Feline Lim

Apple (NASDAQ:AAPL) stock has been flight to safety stock for many investors, given its sterling reputation with consumers. This is reflected by AAPL’s relative outperformance compared to other tech juggernauts, Google (GOOG) and Amazon (AMZN) over the past year.

However, given the high investor sentiment on Apple, I believe it’s time investors take a hard look on whether if the stock deserves its current multiple, especially considering potential headwinds brewing on the horizon.

The Positives

Starting with the positives, AAPL is perhaps the very definition of own a premium brand, as it has spent decades crafting its reputation with consumers, with superior top of line products that cater to its customers from design, usability, and functionality standpoints. In addition, its ecosystem of products and services provides consistent and loyal customer base that has proven to be resilient even through recessions.

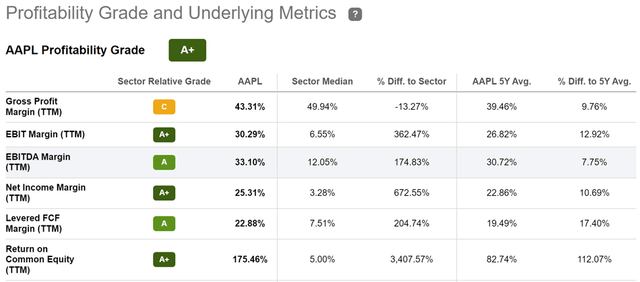

Consumer loyalty is often reflected by a company’s margins, and Apple’s profitability grade says it all with an A+ grade and sector leading EBITDA and Net Income Margins of 33% and 25%, respectively. Moreover, Apple has been aggressive with share buybacks. The heavy reductions in share count pushes up its return on equity. As shown below, AAPL comes with a return on equity of 175%.

AAPL Profitability (Seeking Alpha)

Moreover, investors like recurring subscription revenue streams, as opposed to one-time perpetual hardware sales. Encouragingly, services revenue is growing to become a higher percentage of total sales. This is reflected by the 110 basis points growth in services as a percentage of revenue from 18.7% last year to 19.8% in the current fiscal year (ended in September).

Recent Results

Meanwhile, Apple is demonstrating strong results, particularly amidst a tough economic backdrop, with record revenue of $90 billion in fiscal Q4, representing 8% YoY growth. This was largely driven by iPhone and Mac sales growth of 10% and 25%, respectively, followed by other products and services, with 10% and 5% growth.

Encouragingly, the higher installed base of users came in part from double-digit growth in switchers, mostly from Android devices, and Apple achieved new record revenue in every geographic segment, including double-digit growth in India, Southeast Asia, and Latin America. Moreover, the CEO Tim Cook noted that silicon-related supply constraints were insignificant in its impact to Apple’s operations.

Importantly, Apple maintains an AA+ credit rating, putting it on par with that of the U.S. Government. This is supported by $109 billion in cash, short term investments, and net receivables at present, against $99 billion in long-term debt, much of which is held at low interest rates and was used to fund share buybacks.

Headwinds

Headwinds for Apple include its heavy reliance on China for its manufacturing. This came to fruition last Friday, as Reuters reported that iPhone production could drop at least 30% at Foxconn’s plant in Zhengzhou, China as a result of worker unrest due to COVID-19 restrictions. Furthermore, civil protests in China’s most populous city, Shanghai, over the weekend adds another layer of uncertainty.

Moreover, Reuters also reported that many shoppers were unable to find Apple’s high-end iPhone 14 Pro over Black Friday, as the company struggles with production issues in China. While Apple is a much more diversified now with services, the fact remains that iPhone sales still account for the lion’s share (52%) of Apple’s revenue for fiscal year 2022. In addition, worrying levels of consumer debt is also a risk, as iPhones are a consumer discretionary item, no matter how popular they may seem.

Lastly, I’m wary of a recent report that Apple is interested in buying Manchester United Plc, as companies that venture too far out of their wheelhouse tend to find that they bit off more than the can chew. As fellow contributor Albert Lin noted below in his recent article, such a purchase may not involve much synergies with Apple’s streaming service:

Apple TV isn’t exactly the leader in the streaming space, which is highly competitive with players like Netflix (NFLX), Disney+ (DIS), and a number other AVOD providers including Tubi (FOX) (FOXA) and Peacock (CMCSA). Streaming is a highly fragmented industry and will likely remain so in the future (here’s why). With a market share of just 6%, Apple TV is unlikely to increase its market share by any meaningful amount through buying a football club for $7 billion.

Valuation

Given the aforementioned concerns, I don’t believe Apple deserves to trade at $148 with a forward PE of 23.7 at the moment. This is also considering that analysts estimate just 4 to 9% EPS growth over the next 2 years. I believe a forward PE of 20 is more reasonable, representing a 16% discount to the current price. This equates to a $125 price that I would find attractive. Don’t think that’s possible? Anything is possible, as stock prices are based on investor sentiment, as stockholders of Google and Amazon can attest to.

Investor Takeaway

Apple, while still a great company, is far from being a “no brainer” buy at its current price. With the headwinds of consumer debt and production issues in China, coupled with its low EPS growth expectations, I think it’s best to wait for a pullback before entering this position. For the long-term value conscious investor, a pullback is likely necessary before investing.

Be the first to comment