Dimitrios Kambouris/Getty Images Entertainment

Introduction

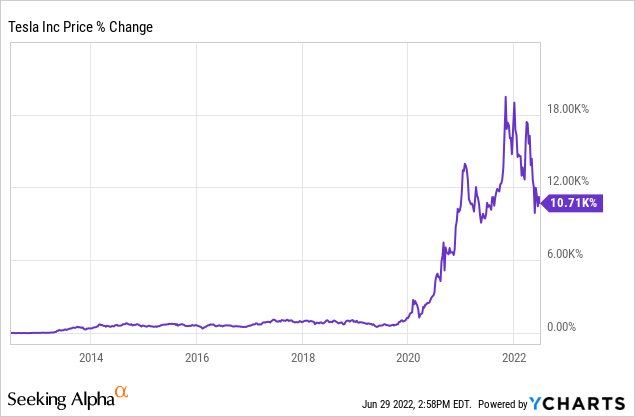

Tesla (NASDAQ:TSLA) has been one of the best-performing stocks over the past decade; its shares defied gravity as it skyrocketed from $6 (split-adjusted) to $674 a piece, thus enriching many die-hard Elon Musk/Tesla loyalists.

That success was further cemented when Standard & Poor’s finally added Tesla to the coveted S&P 500 index. Tesla, led by Elon Musk, a man I believe to be one of the smartest alive, reached what were once unimaginable heights:

Tesla (and Elon Musk) transformed electric cars in the US from novelty to commonplace.

But at the end of the day, valuation does matter. If the valuation doesn’t matter it’s not an investment, it’s a speculation, not unlike the speculation-induced Tulip Mania, Beanie Baby Mania, or the more recent, Crypto Mania.

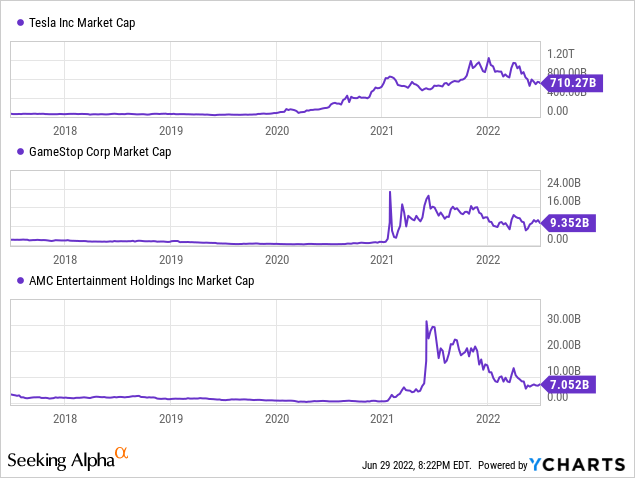

And in the case of Tesla, despite all its innovation, at around $710 Billion in market cap, I can only compare its valuation to the “Meme Stock Mania” of early 2021.

Why do I call Tesla a meme-stock?

Because Tesla meets all the requirements of a meme-stock:

- Unjustifiably and highly valued (see the section on valuation below)

- Cult like following (especially on Reddit)

- High volatility (just look at the chart above, down over $500B)

- A CEO who is proud to be known as “Lorde Edge“

Need I say more?

Within this article I’ll be examining:

- Tesla’s growth and financial performance

- The risks Tesla faces

- My assessment of fair value for Tesla’s shares

Tesla’s Growth Story

Let’s start with Tesla’s financial performance so we can get a better understanding of how Tesla grew its cult-like status.

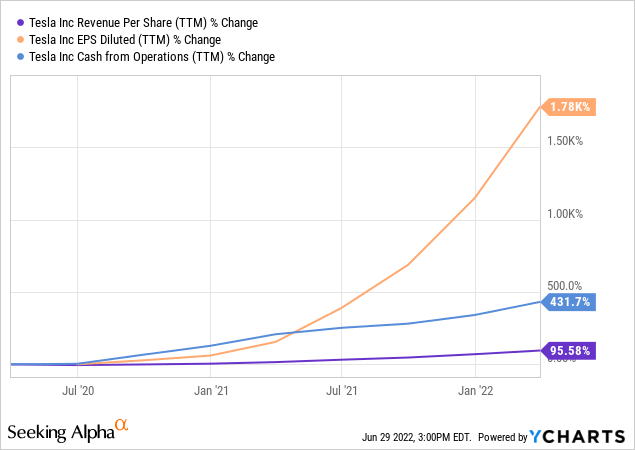

Revenue, Cash Flow, Earnings Growth

The chart above is nothing short of spectacular, in just a bit more than two years Tesla’s revenues per share nearly doubled, CFO per share are up 431% and earnings are up over 1000%!

