Viorika

The US economy may currently be in recession as we have had 2 consecutive quarters of negative GDP. Interest rates and borrowing costs have been rising around the globe. How can investors position their portfolio for the predicted weak global economic growth for the rest of 2022? Prospect Capital (NASDAQ:PSEC) is our 2nd pick for 2022. You can read our 1st pick for 2022: Olympic Steel (ZEUS).

This article is part of a new series of articles with the theme of stock picks for higher interest rates, inflation and weak growth. The main driver of our stock picks for the rest of 2022 will be the “Margin of Safety” concept pioneered by Benjamin Graham.

Benjamin Graham was an investor and is generally considered the father of security analysis and value investing. Margin of safety is the principle of buying a security at a significant discount to its intrinsic value, which is thought to not only provide high-return opportunities but also minimize the downside risk of an investment. In simple terms, Graham’s goal was to buy assets worth $1 for 50 cents. He did this very, very well.

Prospect Capital’s Profile

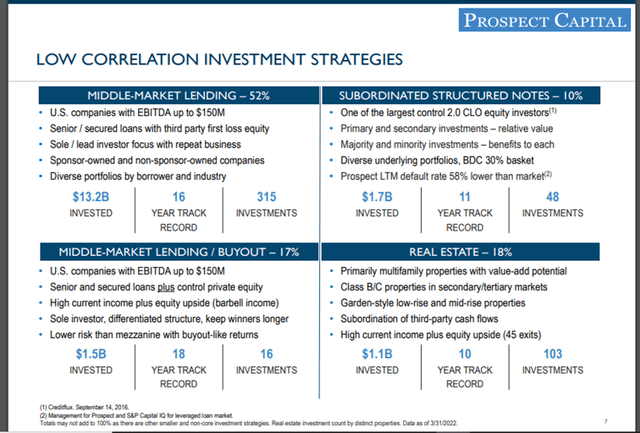

Prospect Capital invests primarily in first-lien and second-lien senior loans and mezzanine debt, which in some cases include an equity component. It provides capital to middle-market companies and private equity financial sponsors for refinancings, leveraged buyouts, acquisitions, recapitalizations, later-stage growth investments, and capital expenditures.

It seeks to invest between $10M to $500M per transaction in companies with EBITDA between $5M and $150M, sales value between $25M and $500M, and enterprise value between $5M and $1000M. It funds also co-invests for larger deals. It’s one of the largest BDCs, with $7.5B in assets under management. PSEC has made over 375 investments totaling more than $18.7 billion of capital with 127 current portfolio companies spanning 39 separate industries.

Prospect Capital is a publicly-traded closed-end investment company that has elected to be treated as a business development company under the Investment Company Act of 1940, as amended. PSEC completed its initial public offering in 2004.

Since their creation by Congress in 1980, BDCs have become an important source of capital by lending to American businesses that might not otherwise obtain financing from the banking or capital markets. Our industry today has grown to approximately 50 publicly traded BDCs, which pay no corporate income tax if, among other requirements, they distribute at least 90% of their taxable income to shareholders.

BDCs are regulated under the Securities Act of 1933 and the Investment Company Act of 1940. As a result, shareholders of BDCs receive the investor protections of our securities laws while having an opportunity to participate in the types of investments that otherwise are only available to deep-pocketed investors through private partnerships. For many of the companies in which a BDC invests, traditional sources of financing like bank lending or public offerings are unavailable. BDCs are also required to offer managerial assistance to the companies in which they invest.

In summary, BDCs provide substantial benefits to the American economy, providing an alternative source of capital for small-sized and medium-sized private companies subject to public disclosure and transparency. BDCs also serve as a tax-efficient and income-oriented investment vehicle for shareholders.

Prospect Capital’s Financials And Trends

Prospect Capital is one of the largest BDCs, with $7.5B in assets under management. Prospect Capital has 127 current portfolio companies spanning 39 separate industries and non-accrual loans remain low at 0.4%. Here is a look at Prospect Capital’s financial metrics for the past year:

| Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | |

| Net Investment Income – NII | $73,402 | $73,229 | $81,369 | $85,557 | $87,005 |

