alxpin/iStock via Getty Images

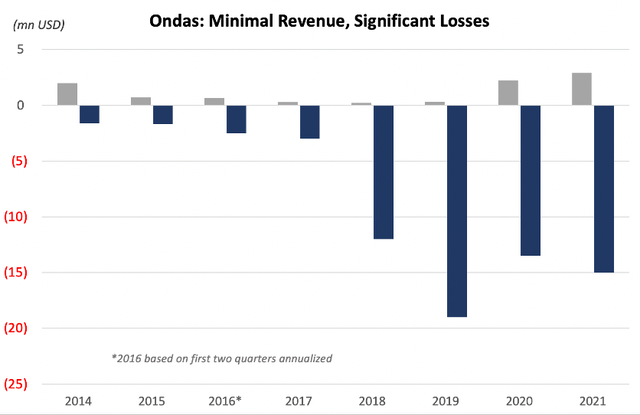

We are short Ondas Holdings (NASDAQ:ONDS) (“the Company”), a developer of private wireless industrial networks and more recently, autonomous drones. We think subsidiaries Ondas Networks and American Robotics will remain sub-scale industry laggards, burning through cash and destroying shareholder value. We believe both subsidiaries are misunderstood and were due to be exposed as such in the near-term.

We believe the FCC mandated 900 MHz band overhaul will not prompt meaningful demand for Ondas. While Ondas characterizes the FCC Order as a required upgrade that will effectuate demand from Class I Railroads, we find the Railroads can simply reconfigure most of their existing network equipment.

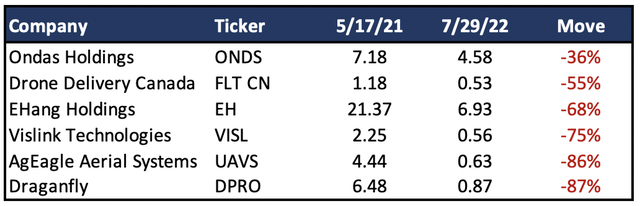

We think UAV subsidiary American Robotics, acquired at the tail end of last year’s crazed drone bubble, will never leave the ground. AR is hailed for a “seminal” FAA approval granted in 2021, but we find the approval limits AR customers to non-commercial use, undercutting its economic value.

Over a year post-acquisition AR looks like a facsimile of the failed network segment, plumbing the lowest of investor expectations. Ondas paid roughly $71m for AR (vs net tangible assets of $511k [Pg. 7]) in part based on a 2021 revenue projection that missed by 90% and a 2022 estimate that is tracking even worse. We believe the $70m in intangible assets and goodwill attributed to American Robotics will eventually be written down.

While Ondas shares have held up well in the recent reversal of overinflated growth fantasies, we believe the stock has considerable downside risk at an enterprise value ~17x an upbeat 2022 consensus revenue estimate. We think the combined business will remain gravely cash flow negative and, with under a year’s worth of cash at current burn rates, require near-term bouts of dilution (perhaps by tapping its $50m ATM facility). After years of being disappointed by the core networking segment and now the flashy drone subsidiary, we believe investor patience is – and should be – running thin.

Core Networking Business Remains Commercially Limp After 15+ Years

Ondas was founded in 2006 as Full Spectrum, a provider of wireless network equipment. The Company’s software defined radio system known as FullMAX was initially marketed to a range of “mission critical” industries including Electric Generation and Natural Gas Utilities, Hazard Pipeline Transportation, Water and Wastewater. Commercialization would evolve into a decade-long cycle of what are so far, in our view, fruitless pivots and announcements of partnerships and projects that almost invariably fizzled.

Multiple Attempts in Electric Utility Market Go Nowhere

By 2010, Full Spectrum was primarily focused on the utility industry. Full Spectrum officials highlighted the platform’s high upload rates relative to commercial wireless networks, a characteristic Ondas still touts today. During this period, Full Spectrum announced partnerships with Tata Exlsi, “technological leaps“, and commercial awards for its “groundbreaking private wireless solution”. Yet by 2015 the business remained undersized and declining – revenue was $707k down from $2m in 2014.

