J Studios

Investment Thesis

Despite record revenues and net income profitability, it has yet to be translated to Petróleo Brasileiro S.A. – Petrobras’ (NYSE:PBR) (NYSE:PBR.A) stock prices thus far, given the elevated political risks. The constant change in its top management would prove detrimental to the company’s progress and growth moving forward. In addition, investors have never liked a company with reduced profits and EPS, given the Brazilian government’s push to make fuel more affordable in the near future.

Combined with the possibility of reduced demand ahead due to the rising inflation and the potential recession, we expect a moderate retracement for PBR in the intermediate term. Though the company may continue to deliver stellar FQ2’22 earnings on 29 July 2022, we do not expect to see a sharp rally as well, given the general pessimism surrounding the energy market. Nonetheless, investors with higher risk tolerance and an appetite for robust dividend payouts may choose to nibble here, given the relatively attractive risk/reward ratio.

In the meantime, investors looking for a more in-depth discussion of the oil and gas prices may refer to other analyses from fellow Seeking Alpha contributors here:

PBR Has Proved To Be A Cash Cow For Long-Term Investors

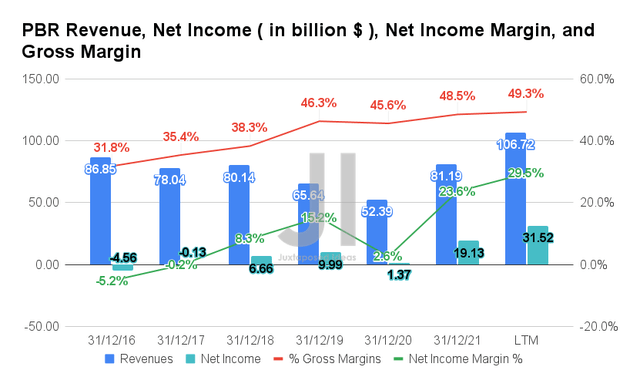

PBR had obviously benefited from the massive demand for oil in the past year, given the tremendous growth in its revenues and net incomes thus far. By the LTM, the company reported record-breaking revenues of $106.72B and a gross margin of 49.3%, representing an increase of 33.1% and 11 percentage points from pre-pandemic levels in FY2018, respectively. In addition, PBR reported net incomes of $31.52B and net income margins of 29.5% in the LTM, representing an impressive increase of 473.2% and 21.2 percentage points from pre-pandemic levels, respectively.

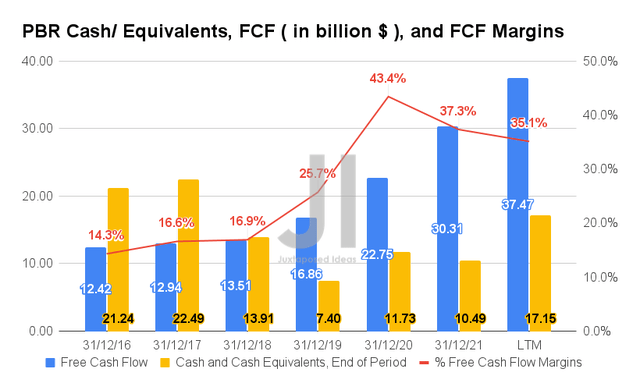

Therefore, given its massive profitability, we are not surprised by PBR’s record high Free Cash Flow (FCF) generation thus far. By the LTM, the company reported an FCF of $37.47B, representing stellar growth of 64.7% from FY2020 levels, while also recording an FCF margin of 35.1% at the same time. As a result, PBR’s cash and equivalents on its balance sheet had risen to $17.15B by the LTM, the highest it has been in the past few years. This would help the company pay out its excellent dividends moving forward, while potentially reducing its debt burden at the same time.