I’m particularly impressed with how strongly they’ve grown their cash flow from operations which I believe is a more accurate barometer of business performance than earnings are.

With such strong growth let’s look at how well Tesla has allocated capital.

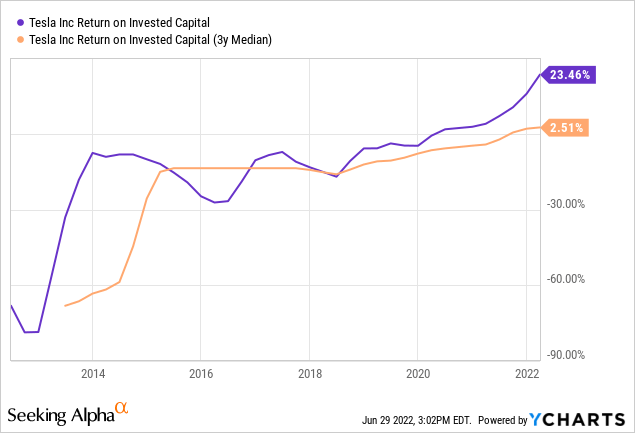

Return on Invested Capital

In contrast to revenue growth, Tesla’s ROIC is, in my opinion, very weak. Tesla’s ROIC levels were consistently negative over the entire decade up until 2020. And with Tesla’s investments in Bitcoin, and subsequent choppiness of its earnings (due to mark-downs, and mark-ups).

Because of their investments, I’m not convinced that earnings are the best metric by which to assess Tesla’s value; it certainly should not be the only metric used to value them. In other words, I think we should take the recent spike to 20%+ ROIC levels with a grain of salt.

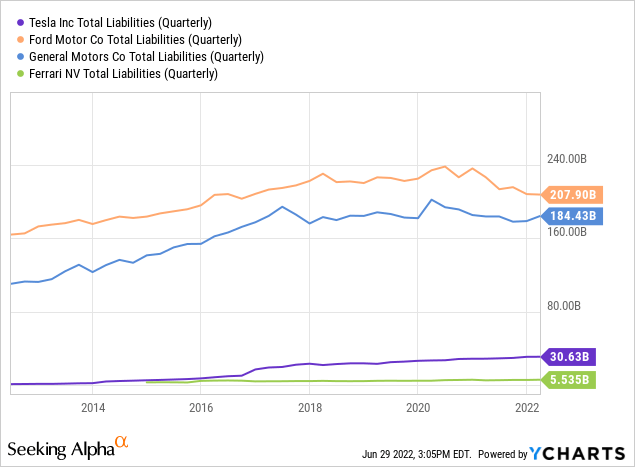

Tesla Long Term Liabilities

One strength for Tesla is its balance sheet. Holding around $31B in long-term liabilities, Tesla is far less indebted than the old stalwarts Ford and GM. In the case of GM and Ford, much of that debt is due to the role they play in helping consumers finance the purchase of a car from a dealership, making it somewhat more difficult to get an apples-to-apples comparison versus Tesla. Even so, less debt should give Tesla a better chance to survive a downturn.

Another reason Tesla has been able to avoid becoming overly indebted is due to its share issuances.

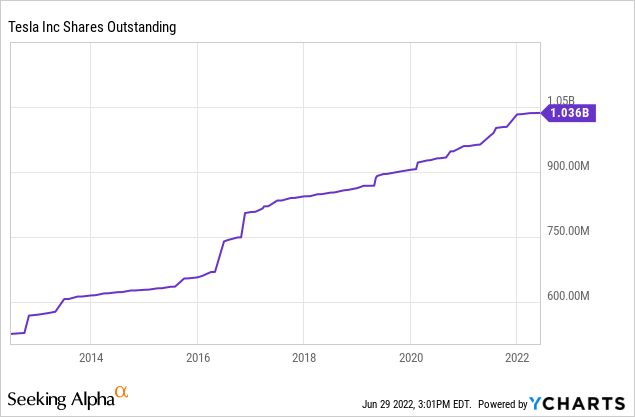

Share Count Changes

To help finance its “electric” growth, Tesla issued hundreds of millions of shares, both to raise capital, and to pay employees. Normally I’d be against this strategy, I despise dilution, but Tesla, being, in my view, highly overvalued, made the right decision here and took advantage of its “meme-stock” status by issuing shares.