In 2016 Full Spectrum developed a second generation of lower cost yet allegedly higher margin radio equipment compatible with the FullMAX platform. According to the Company, these new products would encourage higher order volumes from its large utility customers using FullMAX to “tackle their most challenging data communications needs”. Full Spectrum announced a contract award for the new radio from Great River Energy, its largest customer accounting for roughly 60% of revenue [Pg. 44]. “Volume deliveries” were expected to begin in early 2017 [Pg. 27].

At the same time, the Company believed a Department of Energy initiative would catalyze a utility industry network upgrade yielding material demand for FullMAX:

“The U.S. electric utility industry is undergoing a revolution triggered by the Department of Energy’s Smart Grid program and the widespread adoption of alternative energy sources such as solar and wind. These disruptive initiatives are creating the need for ubiquitous communications networks … Full Spectrum is leveraging its industry expertise and FullMAX technology to develop a second generation of products to capitalize on this burgeoning opportunity, and is poised to become the leading supplier of private cellular network products.” – Full Spectrum S-1, 2016

In addition to the DOE tailwind, the emergence of a new IEEE standard for wireless networks purportedly based on FullMAX technology would lead to “widespread adoption” of FullMAX in the utility industry [Pg. 36]. Yet despite advertising new products, large customers, and secular tailwinds, Full Spectrum’s efforts in the utility industry failed to scale.

Full Spectrum filed for an IPO in September 2016, attempting to raise $15m at a $49m valuation. The registration statement painted a grim financial picture, in our view. In 2014 the Company entered into a purchase order financing agreement for $600k at an extreme 50% annual interest rate. Of $2.5m in total debt, $375k in principal remained on the loan along with $319k in accrued interest [Pg. 20]. Revenue for the first half of 2016 was only $330k, down 28% from the year prior. Net loss was $1.2m up from $0.9m in 2015. The Company had only 3 paying customers (extreme customer concentration remains an issue). Predictably, the S-1 was withdrawn in 2017 due to “market conditions”.

Full Spectrum eventually became public in 2018 through a reverse merger with a Las Vegas-based ticket resale shell company, renaming itself as Ondas Holdings. The name changed, but the announcement of substantial commercial opportunities which have so far failed to materialize resumed.

- December 2018 Ondas launches operations in China to support its global expansion to capitalize on the IEEE 802.16s standard-based upgrade cycle. By the end of 2019, the China subsidiary was closed.

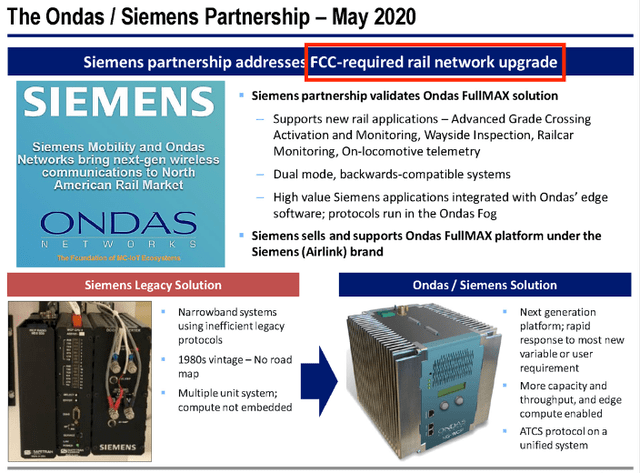

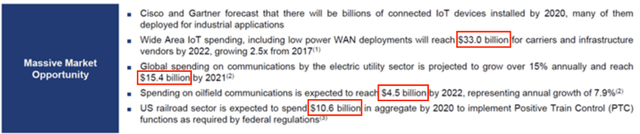

- January 2019 investor slides highlight a “massive market opportunity” in Wide Area IoT, electric utilities, oil and gas, and railroads. Combined TAM for FullMAX was estimated at over $50b. Revenue in 2019 was $320k and net losses were $19m.

January 2019 Investor Relations slide

- In 2019 Ondas separately announces partnerships with Telewave and Altaeros. Nothing has been heard from either partnership since.