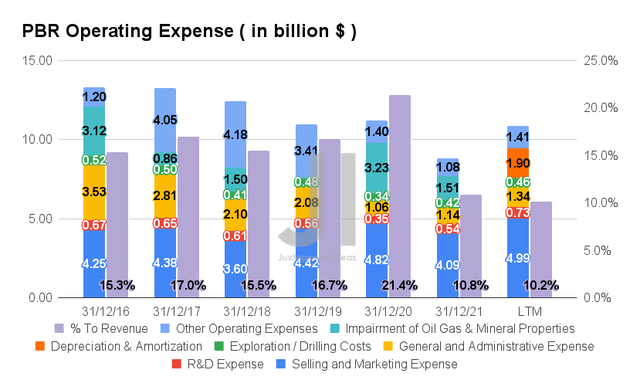

In addition, it is evident that PBR has been very prudent in its capital management thus far, with only $10.83B of operating expenses reported by the LTM. It represented a moderation of 3.3% from FY2020 levels while accounting for a very comfortable 10.2% of its growing revenues in the LTM – compared to FY2019 levels of 16.7%. Furthermore, the company paid $13.86B of income taxes in the LTM, with other relevant government taxes worth 69.9B Brazilian Real – the equivalent of $12.71B in FQ1’22. Further highlighting the PBR’s robust profitability thus far.

In the meantime, PBR also continued to invest in the business, with elevated R&D expenses of $0.73B and SG&A expenses of $6.33B in the LTM, representing an increase of 208.5% and 7.6% from FY2020 levels, respectively, despite the relatively inline exploration/ drilling costs of $0.46B thus far.

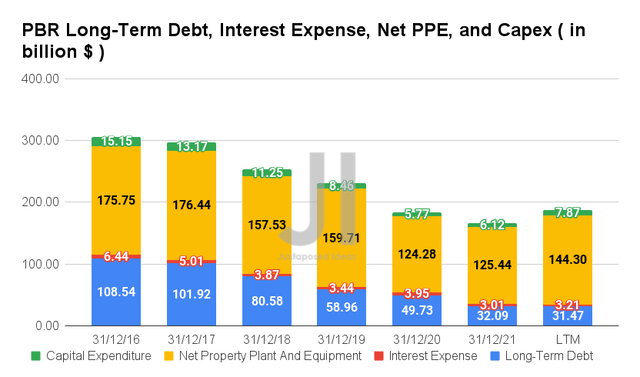

PBR also continued to deleverage fast, given the reduction in its long-term debts thus far. By the LTM, the company reported long-term debts of $31.47B with interest expenses of $3.21B, representing a decrease of 36.7% and 18.7% from FY2020, respectively. In contrast, PBR continues to grow its net PPE assets to $144.3B and capital expenditure to $7.87B by the LTM, representing an increase of 16.1% and 36.3% from FY2020 levels, respectively.

Moving forward, we expect to see up to $68B in capital expenditure through 2026, which potentially indicates a moderate growth in PBR’s output capacity over time, despite the recent cuts in its wholesale gasoline prices. Thereby, signifying a moderation in its profitability moving forward. We shall see.

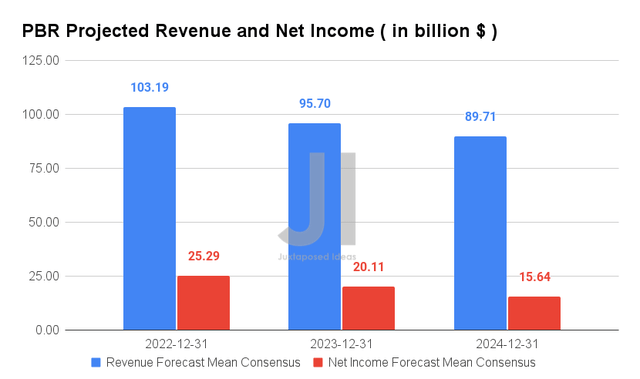

For the next three years, PBR is expected to report a normalization of revenue growth to pre-pandemic levels, while also recording a massive improvement in its net income profitability from net income margins of 8.3% in FY2018 and 15.2% in FY2019 to 17.4% in FY2024. For FY2022, consensus estimates that the company will report revenues of $103.19B and net incomes of $25.29B, representing an excellent increase of 27.1% and 32.2% YoY.