Tesla Faces Many Risks

For this article I’ve identified a few headwinds that could impair Tesla’s growth story in the years to come, those being: Chinese competitors, recessionary concerns, and Elon Musk becoming increasingly distracted.

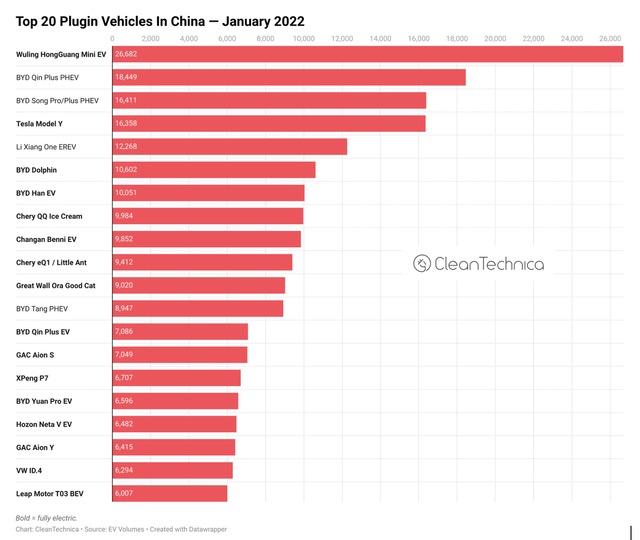

Chinese Competitors: Unlike the US, the Chinese EV market is well developed, Chinese companies like BYD (OTCPK:BYDDY) dominate their local markets taking up the top 3 spots for most sold EV vehicles in China.

Given the prevalence of EVs in China, and their growing manufacturing expertise I believe we could see these competitors further expand outside of China into foreign markets. Beyond the competitive threats based on the Chinese companies’ ingenuity, there is a significant risk of IP theft, as we have seen happen to companies like arm (OTCPK:SFTBY).

In an opinion piece shared in the Financial Times this April, their editorial board stated that:

One 2017 estimate put the cost to the US of stolen trade secrets, pirated software and counterfeiting by China at between $225bn and $600bn a year.

Tesla’s business in China opens it up to influence from its communist government and, in my view, increases the likelihood of IP theft around manufacturing processes and AI technology.

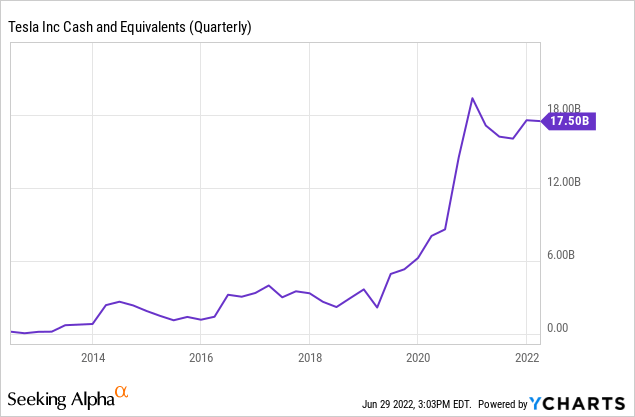

Recessionary Concerns: As Elon Musk has commented on various times in the past, car companies have a history of bankruptcy, Ford is the notable exception. One reason this happens is that in a recessionary environment consumers stop buying new cars. The implication of this is that in a recessionary environment Tesla’s revenue could crash on short notice. This increases the importance of keeping sufficient amounts of cash and access to credit on its balance sheet to weather any potential storms.

Unfortunately for Tesla, since the Fed has begun quantitative tightening debt is much more expensive and share prices are falling, making capital raises more difficult all around.

At least Tesla has 17.5B of cash on its balance sheet to help cushion a blow.

