Bilanol/iStock via Getty Images

Let’s start with the obvious. Coal prices are spiking to new highs as a scramble for energy around the world on the back of post-pandemic economic reopenings and the disruption wrought by Russia’s weaponization of energy. EU sanctions have all but shut Russian coal out of its continent and exacerbated a global scramble for the rock. Thermal coal also still remains important for electricity generation around the world. India uses it for 70% of its total electricity needs and China is looking to add 270 GW of coal thermal capacity in the next five years through 2025. Even Germany, Europe’s largest economy, has pivoted more heavily to coal in recent months as its nuclear power station shutdowns progressed.

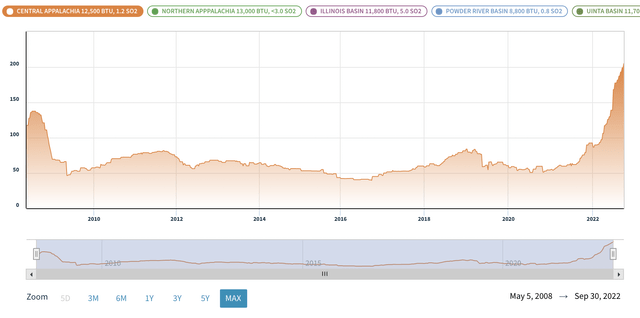

Tulsa, Oklahoma-based Alliance Resource Partners (NASDAQ:ARLP) is now enjoying a near-generational intersection of unique geopolitical events and policy failures. Indeed, US coal prices have surged to a record high past $200/ton. The party has arrived for thermal coal investors with an increased quarterly dividend payout and positive capital gains fully in the swing of the lyrical beat. However, the market sentiment has failed to consider the bigger picture, and whilst the ESG movement might have been too euphoric on its initial timelines for the runway adoption of renewables, the recently signed Inflation Reduction Act represents a step change for the industry. To be clear, coal remains fundamentally incompatible with the drive towards net zero. The Act looks to allocate at least $370 billion to accelerate the drive towards net zero over the next decade.

Coal bulls need to understand that this is not the fringe dreams of a small number of environmentalists. It represents what is fast becoming the single most defining change in contemporary American history. The Inflation Reduction Act is simply unprecedented in its scope and scale and represents the most pertinent effort by any government on earth and against any time in human history to heavily influence the winds of change for its entire energy system. The incentives included in the act go beyond the initial $370 billion cost. They will fast become the ignition that sees coal’s contribution to the US electricity grid continue to realize a permanent decline.

US Demand For Coal Is Eroding As Renewables Become Even Cheaper

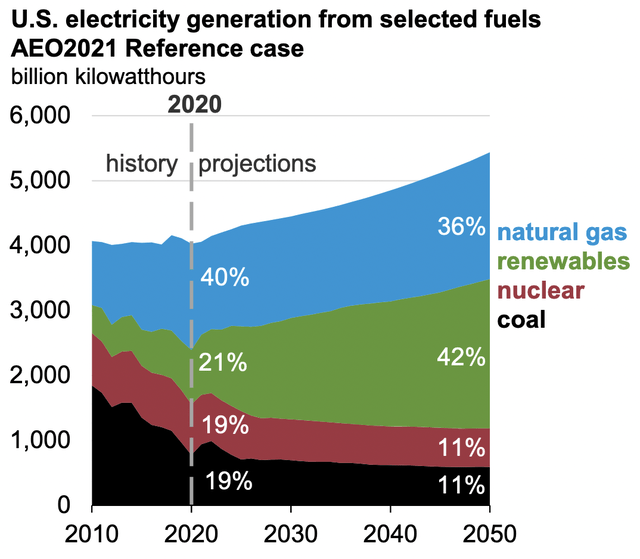

Coal’s contribution to the US electricity grid has been on a structural decline since the start of the new millennium as natural gas took over and renewables experienced explosive growth from a few hundred MWs in the 90s.

Energy Information Association

Analysts from Credit Suisse in late October published a research note on the Act that highlights just how staggering in scope it is. Firstly, the Act might spend twice as much as the currently earmarked $370 billion figure as many important provisions including subsidies for solar and utility-scale battery storage systems are uncapped tax credits.

Essentially, the US government has written a blank check to the renewable industry. The frequently cited figure is wrong. As long as a project meets the terms, the government will award credits. There is no upper ceiling, no budget, and no restrictions. The Act’s total spending is likely to be more than $800 billion, 2x more than what the frequently cited figure. When you adjust for the crowding-in effects of private capital layering on top of government subsidies, the total allocated capital into technologies that compete directly with coal could top $1.7 trillion over the next decade until 2032.

