imagedepotpro/E+ via Getty Images

This article was co-produced with Williams Equity Research.

Arbor’s Role In Real Estate

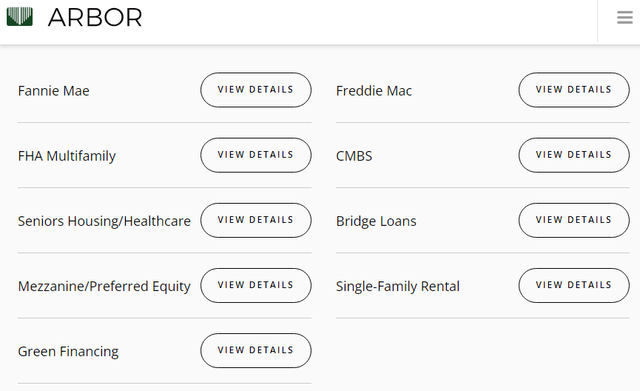

One of the best ways to understand a company is to walk in the shoes of a potential customer. When a prospect visits Arbor Realty Trust’s (NYSE:ABR) website, they’ll quickly realize the firm specializes in loans to all property types, including multifamily, office, industrial, retail, healthcare, hospitality, military, student, and even senior housing.

They’ll also notice two main businesses, one for small loans under $7.5mm and the other for larger loans. Regardless of loan size, Arbor’s approach is excellent terms (e.g., willing to go to 80% loan-to-value, even on small loans), competitive interest rates, hands on support and customization, fast execution, and in-house servicing for the life of the loan.

Many lenders, likely including the one that provided the mortgage on your home, sell the loans almost immediately after origination to a Wall Street firm that securitizes them.

Arbor is a repeat top 3 Freddie Mac Small Balance Loan lender and top 5 Fannie Mae Small Loans lender.

Source: Arbor

These are the loan programs available today just for the larger commercial loans. This diversity allows Arbor to rotate as supply and demand for different loan types fluctuate.

One area that an investor could reasonably assume Arbor is at a disadvantage is technology. We all hear of the hundreds of millions of dollars large financial institutions spend to improve the user interface and integration capabilities of the applications and software clients utilize. J.P. Morgan averages $12 billion in technology spending every year. I picked that number for a few reasons, including the fact it’s almost identical to the value of Arbor’s entire portfolio.

I refinanced my primary residence in July of 2021 to a 15-year loan at 2.0%. I shopped many lenders for the best terms and went through the entire loan process with both established and smaller, more technology focused providers.

It wasn’t the gigantic Wall Street firms spending billions a year in technology that had the most reliable and seamless process – it was firms like Better Mortgage. That wasn’t too much of a surprise as I’d already seen how third parties, like Bankrate, rank lenders.

Arbor’s ALEX platform reminds me of how modern mortgage companies operate. It has e-signature execution, a dedicated loan officer, a single form encompassing the entire loan application process, and 24 hours a day loan progress updates and visibility via mobile. These advancements are still relatively new in the residential mortgage market, but they are brand new on the commercial side.

I am head of acquisitions of a new short-term rental real estate fund I co-founded and recently decided on a lending partner to help grow the portfolio. I doubt there was much difference between the process I went through in recent months and what it would have looked like five or 10 years ago. After learning more about Arbor’s offerings in this area, they are now on my short list for potential lending partners going forward.

Although most people haven’t necessarily run across Arbor in their daily lives, the firm has been around for over 25 years and is rated by S&P and Fitch for commercial and special loan servicing (that’s not the typical company credit rating). This puts Arbor in a small group of sophisticated firms.

Now that we have a good idea of what Arbor does, let’s see what they own.

Understanding A Unique Portfolio

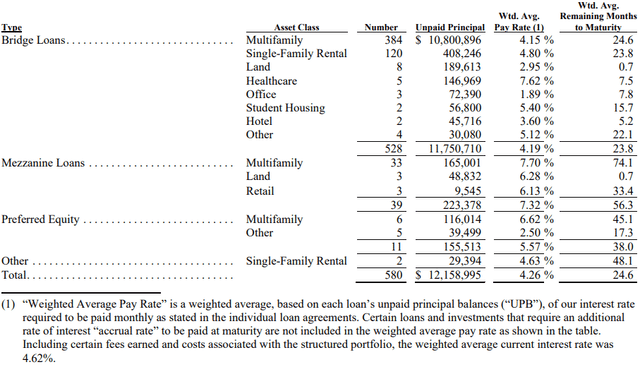

Source: SEC.gov 2021 10-K

A good grasp on portfolio strengths and weaknesses is key to analyzing any equity REIT or mortgage REIT (“mREIT”). There are usually multiple layers if you look closely, and Arbor Realty Trust’s portfolio is a great example of that.