Elon Musk is Distracted: One additional concern is that Elon Musk appears to be growingly distracted from Tesla, whether it’s the Twitter deal, SpaceX, or the Boring Company, Elon Musk’s sole focus won’t be Tesla. Now I’m not saying this cannot be done, I believe Musk is more of a visionary and a product guy than a traditional ‘CEO’. So, perhaps some of his responsibilities have been offloaded to others, but it does raise the question…

How much can one man actually handle?

Call me skeptical, to say the least.

Tesla’s Valuation

I valued Tesla using a couple of different methods, first I performed a forward P/E comparison against the US-listed auto peers and mega-cap platform technologies. Secondly, I performed a discounted cash flow analysis under a variety of growth and discount rates.

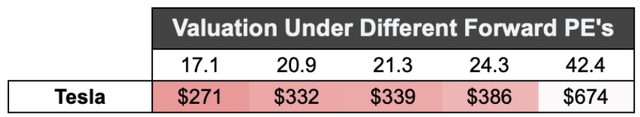

Forward P/E Comparison

Tesla vs. Traditional Car Manufacturers

|

Company |

Current Stock Price |

EPS 2023 Est. |

2023 P/E |

|

TSLA |

$674 |

$15.89 |

42.4 |

|

(F) |

$11 |

$2.15 |

5.3 |

|

(GM) |

$33 |

$6.67 |

5.0 |

|

(RACE) |

$184 |

$5.93 |

31.0 |

|

Average P/E (excl. TSLA) |

13.8 |

Source: Yahoo Finance, Analyst Expectations, and Author’s Calculations

The first peer group I compared Tesla to was the traditional car manufacturers: Ford, GM, and Ferrari. Ford and GM both made significant steps to grow their EV/AI businesses including Ford’s electric Mustang, and GM’s Cruise business. Ferrari, for its part, is currently evaluating electric vehicles and sells a hybrid model. These companies are no longer the same “boring” companies they once were, and in some cases, they compete head-to-head with Tesla.

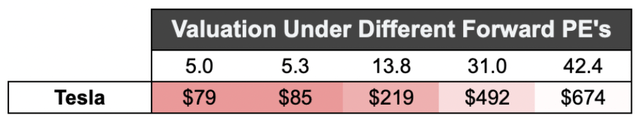

These four companies had a wide dispersion among their forward P/E ratios, GM’s is only 5x its 2023 EPS estimates while Ferrari’s is 31x, but even that’s nothing compared to Tesla’s 42x. Using the forward P/Es of its peers Tesla’s fair value ranges between $79 a share up to $492, taking the average forward P/E of the group, 13.8x, Tesla’s shares are worth just $219 a share.

But some bulls argue Tesla is not a car manufacturer, it’s really a Technology company, or better yet, an Artificial Intelligence company (or whatever buzzword is hot) so they should be valued using a different set of comparable.

Let’s go with that for a moment. Let’s compare Tesla against other Platform Technology companies.

Tesla vs. Platform Technology Companies

|

TSLA |

$674 |

$15.89 |

42.4 |

|

(MSFT) |

$261 |

$10.74 |

24.3 |

|

(AAPL) |

$140 |

$6.55 |

21.3 |

|

(GOOG) |

$2,253 |

$131.87 |

17.1 |

|

Average P/E (excl. TSLA) |

20.9 |

Source: Yahoo Finance, Analyst Expectations, and Author’s Calculations

To satisfy the bulls, here is what Tesla’s valuation looks like compared to mega-cap tech stocks. Using Alphabet’s forward P/E of 17.1x Tesla’s shares are worth just $271 a share, significantly lower than their current per-share price. Even Microsoft’s forward P/E of 24.3x only takes Tesla’s stock price up to $386, a far cry from $674.

