jetcityimage

Tesla, Inc. (NASDAQ:TSLA) investors are finally realizing that they aren’t exempt from the laws of gravity. After years of flying high, the stock cannot catch a break in 2022, with a bucket of bad news including but not limited to the following:

- A nearly 60% fall YTD, which places Tesla at 487 out of the 503 stocks in the S&P 500 in terms of YTD performance.

- Price cuts amidst struggles in China.

- Increasing questions about Musk’s over-involvement in Twitter, resulting in time away from Tesla.

While things are undoubtedly cloudy right now, this article offers a few reasons why there are a few positives for Tesla investors in each of the items that show up on the surface as negatives. We have categorized these reasons as:

- Operational

- Business Fundamentals

- Stock Valuation

- Stock Technical

- Macro.

Let us get into the details.

Operational: Musk’s Distraction or Silver lining?

Clearly, the entire Twitter saga has hammered Tesla investors in a double whammy. Not only are we losing Musk’s time at Tesla, but also we are under heavy selling pressure as Musk had to repeatedly sell his Tesla stock to finance and secure the Twitter deal.

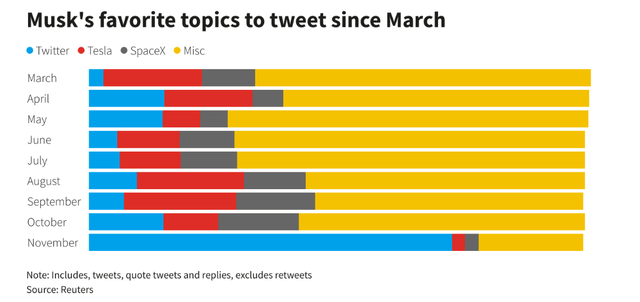

Musk has never been one to hide his feelings in public, and his tweets are generally a reflection of what is occupying his mind. In the graphic below, it is easy to see how Twitter started out as a distraction in early 2022 and ended up being his main day (and night) job by November.

Musk’s Tweets (www.reuters.com/)

But is there a silver lining here? We believe so. It has been well established that Tesla is heavily reliant on Musk. He obviously is still calling all the major shots, but his being so visibly away and distracted from Tesla shows he is confident the company can at least sustain on its own, if not excel. For the first time in Tesla’s history, he may have even picked his successor to run the company. Once again, that shows that Elon is comfortable enough in Tesla’s ability to sustain itself. That sounds like good news in the long term.

Business Fundamentals

Tesla was/is not immune to the macroeconomic factors and has had its own share of production issues. But, as reported in this Seeking Alpha article, Q3 showed a promising rebound in production (~366,000 deliveries) with a 42% improvement over the previous quarter. We believe this will improve further in Q4 (current quarter) as Q3 had downtimes in many factories as reported in this article:

“In the third quarter of this year production was affected by the slow momentum of the Austin and Berlin gigafactories, the latter of which suffered a fire just days ago, as well as continuing issues at its Shanghai plant, which faced downtime due to covid mitigation measures earlier this year.”

With all those factories operating in full capacity as of now and the Fremont factory generally producing 150,000 units each quarter, it is logical to expect about 450,000 units in Q4 given:

- a fully operational Shanghai plant produces more than 22,000 units per week.

- a fully operational Berlin plant produces 2,000 units per week.

- a fully operational Austin plant produces 1,000 units per week.

Stock Valuation: Cheaper than Wipes, Soda, and Diapers

In hindsight, Tesla was clearly overvalued, showing all signs of a short-term top including multiple stock splits in quick succession and a CEO who could do no wrong. The stock deserved to lose some of its premium but how much is too much? After a 60% fall, Tesla is now trading at a forward multiple of 40 with an expected per annum five-year growth rate of 48%.

As a comparison, The Clorox Company (CLX), which is expected to grow earnings at 13% per year for the next five years after earnings regressed 7.30% per year for the past five years, is trading at a forward multiple of 36. Gulp. Obviously, one can argue that both Clorox and Tesla are overvalued, but that is where PEG ratio helps. Growth At a Reasonable Price (GARP) investors will be thrilled to note that the continuing sell-off has pushed Tesla’s PEG to 83% or .83, which indicates the company is being valued less than its projected growth. Clorox, on the other hand, has a PEG of almost 3. To make sure Clorox is not an outlier here, let us use two more popular consumer stocks: The Coca-Cola Company (KO) and The Procter & Gamble Company (PG). Both are trading at a forward multiple of 25 with an expected per annum five-year growth rate of 5%. That gives both these companies a PEG of 5.