Switching Tracks: Ondas Pivots to Railroad Market

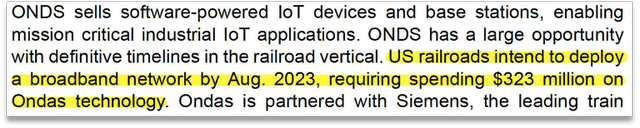

In July 2019, Ondas announced its entry into the Class I Railroad market. Within a year the Company entered a partnership with Siemens Mobility which appeared to substantiate the potential of Ondas’ technology. Ondas also disclosed “multiple, ongoing testing and pilot programs” with BNSF and CSX Corporation [Pg. 59]. It appeared Ondas was finally on track.

However, although its new initiatives contributed to revenue growth, the business again seems to have failed to scale while the expansion ballooned operating expenses. Revenue in 2020 and 2021 was only $2.2m and $2.9m respectively. Operating losses grew 56% to $18m last year.

Moreover, the new revenue appears lower quality. Development Revenue from primarily non-recurring engineering service contracts made up nearly half of revenue in 2020 and 83% of revenue in 2021. Revenue from the sale of products declined 65% from $1.1m in 2020 to $405k in 2021.

And as it was when Ondas was committed to the utility industry, customer concentration is a significant issue. Ondas is completely reliant on two customers – Siemens and AURA Networks – who accounted for 93% and 96% of revenue in 2020 and 2021, respectively. That Ondas is so heavily dependent on AURA, a relatively small company which has raised only $38m to date, is concerning in our view.

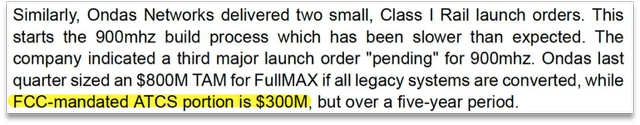

Ondas Touts 900 MHz Rebanding as $300m+ Opportunity; We Think It’s Another Bust

In April 2020, the FCC ordered a realignment of the 900 MHz band which would directly impact Railroads. After the mandate was published, Ondas began advertising the rebanding as a huge opportunity for FullMAX, framing it as an “FCC-required rail network upgrade”:

Ondas December 2020 presentation

We believe investors misinterpret the substance and commercial implications of the FCC Order.

Background:

- Before the April 2020 FCC Order, the 900 MHz band was designated for narrowband land mobile radio communications primarily used by utilities, oil and gas companies, and railroads.

- To modernize the band, the FCC proposed a modification of its structure, allocating a portion for broadband use, and maintaining space for legacy narrowband operations.

- The largest incumbent of legacy narrowband spectrum was the Association of American Railroads (AAR).

- To avoid disruption of the AAR’s operations, the FCC along with Anterix (the largest licensee of 900 MHz spectrum) carved out channels of wide-band spectrum compatible with incumbent AAR equipment.

- The FCC gave the AAR five years to complete the transition from the Order’s effective date corresponding to an August 2025 deadline [Pg. 46].

The FCC Order requires railroads to move legacy narrowband systems to the new narrowband compatible segment. Although railroads can upgrade to newer hardware/software technologies, it appears no upgrade of equipment is required as implied by Ondas and sell-side analysts.

Northland Capital analyst: Ondas equipment required in reconfigured 900MHz band

Northland Capital Markets initiation, February 2021

Oppenheimer & Co analyst: FCC-mandated opportunity is $300m

Oppenheimer & Co report, May 2022

We emailed Ondas investor relations for clarification:

NMR: “In an investor presentation, Ondas called the rebanding an “FCC-required rail network upgrade”. Are railroads required to upgrade their networks and equipment?”

Ondas IR: “That’s correct, on May 13, 2020 the FCC adopted a mandatory transition into the 900MHz band to enable significant advancements to railroad safety. The Association of American Railroads has also declared that no later than five years after this order, the AAR would cancel its incumbent narrowband channels that it currently operates on to help facilitate the transition, see attached footnote 309 on page 44 [of the FCC order].”