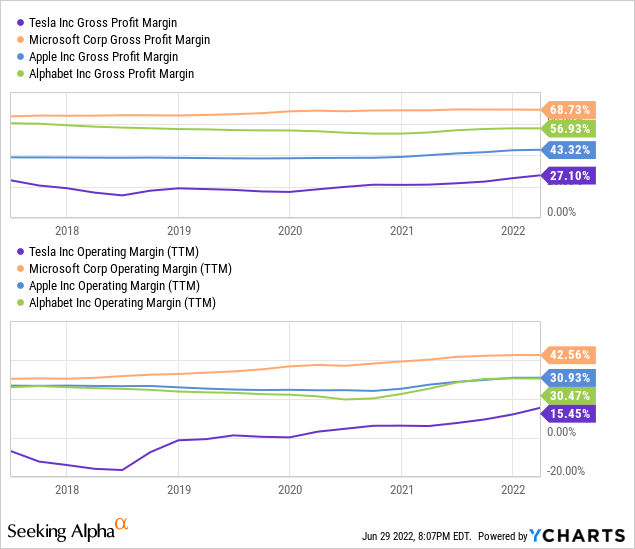

In fairness, Tesla is growing faster than these companies, both in terms of earnings and revenue. But countering that point is the fact that Tesla has a much weaker margin profile because of its intense manufacturing investment requirements.

Discounted Cash Flow Analysis

|

Bull Case Assumptions: |

|

|

Growth rate for next 7 Years (excl. 2022 & 2023) |

30.0% |

|

Terminal Growth Rate |

3.0% |

|

Discount Rate |

10.0% |

|

Share Count Change |

0% |

|

2022 |

2023 |

2024 |

2025 |

2026 |

|

|

Revenue |

$85,420 |

$116,300 |

$151,190 |

$196,547 |

$255,511 |

|

Net Income |

$12,422 |

$16,462 |

$23,541 |

$32,133 |

$43,862 |

|

Cash Flow |

$5,700 |

$8,332 |

$11,915 |

$17,039 |

$24,366 |

|

Intrinsic Value per Share ($USD) |

$405 |

|

Current Share Price ($USD) |

$674 |

|

Upside Potential |

-39.9% |

Source: Yahoo Finance, Analyst Expectations, and Author’s Calculations

For arguments sake, and since Tesla has such a strong backlog of orders, the ongoing secular shift towards electric vehicles, and the potential for Tesla to enable AI-powered rideshare, SaaS subscriptions, and insurance prospects I chose a super high growth rate of 30% for the next 7 years (excl. 2022 and 2023 which are based off the average analyst expectations). In addition to the strong revenue growth assumptions, I forecasted an expansion of their net margin and cash flow conversion. And zero shareholder dilution.

Personally, I have strong doubts that any of those goals can be reached, but I included these assumptions to shine a light on how absurd Tesla’s valuation is, even if you factor in extreme growth expectations.

Under this incredibly optimistic scenario shares are overvalued to the tune of 40%. That’s after assuming no dilution, and 30% growth for 7 years!

Sensitivity Analysis

To further stress test my thesis, I’ve put together a sensitivity analysis where you can see my analysis for the fair value of Tesla’s stock under a modified set of assumptions.

|

8% Discount Rate |

10% Discount Rate |

12% Discount Rate |

|

|

Bull Case: 30% Revenue Growth |

$609 |

$405 |

$294 |

|

Bear Case: 10% Revenue Growth |

$283 |

$193 |

$144 |

As you can see, even after assuming Tesla can grow for 7 years at a 30% clip with a discount rate of 8% there is no scenario I’ve calculated that puts Tesla’s shares into the fairly valued range, let alone a buy range. I cannot understate how extreme these assumptions are, they imply $430B of revenues by 2028; in 2021 Tesla made $54B in revenues, that’s roughly 8x from there.

Turning to the bear case, using a 12% discount rate, shares are only worth $144.

Even in the bull case scenario Tesla’s valuation is positively head-scratching and, to me, seems detached from the fundamentals of its business.

Before I provide my final price target for Tesla, let me first touch on some of the risks to the bear thesis.

Upside Catalysts & Risks to the Bear Thesis

I’ve identified two major potential catalysts for Tesla’s share price: its AI-enabled rideshare services and possible interest rate compression.

