AnnaRise/iStock via Getty Images

JOANN Inc. (NASDAQ:JOAN) is a specialty retailer focusing on sewing and fabric supplies within the arts and crafts category. The company rode a wave of growth during the pandemic, benefiting from the “stay at home” theme, boosting sales leading up to its 2021 IPO. On the other hand, the operating and financial trends over the past year have largely disappointed sending shares nearly 50% below their all-time high.

Indeed, Joann reported its latest quarterly results with a widening loss and weak sales. While the current macro environment is part of the issue, we believe the company has some deep fundamental issues that will make a real turnaround difficult to achieve. Simply put, Joann is over-leveraged and burning cash while its long-term growth strategy faces significant uncertainties. Ultimately, we believe the stock will trend lower from the current level with risks tilted to the downside.

JOAN Financials Recap

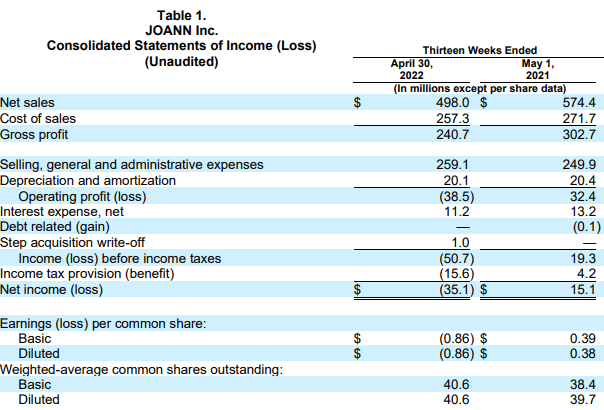

The company’s Q1 non-GAAP EPS loss of -$0.22 came in $0.30 below the consensus. Revenue of $498 million declined by 13.3% year over year and missed estimates by $19 million.

The story here was significant supply chain disruptions limiting some inventory availability and hitting profitability. This was evident as the gross margin of 48.3% fell from 52.6% in the period last year. On this point, management is citing $28.9 million in “excess import freight costs” highlighting the cost pressures. This amount is excluded to arrive at an adjusted EBITDA of $18.6 million in the quarter which was nevertheless down from $57.5 million in Q1 2021.

source: company IR

Many of the comments from management during the earnings conference call focused on projecting some optimism. The company has grown from pre-pandemic levels, and its measure of an “adjusted gross margin” by removing the freight impact was actually up from last year. A development has been an effort to remodel stores, completing nine location refreshes this year thus far with another 27 expected by year-end which is part of its growth strategy.

While the company is not providing formal guidance, the outlook is that conditions have already improved slightly into Q2. The expectation is that comparable sales continue to “decline in the mid-to-high single-digits” for the next two to three quarters against tough 2021 comps before stabilizing or growing year over in 2023.

source: company IR

Is JOAN A Good Long-Term Investment?

We mentioned poor fundamentals are likely the biggest headwind against shares of JOAN right now. We note the company ended the quarter with $22.3 million in cash against $931 million in net long-term debt. From this amount, a reported adjusted EBITDA over the past year at $204 million implies a net leverage ratio of 4.4x. While this is the figure used to stay current with the company’s credit facility, the current run rate is even worse considering the adjusted EBITDA in Q1 included some accounting gymnastics.

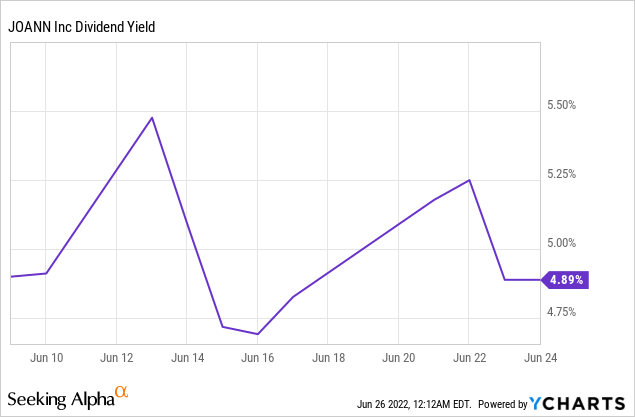

On a cash basis, the company burned around $100 million in free cash flow during Q1 which is expected to remain negative for the next few quarters at least. Investors should also start thinking about the quarterly dividend of $0.11 which currently yields 5% and represents an annual payout of around $20 million. While there’s room for the distribution to be maintained over the next few quarters, the current cash flow trends are not sustainable in our opinion. Again, management believes conditions will improve, but the bigger point here is that the “bullish” case for Joann will be hard to string together.