The following is the text of footnote 309 which Ondas references:

No later than five years following the issuance of any order of modification, AAR would cancel the six paired 12.5 kilohertz narrowband channels on which it currently operates, see Letter from David L. Martin, Counsel to AAR, to Marlene H. Dortch, Secretary, FCC, WT Docket No. 17-200 (filed Apr. 30, 2020). Accordingly, within five years, Commission inventory will increase by 150 kilohertz in every market where AAR is licensed.

We disagree with Ondas’ reading of the regulation. In our view, which is substantiated by our research and discussions with a rail network expert, the FCC Order does not require railroads to upgrade networks nor purchase new equipment as most existing equipment can be retuned to operate in the new band.

In addition, we are unable to find evidence of a 2023 deadline. We also emailed Ondas investor relations asking for clarification on this deadline but have received no reply at time of publishing.

Regardless of the timing, we think the commercial opportunity presented by the 900 MHz realignment is a fraction of what Ondas projects. According to Anterix Executive Chairman Morgan O’Brien, only in rare cases will equipment need to be replaced – most legacy systems can be re-tuned. He estimated it would cost between $90m to $120m to retune all legacy narrowband systems, not just the AAR’s. We spoke with an employee at a railroad network equipment competitor who agreed – the 900 MHz rebanding would not drive a large product upgrade cycle since most systems can be reprogrammed. And the AAR itself estimated total relocation costs of $70m [Pg. 44].

These figures are significantly below the $300m+ opportunity cited by Ondas. In any case, it’s unclear if ancillary services like retuning make up anything more than a trivial part of Ondas’ revenue. And even if Ondas sees retuning demand, it will be shared with competitors, including Anterix [F-19]. Thus, we are skeptical the $20m in rail bookings guidance this year be met (Q1 network segment revenue was only $350k), let alone translate into revenue.

We also note that significant delays in the rebanding process are likely. Consider the FCC’s reconfiguration of the 800 MHz spectrum was scheduled to be completed in 3 years but took 17.

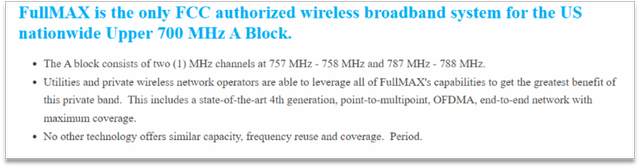

It’s worth mentioning that the Company’s previous attempt to commercialize FullMAX in a targeted band fell flat. As part of its marketing to utilities, Ondas advertised the platform’s superiority in the Upper 700 MHz block and claimed it was the only broadband system approved by the FCC in that spectrum – yet business remained scant. Ondas removed all mentions of the 700 MHz “A Block” band from its 2021 10-K. We think the 900 MHz story may play out similarly.

American Robotics Acquired Amidst Drone Bubble, Misses Own Revenue Projections By 90%+

In May 2021 Ondas purchased American Robotics, a Massachusetts-based developer of automated drone systems. Ondas paid total consideration of $70.6m of which only $7.5m was in cash. AR had been operating since 2016 with little commercial success. A month prior to the announcement Ondas provided AR, which was operating with negative working capital and $2.7m in debt, with a $2m bridge loan.

Manic amounts of speculative capital poured into the drone sector in late 2020 and early 2021. In late 2020 the US government placed restrictions on several Chinese drone manufacturers lifting valuations higher almost indiscriminately. Ondas acquired AR during this speculative drone bubble which has since popped:

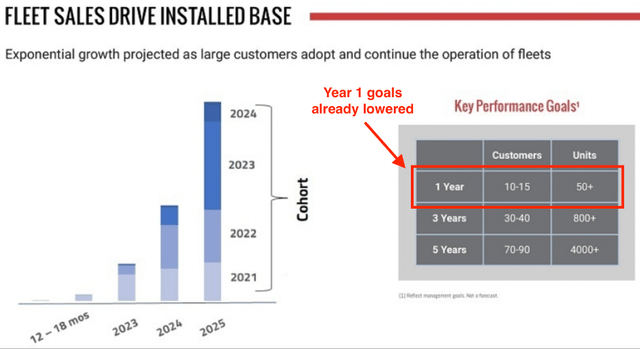

Ondas believes AR’s growth potential is “exponential” within a $100b total addressable market. AR listed a customer pipeline that included seven companies in the agricultural sector including Bayer, numerous large industrials (three of the ten largest oil and gas names), a Class I railroad, and one of the three largest utilities. During a September 2021 Ondas/AR investor day, management offered performance goals which when combined with AR’s estimate of annual recurring revenue per drone of $50k implies revenue of at least $2.5m in 2022, $40m in 2024 and $200m in 2026.

