Andres Victorero

Investment Thesis

Blackstone Mortgage Trust (NYSE:BXMT) is a real estate finance business. The company is experiencing a solid economic tailwind of floating rate expansion which can drive earning growth in the coming years. BXMT’s multifamily portfolio is experiencing income growth due to a supply-demand mismatch. The company is paying a solid dividend yield of 10.95% at the current share price.

About BXMT

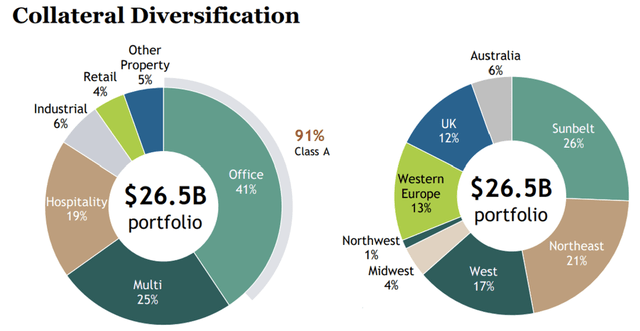

BXMT is a real estate finance business that originates senior loans secured by commercial real estate in Europe, North America, and Australia. BXMT operates its business under only one business segment: Origination and Acquisition of Commercial Mortgage Loans and Related Investments. The company’s portfolio of senior loans is secured by high-quality institutional assets in major markets and sponsored by experienced real estate investment operators and owners. The company operates as Real Estate Investment Trust (REIT). It distributes a minimum of 90% of its net taxable income to its unitholders. That is why it is exempted from U.S. federal income taxes. The company’s portfolio comprises more than five types of properties: Office, Multifamily, Hospitality, Industrial, Retail, and Others.

Collateral Diversification (Investor Presentation: Slide no:8)

The company is experiencing a strong tailwind, which can drive future earnings growth in the coming years. I will explain in detail about this tailwind in the next section.

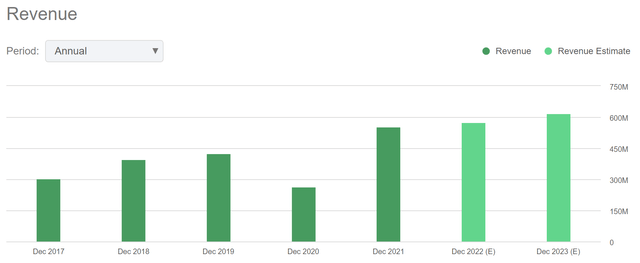

Financial Trends & Economic Tailwind

The revenue has grown from $424.18 million in FY2019 to $554.33 million in FY2021, resulting in a 3-year CAGR of 9.33%. In FY2020, the company experienced a significant decrease in revenue due to the adverse effect of Covid-19. But in FY2021, the company’s revenue increased dramatically. The company reported revenue growth of 109.56% in FY2021 compared to the revenue of FY2020. According to the seeking alpha, the increased revenue levels are sustainable in the coming years. The seeking alpha estimates that the revenue of the FY2022 and FY2023 might be $574.31 million and $619.44 million, respectively, which results in a CAGR of 3.77%. I believe these estimates of sustainable revenue levels of the seeking alpha are accurate as the company is experiencing income growth from the multifamily portfolio. The income growth of the multifamily portfolio is driven by a supply & demand mismatch, which is expanding because of rising build costs and higher mortgage rates for potential house buyers.

Also, the company has stated a positive correlation between its earnings & rising rates, and 99.9% of the floating rate portfolio can earn inflation-protected earnings. I think the company might experience significant growth in its earnings in the coming years as it has a solid economic tailwind rising floating rate of the portfolio. According to the company, a 100bps increase in base rates results in an incremental $0.15 annual EPS. The company’s 98% of investment earns a floating rate of interest which indicates that the rising interest rate can significantly grow earnings.