| Shares Outstanding | 387,400 | 388,400 | 389,500 | 390,600 | 391,700 |

| NII per share | $0.189 | $0.189 | $0.209 | $0.219 | $0.222 |

| Dividend per share | $0.180 | $0.180 | $0.180 | $0.180 | $0.180 |

| Dividend coverage | 105.26% | 104.74% | 116.06% | 121.69% | 123.40% |

| GAAP earnings | $246,008 | $242,421 | $209,724 | $246,441 | $157,157 |

| Shares Outstanding | 387,400 | 388,400 | 389,500 | 390,600 | 391,700 |

| EPS | $0.635 | $0.624 | $0.538 | $0.631 | $0.401 |

| NAV per share | $9.38 | $9.81 | $10.12 | $10.60 | $10.81 |

| Total Debt | $2,160 | $2,233 | $2,079 | $2,360 | $2,589 |

| Debt to equity ratio | 56.50% | 55.90% | 48.20% | 51.30% | 53.90% |

| Unsecured debt % of total debt | 84.30% | 100.00% | 96.00% | 80.30% | 73.30% |

Prospect Capital’s 10-Q

Our key trends of note:

- NII is up 18% from a year ago, and now sustained over 20 cents for 3 straight quarters. Dividend coverage is now at 123%.

- NAV per share up a healthy 15% even after Prospect Capital paying its 9% monthly dividends.

- Total debt up 20% from a year ago, but Debt to Equity falling from a year ago and below 55%. This is the lowest debt to equity in the BDC space.

- Unsecured debt is still over 70% of the capital stack, one of the best in the BDC space.

While we will expand later in this article, one can see the direct relationship between the amount of debt and the amount of Net Investment Income – NII. This makes sense, the more you borrow, the more you can lend out to your portfolio companies. This is a significant advantage for Prospect Capital as it has the lowest debt levels of any BDC, hence can now borrow more going forward, increasing its NII and dividend.

Prospect Capital is also a bit different than many other BDCs as they also invest directly in equity positions of some of their portfolio companies. These equity investments are 23% of Prospect Capital’s portfolio. Here are their top 5 equity holdings:

| Q1 2021 | Q2 2021 | Q3 2021 | Q4 2021 | Q1 2022 | |

| National Property REIT Corp. | $1,084,385 | $1,189,755 | $1,239,596 | $1,223,798 | $1,528,576 |

| First Tower Finance Company LLC | $579,086 | $592,356 | $611,228 | $625,097 | $645,156 |

| InterDent, Inc. | $363,399 | $412,339 | $451,344 | $448,134 | $409,757 |

| Valley Electric Company, Inc. | $145,707 | $149,695 | $142,919 | $146,517 | $148,367 |

| Credit Central Loan Company, LLC | $71,144 | $78,023 | $88,469 | $89,525 | $86,156 |

| Top 5 totals | $2,243,721 | $2,422,168 | $2,533,556 | $2,533,071 | $2,818,012 |

Prospect Capital’s 10-Qs

As we can see from the above data, Prospect Capital’s top 5 holdings have increased in value by about 25% from a year ago. This is the best performance in the BDC space. Also of note is that these top 5 equity positions are a large % of Prospect Capital’s total equity holdings.

One could argue that this is not a very diversified asset based, but we could argue that just having a significant amount of investment in equity is more diversified than the other BDCs players that are 100% loan machines.

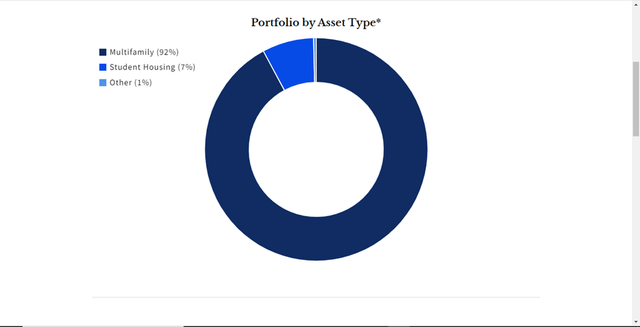

Of the top 5 holdings, one stands out as its largest investment – National Property REIT Corp or NPRC. NPRC’s real estate portfolio consists of equity investments in 58 properties in 47 cities, across 19 states, aggregating more than 20.6 million rentable square feet and more than 22,000 units.

So basically, NPRC is a multifamily housing REIT. Again, this goes back to our theme of “Margin of Safety” for investing in today market of interest rates rising quickly – like mortgage rates. With mortgage rates rising a record 24% in just 1 month after the federal Reserve announced its rates to move higher.