As we’ve stated in some of our previous articles, both positive and negative sentiments overshoot. Right now, it appears like the flight to safety is approaching ridiculous levels, when consumer staples stocks trade at 3 to 5 times the (relative) valuation compared to GARP stocks.

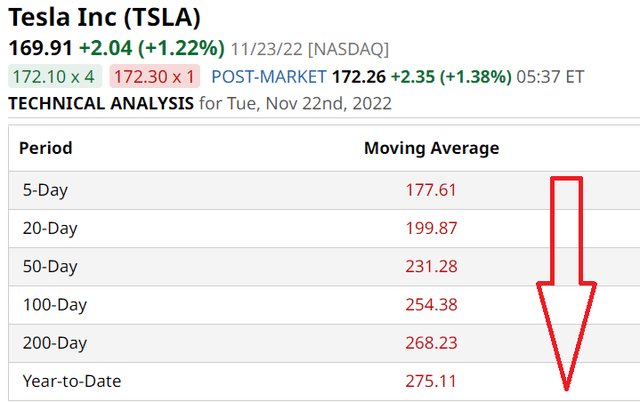

Stock Technical

As a result of the fundamental worries, Tesla’s technical indicators appear shaky as well. The stock continues making lower lows as indicated by the moving averages table below with the 200-, 100-, 50-, 20-, and 5-day moving averages all progressively lower than each other. We expect this weakness to continue over the next few weeks, at least until something positive breaks out about Tesla or Musk. A move below $150 is not out of question with the continuing selling pressure.

TSLA Moving Avg (Barchart.Com)

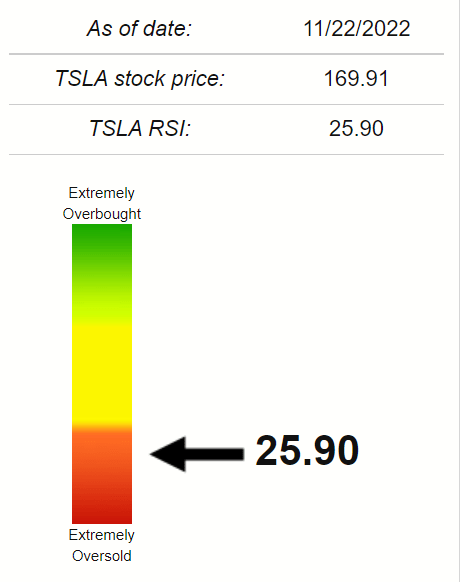

But when pain is at its peak, hope offers solace. The stock getting pummeled has pushed its Relative Strength Index (RSI) to the extremely oversold level of 25. Anything below 30 is considered a safer place to buy, as a rebound is likely from these levels.

TSLA RSI (Stockrsi.com)

Macro

Inflation and Fed policies are still major risk factors for stocks like Tesla that fall under the “risky” bucket. However, there is a silver lining here, too.

“It’s (inflation) probably going to be lower next year” – Kevin Kliesen, business economist and research officer at the Federal Reserve Bank of St. Louis, told CNBC in an interview. How much lower is anyone’s guess but there are enough signs that inflation may have at least topped and, as a result, the Fed is becoming less hawkish. When Mr. Market sees enough signs that October’s slowdown in CPI increase is a trend and not an outlier, GARP names like Tesla will race off the gates as retail and institutional investors start showing some appetite for risk.

Personally, we believe buying Clorox at a PEG of 3 is far riskier than buying Tesla at 0.83.

Conclusion

“Buy when there is a blood on the street” is an adage used frequently in the investing community. Overvaluation, questions about Musk’s involvement, pressure on selling price, and the never-ending China COVID lockdowns have all caused Tesla’s stock to bleed profusely. But will the company bleed to death? No, we don’t believe so. Make no mistake about it, there will be more selling pressure before a rebound, but after a 60% fall, the risk reward appears enticing for longs here.

At the risk of appearing a little early at the party, we believe Tesla is a moderate GARP buy here and will be a strong buy should it go below $150 as technicals seem to be indicating. $150 would mean a forward multiple in the 30s, something Tesla has never seen, and will push the PEG ratio to an even more attractive 0.75.

At heart, Musk is an inventor. Social-media is not where he can quench his thirst and, sooner than later, he will be back at Tesla to take the company to new highs. And Tesla stock should follow (not necessarily to new highs), along with tailwinds from improving fundamentals and macroeconomic factors.

Be the first to comment