American Robotics published goal of 50+ drones sold in 2022 equaling $2.5m in revenue. Since lowered to 30 drones.

AR’s financial results tell a different story, in our view. In 1Q22, AR revenue of $60k implies only 5 revenue-generating drones. In contrast to the dozen or so large industrial customer relationships AR advertised, the bulk of Q1’s business was from one customer. And the 50+ unit goal for the year has been reduced to 30.

Note these performance goals and results to date are miles off projections used to calculate AR’s acquisition value. Last summer AR projected 2021 and 2022 revenue of $1.6m and $10.1m, respectively [Pg. 48]. In 2021, segment revenue of $150k missed the projection by 90% and 2022’s miss will likely be even worse.

AR’s 2022 revenue projection implied roughly 200 revenue-generating drones. So, May 2021 projections of 200 drones became 50+ in September 2021 and 30 in May 2022. We think it’s troubling that AR management is so unable to forecast its business and that Ondas management relied on such poor estimates (especially considering AR’s revenue in 2020 was only $8k).

AR discloses only four customers currently – Chevron, ConocoPhillips, ScottsMiracle-Gro, and Stockpile Reports. Stockpile Reports (SR) is Ondas’ most vocal customer, often providing effusive commentary in Ondas press releases. Note that SR is a relatively small company – only twelve SR employees have LinkedIn profiles and annual revenue is estimated at $1.4m.

American Robotics’ FAA Approval Is Commercially Impotent Relative to Competition

American Robotics was the first company granted FAA approval to operate drones beyond-visual-line-of-sight (BVLOS) without a human pilot co-located onsite, an achievement Ondas mentions in nearly every press release.

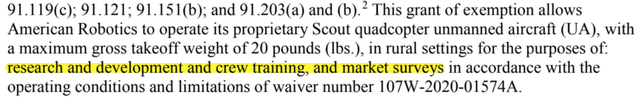

However, we believe the exemption is significantly limited in scope, only permitting flights in daylight, at only 10 locations, and in the absence of people. Most importantly, the approval is restricted to specific non-commercial activities: research and development, crew training and market surveys:

American Robotics exemption excerpt

The exemption was precedent setting, but its commercial value appears deficient. The FAA has granted more commercially impactful permissions to several drone-in-a-box competitors and industrial companies.

In June 2021 BNSF Railway received FAA permission to remotely operate dock based Skydio drones for infrastructure inspection and patrol of rails across most of its network. Skydio notes the exemption is not limited to research and development purposes while slyly referencing AR’s approval:

“Critically, this waiver permits real-world operations–it is not limited to R&D, unlike certain past waivers for remotely operated drones in docks. “

Skydio raised $170m in capital at a $1b valuation in Series D funding led by long-term backer Andreesen Horowitz.

Energy company Delek US received a BVLOS FAA waiver in January 2022, permitting it to fly Percepto drones managed by a remote pilot, marking the first US refinery to receive BVLOS approval.

Percepto competes directly with Ondas and American Robotics. It operates in more than ten countries and counts large industrials as customers including Florida Power & Light, Verizon, and ENEL. Several Percepto customers have themselves applied for BVLOS waivers with remote piloting permissions including Florida Power in 2021 and Vistra in 2022.

On the smaller side, drone developer Asylon in June announced waivers to operate an automated security drone system BVLOS, an achievement it called “world-first”. One of the waivers allows Asylon customers to operate drones over people and moving vehicles at night – significant advantages over the permissions granted to American Robotics. Asylon has only raised $1.3m in funding.

In April, American Robotics applied to amend its exemption to allow flights for commercial purposes, although we question why it took so long. In the application American Robotics notes the amendment would set no precedent, considering the exemption granted to BNSF.