In the meantime, analysts will be closely watching its FQ2’22 performance, with consensus revenue estimates of $29.59B and EPS of $0.89, representing YoY growth of 39.58%, though a decline of -24.78%, respectively. Nonetheless, we are not holding much hope for a quick rally, given its historically mixed performance thus far.

Petrobras Reported Excellent 38.11% Dividend Yield In The LTM – Though Not For Long

PBR 10Y Share Price & Dividend Yield

PBR has had a discernible see-saw price trend over the past ten years, with a notable plunge during the heights of the COVID-19 pandemic before rallying to current levels. Since 2018, the stock also had a relative uptrend dividend yield of 38.11% by now, which is way higher than the Brazilian energy industry’s mean of 2.7%. The fact that PBR paid out $4.35 of dividends in the LTM indicated a very handsome yield to its $13.40 one-year stock price moving average indeed. Therefore, returning enormous value to its long-term stockholders.

Nonetheless, given the Brazilian government‘s continuous interference and the potential slowing revenue growth ahead, we do not expect PBR to continue this unsustainable level of dividend yield moving forward – likely only for the next few quarters only. There would be lesser reasons for any special dividends as well, given the potential reduced FCF profitability. In addition, there are minimal share buyback plans, since the last one was announced in 2021 for $293.21M with an 18 months expiry. The excellent opportunity may have slipped away from investors who hadn’t yet invested.

So, Is PBR Stock A Buy, Sell, Or Hold?

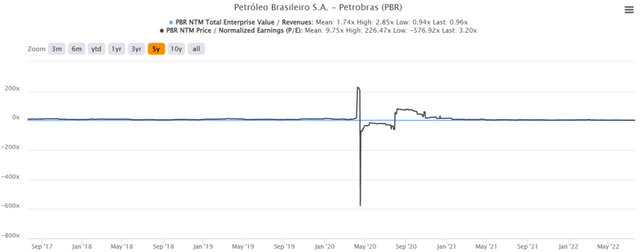

PBR 5Y EV/Revenue and P/E Valuations

PBR is currently trading at an EV/NTM Revenue of 0.96x and NTM P/E of 3.2x, lower than its 5Y mean of 1.74x and 9.75x, respectively. The stock is also trading at $11.47, down 29.6% from its 52-week high of $16.30, though still at a premium of 24.6% from its 52-week low of $9.20.

PBR 5Y Stock Price

Despite the perceived tight oil supply, it is evident that PBR has plunged since 23 May 2022, due to the political volatility and management changes thus far. Its current stock performance is also not helped by the perceived destruction of demand for gasoline, given the rising inflation and potential recession. Thereby, leading to the stock’s sideways price action for the past month.

Therefore, despite consensus estimates’ attractive buy rating with a price target of $17.35, we are not convinced of its 51.26% upside, despite PBR’s excellent profitability and its record-breaking dividend yield of 38.11% thus far. The stock remains rather speculative for now, given the mixed signals on the supply and demand for oil ahead.

Combined with the fact that the Brazilian Presidential Election will only take place in October 2022, we expect to see more volatility ahead in PBR’s operations and management team for the next three months. Furthermore, the talk of taking the company private would also prove fatal to the company’s stock performance, given the chaotic and long-drawn-out process then. The current situation that PBR faces is uncannily similar to the one faced by Alibaba (BABA), when the Chinese government stepped in to halt the much-anticipated ANT IPO then in 2020, along with other regulatory changes. Since then, BABA’s stock prices had plummeted by -66% from their highs and continued swinging wildly depending on the Chinese news.

Moreover, we prefer to refrain from speculating over PBR’s upcoming earnings call, and instead await more clarity regarding its performance in FQ2’22. Nonetheless, investors with higher risk tolerance and an appetite for robust dividend payouts may choose to nibble here, given the relatively attractive risk/reward ratio. Still, it would be advisable to size the portfolio accordingly, given the potential volatility ahead.

Therefore, we rate PBR stock as a Hold for now.

Be the first to comment