bluebay2014

Thesis

Readers familiar with our writing know that we are in general bullish about the energy sector. In this article, I will elaborate on two particular oil stocks: Exxon Mobil (NYSE:XOM) and Enterprise Products Partners (NYSE:EPD). The thesis is quite straightforward: we see them as the premier choice in the integrated space and midstream space, respectively. And in the remainder of this article, we will build the thesis around two anchors: A) their generous and safe dividend to help you fight inflation, and B) the many catalysts they enjoy in the near term. More specifically,

- Our current inflation problem is largely driven by fuel costs, which is not a problem for XOM or EPD. On the contrary, I see both XOM and EPD playing an active role in the solution of the fuel cost problem. Besides the business fundamentals, their safe and generous dividends already provide an effective hedge against inflation. XOM is yielding 3.5%, combined with its ~1.5% buyback yields, it provides a total shareholder yield of almost 5%, handily beating even the worst inflation projection (about 4.5%) in the next few years. EPD is yielding even higher (7.5%) and provides an even thicker cushion against inflation.

- Both are also catalysts-rich stocks. They of course enjoy the catalysts that are more general for the entire energy sector, such as high oil and gas prices and also supply-demand imbalances as to be elaborated on later. More importantly, they also enjoy their own specific catalysts. Notably, for XOM, it recently increased its Permian oil and gas production by roughly 130k oil equivalent barrels per day as compared to the same period last year. For EPD, it also saw a spike in the natural gas processing business in the first half of 2022. Its volume in this sector rose more than 18% to 16.8 Btus/d in the past quarter. Combined with the favorable oil and gas prices (which I foresee continuing or even climbing further), such production boosts will lead to robust cash generation, generous shareholder returns, and also aggressive reinvestment for future growth.

XOM and EPD: our best anti-inflation choices

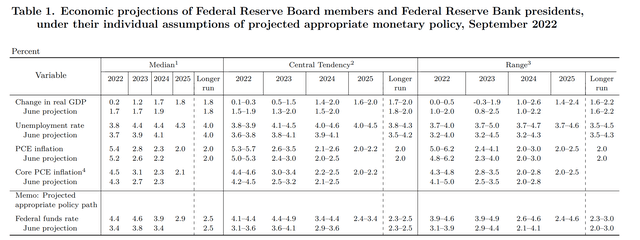

Inflation has turned out to be a more serious and longer-lasting problem than the Fed anticipated. About a year ago, the Fed thought it was “transitory”. But fast forward a year, inflation is still quite high and the Fed anticipates it to remain high as seen from its most recent meeting minutes below. The fed now sees core personal consumption expenditures (“PCE”) at 4.5% for 2022, 3.1% for 2023, and then drop to the 2.x% range starting in 2024.

Source: Fed’s meeting minutes release Sept 2022.

This is where XOM and EPD can help investors in the first place. Besides being able to benefit from rising fuel costs, both pay dividends currently high enough to combat inflation already.