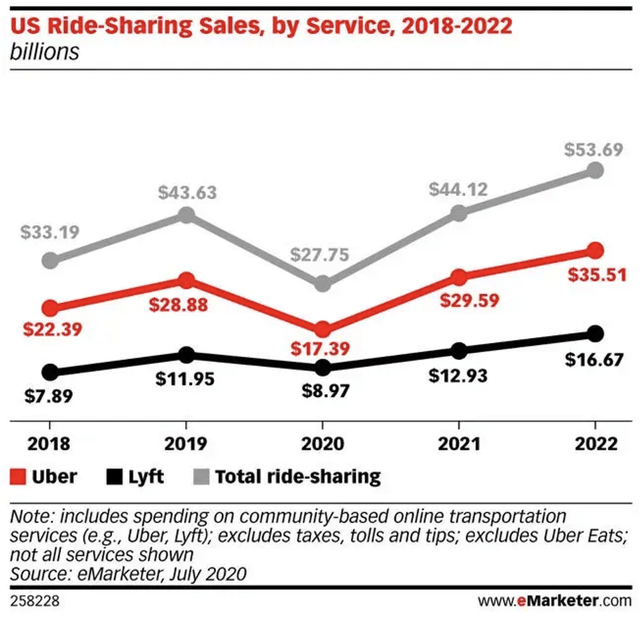

AI-Enabled Ride Share: One potential upside catalyst for Tesla is AI-Enabled ride share. Companies like Uber and Lyft collect billions of revenues each year for ridesharing services, these companies are, as of yet, unprofitable. But their continued revenue growth speaks to the demand that’s present for ridesharing services. The most expensive part of current ride ridesharing services is the driver, a variable cost. Tesla hopes that it can replace the driver with an AI to transport passengers, doing so would allow Tesla to convert a variable cost into a one-time investment.

If Tesla is successful in doing this, they could undercut Uber and Lyft on price and radically transform how transportation happens on the global scale.

Tesla has made significant improvements to its self-driving technology, but it’s by no means perfect. In addition to the software challenges, Tesla will likely face regulatory pushback for both safety and job preservation reasons. Both software and regulation are significant hurdles for Tesla to try to overcome.

That said, should they overcome the challenges, a bull-case scenario may be possible but even in those circumstances, shares still look overvalued.

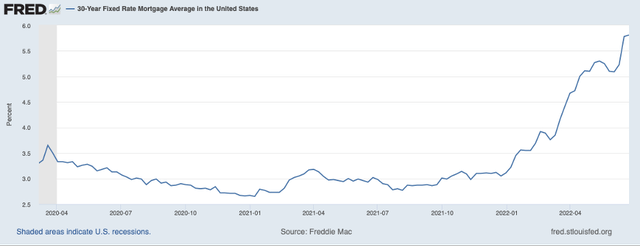

Interest Rate Compression: Interest rates have skyrocketed, whether you’re looking at the 10yr US Treasury or 30yr Standard Mortgage, debt has just become more expensive.

With rising interest rates come lower stock valuations

When the risk-free rate is higher investors demand a higher return from their risk investments. Growth stocks with expected massive future cashflows are especially impacted because the effect of interest rates compounds over time.

In addition to lower stock prices, access to debt markets is diminished in times of rising rates. For example, companies like Unity (U) had once been able to issue convertible debt with a zero-coupon payment. Now that optimism has begun to evaporate in the market that type of debt financing is much rarer.

Conversely, if we see interest rates abate it’s possible the inverse could happen, and Tesla’s price could soar. Because of that, monetary policy will play a pivotal role in all growth stock valuations.

In my view, if inflation persists, Tesla is one of the worst investments on the stock market because much of its growth is forecasted to happen far in the future.

Conclusion

No matter how brilliant a man one is, or how amazing the growth has been, valuation matters.

Elon Musk is brilliant, Tesla’s growth is exemplary, but its valuation is bonkers.

Based on my analysis, shares of Tesla are worth around $350 in an optimistic scenario. The only way I can get to the valuation premium that Tesla trades for is by applying a “meme-stock premium”, just like the premium GameStop (GME) received when it moved up from less than $10 a share to over $100 based on a cult following from social media sites like Reddit.

So, in my view, with a Tesla share, you own $350 worth of a company and $324 worth of a meme, what a meme is worth is beyond me. But in a world where a JPEG of a monkey can trade for thousands of dollars, it seems anything is possible.

All in all, I rate Tesla a “Strong Sell” with a 1yr price-target of $350.

Thank You!

As always thank you for reading. What do you think about Tesla’s valuation? I make an effort to engage with all my readers, so if something has interested you, or if you have a question, please feel free to comment. I will do my best to get back to all of you with a response!

Be the first to comment