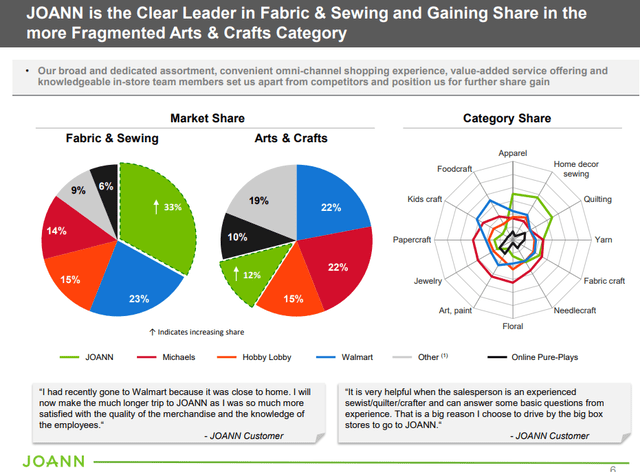

The attraction of Joann stores is that it serves the “Creative Products Industry” specializing in sewing materials and supplies for arts & crafts projects. In many ways, the company’s growth over the last few years parallels the success of platforms like Etsy Inc. (ETSY) which serves as a marketplace for creatives that sell their handmade goods, often based on materials from Joann. There is also a dynamic where social media platforms like Pinterest Inc. (PINS), “YouTube” from Alphabet Inc. (GOOGL), and even “Instagram” from Meta Platforms Inc. (META) have added visibility to the crafts.

source: company IR

The argument we have is that beyond the unique pandemic circumstances, the growth outlook is relatively limited. Joann as a fabric & sewing category leader ends up competing with much larger players including Walmart Inc. (WMT), privately-held “Michaels Stores” and “Hobby Lobby” which offer some of the same core arts & crafts merchandise that serve the needs of a large group of customers.

In other words, Joann appears to be too niche to generate the growth necessary to kick off a full financial turnaround. Anecdotally, the addressable market may be a certain size, but adding new locations won’t necessarily expand the pie if core shoppers are already finding the merchandise through other channels. The competitors here are also looking at the same opportunities.

JOAN Stock Price Forecast

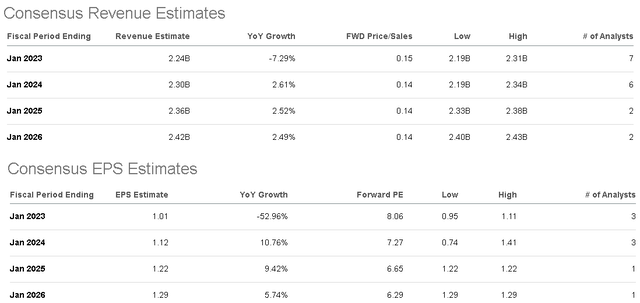

According to consensus estimates, the forecast is for full-year revenue at $2.2 billion, representing a decline of 7.3% y/y. Based on the trends in Q1, the company will need a much stronger second half to hit that target which is far from certain. Looking ahead, the expectation is for top-line growth in the 2-3% range per year through 2025 which is hardly a level to get excited about.

On the earnings side, from the full-year EPS estimate of $1.01, down 53% y/y, before rebounding over the next few years. As it relates to valuation, the forward P/E of 8.1x may give an impression that this is a “value stock”, but the other side to the argument is that the poor trends and recent results justify a discount making JOAN more of a “value trap”. The bearish case here is that its operating and financial trends will continue to underperform amid the weak macro environment and the stock can get even cheaper.

Seeking Alpha

In terms of a price target, shares traded as low as $6.23 in early June which we believe is a level that remains in play. Weaker than expected results going forward can force a reassessment of the long-term earnings outlook. On the upside, only a clear breakout above $10.00 will confirm more positive momentum.

Seeking Alpha

Final Thoughts

We rate JOAN as a sell. This is exactly the type of stock the market has tended to punish particularly with its high debt position and exposure to a challenging consumer spending environment. Beyond the macro outlook and conditions for equities as an asset class, JOAN should underperform based on its company-specific factors. Monitoring points over the next few quarters include the trends in margins as well as the cash flow levels.

Be the first to comment