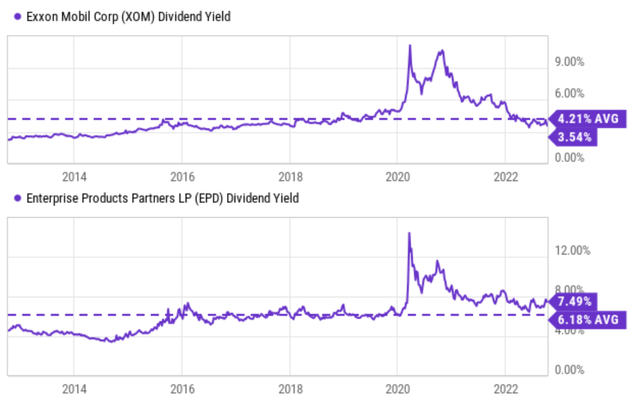

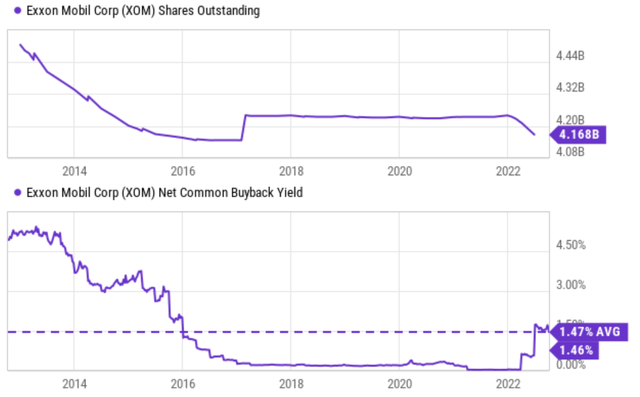

As can be seen from the next chart, currently the dividend yield of XOM is 3.54%. It is admittedly below the 4.5% inflation projection for 2022. However, consider the following facts too. First, a yield of 3.54% is already higher than the average inflation anticipated in the next few years. For example, the average inflation in the next 3 years is projected to be 3.3%. And locking in XOM’s 3.54% yield already provide a full hedge against such averaged inflation. Secondly, I have no double that XOM will keep raising its dividend in the next few years. And finally, XOM is also returning capital to shareholders via share buybacks at the same time. As you can see from the second chart below, it consistently buys its own shares over the long term. And currently, its buyback yield is about 1.46%. So all told, XOM provides a total shareholder yield of almost 5% even, exceeding the worst inflation projection by a good margin even when future dividend raises are ignored.

The picture for EPD is even simpler. As an MLP, it pays out a larger portion of its income as dividends and it is currently yielding 7.49%, which already exceeds the worst inflation projection by almost 300 basis points. It is also worth mentioning that EPD is a dividend champ, with 25 years of consecutive dividend raises. There are only two midstream partnerships that have this elite status (the other one is Enbridge Inc. (ENB)). Its size, diversity, and long-term consistency make it our premier choice in the midstream space.

Source: Seeking Alpha data. Source: Seeking Alpha data.

Industry-wide catalysts

Before we dive into the catalysts specific to XOM and EPD, I feel it is a good idea to recap the industry-wide catalysts to provide a broader context. These catalysts have been detailed in our earlier article and only a brief summary is provided for ease of reference.

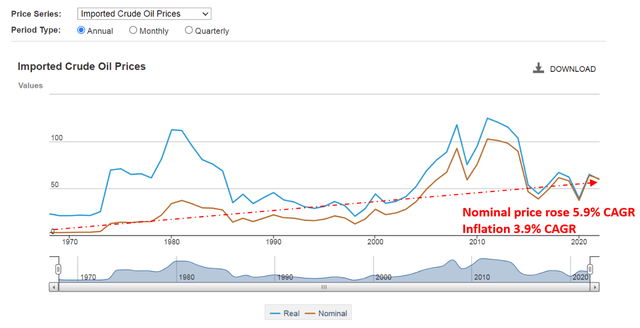

- First, oil prices have consistently beaten inflation in the past and I expect oil and gas prices to at least keep up with inflation going forward too. The nominal oil prices over the past 50+ years have been rising at 5.9% CAGR (see the first chart below). Over this same period of time, inflation has been 3.9% CAGR on average. But the crude oil price is now where it was 8 years ago even after its recent surges. As a result, a rally in oil prices is overdue. The oil prices have more catch-up to do in the future. It should be at about $130 now to just make up the inflation in the past decade or so.