Consultants from the Boston Consulting Group have estimated that the incentives included in the Act could increase the deployment of zero-carbon energy to up to 80% of electricity production as soon as 2030. This would be ahead of the Energy Information Association chart and would see coal fall to a single-digit per cent by the end of this decade. US solar and wind by 2029 could be the cheapest in the world at less than $5 per MWh due to the Act with utility-scale solar deployments alone set to increase by 40%, around 62 GW, over pre-IRA projections through 2027.

Hence whilst the ESG orthodoxy is under siege from the rapacious rise of coal and oil in this distinctive and unique period, it is set to bloom again. The USA’s zero-carbon transition, seemingly faltering, has been resuscitated with the terms of the Act that can only be described as an 800-pound gorilla crushing anything that does not adhere to its scope and requirements.

The Party Will Come To An End But Not Before Risks

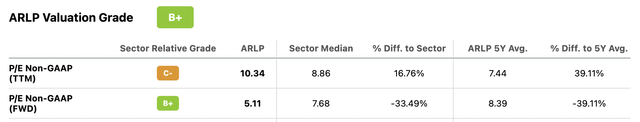

Alliance Resource Partners has seen its market cap rise to $3.10 billion on the back of rising coal prices. However, the company’s broader valuation is understandably still quite favourable to its bulls with its price to trailing 12-months non-GAAP earnings multiple at 10.34x. Whilst this is higher than its sector median, its drops to 5.11x when forward earnings are considered.

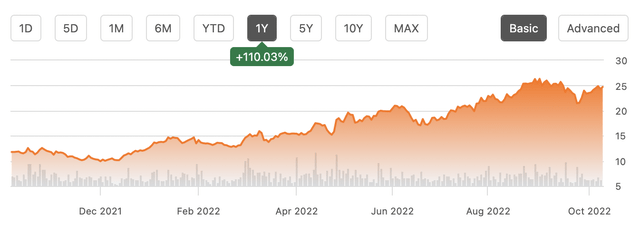

This represents the most pertinent risk for a contrarian bearish view of the company. The financials are improving with revenue growing to $616 million for its fiscal 2022 second quarter, up 70.1% from its year-ago quarter. Coal prices could stay at their elevated levels for years which would support increased dividend payouts and further gains on the common shares.

But the current surge seems to ignore the existential risk posed to Alliance Resource Partners from an economic direction that leaves no room for coal. The Inflation Reduction Act is set to form a foundational element of the US effort to reduce greenhouse gas emissions. Against this future, current dividends and capital gains will prove to be transitory. The Act places a large fiscal backstop to the structural shift to zero carbon technologies and Alliance Resource Partners will likely find itself left behind as the current unique conditions give way and coal prices drop to give way to a zero carbon future. I would not advise investors to short naked using shares but rather through longer-dated out-of-the-money puts. I would go with January 19, 2024, and with any strike price from $20 and below.

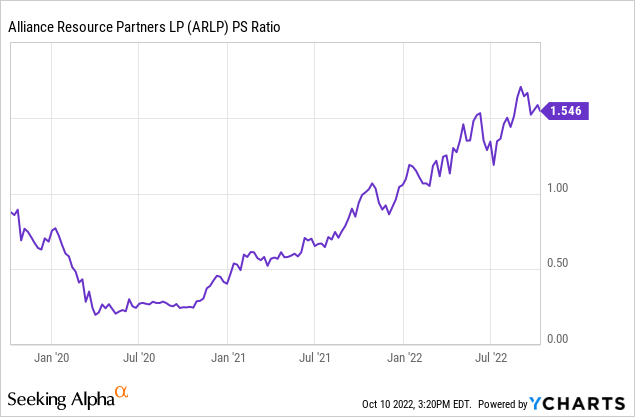

Assuming the short thesis plays out, the company’s P/S ratio should revert closer to its recent lows. This could cut the current multiple from 1.5x to 0.5x. This would be set against the prices for coal dropping by more than half to their historical mean.

This would see a more than 75% reduction in coal prices. Set against both these factors of a falling multiple and declining coal prices, Alliance Resource Partners should see trailing 12-month revenues return to where it was at the start of its fiscal 2020. This would see the company’s valuation revert to under $1 billion on revenue of around $1.5 billion and would be a more than 60% reduction to the current $23.89 price per common share.

Be the first to comment