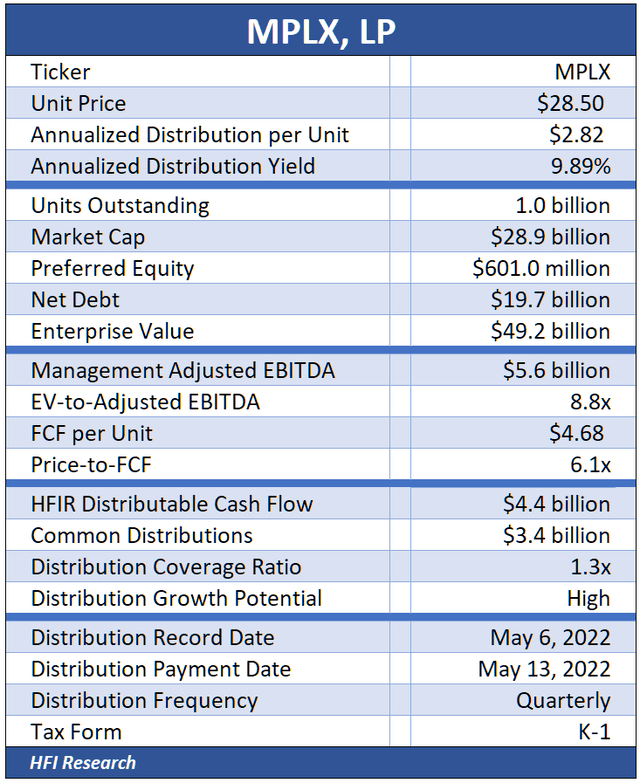

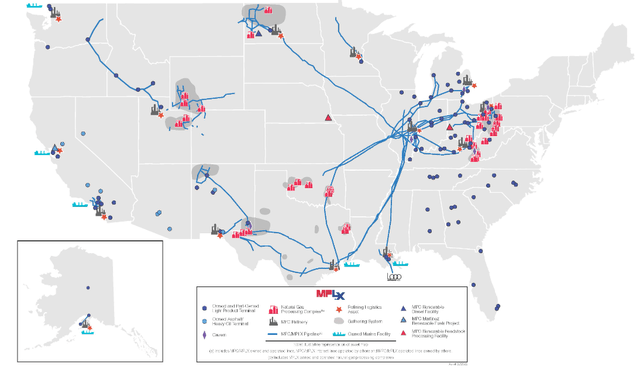

MPLX LP (NYSE:MPLX) operates a diversified midstream system with long-haul pipelines and storage assets that serve Marathon Petroleum Corp. (MPC) refineries and gathering and processing (G&P) operations spread across various shale basins. Its asset footprint is shown below.

MPC, the largest crude oil refiner in the U.S. by capacity, is MPLX’s sponsor. MPC owns MPLX’s general partner, 64% of MPLX’s outstanding units, and accounts for 50% of its revenue. MPLX gathers crude as feedstock for MPC’s refineries, transports it to the refineries through its logistics assets, and transports the refined products to demand centers.

Many of MPLX’s pipelines connect to MPC refineries. As such they involve minimal or no competition. MPLX’s contracts with MPC are fee-based and are priced at market rates. They contain inflation escalators tied to the FERC index and include minimum volume commitments (MVCs) that protect MPLX’s throughput volumes. The MVCs bolstered MPLX’s cash flows in 2020 when MPC’s throughput volumes fell.

MPC’s sponsorship benefits MPLX by ensuring that its major investments have a steady source of supply and demand. The relationship allows MPLX to reduce the risk of its projects and helps ensure attractive long-term returns.

MPLX’s G&P segment has seen its throughput decline over the past few years. However, volumes have recently stabilized on a year-over-year basis amid a revival in drilling activity. Management previously intended to sell off “non-core,” or underperforming, G&P assets, but as cash flow improved, it has decided to stick with the assets.

MPLX’s Operational Results

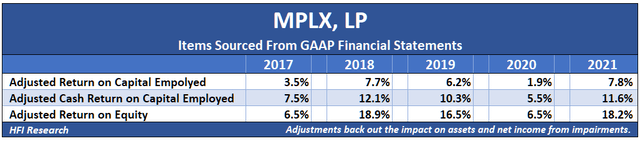

MPLX generates above-average returns on capital employed and equity for the midstream sector. Aside from 2020, when performance was adversely impacted during the industrywide downturn, MPLX has generated a high-single-digit return on capital and a mid-to-high-teens return on equity.

Recent returns have been flattered by significant asset write-downs taken in previous years, primarily in the G&P segment. If we adjust net income and asset value to remove the impact of impairments on returns, the results remain impressive, as shown below.

These higher-than-average returns are attributable to the favorable terms MPLX receives in its contracts with MPC.