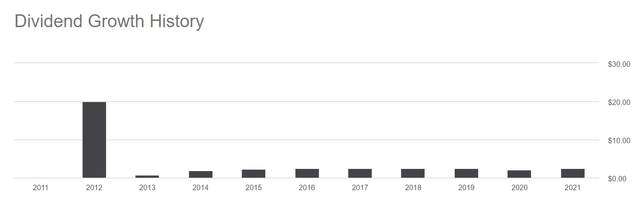

10.95% Dividend Yield

Dividend History (Seeking Alpha)

Recently, the company announced the quarterly dividend payment of $0.62, which is equivalent to the annual payment of $2.48. At the current share price, the dividend payment of $2.48 will translate into a forward dividend yield of 10.95%. The company has a long history of stable dividend payments. The company has paid an annual dividend of $2.48 from FY2016 to FY2019. Due to the economic slowdown and uncertainties caused by Covid-19, the company decreased the dividend payment and paid $2.06 annually. But, after the substantial revenue and earnings growth, the company has again resumed the dividend payment of $2.48. I think the current dividend payment is sustainable in the coming years as the company is experiencing strong growth and an economic tailwind after Covid-19. I believe the stable dividend yield of 10.95% is an attractive investment opportunity for retirees and risk-averse investors.

What is the Main Risk Faced by BXMT?

Prepayment Rates

The company’s current business strategy is to create floating-rate mortgage loans backed by commercial real estate assets. Mortgage loan customers typically have the option of paying off their debt before the specified maturity. Prepayment rates on loans typically rise during falling interest rates and credit spreads. The proceeds of such prepayments received during such periods may not be reinvested for a time or may be reinvested by the company in securities with lower returns than the assets that were prepaid if general interest rates or credit spreads decrease concurrently. Prepayment rates have little impact on the value of these loan assets because BXMT’s mortgage loans are often neither acquired nor generated at a premium to par value.

On the other hand, prepayment rates might impact the value of some other assets. The company would assume that the underlying mortgages would pay back at a predicted pace, providing an expected yield if BXMT were to create or acquire mortgage-related securities or a pool of mortgage securities in the future. The accompanying prepayments on any such mortgage-related securities will probably diminish the expected yield if the corporation buys such assets at a discount to par value or if borrowers prepay their loans sooner than anticipated. In contrast, if the corporation chooses to purchase such assets at a discount to par value, the decline in corresponding prepayments on the mortgage-related securities would probably cause the expected yield to decrease as borrowers prepay their loans more slowly than anticipated. The then-current level of interest rates and credit spreads, changes in asset values, the accessibility of mortgage credit, the relative economic vitality of the area of the property, the servicing of the loans, potential changes in tax laws, alternative investment opportunities, and other economic, social, geographic, demographic, legal, and other factors could all have an impact on prepayment rates. As a result, such prepayment rates are very variable and unpredictable from one period to the next. Prepayment risks cannot be completely eliminated by any method, and quicker or slower prepayments may have a negative impact on the business’s profitability and the amount of cash available to distribute to shareholders.

Valuation

The company is experiencing an economic tailwind of increasing floating interest rates and rising income from the multifamily portfolio. Both of these factors can drive earnings growth for the company in the coming years. After considering all these factors, I believe the seeking alpha’s EPS estimate of FY2023 of the company is accurate. According to the seeking alpha, the company’s EPS for FY2023 might be $2.77, which gives the forward P/E ratio of 8.16x. According to my analysis, the company is undervalued as its forward P/E ratio is lower as compared to the sector median of 9.35x. The primary risk factor of the company is prepayment rates. But I think the possibility of loan prepayment is not significant in the current economy as interest rates are rising, which makes the risk-reward favorable. Hence, I believe the company can trade at its 5-year average P/E ratio of 10.5x, which gives the target price of $29.09, representing a 28.5% upside from the current share price.

Conclusion

BXMT has a solid economic tailwind of a rising floating rate which can help it to generate solid inflation-protected earnings. The company is experiencing income growth from its multifamily portfolio due to a supply & demand mismatch. At the current share price, the company pays a dividend yield of 10.95%. BXMT is undervalued as its forward P/E ratio is lower as compared to the sector median of 9.35x. The company can give a price return of 28.5% from the current share price levels. The addition of dividend yield and price return translates into potential total returns of 39.45% from the current share price. After considering all these factors, I assign a buy rating for BXMT.

Be the first to comment