These much higher borrowing costs for buying a home has caused severe market dislocations, forcing many potential home buyers out of the market and into the multifamily rental market – and NPRC could not be more pleased to help! This is a great set-up for Prospect Capital, as it has seen a 40% increase in value from its investment in NPRC.

This is one of the many reasons I like owning Prospect Capital stock. I receive my 9% monthly dividend, plus own assets like the growing NPRC. Even better is Prospect Capital’s DRIP program with a 5% discount.

Will Prospect Capital raise its Dividend soon?

We will soon get the answer to this question. Looking at the trends and financial metrics above, we believe there is a greater than 50% chance that Prospect Capital will raise its dividend this month.

BDCs were created by Congress to encourage investment in the real economy, and both benefit from preferential tax treatment, paying no income tax at the corporate level so long as they pay out at least 90% of their net income as dividends.

Finally, a BDC’s net investment income (NII) is what funds the dividend. NII represents a BDC’s total investment income reduced by operating expenses such as financing costs and management fees.

So, the 90% rule may “push” Prospect Capital into raising its dividend. Prospect Capital has paid out 6 cents per month now for 5 years – or 18 cents per quarter. It NII has been at or just slightly above that 18-cent level for quite a while.

For the 2021 March and June quarters, Prospect Capital earned .189 cents of NII, so above the 90% threshold. Then as stated above, Prospect Capital started increasing its debt load and invested in more loans to its portfolio companies increasing its NII.

Now we see a higher NII for Prospect Capital – .209 for Q3 2021, .219 for Q4 2021, and .222 for Q1 2022. So, for 3 consecutive quarters, we would be below that 90% level of dividends. Prospect Capital for the past year has been growing its NII, and can easily continue this trend by increase its very low level of debt.

We do not know what exact legal requirements for this 90% rule, so we will have to wait and see if Prospect Capital increases its dividend. Prospect Capital also has issued preferred share that may factor into this rule.

Prospect Capital’s Margin of Safety

So, as we can see from the above data points, Prospect Capital is growing its earnings, NII, NAV while keeping its debt at lower levels than other BDCs. So what are our Margin of Safety talking points?

Like in our last article on a small US based steel firm Olympic Steel, Prospect Capital is trading well below its liquidation value – 30% below NAV. Net Asset Value for a BDC is a good proxy for liquidation value in our opinion. These BDC’s firms own loans and equity positions that can be sold and are “fungable” and sellable. It would obviously take time to unwind all these assets.

For other data points on Prospect Capital’s Margin of Safety, I will provide direct quotes from their last conference call:

John Barry CEO:

In the March quarter, our net debt-to-equity ratio was 53.9%, down 20.2 percentage points from March 2020 and up 2.6 percentage points from the December quarter as we continue to run an underleveraged balance sheet, which has been the case for us for multiple quarters. Over the past four years, other listed BDCs overall have increased leverage with a typical listed BDC now at around 114% debt to total equity or approximately 60 percentage points higher than for Prospect. Running at half the debt leverage of the rest of the industry

So Prospect Capital has 50% less debt than the other BDCs – Safety…

We have no plans to increase our actual drawn debt leverage beyond our historical target of 0.70 to 0.85 debt to equity, and we are currently significantly below such target range.

Prospect’s balance sheet is highly differentiated from peers with 100% of Prospect’s funding coming from unsecured and nonrecourse debt, which has been the case for Prospect for more than 14 years.

Prospect’s management is the largest shareholder in Prospect and has never sold a share. Our senior management team and employees eat our own cooking, currently owning approximately 28% of shares outstanding

We like a management team that stays invested in its own shares – Margin of Safety…

Grier Eliasek COO

We also continued to invest in a diversified fashion across many different portfolio company industries with a preference for avoiding cyclicality and with no significant industry concentration. The largest is 18.2%.

Well diversified – Safety…

Nonaccruals as a percentage of total assets stood at approximately 0.4% in March 2022, remaining static from the prior quarter and down 0.5% from June of 2020. Our weighted average middle market portfolio net leverage stood at 5.3 times EBITDA, substantially below our reporting peers.

Again, very low nonaccruals, and multiples below the BDC industry – Safety.

NPRC, our private REIT, has real estate properties that have benefited over the last several years and more recently, from rising rents showing the inflation hedge nature of this business segment

Yes, as we discussed above, and great asset for this high inflationary environment – Safety.