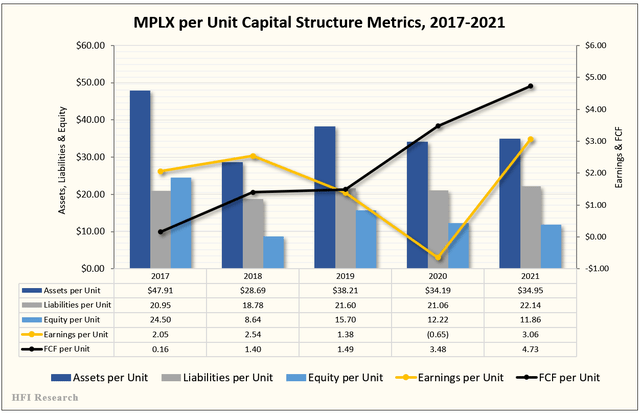

MPLX’s returns translate into robust free cash flow, which has increased steadily on a per-unit basis since 2017, as shown in the black line in the chart below.

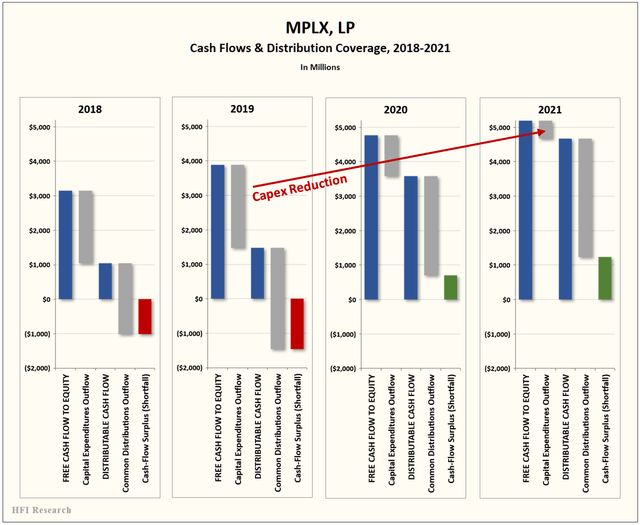

Before 2020, the company routinely plowed free cash flow into growth projects. As a result, during this time, it operated at a cash flow deficit. However, in 2020 MPLX shifted its focus from growth to capital discipline, which caused it to generate a cash flow surplus in 2020 and 2021.

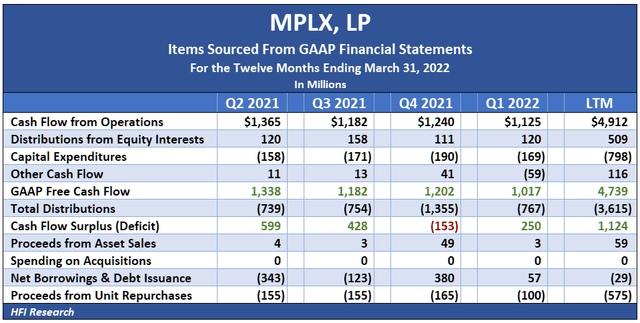

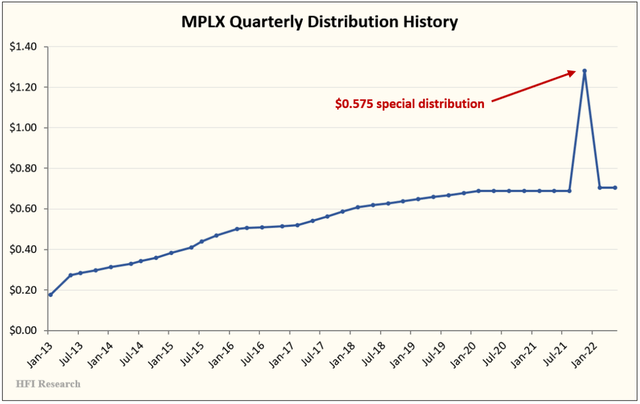

In 2021, MPLX used its cash flow surplus to pay down debt, repurchase units, and increase distributions to unitholders. In the third quarter of 2021, it paid a large special distribution to unitholders. Its last four quarters’ cash flows are shown in the table below.

In light of how cheap MPLX’s units have been since 2020, we view repurchases as the highest-value way to return capital to unitholders.

MPLX’s distribution increases are in line with its long-term distribution history.

The current regular distribution is well covered at 1.4-times our estimate of distributable cash flow. We expect distributions and unit repurchases to continue over both the near term and long term.

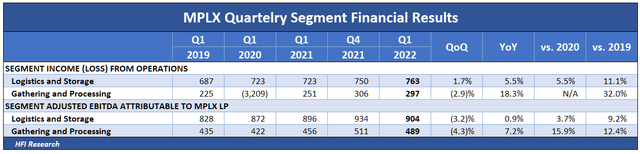

Looking at first-quarter segment results, MPLX’s G&P segment results showed a marked improvement primarily attributable to increasing volumes. Logistics and Storage segment results were driven by increases in throughput volumes and income from equity investments.