We think the impotence of AR’s waiver and its financial weakness when it was acquired relative to the strength of competitors such as Percepto are important signals. The autonomous drone market offers substantial growth potential, but it’s extremely competitive. We think AR’s business has fallen irreparably behind more established operators. Lack of research and development in such a technically competitive space (only $2.2m total spent in 2019 and 2020) is a potential cause and/or symptom.

Airobotics: Broken Drone Story Similar to American Robotics

In July, Ondas announced the acquisition of Israeli drone maker Airobotics. We believe the deal merged two struggling companies with a narrowing set of options.

Like American Robotics before it was acquired, Airobotics (even their names are similar) appears to have been financially desperate. Ondas backstopped a $1.5m loan to cover Airobotics’ operations until the transaction was closed. Airobotics had an $11m market cap before the acquisition and carried $1.1m in crowdfunded debt, not a sign of a company with ready access to capital. Airobotics did just $3.2m in sales with negative gross margins, losing over $18m.

Airobotics founder Ran Krauss previous drone endeavors have not been successful. For instance, see Krauss’ ParaZero which has a pending F-1 filed in May. After eight years in operation, ParaZero did just $724k in sales for 2021.

Ondas Founders, Largest Investor and Board Member Associated with Past Investor Wipeouts

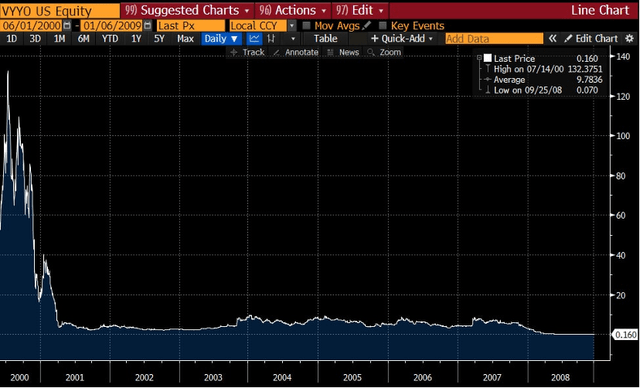

Ondas Networks was founded by Chief Technology Officer Menashe Shahar and President Stewart Kantor, who previously worked as CTO and VP of Business Development at Vyyo, another wireless network developer. Founded in 1997 and delisted in 2008, Vyyo had an accumulated deficit of $264m on less than $70m in cumulative revenue.

Vyyo Inc. (VYYO) – Ondas Founders previous network endeavor ended in delisting

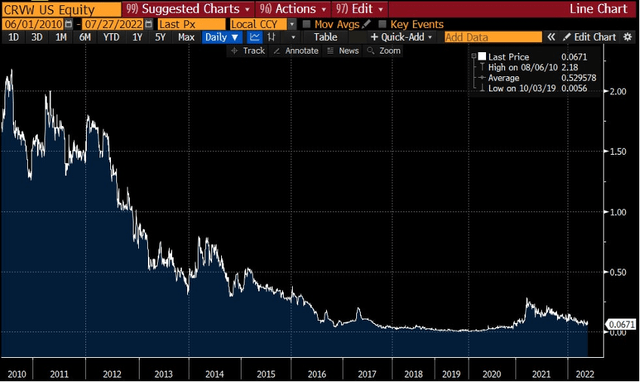

Ondas’ largest investor (14% stake at last disclosure) is Energy Capital, LLC, an entity registered to Robert J. Smith who has owned beneficial stakes in troubled companies. All six of his public investments are reverse mergers. See CareView Communications which is down 99% since its IPO with an $8m market cap. TherapeuticsMD was recently acquired although 99% below peak levels. Or Global Energy Group, a heating and air-conditioning company that in the eight years before it was delisted in 2007 never managed to properly file a 10-K.