Kristin Van Dask CFO

As of March 2022, we held approximately $4.92 billion of our assets as unencumbered assets, representing approximately 66% of our portfolio

Our drawn pricing is now LIBOR plus 2.05%, a decrease of 15 basis points from before. Our undrawn pricing between 35% and 60% utilization has been reduced by 30 basis points. Of our floating rate assets, 93.9% have LIBOR floors with a weighted average floor of 1.34%. Short-term rates are now beginning to exceed these floors, giving us visibility for increased asset yields from Fed rate hikes.

In the March 2022 quarter, we have continued to substitute more expensive term debt with significantly lower cost revolving credit with an incremental 2.19% cost.

A very strong set up for 2022-2023.

Why are BDCs a good way to play higher interest rates?

In general, as interest rates rise, BDCs can lend out money at higher rates as well, and with a fixed rate structure for its capital stack should be able to generate higher net investment incomes.

Here is a quick quote from Darren McCammon a Seeking Alpha author:

Thus, BDCs are one of the few types of firms that benefit from both a strong economy and higher interest rates.

Prospect Capital’s Discount to other BDCs explained

This is where things get a bit strange. With all these positive aspects of investing in Prospect Capital – its strong NAV and NII growth, high dividend yield, low PE, low debt levels, long history in the BDC space, etc..Then why does Prospect Capital trade at a 30% discount to NAV, when almost all the other BDCs trade at a premium to NAV?

Its all about the past – the distant past. Many investors that own BDCs or REITs are dividend chasers or “lovers” depends on your perspective. It appears from comments here on SA, these BDCers have concentrated portfolios of mostly BDCs/REITs – high dividend stocks.

From our investing philosophy, only the future matters in valuation of any capital asset such as equities. The past is irrelevant – kind of…For us the future looks very bright for Prospect Capital and the entire BDC space.

We like to analyze the past few years to glean future trends and dynamics, but beyond 2-3 years ago, these data points become less meaningful.

BDCers and dividend investors and chasers have a golden rule: Never, ever reduce your dividend! This is understandable to a point – many investors are counting on these payouts from their portfolio during retirement. We like a more diversified portfolio, with a mix of some dividend and growth stocks, large, medium and small caps.

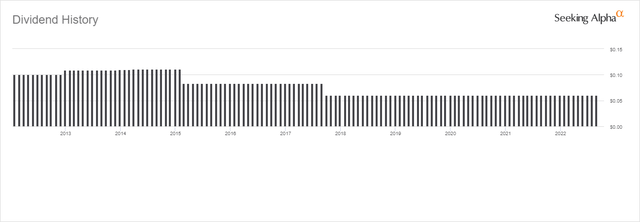

Prospect Capital’s 10 year dividend history:

As we can see in 2014 Prospect Capital paid out 11 cent per month, then decreased it to 8 cents, the again to the current 6 cents back in 2017 5 years ago. They broke the golden rule not just once, but twice!

Most of the other BDCs have not lowered their dividend over the past 10 years, so why did Prospect Capital ? Its all about debt!

In 2015 when Prospect Capital lowered its dividend it carried $2.8B in debt, and now it currently has $2.5 a 9% decrease in debt since 2015. Prospect Capital could not find good enough risk adjusted investments in the compressed yield curve environment, so it lowered its debt, which resulted in lower NII and dividend payouts.

Most of the other BDCs did the opposite – with compressed yield curves the only way to maintain their NII and dividends was to increase their debt to fund more and more loans -make it up with volume.

To visualize from 2015 to today:

Prospect Capital – 9% decrease in debt

Ares Capital (ARCC) – 350% increase in debt

Main Street Capital (MAIN) – 240% increase in debt

Sixth Street Specialty Lending (TSLX) – a 200% increase in debt

This has been the trend for the BDC industry. To keep or increase their dividends they simply just kept increasing their debt loads. So while their returns may have been better, maybe not their risk-adjusted returns in our opinion.

So about 10 years ago, Prospect Capital angered the BDCers, and the analysts that cover the BDC space. Since Prospect Capital broke the golden rule they will never own or “cover” the stock. When Prospect Capital has a conference call, we typically see little or no analyst on the call to ask questions.

This creates an excellent opportunity for investors. A total misunderstanding of Prospect Capital and its “view” of risk, and risk adjusted returns. Now with the lowest debt levels in the industry, now is the time to invest in Prospect Capital.

Be the first to comment