Starting with the above chart, we see it consists primarily of Bridge Loans, Mezzanine Loans, and Preferred Equity. $11.75 billion of the $12.16 billion in gross assets, or 96.6%, fall under the bridge category.

As the name suggests, these are loans designed to transition properties from one purpose or condition to another. Yields for bridge loans are higher than traditional mortgage loans and can entail more risk (but not always).

Within the 96.6% of the portfolio allocated to bridge loans, the vast majority, $10.8 billion or 91.9%, are tied to multifamily properties. The next largest allocation is $408.3 million to single-family residential. You won’t be able to gauge how heavily weighted Arbor’s business is to bridge loans connected to multifamily properties by perusing the website.

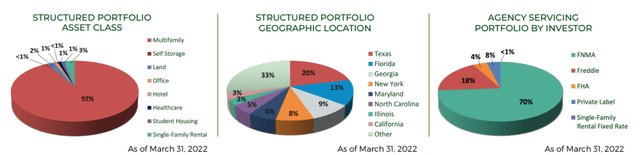

Source: Arbor Q1 2022 Fact Sheet

Despite the concentration in multifamily bridge loans, the portfolio is well diversified geographically, which is important. Perhaps more than ever, spreading what is effectively real estate exposure across many states and regions is critical.

Let’s see how the portfolio’s cash flows have evolved in recent quarters.

Arbor Realty’s Cash Flow & Dividend

Like most non-equity REITs, Arbor uses distributable earnings per share (“EPS”) to measure its cash flow. It’s not a perfect measure, but it’s sufficient for measuring cash flow and dividend coverage over time.

Going into Q1 2022, the market expected Arbor to generate $0.48 in distributable EPS. Arbor’s stock last closed at $15.19, meaning $0.48 would be a 12.6% cash flow yield. That’s already among the best of any REIT, equity, or mortgage.

But Arbor isn’t just any REIT.

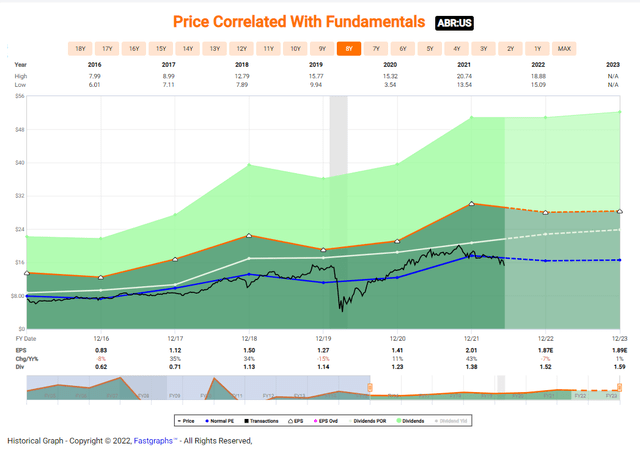

It beat Q1 estimates by 14.6% by delivering $0.55 per share in distributable EPS. Arbor is also among the fastest growing of any REIT. For context, Arbor generated $0.74 in annual distributable EPS in 2017 versus $2.01 in 2021. That’s 171.6% growth in four years.

That’s permitted Arbor to responsibly grow its dividend at a rapid pace. On May 6th, just after Q1 earnings were released, the company increased the quarterly dividend yet again to $0.38 per share. At the time, that equated to a 8.8% forward yield. With the stock price down from ~$17.35 to $15.19 since earnings were released, that has increased to 10.01%.

If you are like most experienced dividend investors, the first thought that enters your mind after reading that statistic is “sure, now what about dividend coverage?”

And back in 2017, that was an especially good question as the payout ratio was essentially 100%. That’s not the case in recent years, however, as Arbor generated excess earnings per share above what was needed to cover the distribution of $0.43 in 2020 and $0.53 in 2021.

That’s a 73.6% payout ratio for 2021.

Last quarter wasn’t any different; the $0.55 in distributable EPS against the latest dividend of $0.38 is a 69.01% payout ratio.

A 70-75% payout ratio is associated with top quality investment grade equity REITs. Most mortgage REITs, even the good ones like Blackstone Mortgage Trust (BXMT) and Starwood Property (STWD), routinely pay out above 90% of their distributable earnings in distributions.

And none of Arbor’s peers, and I mean none, have increased their dividend eight consecutive quarters. In case you are wondering if they were doing the “one cent a quarter” trick, the dividend is up 27% over that period.

Do you know why all that is especially surprising?