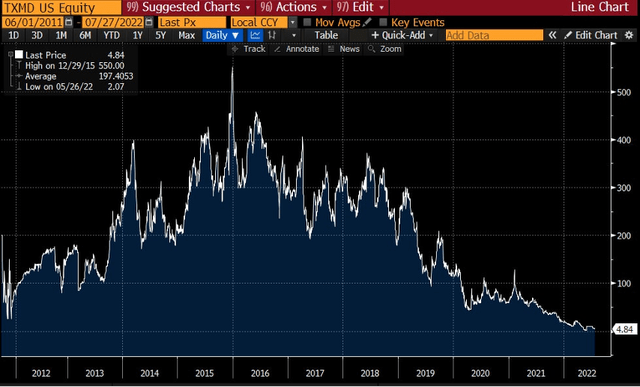

TherapeuticsMD is analogous to ONDS: a reverse merger of a Utah-based mining shell with two businesses: a money-losing legacy business (vitamins), and a development-stage segment (hormone therapy) with seemingly attractive growth prospects.

Senseonics (NYSE:SENS), another reverse takeover, sells a commodity product (blood glucose monitors) thus far at negative gross margins. The stock is down 50% from its American Stock Exchange listing and shares outstanding have exploded 40x from 11.5m in 2015 to over 463m.

CareView Communications (OTCQB:CRVW) down 99% since IPO

TherapeuticsMD (NASDAQ:TXMD) off 99% since peaking in 2015

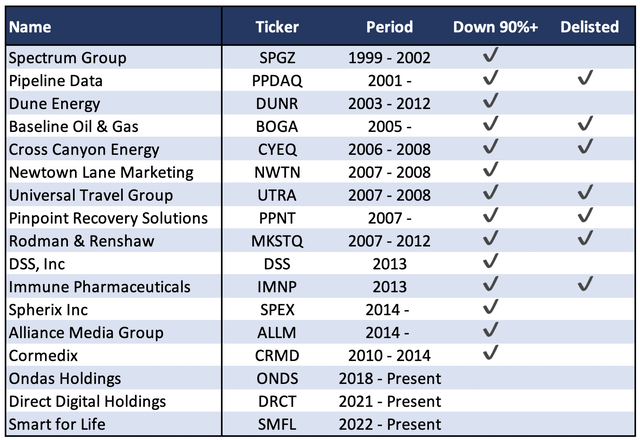

The track record of board member Richard Cohen is more concerning. Cohen has been an officer or director at 17 public companies. The stocks of all but three (including Ondas) have lost at least 90% since becoming public and/or have been delisted, a remarkably consistent pattern of value destruction. In addition, Cohen was a member of the Audit Committee at the infamous Rodman & Renshaw until August 2012, during the notorious period covered in the documentary The China Hustle when it brought largely worthless Chinese companies public through reverse mergers.

Cohen runs a consulting firm known as Aciri whose website fails to advance past its homepage as all links are non-functioning. Note also that two of the names listed below are associated with infamous stock promoter Barry Honig (Spherix and Document Security Systems).

Public Companies Associated with Director Richard Cohen Have Incurred Significant Losses

This Pivot Is Not Different: Stock At Risk

With less than a year of cash left ($25m or $0.50/share) at the current burn rate which could increase after recent acquisitions, Ondas and its drone developing subsidiary may need to quickly pull proverbial rabbits out of their hats to avoid considerable downside in the stock. After multiple misfires in a variety of markets, the Company must deliver on its long-promised 900 MHz upgrade opportunity, and the drone segment – now a mixture of lagging, cast-off operations – will need to finally leave the ground.

We are convinced neither will happen. We think the FCC’s spectrum realignment will prove to be a commercial bust. American Robotics will not scale, in our view, as its drone-in-a-box model is executed by more credible and well-funded operators with stronger partnerships and FAA permissions. We think investor disappointment and dilution lie ahead.

Risks of Short Position

We believe Ondas shares are substantially overvalued and recommend it as a short idea. Risks to the upside include stronger than expected network equipment revenues (for example from Class I Rails as part of the 900 MHz realignment), larger than expected commercial orders or substantial commercial partnerships at American Robotics, and changes in regulations covering UAVs or government support for the industry.

As an alternative to shorting stock, long put options offer bearish exposure with losses limited to premium paid. Investors should also be mindful of the potential for pronounced volatility in small cap equities.

Be the first to comment