MPLX’s Liabilities and Risks

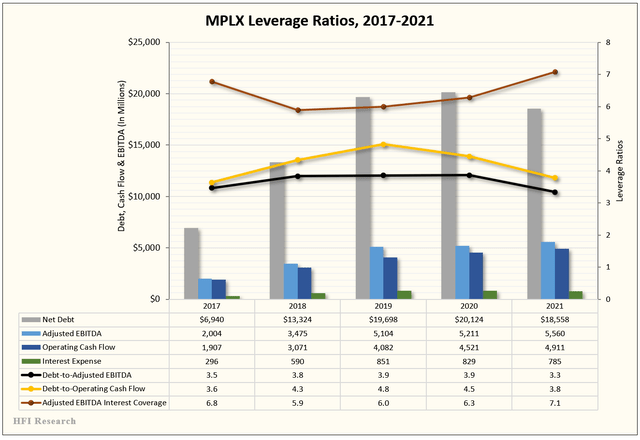

MPLX’s leverage is at reasonable levels, not particularly high or low. Annual leverage ratios since 2017 are shown in the following chart.

Debt ticked up in the first quarter of 2022, which brought the leverage ratio to 3.6-times by quarter-end.

MPLX’s reasonable leverage level, supportive relationship with its sponsor, and geographical and operational diversification translate into stable cash flow under virtually all energy market or macroeconomic conditions. Management has been among the best in the midstream sector at reining in capex and stepping up its return of capital to unitholders. These attributes make MPLX’s massive 9.9% distribution one of the safest and most attractive in the sector. The distribution is also likely to grow over the coming years as its fee income increases organically and as recent years’ capital investments bear fruit.

Valuation

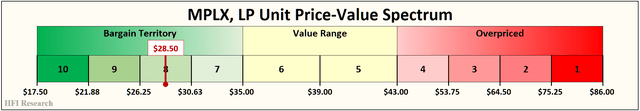

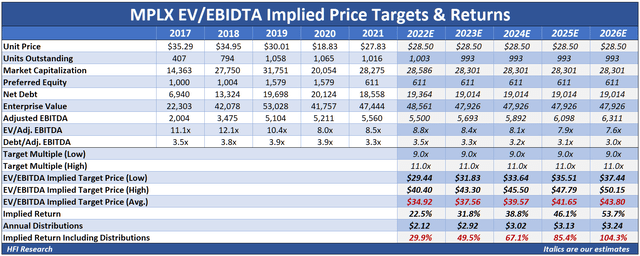

To top it off, MPLX’s units are cheap. We value them in the range of $35 to $43. Our price target is $39, the middle of the range. The units offer 36.8% upside to reach our price target.

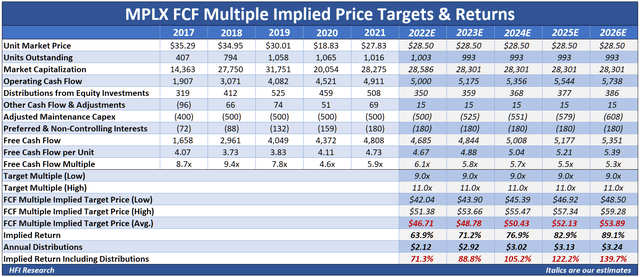

Our valuations assume MPLX generates a cash flow surplus in 2022 and 2023 and that it pays down debt by $350 million and repurchases $250 million of units in both of those years. Operating cash flow and distributions both increased by 3.5%.

Our valuation using free cash flow multiples implies MPLX units are worth $46.71 in 2022. Including distributions, the units offer a total return of 71.3%. The total return increases to 139.7% over the next five years.

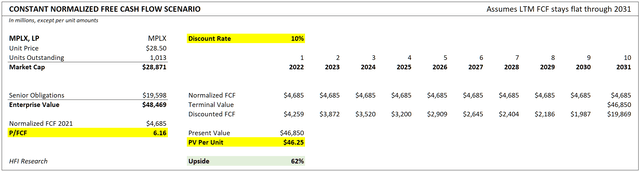

Our discounted cash flow scenario that assumes free cash flow remains flat over the next ten years values the units at $46.25, which equates to 62% upside from the current price.

Our EV/EBITDA valuation implies a lower valuation than our cash flow valuations. It values MPLX units at $34.92 in 2022. Including distributions, the units offer a 29.9% return from their current price. The total return increases to 104.3% by the end of 2026.

Conclusion

MPLX offers income investors the complete package. Its units sport a massive 9.9% yield that is well-covered and resistant to inflation. Its distributions are likely to increase. As long as the units remain depressed, management is likely to continue with accretive repurchases. And to top it off, the units are cheap, offering a large margin of safety to buyers at the current price.

We’d note that if MPLX’s yield compressed to 7.5% to match that of its major midstream peers, its units would trade at $37.60, only slightly less than our price target. For all these reasons, MPLX remains one of our favorite equities in the midstream sector, and we rate its units a Buy.

Be the first to comment