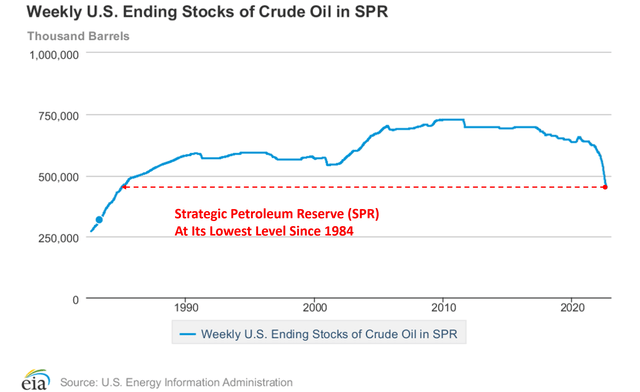

- Second, the U.S. will need to replenish the strategic petroleum reserve (“SPR”). The SPR is at a current level of 427 barrels after President Biden decided to release the SPR to fight higher oil and gasoline prices last year. To put things into perspective, the SPR was 620 M one year ago and the current level is the lowest since 1984 (see the second chart below).

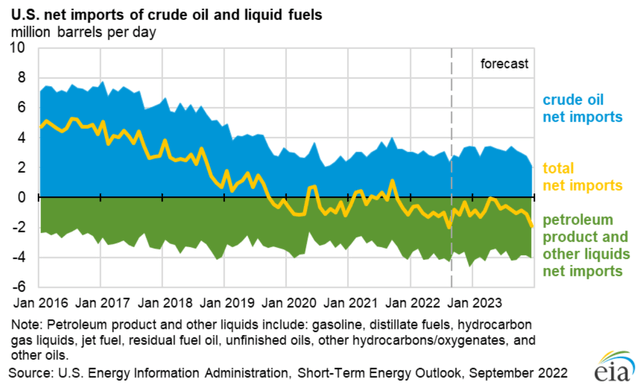

- Third, unfortunately, both our imports and our current oil inventor are also low. Our imports are actually at a net negative level as seen from the third chart below.

Going forward, the recent decision by OPEC to limit the crude oil supply, the ongoing Russian/Ukraine situation, the U.S.’ needs to refill the SPR, and also the possibility of cold winter, could all further exacerbate the supply-demand imbalance.

Under this broader context, let’s examine the specific catalysts for XOM and EPD.

Source: U.S. Energy Information Administration (EIA) Source: U.S. Energy Information Administration (EIA) Source: U.S. Energy Information Administration (EIA)

XOM specific catalysts

As aforementioned, during the first half of this year, XOM increased its Permian oil and gas production by roughly 130k oil-equivalent barrels per day compared to the same period last year. It also increased its refining throughput by 180k barrels per day. Such production boosts came at very fortuitous timing to meet recovering product demand. As mentioned, thanks to the robust oil and gas prices, its bottom line reaped the rewards of increased production, higher realizations and margins, and aggressive cost controls. All told, it reported June-quarter EPS of $4.21 (compared to $1.1 one year ago) and an impressive 71% jump in sales YoY.

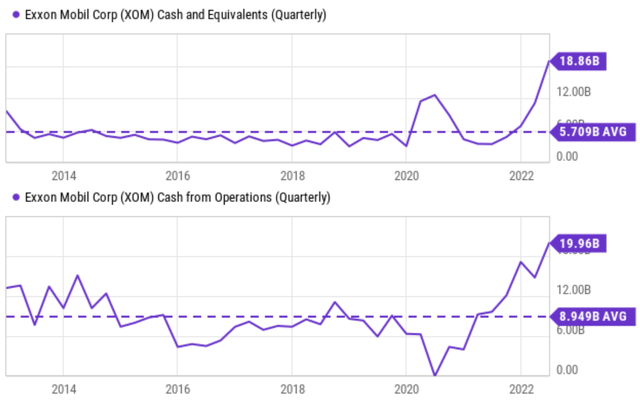

It is in strong financial shape. The company currently has about $18.9 billion of cash and equivalents on its ledger, the peak level in a decade as you can see from the top panel of the chart below. In the meantime, strong expected cash flow ought to be more than sufficient to cover capital expenditures and support further dividend raises. as you can see from the bottom panel of the following chart, it generated a $19.9B operation case in the past quarter, not only at the peak level in a decade but also more than 2x higher than its average of $8.9B.