BXMT and STWD have dividend yields of 8.35% and 8.63%, respectively, and that’s despite payout out a much higher percentage of their cash flow as dividends.

To understand how that’s possible, it’s time to talk valuation. And we can’t forget about risk.

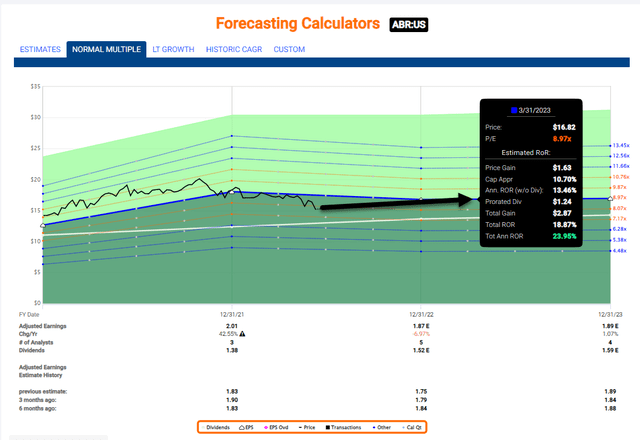

FAST Graphs

The Key Ingredients To Every Investment Recipe: Valuation & Risk

On the risk front, Arbor recorded $3.1 million in provisions for current expected credit losses (often noted as CECL in presentations and filings). For context, Arbor originated $2.83 billion in new loans in Q1 2022, and as we discussed earlier, maintains a portfolio of over $12 billion loans.

If my math is right, the CECL is 0.0254% of the total portfolio value. That’s less than a one tenth of one percent. Rarely is $3.1 million a rounding error, but it is here.

This is in line with Arbor’s excellent risk management and loan loss mitigation historically. Loan losses are where the rubber meets the road for mortgage REITs like Arbor, but what other risks should we be aware of?

Despite a heavily diversified income stream in some way, in others it is closely tied to bridge loans in one or two areas of the real estate market. In some ways, that’s significantly more concentrated than the businesses of larger commercial mortgage REITs like BXMT and STWD.

In addition, while neither BXMT or STWD are investment grade, they do have much larger balance sheets, a large parent company as a potential backstop/support system, during a crisis, and have credit ratings, albeit a couple notches from investment grade.

On the other hand, I know many real estate investors that would much rather have Arbor’s portfolio than BXMT or STWD’s as they are loaded with office, retail, and a good amount of hotel properties that many remain bearish on. Arbor has no material exposure to any of those sectors.

Determining book value for Arbor isn’t an exact process, but we can still use earnings multiples to reliably encapsulate the firm’s relative value to other mortgage REITs. In reality, cash flow yield per share is more important than premium or discount to book value.

Arbor is on track to generate at least $2.10 in distributable EPS in 2022, or a 7.3 EPS multiple against Friday’s close. Applying roughly the same EPS calculation yields $2.50 for 2022, or a 11.8 EPS multiple. STWD’s distributable earnings have been more volatile and more difficult to predict but should land around $2.30 per share, or a 9.7 EPS multiple.

We could also talk about Granite Point Mortgage Trust (GPMT) or Ladder Capital (LADR), but they are significantly more expensive on a cash flow basis than ABR, STWD, or BXMT as they were more negatively impacted by the pandemic and associated market crisis.

They aren’t bad companies and have other elements of their business models that are unique and attractive. Williams Equity owns shares in every company mentioned in this article, including them.

That said, it’s clear that Arbor has been playing on a completely different stage than the other small and middle-weight mortgage REITs and has more often than not outperformed the heavyweights.

Conclusion

I don’t know of any other company with a comparable three or 5-year track record as Arbor that trades below 12x forward cash flow, much less 8x.

Arbor handled the pandemic extraordinarily well and its heavy concentration in multifamily bridge loans, although a risk in of itself, is compelling in an inflationary environment where risks in many other areas of real estate, like office, don’t seem to be going away.

If you were to adjust Arbor’s stock to the median of the heavyweight peers, that’s $22 per share, or about a dollar shy of the 52-week high set in November of last year. That’s a 43.9% capital gain and a 10.01% yield on cost if you assume it takes a year to get there, or a ~54% total return. This is the literal upside to a high-quality stock like Arbor selling off indiscriminately.

On the downside, Arbor’s double-digit yield (by two basis points) and exceedingly conservative payout ratio means there is at least a reasonably high likelihood that investors will receive the current distribution rate of $0.38 quarterly while we wait for the stock price to take its course.

That’s not a terrible “bear” case if you ask me.

Note we didn’t even mention the fact the distribution has increased for eight consecutive quarters and has more than doubled since 2017.

My oh my, Arbor is a definitive Buy!

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment