JamesBrey

Introduction

It’s time to talk about Duke Energy (NYSE:DUK). Duke Energy is one of America’s biggest electric utility companies with a market cap of $84.0 billion. It’s also one of the first five stocks I bought for my dividend growth portfolio a couple of years ago as I knew I needed and wanted defensive exposure. While DUK can be considered to be one of the most boring stocks on the market as it doesn’t sell fancy products or develops breathtaking technologies, I think calling DUK “boring” is a compliment. The company is a reliable source of high income for investors thanks to regular and satisfying dividend hikes, and above all, the company does not underperform the market, which a lot of market participants seem to forget occasionally. While I have bought a lot of dividend growth stocks with a focus on growth this year, I am eagerly adding to my Duke Energy position for all the reasons I just mentioned and the fact that it has a lot of nuclear exposure. Moreover, the company is selling its solar and wind assets, which I believe is a smart move.

So, with all of this in mind, let me explain why DUK is my favorite defensive investment.

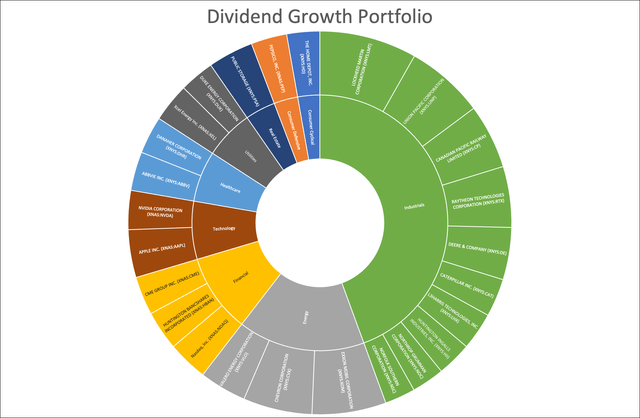

By the way, below is an overview of my portfolio. In case it’s hard to read (click to enlarge), I put the full list in my Seeking Alpha bio.

When Boring Is Good

First, let me give you some background info that explains why high yield and low volatility make sense. In June, S&P Dow Jones Indices published an article highlighting the outperformance of the S&P 500 Low Volatility High Dividend Index. While that’s obviously a way to promote their index, there is no denying that the research is worth something.

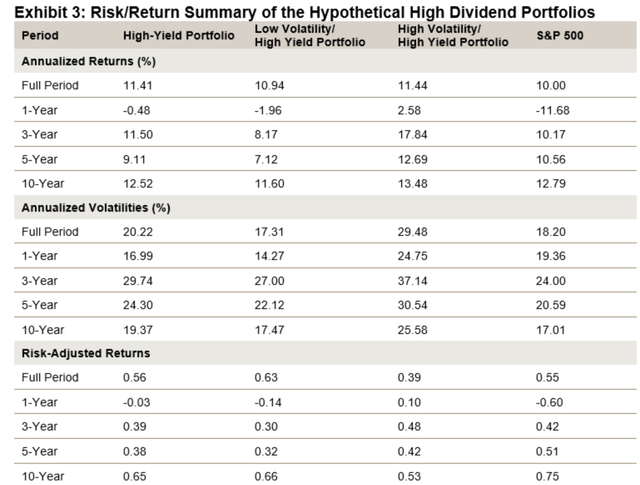

The low volatility high-yield portfolio consists of the 25 lowest volatility stocks of the 75 highest-yielding S&P 500 stocks.

When looking at a comparison of the past 10 years (in the table below) we see a lot of numbers.

So, let’s make sense of it all.

Going back to January 31, 1990, the S&P 500 has been beaten by all high-yield investments, regardless of volatility. However, only one portfolio beat the S&P 500 on a risk-adjusted basis. And that’s the low volatility, high-yield portfolio. This portfolio had annualized volatility of 17.3%, which helps as downside protection is key. Low-volatility stocks tend to outperform during bear markets. Even if these stocks don’t always keep up during bull markets, downside protection is enough to maintain high long-term total returns.

From my own experience and research, I obviously agree with the things above. After all, it’s based on facts.

However, it is extremely easy to buy high-yielding stocks that do not outperform as there are more high-yielding stocks on the market than low-volatility stocks with quality dividends that withstand the test of time.

In other words, use this information carefully when assessing the high-yield stocks you consider buying.

The good news is that Duke Energy is a perfect example of a high yield and low volatility.

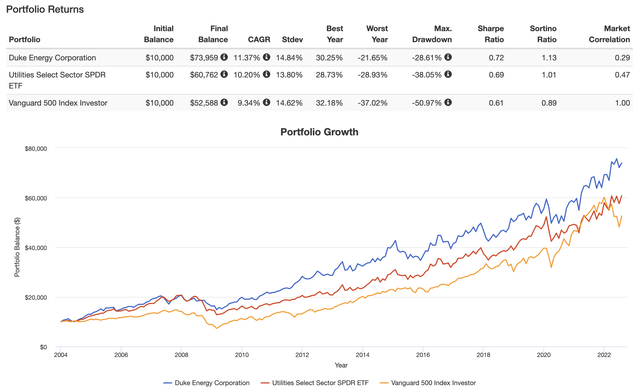

Going back to 2004, the company has returned 11.4% per year including dividends. This beats the Utilities Select Sector SPDR ETF (XLU) by roughly 120 basis points, which really adds up over time. It also beats the S&P 500, which returned 9.3% during this period.

Moreover, the standard deviation of Duke was 14.8% during this period, which is in line with the S&P 500. That’s impressive as we’re comparing a single stock to a well-diversified basket of 500 stocks. Hence, Duke scores high on a volatility-adjusted basis as well (Sharpe/Sortino ratio). And, it has a very low market correlation, which helps when structuring a portfolio. It’s also the reason why I will own utilities. Not because I’m fascinated by the way they generate electricity, but because it makes so much sense to own safe dividend stocks on top of more exciting dividend growth investments.

Note that outperformance varies. Overall, we’re talking about the very long-term as we can include periods of high and low inflation, recessions, economic expansions, wars, Democrat and Republican Presidents, and whatnot.

Over the past 3 and 5-year intervals, Duke has not outperformed the market, but it has come very close with an almost similar standard deviation, which is impressive as the past 3-5 years were more favorable for tech stocks, which are a big part of the S&P 500.

With that said, Duke brings a ton of value to the table, which supports the company’s impressive returns.

The Duke Dividend

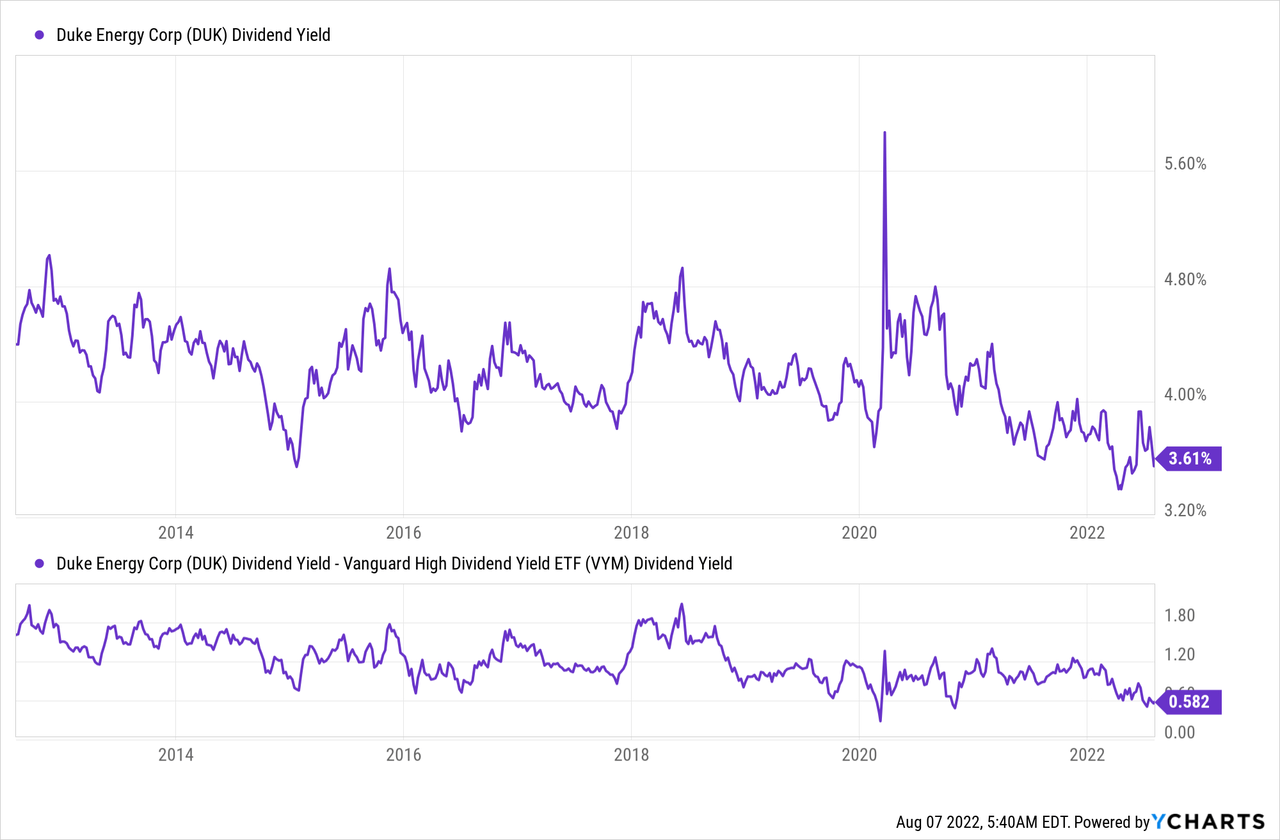

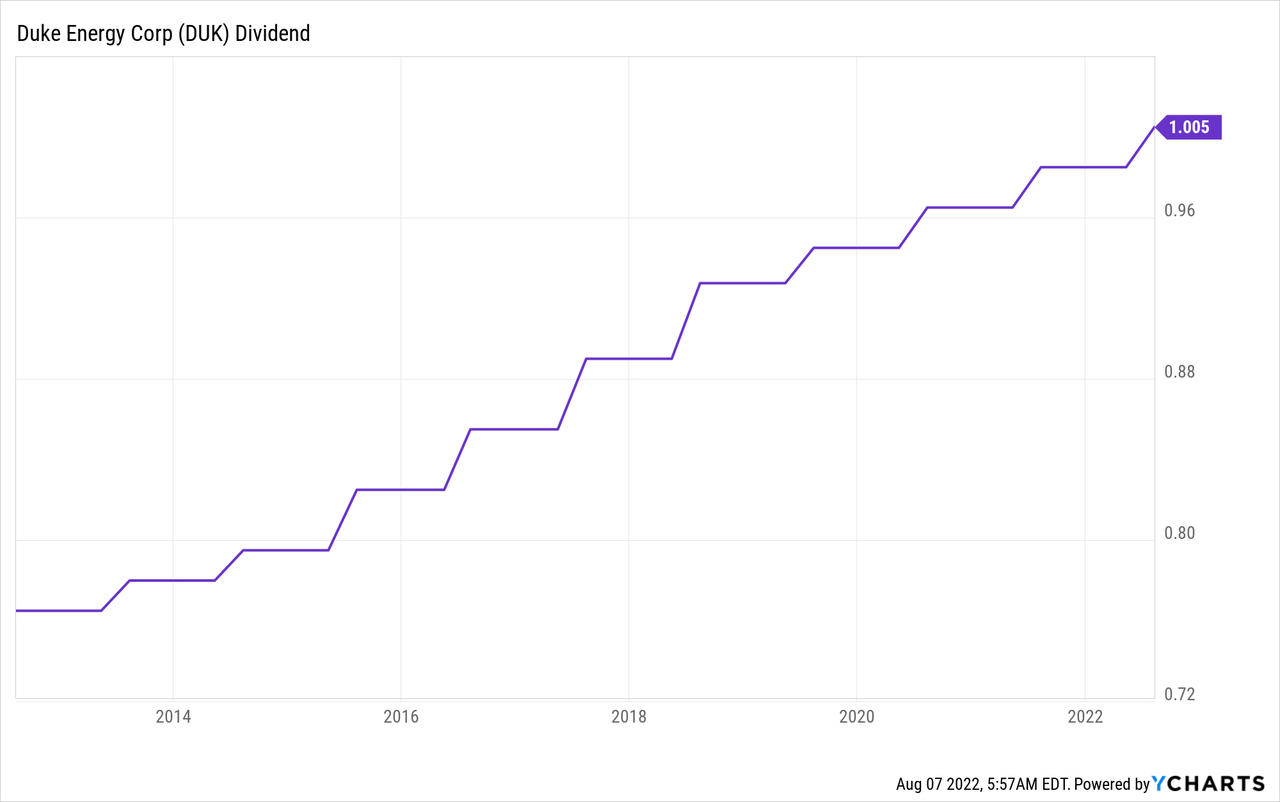

Duke is currently paying a $1.005 dividend per share per quarter. That’s $4.02 per share per year. Based on its $109 share price, we’re dealing with a yield of 3.7%.

This yield is one of its lowest as the yield usually hovers somewhere above 4.0%. Moreover, the yield is roughly 70 basis points (the graph below says 60, but that number is 10 basis points too low), above the Vanguard High Dividend ETF’s (VYM) yield.

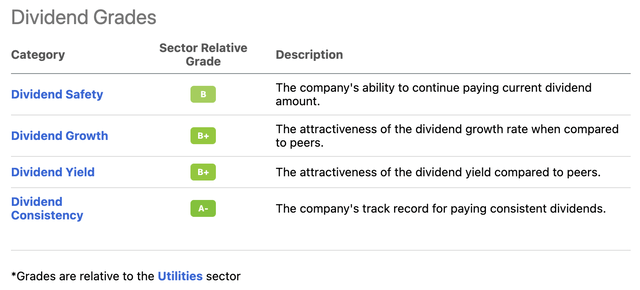

When incorporating Seeking Alpha’s dividend scorecard, we see that the company scores very decently versus its utility peers with no grade below B.

The “problem” is that the dividend growth score of B+ is mainly based on factors like EBITDA growth, which are also part of the calculations in this category. When it comes to actual dividend growth, the company scores a D+.

This also explains why the company’s yield is now one of the lowest of the past 10 years as capital gains have outperformed dividend growth.

Over the past 10 years, dividend growth has averaged 2.8% per year. This number is 2.0% on a 3-year basis.

These are the most “recent” hikes:

- July 2022: 2.0%

- July 2021: 2.1%

- July 2020: 2.1%

- July 2019: 1.9%

- July 2018: 4.2%

In other words, as long as inflation remains close to the Fed’s target of 2.0% investors avoid losing purchasing power – ignoring reinvested dividends.

With that said, there are two things worth mentioning here. First, the company has kept up with the S&P 500 despite these slow dividend growth rates. The fact that its yield is close to 4.0% is playing a major role here.

Second, the company is currently investing in renewables.

Duke’s Value

As I already briefly mentioned, Duke Energy is an $84 billion market cap giant in the utility sector. The company is the second-largest company in the regulated electric utility industry behind its Florida-based peer NextEra Energy (NEE).

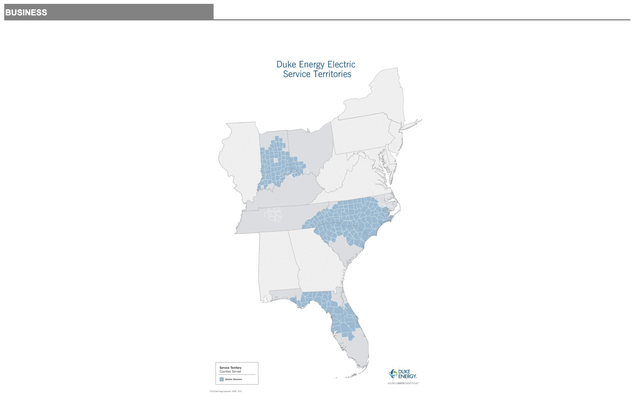

Through five subsidiaries, the company services Indiana, Southwest Ohio, The Carolinas, and Florida.

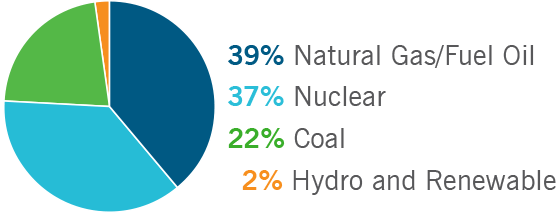

In 2021, the company generated 81.3% of the power it sold to customers. 18.7% was purchased power. Just 1.5% was hydro and solar power. Roughly 30% was nuclear power. Natural gas came in slightly bigger at 31.8% with coal accounting for 18.2% of power generation.

Ignoring third-party power, this is what the breakdown of the company’s current generated net output in gigawatt-hours looks like.

Duke Energy

The company’s commercial renewables produce more than 2,760 MW in 21 states. In this segment, 52% is generated by wind followed by 46% solar and just 2% fuel cell/storage.

Like all major utilities, Duke Energy aims to become carbon neutral in the future. By 2030, the company aims to generate less than 5% of its energy from coal, followed by a full exit by 2035.

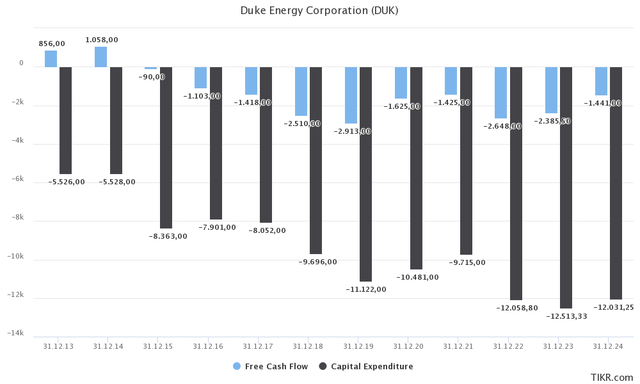

The problem is that this is extremely expensive. Hence, the company is expected to invest more than $10 billion in capital expenditures on a constant basis. This year, for example, CapEx is expected to be $12.1 billion.

While the company was able to achieve positive free cash flow prior to the aggressive energy transition, it is now unable to generate enough cash from its operations to meet investment requirements.

What this means is that the company needs to borrow money for its CapEx plans and to pay a dividend. Normally, companies pay dividends with free cash flow.

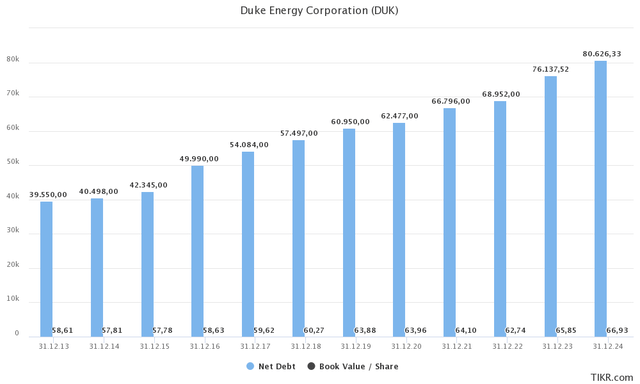

Hence, Duke Energy is expected to end up with more than $80 billion in net debt in 2024. That’s up from $40 billion prior to 2015.

On top of that, the company issues common stock to fund its operations. Over the past three years, the company issued $8.9 billion in net new debt. It also issued shares worth $3.1 billion.

Over the past five years, the company increased the number of common shares outstanding by 9.9%. That’s 1.9% per year.

With this in mind, it’s important to mention that the company does generate shareholder value. The company isn’t just piling on new debt and diluting existing shareholders, but actually improving its business – at least when it comes to real dollars.

The chart above doesn’t just show net debt, it also shows the book value per share at the very bottom. The book value means total assets minus liabilities divided by the number of shares outstanding. In other words, it also incorporates an increasing number of shares outstanding, which is extremely important.

What we see is an increase from $58.6 in 2013 to $66.9 in 2024 (expected). That’s an annual compounding growth rate of 1.1%. Again, please note that this incorporates share dilution.

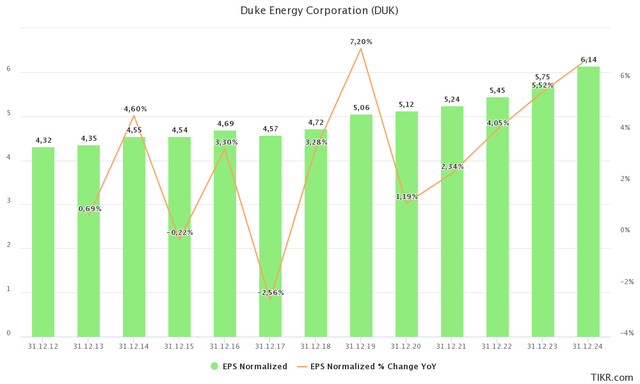

The same goes for (expected) earnings per share (note the “per share” part). Between 2012 and 2024E, EPS is growing by 2.7% per year, which supports the average dividend growth rate.

However, while EPS has been improving, Credit Suisse believes that slower EPS growth is likely. The bank mentioned higher interest rates when it lowered its stock price outlook. As reported by Seeking Alpha:

[…] Credit Suisse downgraded shares to Neutral from Outperform with a $114 price target, following the utility’s Q2 results the bank says point to an “increased risk of a re-base to the 5%-7% long-term EPS compound annual growth rate.

While encouraged to see a sale of Duke’s commercial renewable energy business earlier than expected, “after considering dilution from the sale and wider pressure from interest rates on Duke’s variable rate debt, we see downside to consensus EPS estimates,” Credit Suisse analyst Nicholas Campanella wrote.

This is what the company commented on head and tailwinds in its 2Q22 earnings call:

We expect third quarter adjusted earnings per share will be slightly lower than 2021, mainly due to favorable weather in the prior year, higher interest expense, tax timing and lower contributions from Commercial Renewables. This will be partially offset by higher revenues from rate cases, riders and wholesale. In the fourth quarter, we expect to see favorability from several drivers, including normal weather, higher loan, lower O&M and higher revenue from rate cases and riders.

With regard to rates, we’re seeing something interesting, which I will discuss in the next “segment”.

Valuation

Higher rates are a problem for companies with a lot of debt. Utilities have a lot of debt and a high need for future funding. Hence, I do not disagree with Credit Suisse that higher rates are a reason to believe that EPS growth will weaken a bit.

However, EPS growth will remain strong and investors are not ignoring utilities because of higher rates. The opposite is true. DUK is up 4% year to date. The S&P 500 is down 13%.

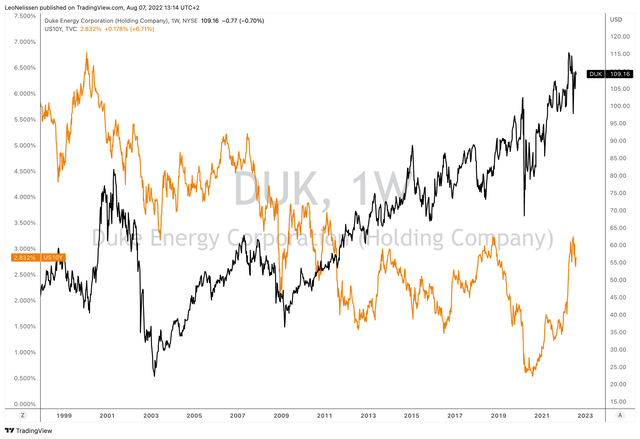

The most recent decline in 10-year yields caused DUK to rally more than 12% from its 2022 lows. All it took was a 40 basis points decline in 10-year yields.

TradingView (Orange = 10Y Yield, Black = DUK Stock Price)

In this case, the 10-year yield is down because investors are pricing in slower economic growth and lower inflation. If rates continue their downtrend, I believe that DUK has a lot of room to rise.

When rates started to fall after the 2018 peak in rates, DUK shares rallied by more than 30%.

Right now, the Fed is expected to remain aggressive as the jobs report on Friday was good and inflation remains high.

However, if the Fed starts to pivot next year, I believe that investors will rush for high-quality yield stocks. Lower (expected) futures rates, above-average inflation, and a more accommodative Fed are reasons to buy quality yield investments like DUK. Hence, the stock has a history of aggressive rallies whenever these events occur.

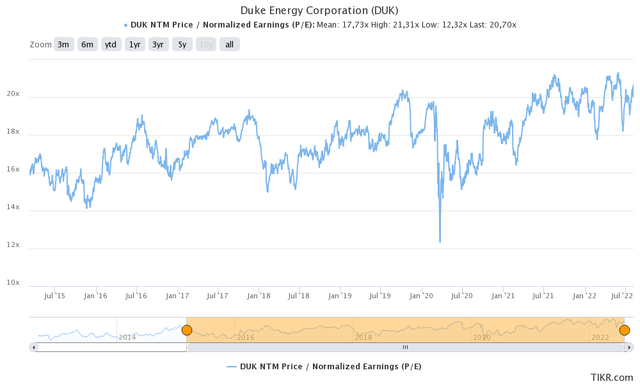

That said, the company is expected to do $5.75 in normalized EPS next year. This implies a P/E ratio of 19.0. This is slightly below the median of the past two years and an “OK” valuation. Not cheap, but also not overvalued.

Now, there’s one more thing.

The Solar/Wind Sale

Duke Energy is considering selling its commercial renewable energy assets.

These assets generate less than 5% of total consolidated earnings and growth in this area is expected to underperform the other segments.

The deal is expected to be worth $4.0 billion. According to the company, and reported by UtilityDrive:

The proceeds from the sale, Good said, would reduce the amount of new debt required to fund decarbonization of the company’s regulated utilities. Duke Energy remains on track to meet its emissions targets, with an accelerated deployment of renewable energy planned to begin after 2025, she said.

I believe this is a smart move as I am more in favor of nuclear energy and related technologies with a much higher energy density than wind and solar. I think now is a good time to sell these assets as demand is high and proceeds can be invested in its existing business.

On top of that, the company is looking for an additional $200 million in cost cuts to deal with inflation.

Takeaway

This title isn’t clickbait. Duke Energy is indeed my favorite defensive investment. The company is my largest utility investment, it offers a 3.7% dividend yield, and its low-volatility profile allows its investors to benefit from high (often outperforming) long-term returns.

Right now, the company is being pressured by high rates, high inflation, and headwinds in renewables. Yet, the company is outperforming the market and is on track to maintain healthy earnings per share growth.

Moreover, the company is maintaining a very healthy balance sheet as it uses new debt to invest in its business in a way that it allows the book value per share to grow by at least 1% per year.

While dividend growth is flat, it’s in line (even slightly below) earnings per share growth and enough to maintain a steady high-yield income stream for its owners.

Adding to that, I believe that the sale of its renewable segment is a smart move as the company can use it to lower debt and focus on higher growth in other segments.

When it comes to the valuation, we’re dealing with a “fair” valuation. However, I expect the Fed to pivot sometime next year, which should cause a rush for quality yield stocks like DUK.

Hence, I remain bullish on the stock.

(Dis)agree? Let me know in the comments!

Be the first to comment