Going forward, I see it continuing to reap the rewards of higher industry prices and margins. As mentioned above, foresee high oil and gas prices continuing or even climbing further. XOM’s production boosts are expected to keep generating robust cash flow to support generous shareholder returns and growth CAPEX expenditures.

EPD specific catalysts

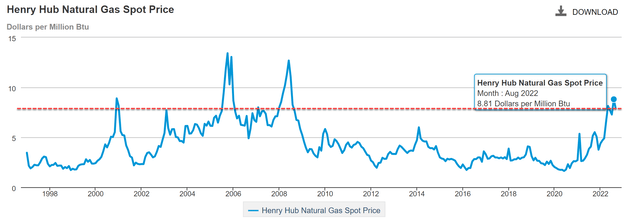

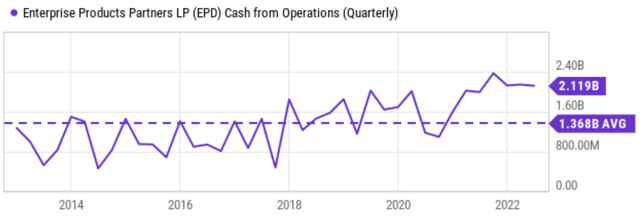

EPD boosted its natural gas processing business too. Volume in this sector rose more than 18% to 16.8 Btus/d. And thanks to robust natural gas prices, such a volume boost translates into a $252 million increase in its gross operating income in the past quarter alone. As you can see from the top panel of the following chart, natural gas prices now stand at $7.88 per million Btu. It is slightly lower than its peak level of $8.81reached in August, but still among the highest prices since 2008. Such production boosts and a strong pricing environment were also reflected in its bottom lines. In the second quarter of 2022, unit earnings came in a $0.64, a whopping 28% hike YoY. Its cash from operations also stand at a record level as seen from the second chart below.

Going forward, I expect these tailwinds to continue. I am anticipating a 2022 unit net of around $2.5. As mentioned above, the boycott of Russian oil and the production limit set by OPEC provides an immediate catalyst for domestic production leaders like EPD. Besides the boost in its natural gas production and robust natural gas prices, I also expect EPD exports of LNG (liquified natural gas) to grow with Europe’s energy needs, especially in the incoming winter. Meanwhile, I expect its other reporting sectors such as octane enhancement and NGL fractionators to contribute to the growth as well given the strong commodity prices.

Source: U.S. Energy Information Administration (EIA) Source: Seeking Alpha data

Risks and final thoughts

The main risks I see are mostly in the long term (5 years and beyond). As a society, we are paying increasingly greater attention to climate change. For example, new industry priorities and the Biden Administration are pushing oil companies to conduct operations with an eye toward reducing carbon emissions. High fuel prices can also trigger political risks for big oil companies. For example, the Governor of California recently called for a windfall tax as gasoline prices renewed their climb recently and California has some of the most rapid gasoline price hikes compared with other states.

All told, we are in general bullish about the energy sector. And in particular, XOM and EPD are our best picks among the major energy players. In our view, both are excellent anti-inflation and catalyst-rich picks. Both are dividend champs. And both provide safe and generous dividends to handily beat even the worst inflation projection (about 4.5%) in the next few years. EPD is yielding 7.5%. XOM is yielding 3.5%. But when combined with its ~1.5% buyback yields, it provides a total shareholder yield of almost 5%. In terms of catalysts, in addition to the industry-wide catalysts, their production boosts and scale also provide additional catalysts unique to themselves only. Combined with the high oil and gas prices, I expect these catalysts to keep their cash generation robust to support continued dividend raises, buybacks, and growth reinvestment.

Be the first to comment